|

시장보고서

상품코드

1721438

BOPP 필름 시장 : 기회 및 촉진요인, 시장 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)BOPP Films Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

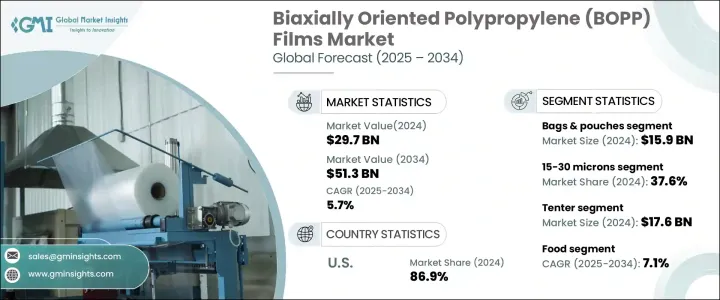

세계의 BOPP 필름 시장은 2024년에는 297억 달러로 평가되었고, 2034년에는 513억 달러에 이를 것으로 예측되며, CAGR 5.7%로 성장할 전망입니다. 이 필름은 경제성뿐만 아니라 뛰어난 강도, 선명도 및 다용도로 인해 주목을 받고 있습니다. 식음료, 제약, 전자, 퍼스널 케어 분야의 제조업체들은 가볍고 내구성이 뛰어나며 지속 가능한 포장재에 대한 소비자의 선호도 변화를 충족하기 위해 점점 더 BOPP 필름으로 전환하고 있습니다.

효율적인 공급망과 제품 진열대의 매력이 비즈니스 성공에 중요한 시대에 BOPP 필름은 기능적, 미적 요구 사항을 모두 충족하는 이상적인 솔루션을 제공합니다. 재활용성과 진화하는 지속 가능성 목표와의 호환성으로 인해 연포장 시장의 입지가 더욱 강화되었습니다. 포장 요구 사항이 더욱 복잡해지고 전 세계적으로 수요가 계속 증가함에 따라, 경쟁력을 유지하고자 하는 제조업체는 BOPP 필름 생산 및 코팅 기술의 혁신에 집중하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 297억 달러 |

| 예측 금액 | 513억 달러 |

| CAGR | 5.7% |

이 시장 확대의 주요 요인은 비용 효율성, 높은 인장 강도, 내습성 및 우수한 인쇄성으로 인해 다양한 산업 분야에서 BOPP 필름의 사용이 증가하고 있기 때문입니다. 순차적 및 동시 연신과 같은 고급 생산 방식은 선명도와 차단 특성을 크게 향상시켰습니다. 금속화는 시각적 매력과 보관 수명을 향상시켜 프리미엄 브랜딩에 선호되는 필름입니다. 내열 기능이 있는 코팅 BOPP 필름은 특히 전자레인지용 포장에 적합하여 기능적 가치를 더합니다.

시장은 제품별로 랩, 가방 및 파우치, 테이프, 라벨로 구분됩니다. 소매업체와 주문 처리 센터는 기존의 딱딱한 포장 형식에 비해 펑크에 강하고 구조가 가벼우며 물류 비용을 절감할 수 있는 BOPP 백 및 파우치를 점점 더 선호하고 있습니다.

두께별로 분류했을 때 15-30미크론 부문은 2024년에 37.6%의 점유율을 차지할 것으로 예상됩니다. 이 카테고리는 친환경적이고 효율적인 포장 솔루션에 대한 강조가 높아지는 추세에 맞춰 강도, 비용 효율성 및 재료 절감이라는 핵심 속성의 완벽한 균형을 제공합니다. 이 필름은 내구성과 최소한의 재료 사용이 필수적인 식품 포장에 널리 사용됩니다.

미국의 BOPP 필름 시장은 2024년 북미 매출액의 86.9%를 차지했습니다.

Uflex Ltd., Inteplast Group, Jindal Poly Films와 같은 주요 제조업체들은 시장의 존재를 확대하고 진화하는 업계 수요에 부응하기 위해 고급 생산 시스템, 제품 혁신 및 지속가능성에 대한 노력에 많은 투자를 하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 급속한 기술 혁신과 자동화

- 지속 가능하고 친환경적인 포장 솔루션에 대한 수요 증가

- R&D의 발전으로 필름 품질 및 성능 향상

- 식품, 의료, 전자기기 등의 분야의 응용 확대

- 규제 변화

- 업계의 잠재적 위험 및 과제

- 원자재 비용의 변동성

- 치열한 시장 경쟁으로 인한 가격 압박

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술의 상황

- 장래 시장 동향

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장추계 및 예측 : 유형별(2021-2034년)

- 주요 동향

- 랩

- 가방 및 파우치

- 테이프

- 라벨

제6장 시장추계 및 예측 : 두께별(2021-2034년)

- 주요 동향

- 15미크론 이하

- 15-30미크론

- 30-45미크론

- 45미크론 이상

제7장 시장 추계 및 예측 : 생산 공정별(2021-2034년)

- 주요 동향

- 텐터

- 관

제8장 시장추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 식음료

- 음료

- 담배

- 퍼스널케어

- 의약품

- 전기 및 전자공학

- 기타

제9장 시장추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 호주

- 한국

- 일본

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

제10장 기업 프로파일

- CCL Industries

- Cosmo Films Limited

- Gulf Packaging Industries Co.

- Inteplast Group

- Jindal Poly Films

- Oben Group

- Polibak

- Polinas

- Sibur Holdings

- Taghleef Industries

- TOPPAN Group

- Toray Industries

- Uflex Ltd.

- Zhejiang Kinlead Innovative Materials

The Global BOPP Films Market was valued at USD 29.7 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 51.3 billion by 2034. The market continues to witness robust growth as industries across the board recognize the superior performance and cost advantages of BOPP films in packaging applications. These films are gaining traction not only due to their affordability but also because of their exceptional strength, clarity, and versatility. Manufacturers across food and beverage, pharmaceutical, electronics, and personal care sectors are increasingly shifting toward BOPP films to meet changing consumer preferences for lightweight, durable, and sustainable packaging materials.

In an era where efficient supply chains and product shelf appeal are critical to business success, BOPP films offer an ideal solution that meets both functional and aesthetic demands. Their recyclability and compatibility with evolving sustainability goals have further strengthened their position in the flexible packaging market. As packaging requirements become more complex and global demand continues to rise, innovation in BOPP film production and coating technologies remains a key focus for manufacturers aiming to stay competitive.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.7 Billion |

| Forecast Value | $51.3 Billion |

| CAGR | 5.7% |

The primary driver of this market expansion is the increasing use of BOPP films across diverse industries due to their cost-effectiveness, high tensile strength, moisture resistance, and excellent printability. Advanced production methods like sequential and simultaneous stretching have significantly improved clarity and barrier properties. Metallization enhances visual appeal and shelf life, making these films a preferred choice for premium branding. Coated BOPP films, with heat-resistant capabilities, are especially suitable for microwaveable packaging, adding to their functional value.

The market is segmented by product into wraps, bags and pouches, tapes, and labels. In 2024, the bags and pouches segment alone accounted for USD 15.9 billion, driven largely by the exponential growth of e-commerce. Retailers and fulfillment centers increasingly prefer BOPP bags and pouches for their puncture resistance, lightweight structure, and ability to reduce logistics costs when compared to traditional rigid packaging formats.

When classified by thickness, the 15-30 microns segment commanded a 37.6% share in 2024. This category offers a perfect balance of strength, cost-efficiency, and material reduction-key attributes that align with the growing emphasis on eco-friendly and efficient packaging solutions. These films are widely used in food packaging, where durability and minimal material usage are essential.

The U.S. BOPP Films Market accounted for 86.9% of North American revenue in 2024. Its dominance stems from significant R&D investments by leading manufacturers aiming to enhance film strength, clarity, and versatility for broadening end-use applications. With the surge in e-commerce and demand for lightweight, sustainable packaging, the U.S. market continues to set the pace globally.

Key players like Uflex Ltd., Inteplast Group, and Jindal Poly Films are investing heavily in advanced production systems, product innovation, and sustainability initiatives to expand their market presence and cater to evolving industry demands.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research Approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid technological innovation and automation

- 3.2.1.2 Growing demand for sustainable and eco-friendly packaging solutions

- 3.2.1.3 Advancements in R&D enhance film quality and performance

- 3.2.1.4 Expanding applications in sectors like food, medical, and electronics

- 3.2.1.5 Regulatory changes

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Volatility in raw material costs

- 3.2.2.2 Intense market competition results in pricing pressures

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn & Kilo Tons)

- 5.1 Key trends

- 5.2 Wraps

- 5.3 Bags & pouches

- 5.4 Tapes

- 5.5 Labels

Chapter 6 Market Estimates and Forecast, By Thickness, 2021 – 2034 ($ Mn & Kilo Tons)

- 6.1 Key trends

- 6.2 Below 15 microns

- 6.3 15-30 microns

- 6.4 30-45 microns

- 6.5 More than 45 microns

Chapter 7 Market Estimates and Forecast, By Production Process, 2021 – 2034 ($ Mn & Kilo Tons)

- 7.1 Key trends

- 7.2 Tenter

- 7.3 Tubular

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn & Kilo Tons)

- 8.1 Key trends

- 8.2 Food

- 8.3 Beverage

- 8.4 Tobacco

- 8.5 Personal care

- 8.6 Pharmaceutical

- 8.7 Electrical & electronics

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Australia

- 9.4.4 South Korea

- 9.4.5 Japan

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 U.A.E.

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 CCL Industries

- 10.2 Cosmo Films Limited

- 10.3 Gulf Packaging Industries Co.

- 10.4 Inteplast Group

- 10.5 Jindal Poly Films

- 10.6 Oben Group

- 10.7 Polibak

- 10.8 Polinas

- 10.9 Sibur Holdings

- 10.10 Taghleef Industries

- 10.11 TOPPAN Group

- 10.12 Toray Industries

- 10.13 Uflex Ltd.

- 10.14 Zhejiang Kinlead Innovative Materials