|

시장보고서

상품코드

1721503

브로콜리 종자 수성 추출물 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Broccoli Seed Aqueous Extract Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

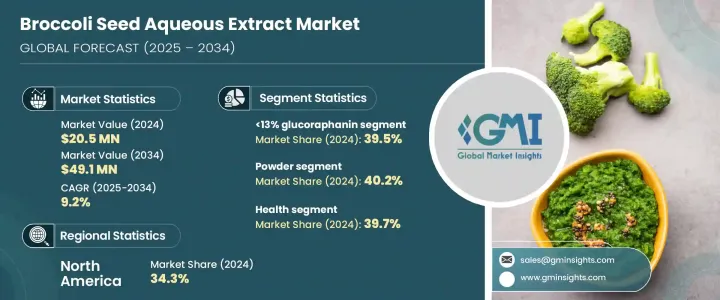

세계의 브로콜리 종자 수성 추출물 시장은 2024년에는 2,050만 달러로 평가되었고, CAGR 9.2%를 나타내 2034년에는 4,910만 달러에 이를 것으로 예상되고 있습니다. 건강 지향 사람들은 유기농과 식물 유래의 대체품으로 이동하고 있습니다. 술포라판의 폭넓은 치료가능성은 소비자들 뿐만 아니라 다양한 만성질환에 대한 예방효과를 밝히는 연구를 하고 있는 과학계들 사이에서도 관심을 불러 일으키고 있습니다. 비건 채식 및 식물성 식단의 급증은 특히 신흥국 시장에서 브로콜리 씨앗 유래의 보충제에 대한 수요를 더욱 높여주고 있습니다.

브로콜리 종자 수성 추출물에 대한 수요는 당초는 주로 건강 지향의 개인과 영양 보조 식품 분야에서의 것이었습니다. 카테고리로 나뉘어 그 중 하나가 수지 유형입니다. 2024년에는 13% 글루코라파닌 부문이 39.5%의 시장 점유율을 차지했습니다. 대중용 보충제 제조업체도 이용하기 쉽습니다. 밸런스가 잡힌 생리 활성과 저렴한 가격에 의해 이 카테고리는 임상 등급의 영양 보조 식품이나 의료 영양 브랜드공급업체의 사이에서 정평이 되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 2,050만 달러 |

| 예측 금액 | 4,910만 달러 |

| CAGR | 9.2% |

시장은 또한 분말, 캡슐, 정제 등 제품 형태별로 구분됩니다. 2024년에는 파우더 형태가 40.2%의 점유율을 차지했으며 2025년부터 2034년까지 9.4%의 연평균 성장률을 나타낼 것으로 예상됩니다. 분말은 스무디, 단백질 블렌드, 식물성 영양 제품 등 범용성이 높고 사용하기 쉽기 때문에 건강과 웰니스 분야에서 지지되고 있습니다. 또한 특히 준비가 필요없는 편의성과 정확한 복용량을 요구하는 사용자들 사이에서 기세를 늘리고 있습니다.

북미는 2024년 세계의 브로콜리 종자 수성 추출물 시장에서 34.3%의 점유율을 차지했습니다. 헬스케어에 대한 의식이 높아지면서 이 기세에 기여하고 있습니다.

시장 주요 기업으로는 Sabinsa Corporation, Kemin Industries, NutraScience Labs, Frutarom Health, NutraBio, 닛코 케미컬스 등이 있습니다. 이들 기업은 진화하는 소비자 요구에 대응하기 위해 분말, 캡슐, 정제 등 다양한 제품 형태로 포트폴리오를 확대하고 있습니다. 과도한 제제를 제공하기 위해 연구 개발에 투자하는 기업도 많습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 파괴적 혁신

- 향후 전망

- 제조업체

- 유통업체

- 트럼프 정권의 관세 영향 - 구조화된 개요

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 무역 통계

참고 : 위의 무역 상황은 주요 국가에 대해 제공됩니다.

- 공급업체의 상황

- 이익률 분석

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 소비자의 자연 식품에의 기호 증가

- 클린 뷰티와 퍼스널케어의 성장

- 보다 엄격한 규제와 클린 라벨 수요

- 업계의 잠재적 위험 및 과제

- 높은 생산 비용

- 공급망의 제약

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계·예측 : 유형별(2021-2034년)

- 주요 동향

- 글루콜라파닌 13% 미만

- 글루콜라파닌 13%

- 글루콜라파닌 20%

제6장 시장 추계·예측 : 형태별(2021-2034년)

- 주요 동향

- 분말

- 캡슐

- 정제

제7장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 동향

- 건강 제품

- 기능성 식품

- 제약

- 기타

제8장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

제9장 기업 프로파일

- Kemin Industries

- Sabinsa Corporation

- Frutarom Health

- NutraScience Labs

- NutraBio

- Sabinsa Corporation

- Nikko Chemicals

The Global Broccoli Seed Aqueous Extract Market was valued at USD 20.5 million in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 49.1 million by 2034. The market has experienced consistent growth as more consumers embrace plant-based wellness products and prioritize natural ingredients in their health regimens. With the rising awareness of the risks associated with synthetic supplements, health-focused individuals are shifting toward organic and plant-based alternatives. Broccoli seed aqueous extract, known for its high concentration of sulforaphane-a potent antioxidant compound-has gained attention for its ability to support detoxification, reduce inflammation, and combat oxidative stress. Sulforaphane's broad therapeutic potential has sparked interest not only among consumers but also within the scientific community, where research continues to uncover its protective effects against various chronic conditions. Additionally, the surge in veganism and plant-based diets has further amplified demand for broccoli seed-derived supplements, particularly in developed markets. Brands that highlight clean labels, functional ingredients, and transparency in sourcing are thriving, aligning with modern consumer values and wellness goals.

Initially, the demand for broccoli seed aqueous extract came primarily from health-conscious individuals and the dietary supplement segment. As awareness grows, this demand has broadened to include functional food producers and clinical nutrition sectors. The market is divided into various categories, one of which is resin type-this includes 13% glucoraphanin, a combination of 13% and 20% glucoraphanin, and 20% glucoraphanin concentrations. In 2024, the 13% glucoraphanin segment accounted for a 39.5% market share. It is especially popular due to its strong antioxidant and anti-inflammatory characteristics, making it a go-to ingredient for general wellness supplements and functional food formulations. Its affordability compared to higher concentrations makes it accessible to mass-market supplement manufacturers. The balanced bioactivity and reasonable cost have made this category a staple among suppliers of clinical-grade dietary supplements and medical nutrition brands.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $20.5 Million |

| Forecast Value | $49.1 Million |

| CAGR | 9.2% |

The market is further segmented by product form, including powder, capsules, and tablets. In 2024, powder form captured a 40.2% share and is expected to expand at a 9.4% CAGR from 2025 to 2034. Powders are favored in the health and wellness space due to their versatility and ease of use in smoothies, protein blends, and plant-based nutrition products. Capsules are also gaining momentum, especially among users seeking convenience and precise dosage without preparation. This format resonates with the nutraceutical and preventive health markets where consistency and accuracy matter.

North America held a 34.3% share of the global broccoli seed aqueous extract market in 2024. Growth in this region is driven by increasing consumer preference for natural, plant-based wellness solutions. Rising disposable incomes, coupled with growing awareness of preventive healthcare, have contributed to this momentum. Across regions-including North America, Europe, Asia Pacific, and Latin America-consumer behaviors, income levels, and health priorities vary, shaping regional growth patterns and market potential.

Key players in the global market include Sabinsa Corporation, Kemin Industries, NutraScience Labs, Frutarom Health, NutraBio, and Nikko Chemicals. These companies are expanding their portfolios with diverse product formats such as powders, capsules, and tablets to meet evolving consumer needs. With a focus on innovation and enhanced bioavailability, many are investing in R&D to deliver more effective formulations. Strategic partnerships with wellness influencers and collaborations with retailers and online platforms have been instrumental in boosting brand visibility and capturing new audiences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact of trump administration tariffs – structured overview

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics

Note: the above trade status will be provided for key countries

- 3.4 Supplier landscape

- 3.5 Profit margin analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising consumer preference for natural products

- 3.8.1.2 Growth in clean beauty & personal care

- 3.8.1.3 Stricter regulations & clean label demand

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High production costs

- 3.8.2.2 Supply chain constraints

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 <13% Glucoraphanin

- 5.3 13% Glucoraphanin

- 5.4 20% Glucoraphanin

Chapter 6 Market Estimates and Forecast, By Form, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Powder

- 6.3 Capsule

- 6.4 Tablet

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Health products

- 7.3 Functional foods

- 7.4 Pharmaceutical

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Kemin Industries

- 9.2 Sabinsa Corporation

- 9.3 Frutarom Health

- 9.4 NutraScience Labs

- 9.5 NutraBio

- 9.6 Sabinsa Corporation

- 9.7 Nikko Chemicals