|

시장보고서

상품코드

1721424

자동차용 워셔 시스템 : 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Automotive Washer Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

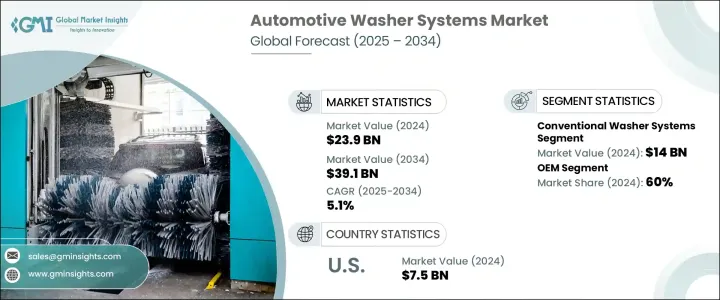

세계의 자동차용 워셔 시스템 시장 규모는 2024년 239억 달러로 평가되었고, 2034년에는 391억 달러에 달할 것으로 예측되며, CAGR 5.1%로 성장할 전망입니다. 자동차 환경이 빠르게 변화함에 따라 워셔 시스템 시장은 전 세계적으로 상당한 견인력을 얻고 있습니다. 차량 소유자와 제조업체 모두 최적의 주행 안전을 위해 정기적인 유지보수와 명확한 가시성의 중요성에 점점 더 주의를 기울이고 있습니다. 워셔 시스템은 단순한 세척 도구에서 최신 차량에 통합된 정교한 솔루션으로 진화했습니다. 스마트 센서 세척 시스템의 통합, 첨단 운전자 보조 시스템(ADAS)과의 호환성, 전기 및 자율 주행 차량으로의 전환으로 인해 보다 효율적이고 혁신적인 워셔 시스템에 대한 요구가 더욱 가속화되고 있습니다.

2024년에는 기존 워셔 시스템 부문이 140억 달러의 매출을 올리며 시장을 주도했습니다. 이 부문의 리더십은 단순성, 신뢰성, 비용 효율성으로 인해 기존 시스템이 광범위하게 채택된 데서 비롯됩니다. 기계식 작동과 표준 유체 노즐로 설계된 이 시스템은 승용차 및 상용차 부문 모두에 간단하고 예산 친화적인 솔루션을 제공합니다. 자동차 제조업체는 입증된 성능과 기존 차량 설계에 쉽게 통합할 수 있다는 점에서 이러한 워셔 시스템을 선호하는 경우가 많습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 239억 달러 |

| 예측 금액 | 391억 달러 |

| CAGR | 5.1% |

시장은 판매 채널에 따라 OEM과 애프터마켓으로 분류되며, 2024년에는 OEM 부문이 60%의 점유율을 차지할 것으로 예상됩니다. 이러한 우위는 주요 국가에서 자동차 생산량이 증가하고 공장 설치형 워셔 기술에 대한 수요가 증가했기 때문입니다. 제조업체들은 가시성을 높이고 센서 정확도를 지원하며 글로벌 안전 표준을 충족하기 위해 헤드라이트 워셔, 첨단 윈드실드 클리닝 시스템, ADAS 호환 기술을 신모델에 장착하고 있습니다.

미국의 자동차용 워셔 시스템 시장은 2024년에만 75억 달러의 수익을 창출하며 주요 매출 기여자로서 그 중요성을 강조하고 있습니다. 미국 내 수요는 높은 차량 생산 수준, ADAS 장착 및 전기자동차의 급증, 자동차 안전에 대한 엄격한 규제에 힘입어 지속적으로 증가하고 있습니다. 이러한 요인으로 인해 OEM은 환경 조건에 관계없이 센서 및 온보드 카메라와 같은 중요 시스템의 중단 없는 작동을 보장하는 혁신적인 워셔 기술을 통합해야 합니다.

세계의 자동차용 워셔 시스템 시장을 형성하는 주요 기업은 Valeo SA, Trico, Shihlin Electric, Magna, Mitsuba, Robert Bosch, HELLA, Kautex Textron, Denso, Continental 등이 있습니다. 이러한 기업은 R&D에 투자하고 자동차 제조업체와 전략적 파트너십을 맺음으로써 진화하는 자동차 환경에서 입지를 강화하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 원자재 공급자

- 부품 공급업체

- 제조업자

- 기술 공급자

- 유통 채널 분석

- 최종 용도

- 이익률 분석

- 공급자의 상황

- 기술과 혁신의 상황

- 특허 분석

- 규제 상황

- 비용 분석

- 주요 뉴스와 대처

- 영향요인

- 성장 촉진요인

- 자동차 생산 및 판매 증가

- 엄격한 안전 및 가시성 규제

- ADAS 및 스마트 차량 기술과의 통합

- 친환경적이고 효율적인 워셔액의 발전

- 업계의 잠재적 위험 및 과제

- 스마트 워셔 시스템의 높은 초기 비용

- 전기자동차와 자율주행차와의 호환성 문제

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계 및 예측 : 기술별(2021-2034년)

- 주요 동향

- 기존 워셔 시스템

- 빗방울 감지 워셔 시스템

- 가열 워셔 시스템

제6장 시장추계 및 예측 : 차종별(2021-2034년)

- 주요 동향

- 승용차

- 상용차

제7장 시장 추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 와이퍼 블레이드

- 펌프

- 노즐

- 호스 및 커넥터

- 워셔액 탱크(저수조)

제8장 시장 추계 및 예측 : 판매 채널별 2021-2034

- 주요 동향

- OEM

- 애프터마켓

제9장 시장추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 프랑스

- 영국

- 스페인

- 이탈리아

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주 및 뉴질랜드

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 남아프리카

- 사우디아라비아

제10장 기업 프로파일

- Asmo

- Bowles Fluidics

- Continental

- Denso

- Doga

- DOGA

- Exo-S

- Federal-Mogul

- HELLA

- ITW

- Kautex Textron

- Magna

- Mergon

- Mitsuba

- Mitsubishi

- PIAA

- Robert Bosch

- Shihlin Electric

- Trico

- Valeo SA

The Global Automotive Washer Systems Market was valued at USD 23.9 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 39.1 billion by 2034. With the automotive landscape undergoing rapid transformation, the market for washer systems is gaining substantial traction worldwide. Vehicle owners and manufacturers alike are becoming increasingly attentive to the importance of regular maintenance and clear visibility for optimal driving safety. Washer systems have evolved from simple cleaning tools to sophisticated solutions integrated into modern vehicles. The integration of smart sensor-cleaning systems, compatibility with advanced driver assistance systems (ADAS), and the shift toward electric and autonomous vehicles are collectively accelerating the need for more efficient and innovative washer systems. This demand is further supported by government regulations focusing on vehicle safety and visibility, especially in regions with harsh weather conditions. As carmakers continue to prioritize safety, performance, and comfort, washer systems are becoming essential for ensuring unimpeded camera and sensor operation, particularly in next-generation vehicles.

In 2024, the conventional washer systems segment led the market, generating USD 14 billion in revenue. This segment's leadership stems from the wide-scale adoption of traditional systems due to their simplicity, reliability, and cost-effectiveness. Designed with mechanical activation and standard fluid nozzles, these systems offer a straightforward and budget-friendly solution for both passenger and commercial vehicle segments. Automakers often favor these washer systems for their proven performance and ease of integration into existing vehicle designs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.9 Billion |

| Forecast Value | $39.1 Billion |

| CAGR | 5.1% |

The market is segmented by sales channels into OEM and aftermarket, with the OEM segment capturing a 60% share in 2024. This dominance is primarily due to the rising volume of vehicle production across major economies and the increasing demand for factory-installed washer technologies. Manufacturers are equipping new models with headlight washers, advanced windshield cleaning systems, and ADAS-compatible technologies to enhance visibility, support sensor accuracy, and meet global safety standards.

The U.S. Automotive Washer Systems Market alone generated USD 7.5 billion in 2024, underlining its significance as a key revenue contributor. Demand in the U.S. continues to grow, driven by high vehicle production levels, a surge in ADAS-equipped and electric vehicles, and stringent regulations around automotive safety. These factors are pushing OEMs to integrate innovative washer technologies that ensure uninterrupted operation of critical systems such as sensors and onboard cameras, regardless of environmental conditions.

Key players shaping the Global Automotive Washer Systems Market include Valeo SA, Trico, Shihlin Electric, Magna, Mitsuba, Robert Bosch, HELLA, Kautex Textron, Denso, and Continental. These companies are focused on developing advanced washer solutions through high-pressure nozzles, fluid-efficient systems, and smart sensor-cleaning mechanisms. By investing in R&D and forming strategic partnerships with automakers, these manufacturers are enhancing their presence in the evolving automotive landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Cost breakdown analysis

- 3.6 Key news & initiatives

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing vehicle production & sales

- 3.7.1.2 Stringent safety & visibility regulations

- 3.7.1.3 Integration with ADAS & smart vehicle technologies

- 3.7.1.4 Advancements in eco-friendly & efficient washer fluids

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High initial costs for smart washer systems

- 3.7.2.2 Compatibility issues with electric & autonomous vehicles

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Conventional washer systems

- 5.3 Rain-sensing washer systems

- 5.4 Heated washer systems

Chapter 6 Market Estimates & Forecast, By Vehicle Type, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.3 Commercial vehicles

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Wiper blades

- 7.3 Pumps

- 7.4 Nozzles

- 7.5 Hoses & connectors

- 7.6 Reservoirs

Chapter 8 Market Estimates & Forecast, By Sale Channel 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Asmo

- 10.2 Bowles Fluidics

- 10.3 Continental

- 10.4 Denso

- 10.5 Doga

- 10.6 DOGA

- 10.7 Exo-S

- 10.8 Federal-Mogul

- 10.9 HELLA

- 10.10 ITW

- 10.11 Kautex Textron

- 10.12 Magna

- 10.13 Mergon

- 10.14 Mitsuba

- 10.15 Mitsubishi

- 10.16 PIAA

- 10.17 Robert Bosch

- 10.18 Shihlin Electric

- 10.19 Trico

- 10.20 Valeo SA