|

시장보고서

상품코드

1721569

산업용 변전소 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Industrial Substation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

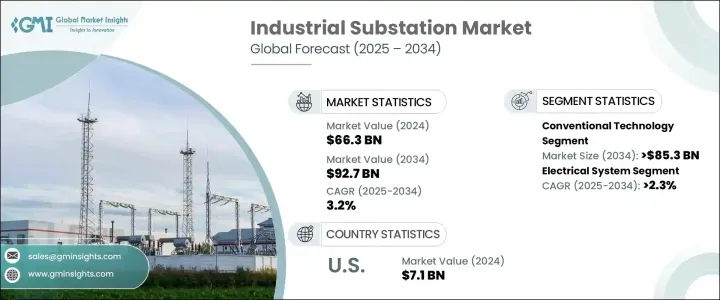

세계의 산업용 변전소 시장은 2024년에는 663억 달러로 평가되었고, CAGR 3.2%를 나타내 2034년에는 927억 달러에 이를 것으로 추정되고 있습니다. 변혁의 백본으로서의 역할을 완수하고, 중단 없는 전력 흐름, 시스템의 안정성, 재생 가능 에너지원과의 통합을 가능하게 합니다.

게다가 송전망의 신뢰성과 에너지 안보에 대한 우려가 높아짐에 따라 각 업계는 시대 지연의 전기 인프라를 근대화할 필요에 힘입어지고 있습니다. 정부와 민간 기업 모두, 특히 급속한 산업화와 도시의 성장에 의해 에너지 수요가 급증하고 있는 지역에서는 송전망의 근대화 구상에 다액의 투자를 투입하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 663억 달러 |

| 예측 금액 | 927억 달러 |

| CAGR | 3.2% |

이 기세는 생산활동 중 신뢰할 수 있는 전력공급에 대한 수요 증가, 재생가능에너지 통합 확대, 노후화된 전력망 시스템 업그레이드의 임박한 필요 등이 주요 요인이 되고 있습니다. 산업 부문이 지속 가능한 전략을 채택함에 따라 변전소는 그리드 성능을 향상시키고 에너지 손실을 줄이고 전체적인 신뢰성을 높이는 스마트 기술로 진화하고 있습니다. 네트워크의 운용을 합리화하고 에너지 효율을 높이는 고도의 감시·제어 시스템이 포함됩니다.

시장에서는 기존의 변전소 기술의 채용이 증가하고 있으며, 이 분야는 2034년까지 853억 달러를 창출할 것으로 예측되고 있습니다. 개발도상 지역의 대규모 사업에 있어서, 매우 중요한 역할을 계속하고 있습니다. 여기에서는 정부 주도의 인프라 개발 이니셔티브가, 송전망의 신뢰성을 확보하는 기존 변전소 수요를 가속시키고 있습니다.

전기 시스템 부문은 2025년부터 2034년에 걸쳐 CAGR 2.3%를 나타낼 것으로 예측되고 있습니다.

미국의 산업용 변전소 시장은 레거시 인프라의 근대화와 급속한 기술 도입으로 2024년에는 71억 달러에 달했습니다.

세계 시장 주요 기업은 ABB, 지멘스, 미쓰비시 전기, 슈나이더 일렉트릭, 제너럴 일렉트릭, 시스코 시스템즈, 이튼, 로크웰 오토메이션, 벨덴, 히타치 에너지, 도시바, Efacec, Netcontrol Group, L& T Electrical and Automation, SIFANGTes, Incorporated 등이 있습니다. 이들 기업은 그리드 효율과 재생 가능 에너지의 통합을 촉진하는 스마트 기술과 오토메이션 솔루션에 주력하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 업계 인사이트

- 생태계 분석

- 규제 상황

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 성장 가능성 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- PESTEL 분석

제3장 경쟁 구도

- 전략적 대시보드

- 혁신 및 지속가능성 전망

제4장 시장 규모와 예측 : 기술별(2021-2034년)

- 주요 동향

- 기존

- 디지털

제5장 시장 규모와 예측 : 구성 요소별(2021-2034년)

- 주요 동향

- 변전소 자동화 시스템

- 통신 네트워크

- 전기 시스템

- 모니터링 및 제어 시스템

- 기타

제6장 시장 규모와 예측 : 카테고리별(2021-2034년)

- 주요 동향

- 신규

- 개조

제7장 시장 규모와 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 프랑스

- 독일

- 이탈리아

- 러시아

- 스페인

- 아시아태평양

- 중국

- 호주

- 인도

- 일본

- 한국

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 남아프리카

- 이집트

- 라틴아메리카

- 브라질

- 아르헨티나

제8장 기업 프로파일

- ABB

- Belden

- Cisco Systems

- Eaton

- Efacec

- General Electric

- Grid to Great

- Hitachi Energy

- L&T Electrical and Automation

- Mitsubishi Electric

- Netcontrol Group

- Rockwell Automation

- Schneider Electric

- Siemens

- SIFANG

- Tesco Automation

- Texas Instruments Incorporated

- Toshiba

The Global Industrial Substation Market was valued at USD 66.3 billion in 2024 and is estimated to grow at a CAGR of 3.2% to reach USD 92.7 billion by 2034. This growth trajectory underscores the critical role of substations in the industrial sector's transition toward smarter, more sustainable energy practices. As industries accelerate their adoption of digitized and automated systems, the need for robust power infrastructure becomes non-negotiable. Industrial substations serve as the backbone of this transformation, enabling uninterrupted power flow, system stability, and integration with renewable energy sources. From manufacturing to mining and oil & gas, sectors across the board are heavily investing in reliable energy distribution to minimize production downtime and support efficient operations.

Moreover, growing concerns over grid reliability and energy security are compelling industries to modernize outdated electrical infrastructure. As nations ramp up their efforts to meet decarbonization targets and electrify their industrial base, substations equipped with smart technologies are poised to become the standard rather than the exception. Governments and private enterprises alike are funneling significant investments into grid modernization initiatives, particularly in regions where energy demand is surging due to rapid industrialization and urban growth. These dynamics are driving a steady demand for next-generation substation solutions that enhance monitoring, control, and operational resilience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $66.3 Billion |

| Forecast Value | $92.7 Billion |

| CAGR | 3.2% |

This momentum is largely driven by the rising demand for a reliable power supply during production operations, the growing integration of renewable energy, and the pressing need to upgrade aging grid systems. As industrial sectors adopt sustainable strategies, substations are evolving with smart technologies that improve grid performance, reduce energy losses, and increase overall reliability. These innovations include advanced monitoring and control systems that streamline grid operations and enhance energy efficiency. The focus remains on modernizing infrastructure to align with new energy standards while minimizing downtime and improving stability across networks. The demand for consistent and high-quality power is a cornerstone of market growth, especially in power-intensive industries like manufacturing, oil & gas, and mining.

The market is seeing increasing adoption of conventional substation technologies, with the segment projected to generate USD 85.3 billion by 2034. Despite the influx of smart systems, traditional substations continue to play a pivotal role, particularly in large-scale operations across developing regions. Here, government-led infrastructure development initiatives are accelerating demand for conventional substations that ensure grid reliability.

The electrical systems segment is anticipated to grow at a CAGR of 2.3% from 2025 to 2034. The rising integration of smart grid technologies and automation is propelling the adoption of energy-efficient components such as transformers, circuit breakers, and switchgear that reduce operational downtime and improve efficiency.

The U.S. Industrial Substation Market reached USD 7.1 billion in 2024, driven by the modernization of legacy infrastructure and rapid technology adoption. With increasing industrial demand for uninterrupted power-especially in sectors like manufacturing and oil & gas-investment in substation upgrades and expansions is expected to climb steadily.

Major players in the global market include ABB, Siemens, Mitsubishi Electric, Schneider Electric, General Electric, Cisco Systems, Eaton, Rockwell Automation, Belden, Hitachi Energy, Toshiba, Efacec, Netcontrol Group, L&T Electrical and Automation, SIFANG, Tesco Automation, and Texas Instruments Incorporated. These companies are focusing on smart technologies and automation solutions to boost grid efficiency and renewable integration. Strategic partnerships and tailored service offerings are also helping market leaders expand in developing regions, prioritizing power infrastructure upgrades.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Industry Insights

- 2.1 Industry ecosystem analysis

- 2.2 Regulatory landscape

- 2.3 Industry impact forces

- 2.3.1 Growth drivers

- 2.3.2 Industry pitfalls & challenges

- 2.4 Growth potential analysis

- 2.5 Porter's analysis

- 2.5.1 Bargaining power of suppliers

- 2.5.2 Bargaining power of buyers

- 2.5.3 Threat of new entrants

- 2.5.4 Threat of substitutes

- 2.6 PESTEL analysis

Chapter 3 Competitive landscape, 2024

- 3.1 Strategic dashboard

- 3.2 Innovation & sustainability landscape

Chapter 4 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million, Units)

- 4.1 Key trends

- 4.2 Conventional

- 4.3 Digital

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Substation automation system

- 5.3 Communication network

- 5.4 Electrical system

- 5.5 Monitoring & control system

- 5.6 Others

Chapter 6 Market Size and Forecast, By Category, 2021 - 2034 (USD Million, Units)

- 6.1 Key trends

- 6.2 New

- 6.3 Refurbished

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million, Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Belden

- 8.3 Cisco Systems

- 8.4 Eaton

- 8.5 Efacec

- 8.6 General Electric

- 8.7 Grid to Great

- 8.8 Hitachi Energy

- 8.9 L&T Electrical and Automation

- 8.10 Mitsubishi Electric

- 8.11 Netcontrol Group

- 8.12 Rockwell Automation

- 8.13 Schneider Electric

- 8.14 Siemens

- 8.15 SIFANG

- 8.16 Tesco Automation

- 8.17 Texas Instruments Incorporated

- 8.18 Toshiba