|

시장보고서

상품코드

1721462

사탕수수 포장 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Sugarcane Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

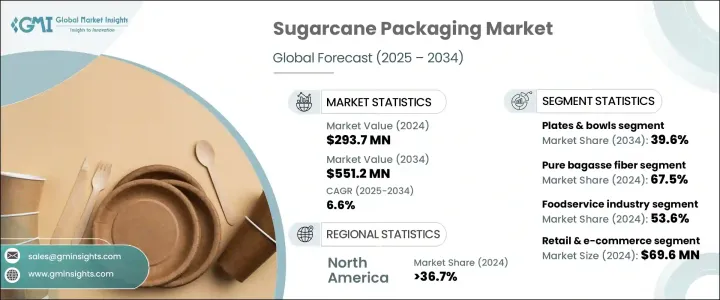

세계의 사탕수수 포장 시장은 2024년 2억 9,370만 달러로 평가되었고 CAGR 6.6%를 나타내 2034년에는 5억 5,120만 달러에 이를 것으로 추정되고 있습니다. 기후 변화와 환경에 대한 우려가 여전히 전면에 나오고 있기 때문에 기업은 석유 기반 포장을 재생 가능하고 퇴비화 가능한 옵션으로 적극적으로 대체하고 있습니다. 소비자는 현재 환경 친화적인 가치관에 맞는 제품을 지지하는 경향이 있으며, 기업은 ESG에 대한 헌신을 강화하는 포장 솔루션을 우선함으로써 대응하고 있습니다. 세계 각국이 일회용 플라스틱 규제를 도입하고 산업계에 폐기물 삭감의 압력을 가하고 있는 가운데 사탕수수 포장은 성능과 지속가능성 모두의 목표에 부합하는 혁신적이고 비용 효율적인 솔루션으로 등장했습니다.

바가스는 사탕수수에서 주스를 추출한 후에 남는 섬유상 제품별로, 이 환경 친화적인 포장 시프트의 핵심을 이루는 것입니다. 셀룰로오스, 리그닌, 헤미셀룰로오스로 이루어지는 이 소재는 자연적으로 생분해되어 퇴비화 가능합니다. 용도를 기대할 수 있는 선진 포장을 개발하고 있습니다. 구조적 무결성, 다용도성, 환경적 이점이 개선된 것으로, 외식 산업으로부터 소매업에 이르기까지, 폭넓은 업계로부터 관심이 끌려 가고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 2억 9,370만 달러 |

| 예측 금액 | 5억 5,120만 달러 |

| CAGR | 6.6% |

푸드서비스 분야에서는 2024년에 플레이트와 그릇이 최대의 수익 점유율을 차지하여 1억 1,640만 달러를 창출했습니다. 리프리바이더에 널리 지지되고 있습니다. 편리하고 환경 친화적인 포장에 대한 수요가 늘어나고 있기 때문에 이 분야는 일관된 확대가 전망되고 있습니다.

컵과 뚜껑의 분야는 패스트 푸드 체인, 커피숍, 이벤트 서비스 제공업체에 의한 퇴비화 가능 음료 용기의 급속한 보급을 반영하여 2024년에는 6,680만 달러로 평가되었습니다. 누출이 어려워 따뜻한 음료나 차가운 음료에도 적합합니다.플라스틱 폐기물을 없애려는 움직임이 강해지는 가운데, 호스피탈리티 섹터의 각 기업은 생분해성 드링크웨어에의 이행을 진행하고 있어 예측 기간중의 동 분야의 성장을 뒷받침하고 있습니다.

미국의 사탕수수 포장 시장은 2024년 8,820만 달러를 창출했고 2034년까지 연평균 복합 성장률(CAGR) 6.3%를 나타내 큰 견인력이 될 전망입니다. 캘리포니아주나 뉴욕주 등 일회용 플라스틱의 금지를 실시한 주에 있어서의 규제 개발이 퇴비화 가능한 대체품의 채용을 가속시키고 있습니다.

세계 시장의 성장을 견인하는 주요 기업으로는 에코레이츠, 후타마키, Pactiv Evergreen, Dart Container Corporation, Detmold Group, Berry Global Inc.등이 있습니다. 이 기업은 퇴비화 가능한 제품 포트폴리오의 확대, 유통망의 강화, 패스트 푸드 체인이나 소매 브랜드와의 장기 계약 획득에 다액의 투자를 실시했습니다. 또, 효율적으로 생산 규모를 확대해, 다양한 규제나 고객 수요에 응하기 위해, 현지 생산에 주력해, 생분해성 재료 연구 발전에 주력하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급업체 매트릭스

- 이익률 분석

- 기술 및 혁신 전망

- 특허 분석

- 주요 뉴스와 대처

- 업계에 미치는 영향요인

- 성장 촉진요인

- ESG(환경, 사회, 거버넌스)의 우선사항 확대

- 정부의 대처와 인센티브

- 소비자의 환경 의식의 고조

- 브랜드 이미지와 시장차별화 강화

- 연구개발과 지속가능한 제조에 대한 투자 증가

- 업계의 잠재적 위험 및 과제

- 높은 생산 비용

- 공급 체인과 확장성 문제

- 성장 촉진요인

- Porter's Five Forces 분석

- PESTEL 분석

- 향후 시장 동향

- 규제 상황

제4장 시장 추계·예측 : 제품 유형별(2021-2034년)

- 주요 동향

- 가방 및 파우치

- 접시 및 그릇

- 컵 및 뚜껑

- 클램쉘/컨테이너

- 기타

제5장 시장 추계·예측 : 재료 유형별(2021-2034년)

- 주요 동향

- 순수 바가스 섬유

- 혼합 바가스

제6장 시장 추계·예측 : 최종 이용 산업별(2021-2034년)

- 주요 동향

- 푸드서비스 업계

- 소매 및 E커머스

- 헬스케어 부문

- 소비재

- 산업 용도

제7장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 기타 유럽

- 아시아태평양

- 일본

- 중국

- 인도

- 한국

- 호주 및 뉴질랜드

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

- 남아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 기타 중동 및 아프리카

제8장 기업 프로파일

- Berry Global Inc.

- BioPak

- Dart Container Corporation

- Detmold Group

- ECO Guardian

- Ecolates

- good natured Products Inc.

- Good Start Packaging

- GreenLine Paper Co.

- Huhtamaki

- Material Motion, Inc.

- Packman

- Pactiv Evergreen

- PAKKA

- Pappco Greenware

- TedPack Company Limited

- Vegware Ltd

The Global Sugarcane Packaging Market was valued at USD 293.7 million in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 551.2 million by 2034. This growth trajectory reflects a global shift toward sustainable and eco-conscious alternatives in packaging, driven by regulatory changes, changing consumer behavior, and corporate environmental strategies. As climate change and environmental concerns remain front and center, businesses are actively replacing petroleum-based packaging with renewable, compostable options. The market is seeing robust momentum as sugarcane bagasse-based materials gain ground across industries. Consumers are now more inclined to support products that align with green values, and enterprises are responding by prioritizing packaging solutions that reinforce their ESG commitments. With countries around the world adopting restrictions on single-use plastics and putting pressure on industries to cut down waste, sugarcane packaging has emerged as an innovative, cost-effective solution that aligns with both performance and sustainability goals.

Bagasse, the fibrous byproduct left after juice extraction from sugarcane, is at the core of this eco-friendly packaging shift. Comprising cellulose, lignin, and hemicellulose, this material is naturally biodegradable and compostable. As research continues to evolve around cellulose nanofibers and bio-composite materials, manufacturers are developing advanced packaging options with enhanced durability and broader application potential. The improved structural integrity, versatility, and environmental benefits are attracting interest from industries ranging from food service to retail. These innovations are not only minimizing environmental impact but also helping companies comply with rising sustainability benchmarks and consumer expectations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $293.7 Million |

| Forecast Value | $551.2 Million |

| CAGR | 6.6% |

In the food service sector, plates and bowls accounted for the largest revenue share in 2024, generating USD 116.4 million. These products are widely favored by restaurants, catering services, and food delivery providers because they offer moisture and grease resistance without compromising compostability. As the demand for convenient, eco-friendly packaging continues to grow, this segment is expected to witness consistent expansion. Consumers and businesses alike are looking for alternatives that do not sacrifice quality while delivering sustainable performance for everyday use.

The cups and lids segment was valued at USD 66.8 million in 2024, reflecting a rapid uptake of compostable beverage containers by fast food chains, coffee shops, and event service providers. The strong heat resistance and leak-proof capabilities of sugarcane-based cups make them suitable for both hot and cold beverages. With a growing push to eliminate plastic waste, businesses across the hospitality sector are transitioning to biodegradable drinkware, fueling segment growth over the forecast period.

The United States Sugarcane Packaging Market generated USD 88.2 million in 2024 and is gaining significant traction, expanding at a CAGR of 6.3% through 2034. Regulatory developments in states like California and New York, which have implemented bans on single-use plastics, are accelerating the adoption of compostable alternatives. As sustainable procurement becomes a core business focus, the U.S. is solidifying its position as a high-potential market for sugarcane-based packaging.

Key players driving growth in the global market include Ecolates, Huhtamaki, Pactiv Evergreen, Dart Container Corporation, Detmold Group, and Berry Global Inc. These companies are heavily investing in expanding their compostable product portfolios, strengthening distribution networks, and partnering with fast-food chains and retail brands to secure long-term contracts. They're also focusing on localized manufacturing and advancing biodegradable material research to scale production efficiently and meet diverse regulatory and customer demands.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Vendor matrix

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news and initiatives

- 3.7 Industry impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Growing ESG (Environmental, Social, and Governance) Priorities

- 3.7.1.2 Government Initiatives and Incentives

- 3.7.1.3 Growing Consumer Environmental Awareness

- 3.7.1.4 Enhanced Brand Image and Market Differentiation

- 3.7.1.5 Increased Investment in R&D and Sustainable Manufacturing

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High production Costs

- 3.7.2.2 Supply Chain and Scalability Issues

- 3.7.1 Growth drivers

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

- 3.11 Regulatory landscape

Chapter 4 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Mn & kilotons)

- 4.1 Key trends

- 4.2 Bags & Pouches

- 4.3 Plates & Bowls

- 4.4 Cups & Lids

- 4.5 Clamshells/Containers

- 4.6 Others

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 – 2034 (USD Mn & kilotons)

- 5.1 Key trends

- 5.2 Pure bagasse fiber

- 5.3 Blended bagasse

Chapter 6 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Mn & kilotons)

- 6.1 Key trends

- 6.2 Foodservice industry

- 6.3 Retail & E-Commerce

- 6.4 Healthcare sector

- 6.5 Consumer goods

- 6.6 Industrial applications

Chapter 7 Market Estimates and Forecast, By Region, 2021– 2034 (USD Mn & kilotons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 Japan

- 7.4.2 China

- 7.4.3 India

- 7.4.4 South Korea

- 7.4.5 ANZ

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 UAE

- 7.6.3 Saudi Arabia

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 Berry Global Inc.

- 8.2 BioPak

- 8.3 Dart Container Corporation

- 8.4 Detmold Group

- 8.5 ECO Guardian

- 8.6 Ecolates

- 8.7 good natured Products Inc.

- 8.8 Good Start Packaging

- 8.9 GreenLine Paper Co.

- 8.10 Huhtamaki

- 8.11 Material Motion, Inc.

- 8.12 Packman

- 8.13 Pactiv Evergreen

- 8.14 PAKKA

- 8.15 Pappco Greenware

- 8.16 TedPack Company Limited

- 8.17 Vegware Ltd