|

시장보고서

상품코드

1740756

자동차용 액티브 롤 컨트롤 시스템 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Automotive Active Roll Control System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

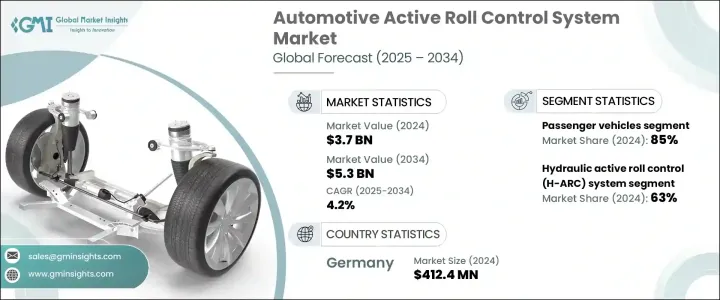

세계의 자동차용 액티브 롤 컨트롤 시스템 시장 규모는 2024년에 37억 달러에 달했고, CAGR 4.2%로 성장해 2034년까지 53억 달러에 이를 것으로 예측됩니다.

이는 차량의 안정성, 안전성, 승차감의 향상에 대한 요구의 높아짐, 특히 성장 현저한 SUV나 고급차 부문에 있어서의 요구가 원동력이 되고 있습니다. 부정지 주행시의 바디의 롤을 저감해, 핸들링의 정밀도와 전체적인 안전성을 대폭 향상시키는데 중요한 역할을 완수하고 있습니다. 쾌적성을 손상시키지 않고, 세련된 퍼포먼스 지향의 승차감을 제공하는 것을 목표로 하는 자동차 제조업체가 늘어나는 가운데, 액티브 롤 컨트롤 시스템은 최신의 차량 설계에 불가결한 것이 되었습니다.

이 시장은 SUV와 크로스 오버 차량의 판매 급증 덕분에 기세를 늘리고 있으며, 모두 중심이 높고 부드럽고 안전한 주행을 확보하기 위해보다 뛰어난 동적 제어가 필요합니다. 특히 도시와 교외의 환경에서는 예측 불가능한 노면이나 고속 코너링이 일반적으로 되어 있기 때문에 소비자는 실주행 조건 하에서의 자동차 성능을 보다 의식하게 되어 있습니다. 고객의 기대에 부응하여 브랜드 가치를 높이기 위해 프리미엄 차량 뿐만 아니라 중급차에도 액티브 롤 컨트롤 시스템을 탑재하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 37억 달러 |

| 예측 금액 | 53억 달러 |

| CAGR | 4.2% |

유럽과 북미와 같은 주요 지역의 안전 규제는 자동차 제조업체에 최첨단 기술에 대한 투자를 촉구하는 데 큰 역할을 수행하고 있습니다. 액티브 롤 컨트롤 시스템은 이러한 규제상의 요구를 충족하는 동시에 뛰어난 드라이빙 체험을 제공하는 것으로, 미래의 제품 라인업의 충실을 목표로 하는 OEM에 현명한 투자입니다.

자동차용 액티브 롤 컨트롤 시스템 시장은 유압식 액티브 롤 컨트롤(H-ARC)과 전기 기계식 액티브 롤 컨트롤(eARC)의 두 가지 주요 기술로 구분됩니다. 높은 작동력, 신뢰성, 빠른 응답 시간으로 알려진 H-ARC 시스템은 뛰어난 안정성과 성능을 제공할 수 없는 SUV 및 고급 차량에 널리 사용되고 있습니다.

한편, 전기기계식 액티브 롤 컨트롤 시스템은 특히 자동차 제조업체가 보다 에너지 효율이 높고, 컴팩트하고 전자 제어의 솔루션을 모색하고 있기 때문에 서서히 보급되고 있습니다. 차세대 EV와 하이브리드 차량에의 통합으로 향후 10년간 꾸준히 보급이 진행될 것으로 예측됩니다.

승용차는 2024년 세계 시장 점유율의 약 85%를 차지하는 주요 자동차 카테고리입니다. 하이브리드 자동차의 생산을 확대함에 따라 독자적인 설계와 중량 배분의 과제에 적응할 수 있는 혁신적인 서스펜션 시스템의 필요성이 높아지고 있습니다.

독일은 주요 기업으로 눈에 띄고 있으며, 2024년 세계 자동차용 액티브 롤 컨트롤 시스템 시장에서 29%의 점유율을 차지하고 있습니다. 독일은 최첨단 자동차 기술을 채택하고 있으며, 강력한 연구 개발 투자, 성숙한 공급업체 기반 및 엄격한 규제 프레임 워크를 통해 독일은 자동차 카테고리 전체에 첨단 안정성 시스템을 도입함으로써 주도적 지위를 유지하고 있습니다.

이 시장의 주요 기업은 ZF Friedrichshafen, ThyssenKrupp, Hyundai Mobis, Denso, Schaeffler, Robert Bosch, HELLA GmbH, Magna International, Continental 등이 있습니다.이 회사는보다 스마트하고 비용 효율적인 롤 제어 솔루션을 개발하기 위해 연구 개발에 많은 투자를하고 혁신을 두 배로 늘리고 있습니다. 에 EV와 하이브리드 모델에 이러한 시스템의 통합에 있어 그 범위를 넓혀가고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 부품 공급자

- Tier 1 공급업체

- 자동차 제조업체(OEM)

- 소프트웨어 및 기술 공급자

- 연구개발기관

- 이익률 분석

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 타국에 의한 보복조치

- 업계에 미치는 영향

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 기술과 혁신의 상황

- 가격 동향

- 특허 분석

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 차량의 안정성과 조종성 향상에 대한 수요 증가

- SUV나 고급차의 판매 증가

- 안전기능을 의무화하는 엄격한 정부규제

- 첨단 운전 지원 시스템(ADAS) 및 자동 운전 기술과의 통합

- 서스펜션 기술의 진보

- 업계의 잠재적 위험 및 과제

- 높은 초기 비용

- 통합과 조정의 복잡성

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계 및 예측 : 컴포넌트별, 2021-2034년

- 주요 동향

- 액추에이터

- 전자제어유닛(ECU)

- 센서

- 링키지와 마운트

제6장 시장 추계 및 예측 : 유형별, 2021-2034년

- 주요 동향

- 유압식 액티브 롤 컨트롤(H-ARC) 시스템

- 전기 기계식 액티브 롤 컨트롤(eARC) 시스템

제7장 시장 추계 및 예측 : 차량별, 2021-2034년

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV

- 상용차

- 소형 상용차(LCV)

- 중형 상용차(MCV)

- 대형 상용차(HCV)

제8장 시장 추계 및 예측 : 판매채널별, 2021-2034년

- 주요 동향

- OEM

- 애프터마켓

제9장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주 및 뉴질랜드

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

제10장 기업 프로파일

- Benteler

- BWI Group

- Continental

- Denso

- Eibach

- HELLA GmbH

- Hitachi Astemo

- Hyundai Mobis

- Infineon Technologies

- JTEKT Corporation

- KYB Corporation

- Magna International

- Mando Corporation

- Robert Bosch

- Schaeffler

- Tenneco

- ThyssenKrupp

- TRW Automotive

- WABCO

- ZF Friedrichshafen

The Global Automotive Active Roll Control System Market was valued at USD 3.7 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 5.3 billion by 2034, driven by the rising need for enhanced vehicle stability, safety, and ride comfort-especially in the growing SUV and luxury vehicle segments. As more consumers prioritize driving experience and on-road safety, the adoption of advanced suspension technologies like active roll control systems continues to accelerate. These systems play a vital role in reducing body roll when cornering or driving on uneven terrain, significantly improving handling precision and overall safety. With more automakers aiming to deliver a refined, performance-oriented ride without compromising comfort, active roll control systems are now seen as critical to modern vehicle design.

This market is witnessing increased momentum thanks to the surge in SUV and crossover vehicle sales, both of which have a higher center of gravity and require better dynamic control to ensure a smooth and safe ride. Consumers are also becoming more conscious of how vehicles perform in real-world driving conditions, especially with unpredictable road surfaces and high-speed cornering becoming more common in urban and suburban environments. Automakers are now integrating active roll control systems not only in premium vehicles but also in mid-range models to meet customer expectations and boost brand value. At the same time, the growing footprint of electric and hybrid vehicles-which often carry additional weight due to battery systems-calls for specialized suspension and stability systems, further fueling demand for active roll control technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $5.3 Billion |

| CAGR | 4.2% |

Safety regulations across key regions like Europe and North America are playing a major role in pushing automakers to invest in cutting-edge technologies. As governments impose stricter compliance norms around vehicle safety and performance, manufacturers are under pressure to enhance the safety profiles of their vehicles. Active roll control systems help meet these regulatory demands while simultaneously offering a superior driving experience, making them a smart investment for OEMs looking to future-proof their product lines.

The automotive active roll control system market is segmented into two primary technologies: hydraulic active roll control (H-ARC) and electromechanical active roll control (eARC). As of 2024, hydraulic systems dominate the space, accounting for nearly 63% of the market share. Known for their high actuation force, reliability, and fast response times, H-ARC systems are widely used in SUVs and luxury vehicles where superior stability and performance are non-negotiable. These systems are particularly suited for heavier vehicles and continue to be the go-to solution for manufacturers prioritizing robust performance.

On the other hand, electromechanical active roll control systems are gradually gaining traction, especially as automakers explore more energy-efficient, compact, and electronically controlled solutions. While eARC still holds a smaller portion of the market, its integration into next-gen EVs and hybrids is expected to drive steady adoption over the next decade. The shift toward electrification and software-defined vehicles aligns well with the capabilities of eARC systems, which offer more precise control and integration with vehicle electronics.

Passenger cars represent the dominant vehicle category, capturing around 85% of the global market share in 2024. This segment's lead stems from the growing preference for cars that offer a premium driving experience coupled with top-tier safety features. As automakers ramp up the production of electric and hybrid cars, there is an increasing need for innovative suspension systems that can adapt to unique design and weight distribution challenges. Active roll control systems fit perfectly into this equation, offering enhanced control and comfort without sacrificing energy efficiency.

Germany stands out as a major player, holding a 29% share of the global automotive active roll control system market in 2024. With its robust automotive sector-home to some of the world's top luxury and performance car manufacturers-Germany continues to lead in the adoption of cutting-edge vehicle technologies. Strong R&D investment, a mature supplier base, and stringent regulatory frameworks have helped the country maintain a leadership position in deploying advanced stability systems across vehicle categories.

Key players in this market include ZF Friedrichshafen, ThyssenKrupp, Hyundai Mobis, Denso, Schaeffler, Robert Bosch, HELLA GmbH, Magna International, and Continental. These companies are doubling down on innovation by investing heavily in R&D to develop smarter, more cost-effective roll control solutions. Collaborations with global automakers are expanding their reach, especially in integrating these systems into EVs and hybrid models. A strong focus on regulatory alignment, technology advancement, and presence in emerging economies is allowing these companies to stay competitive while meeting rising demand for safety, comfort, and high-performance driving.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component suppliers

- 3.2.2 Tier 1 suppliers

- 3.2.3 Automotive manufacturers (OEMs)

- 3.2.4 Software and technology providers

- 3.2.5 Research and development institutions

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Price trends

- 3.7 Patent analysis

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing demand for enhanced vehicle stability and handling

- 3.10.1.2 Increasing sales of SUVs and luxury vehicles

- 3.10.1.3 Stringent government regulations mandating safety features

- 3.10.1.4 Integration with advanced driver-assistance systems (ADAS) and autonomous driving technologies

- 3.10.1.5 Advancements in suspension technologies

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High initial cost

- 3.10.2.2 Complexity of integration and calibration

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Actuators

- 5.3 Electronic Control Units (ECUs)

- 5.4 Sensors

- 5.5 Linkages and mounts

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Hydraulic active roll control (H-ARC) system

- 6.3 Electromechanical active roll control (eARC) system

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Medium Commercial Vehicles (MCV)

- 7.3.3 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 OEMs (Original Equipment Manufacturers)

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Benteler

- 10.2 BWI Group

- 10.3 Continental

- 10.4 Denso

- 10.5 Eibach

- 10.6 HELLA GmbH

- 10.7 Hitachi Astemo

- 10.8 Hyundai Mobis

- 10.9 Infineon Technologies

- 10.10 JTEKT Corporation

- 10.11 KYB Corporation

- 10.12 Magna International

- 10.13 Mando Corporation

- 10.14 Robert Bosch

- 10.15 Schaeffler

- 10.16 Tenneco

- 10.17 ThyssenKrupp

- 10.18 TRW Automotive

- 10.19 WABCO

- 10.20 ZF Friedrichshafen