|

시장보고서

상품코드

1740793

건조 이유식 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Dried Baby Food Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

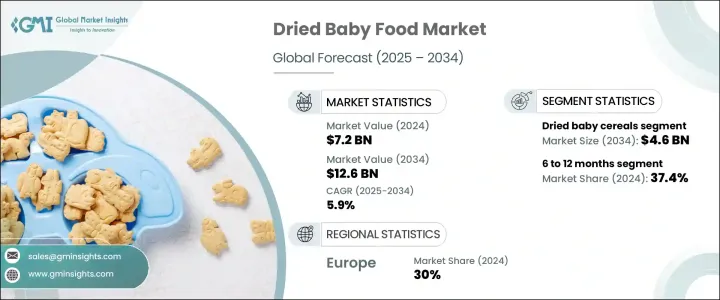

세계의 건조 이유식 시장은 2024년 72억 달러로 평가되었으며, 2034년까지 CAGR 5.9%로 성장하여 126억 달러에 이를 것으로 예측됩니다.

바쁜 라이프 스타일, 가처분 소득 증가, 유아 건강에 대한 보호자의 의식이 높아짐에 따라 선진 지역과 개발 도상 지역 수요를 밀어 올리고 있습니다. 시장의 역사적인 확대는 특히 시간 절약과 안전한 수유 옵션이 중요한 도심부에서 아기의 영양에 대한 인식이 진화하고 있는 것과 관련이 있을 수 있습니다.

핵가족화와 공동작업 가구가 증가함에 따라 컴팩트하고 여행에 편리한 유아용 식품으로의 이동도 현저합니다. 그 결과, 제조업체는 바쁜 라이프 스타일에 매끄럽게 피트하는 경량으로 리실러블, 1회분씩의 포장에 주목하고 있습니다. 낭비를 최소화하고 위생면에서도 우수하기 때문에 현대 육아의 요구에 이상적입니다. 수요를 뒷받침합니다. 부모는 자녀의 음식에 무엇이 들어 있는지 점점 더 신중해지고 있으며 투명성이 높은 원재료 조달과 최소한의 가공을 한 처방에 대한 수요의 급증으로 이어지고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 72억 달러 |

| 예측 금액 | 126억 달러 |

| CAGR | 5.9% |

제품 카테고리 중 건조 아기용 시리얼 분야는 프로바이오틱스, 비타민, 필수 미네랄을 포함한 영양 강화, 알레르겐 프리, 소화하기 쉬운 시리얼에 대한 수요의 급증에 영향을 받으며 CAGR 6.1%로 성장하여 2034년까지 46억 달러에 달할 것으로 예측됩니다. 어린 시절의 건강에 대한 우려 증가에 대응하기 때문에 깨끗한 원료와 강화 된 영양 프로파일에 초점을 맞추었습니다. 이 시장에서는 글루텐 프리와 유기농 등 특정 식단 요구에 대응하는 혁신이 진행되고 있습니다.

연령 기준의 선호도를 바탕으로 2024년에는 6-12개월의 카테고리가 37.4%로 최대의 점유율을 차지하고, 2034년까지의 CAGR은 6.5%를 보일 것으로 예측됩니다. 이 유아 개발 단계에서는 보다 복잡한 식감과 영양 성분을 도입할 필요가 있어, 편리한 소분분량 수요에 박차를 가하고 있습니다. 리실러블 용기나 일회용 파우치 등의 패키징 혁신으로, 이 제품은 일하는 부모에게 더욱 실용적이 되고 있습니다. 공동 작업 가구 증가와 조리된 제품의 인기 증가도이 부문의 원동력이 되었습니다. 시장이 확대되고 있지만, 특히 비용에 민감한 지역에서는 가격면에서 우려가 성장을 다소 억제할 수 있습니다.

유럽 건조 이유식 2024년 시장 점유율은 30%로 최대 영양 의식 높이와 영유아 식품 안전에 대한 규제 당국의 지원이 원동력 프리미엄 이유식와 유기농 이유식 선택에 대한 수요 증가가 계속 이 지역 전체의 제품 개발을 형성하고 있습니다. 시장의 확대는 강력한 구매력과 유럽 가정에서의 클린 라벨 제품의 인기가 높아지고 있습니다.

Abbott Laboratories, The Hain Celestial Group, Sprout Foods Inc., Meiji Holdings Co.Ltd., Nestle SA, Hero Group, Holle Baby Food GmbH, Arla Foods amba, Ella's Kitchen Limited, Plum PBC, Danone SA, FrieslandCampina, Co.Ltd., Gerber Products Company, The Kraft Heinz Company, Beech-Nut Nut Nrition Corporation, Topfer GmbH, HiPP International과 같은 기업이 시장에서의 프레즌스 향상에 적극적으로 참여하고 있습니다. 현지 유통업체와 제휴해, 패키징을 개량해 선반에의 소구력을 높이고 있습니다. 또한 각사는 세계적인 움직임을 강화해, 고객의 편의성을 향상시키기 위해, 디지털 인게이지먼트와 E-Commerce 채널을 늘리고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 제조업자

- 리셀러

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 무역 통계(HS코드)

- 주요 수출국

- 주요 수입국

- 공급망과 유통분석

- 원재료 조달

- 제조 공정

- 탈수 기술

- 동결건조법

- 품질관리

- 패키징 혁신

- 지속 가능한 패키지

- 스마트 패키징

- 편리한 기능

- 유통 네트워크

- 전통적인 소매업

- 전자상거래

- 소비자 직접 판매

- 공급망의 과제

- 원재료의 이용가능성

- 엔드 투 엔드의 품질 관리

- 물류

- 공급망 최적화

- 이익률 분석

- 주요 뉴스와 대처

- 규제 상황

- 세계의 규제 기준

- 지역 가이드라인

- FDA(미국)

- EFSA(EU)

- FSSAI(인도)

- CFDA(중국)

- 기타 지역규제

- 품질과 안전 기준

- 중금속 및 오염물질

- 영양소요량

- 라벨 및 클레임

- 포장의 안전성

- 유기농 인증 기준

- 규제상의 과제와 전략

- 미래의 규제 동향

- 영향요인

- 성장 촉진요인

- 여성의 노동력 참여율 향상

- 영아 영양에의 의식 향상

- 도시화와 라이프 스타일의 변화

- 편리성과 긴 보존 기간

- 업계의 잠재적 위험 및 과제

- 수제 이유식을 선호

- 엄격한 규제 기준

- 신흥 시장에서의 가격 감응성

- 공급망의 혼란

- 시장 기회

- 유기농 및 깨끗한 라벨 제품

- 강화된 기능적인 건조 이유식

- 신흥 시장 진출

- 전자상거래와 D2C 모델

- 시장의 과제

- 중금속 오염 우려

- 경쟁가격압력

- 소비자의 기호의 변화

- 지속가능성에 대한 우려

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

- 소비자 행동과 기호

- 소비자의 인구통계

- 구매 결정 요인

- 영양가

- 브랜드 신뢰

- 가격 감도

- 편리성

- 유기농과 천연 성분

- 소비자의 구매 패턴

- 온라인 vs. 오프라인

- 구독 모델

- 요약 구매

- 소비자의 의식과 교육

- 문화적 및 지역적 기호

- 소셜 미디어와 인플루언서의 영향

- 기술 혁신과 제품개발

- 처리 기술

- 고급 탈수

- 영양소의 보존

- 클린 라벨 방식

- 원료의 혁신

- 슈퍼 푸드

- 대체 단백질

- 천연 보존료

- 패키징 혁신

- 생분해성/퇴비화 가능한 소재

- 액티브하고 지능적인 패키징

- 물약 제어

- 디지털 통합

- QR코드 및 추적 가능성

- 모바일 앱

- 전자상거래 최적화

- 연구개발과 미래 동향

- 처리 기술

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계 및 예측 : 제품 유형별, 2021-2034년

- 주요 동향

- 건조 유아용 시리얼

- 건조 이유식

- 건조 아기 스낵 및 핑거 푸드

- 말린 과일 및 채소 퓌레

- 동결 건조 이유식

제6장 시장 추계 및 예측 : 원료별, 2021-2034년

- 주요 동향

- 유기농

- 기존

제7장 시장 추계 및 예측 : 연령별, 2021-2034년

- 주요 동향

- 4-6개월

- 6-12개월

- 12-24개월

- 24개월 이상

제8장 시장 추계 및 예측 : 유통 채널별, 2021-2034년

- 주요 동향

- 슈퍼마켓 및 하이퍼마켓

- 전문점

- 편의점

- 온라인 소매

- 약국과 약국

- 기타

제9장 시장 추계 및 예측 : 포장 형태별, 2021-2034년

- 주요 동향

- 파우치

- 병 및 병

- 캔

- 상자 및 판지

- 기타

제10장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제11장 기업 프로파일

- Nestle SA

- Danone SA

- Abbott Laboratories

- Hero Group

- Mead Johnson Nutrition Company

- The Hain Celestial Group, Inc.

- HiPP International

- The Kraft Heinz Company

- Plum, PBC

- Ella's Kitchen Limited

- Gerber Products Company

- Sprout Foods, Inc.

- Beech-Nut Nutrition Corporation

- Bellamy's Organic Pty Ltd

- Arla Foods amba

- FrieslandCampina

- Meiji Holdings Co.,Ltd.

- Topfer GmbH

- Holle Baby Food GmbH

- Riri Baby Food Co.,Ltd.

The Global Dried Baby Food Market was valued at USD 7.2 billion in 2024 and is estimated to grow at a CAGR of 5.9 % to reach USD 12.6 billion by 2034, driven by the increasing preference for easy-to-prepare and nutritionally balanced infant meals. Busy lifestyles, rising disposable incomes, and growing parental awareness about infant health are pushing demand across developed and developing regions. Parents choose dried baby food for its long shelf life, convenience, and nutritional value. The market's historic expansion can be linked to the evolving perception of baby nutrition, particularly in urban centers where time-saving and safe feeding options are critical.

With an increasing number of nuclear families and working parents, there's also a noticeable shift toward compact, travel-friendly food options for infants. Convenience and portability have become essential factors for time-constrained caregivers who prioritize both nutrition and ease of use. As a result, manufacturers are focusing on lightweight, resealable, and single-serve packaging that fits seamlessly into busy lifestyles. These formats reduce preparation time, minimize waste, and offer greater hygiene, making them ideal for modern parenting needs. The trend toward organic, non-GMO, and clean-label products is reshaping buyer preferences and supporting sustained demand across global markets. Parents are becoming increasingly cautious about what goes into their children's food, leading to a surge in demand for transparent ingredient sourcing and minimally processed formulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.2 Billion |

| Forecast Value | $12.6 Billion |

| CAGR | 5.9% |

Among product categories, the dried baby cereals segment is expected to reach USD 4.6 billion by 2034, growing at a CAGR of 6.1% influenced by the surge in demand for fortified, allergen-free, and easily digestible cereals that contain probiotics, vitamins, and essential minerals. New formulations now focus on clean ingredients and enhanced nutritional profiles to address growing concerns about early childhood health. The market witness's innovation through gluten-free and organic options catering to specific dietary needs.

Based on age-based preferences, the 6 to 12-month category held the largest share in 2024 at 37.4% and is expected to grow at a 6.5% CAGR through 2034. This stage of infant development requires the introduction of more complex food textures and nutritional content, fueling demand for convenient, pre-portioned meals. Packaging innovation, such as resealable containers and single-use pouches, makes these products even more practical for working parents. The rise in dual-income households and the increasing popularity of ready-to-eat products are also driving forces in this segment. Although the market is expanding, pricing concerns may temper growth slightly, especially in more cost-sensitive regions.

Europe Dried Baby Food Market held the largest share of 30% in 2024, driven by high nutritional awareness and regulatory support for infant food safety. Increased demand for premium and organic baby food options continues to shape product development across the region. Market expansion is also supported by strong purchasing power and the rising popularity of clean-label offerings in European households. In addition to a strong regulatory framework, Europe benefits from high purchasing power, which fuels the demand for high-quality baby food products.

Companies such as Abbott Laboratories, The Hain Celestial Group, Sprout Foods Inc., Meiji Holdings Co. Ltd., Nestle S.A., Hero Group, Holle Baby Food GmbH, Arla Foods amba, Ella's Kitchen Limited, Plum PBC, Danone S.A., FrieslandCampina, Bellamy's Organic Pty Ltd, Riri Baby Food Co. Ltd., Gerber Products Company, The Kraft Heinz Company, Beech-Nut Nutrition Corporation, Topfer GmbH, and HiPP International are actively working to enhance market presence. Leading brands invest in product diversification, sustainable sourcing, and clean-label innovation. Many are expanding organic lines, partnering with local distributors, and enhancing packaging for greater shelf appeal. Additionally, companies are increasing digital engagement and e-commerce channels to strengthen global outreach and improve customer convenience.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Manufacturers

- 3.1.4 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic Industry Responses

- 3.2.4.1 Supply Chain Reconfiguration

- 3.2.4.2 Pricing and Product Strategies

- 3.2.4.3 Policy Engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.6 Strategic industry responses

- 3.2.6.1 Supply chain reconfiguration

- 3.2.6.2 Pricing and product strategies

- 3.2.6.3 Policy engagement

- 3.2.7 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

- 3.4 Supply Chain and Distribution Analysis

- 3.4.1 Raw Material Sourcing

- 3.4.2 Manufacturing Processes

- 3.4.2.1 Dehydration Technologies

- 3.4.2.2 Freeze-Drying Methods

- 3.4.2.3 Quality Control

- 3.4.3 Packaging Innovations

- 3.4.3.1 Sustainable Packaging

- 3.4.3.2 Smart Packaging

- 3.4.3.3 Convenience Features

- 3.4.4 Distribution Network

- 3.4.4.1 Traditional Retail

- 3.4.4.2 E-commerce

- 3.4.4.3 Direct-to-Consumer

- 3.4.5 Supply Chain Challenges

- 3.4.5.1 Raw Material Availability

- 3.4.5.2 End-to-End Quality Control

- 3.4.5.3 Logistics

- 3.4.6 Supply Chain Optimization

- 3.5 Profit margin analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.7.1 Global Regulatory Standards

- 3.7.2 Regional Guidelines

- 3.7.2.1 FDA (U.S.)

- 3.7.2.2 EFSA (EU)

- 3.7.2.3 FSSAI (India)

- 3.7.2.4 CFDA (China)

- 3.7.2.5 Other Regional Regulations

- 3.7.3 Quality and Safety Standards

- 3.7.3.1 Heavy Metals and Contaminants

- 3.7.3.2 Nutritional Requirements

- 3.7.3.3 Labeling and Claims

- 3.7.3.4 Packaging Safety

- 3.7.4 Organic Certification Standards

- 3.7.5 Regulatory Challenges and Strategies

- 3.7.6 Future Regulatory Trends

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising Female Workforce Participation

- 3.8.1.2 Increasing Awareness of Infant Nutrition

- 3.8.1.3 Urbanization and Changing Lifestyles

- 3.8.1.4 Convenience and Longer Shelf Life

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Preference for Homemade Baby Food

- 3.8.2.2 Stringent Regulatory Standards

- 3.8.2.3 Price Sensitivity in Emerging Markets

- 3.8.2.4 Supply Chain Disruptions

- 3.8.3 Market opportunities

- 3.8.3.1 Organic and Clean Label Products

- 3.8.3.2 Fortified and Functional Dried Baby Food

- 3.8.3.3 Expansion in Emerging Markets

- 3.8.3.4. E-commerce and D2 C Models

- 3.8.4 Market Challenges

- 3.8.4.1 Heavy Metal Contamination Concerns

- 3.8.4.2 Competitive Pricing Pressure

- 3.8.4.3 Changing Consumer Preferences

- 3.8.4.4 Sustainability Concerns

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Consumer Behavior and Preferences

- 3.12.1 Consumer Demographics

- 3.12.2 Purchase Decision Factors

- 3.12.2.1 Nutritional Value

- 3.12.2.2 Brand Trust

- 3.12.2.3 Price Sensitivity

- 3.12.2.4 Convenience

- 3.12.2.5 Organic and Natural Ingredients

- 3.12.3 Consumer Buying Patterns

- 3.12.3.1 Online vs. Offline

- 3.12.3.2 Subscription Models

- 3.12.3.3 Bulk Purchases

- 3.12.4 Consumer Awareness and Education

- 3.12.5 Cultural and Regional Preferences

- 3.12.6 Impact of Social Media and Influencers

- 3.13 Technological Innovations and Product Development

- 3.13.1 Processing Technologies

- 3.13.1.1 Advanced Dehydration

- 3.13.1.2 Nutrient Preservation

- 3.13.1.3 Clean Label Methods

- 3.13.2 Ingredient Innovations

- 3.13.2.1 Superfoods

- 3.13.2.2 Alternative Proteins

- 3.13.2.3 Natural Preservatives

- 3.13.3 Packaging Innovations

- 3.13.3.1 Biodegradable/Compostable Materials

- 3.13.3.2 Active and Intelligent Packaging

- 3.13.3.3 Portion Control

- 3.13.4 Digital Integration

- 3.13.4.1 QR Codes and Traceability

- 3.13.4.2 Mobile Apps

- 3.13.4.3 E-commerce Optimization

- 3.13.5 R&D and Future Trends

- 3.13.1 Processing Technologies

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Dried baby cereals

- 5.3 Dried baby meals

- 5.4 Dried baby snacks and finger foods

- 5.5 Dried fruit and vegetable purees

- 5.6 Freeze-dried baby food

Chapter 6 Market Estimates & Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Organic

- 6.3 Conventional

Chapter 7 Market Estimates & Forecast, By Age Group, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 4–6 Months

- 7.3 6–12 Months

- 7.4 12–24 Months

- 7.5 Above 24 Months

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Supermarkets and hypermarkets

- 8.3 Specialty stores

- 8.4 Convenience stores

- 8.5 Online retail

- 8.6 Pharmacies and drugstores

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Pouches

- 9.3 Jars and bottles

- 9.4 Cans

- 9.5 Boxes and cartons

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Nestle S.A.

- 11.2 Danone S.A.

- 11.3 Abbott Laboratories

- 11.4 Hero Group

- 11.5 Mead Johnson Nutrition Company

- 11.6 The Hain Celestial Group, Inc.

- 11.7 HiPP International

- 11.8 The Kraft Heinz Company

- 11.9 Plum, PBC

- 11.10 Ella's Kitchen Limited

- 11.11 Gerber Products Company

- 11.12 Sprout Foods, Inc.

- 11.13 Beech-Nut Nutrition Corporation

- 11.14 Bellamy's Organic Pty Ltd

- 11.15 Arla Foods amba

- 11.16 FrieslandCampina

- 11.17 Meiji Holdings Co., Ltd.

- 11.18 Topfer GmbH

- 11.19 Holle Baby Food GmbH

- 11.20 Riri Baby Food Co., Ltd.