|

시장보고서

상품코드

1740816

자동차 캠 샤프트 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Automotive Camshaft Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

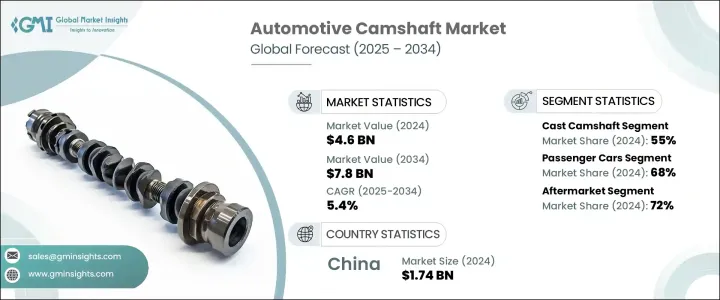

세계의 자동차 캠 샤프트 시장 규모는 2024년 46억 달러에 달하고, CAGR 5.4%로 성장해 2034년까지 78억 달러에 달할 것으로 예측됩니다.

이러한 성장은 고성능 엔진에 대한 요구 증가와 세계 자동차 생산의 지속적인 증가를 기여합니다. 승용차 제조업체도 상용차 제조업체도 최신의 엔진 기술을 채용해, 캠 샤프트를 엔진 강화 전략의 핵심에 자리잡고 있습니다. 자동차 제조업체는 경량 소재, 정밀 공학, 가변 밸브 타이밍 등의 선진 기술을 통합한 차세대 캠 샤프트 설계에 투자하고 있습니다. 이러한 기술 혁신은 출력을 최적화하고, 연비를 향상시키고, 배출 가스를 줄이는 동시에 다양한 차량 클래스에서 부드러운 가속과 응답성을 향상시킵니다. 또한 캠 샤프트는 엔진의 장수명화에도 공헌하고 있어, 고성능 모델 뿐만이 아니라, 일상적인 자동차에도 빠뜨릴 수 없는 것이 되고 있습니다. 엔진 성능과 연비 향상에 대한 관심이 높아지고 있는 것은 북미에 한한 것은 아닙니다. 가처분 소득 증가, 자동차 소유 증가, 효율적인 자동차 수요 증가가 아시아태평양과 라틴아메리카 신흥 시장에서 왕성한 수요를 이끌고 있습니다. 이러한 동향은 세계에서 캠 샤프트의 개발과 제조의 미래를 형성하는 데 도움이 되고 있습니다.

시장 세분화는 제품별로 주조, 단조, 조립 캠 샤프트로 구분됩니다. 주조 캠 샤프트가 널리 사용되는 이유는 비용 효율적이고 대량 생산이 용이하기 때문입니다. 제작에 있어서, 계속해서 최유력 후보입니다. 개선된 야금 방법이나 금형 설계 등의 주조 기술의 진보는 주조 캠 샤프트의 성능과 내구성의 향상에 도움이 되고 있습니다. 주조 캠 샤프트와 경쟁하여 그 우위성을 보다 견고한 것으로 하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 46억 달러 |

| 예측 금액 | 78억 달러 |

| CAGR | 5.4% |

차종별로 캠 샤프트 시장은 승용차와 상용차로 구분됩니다. 승용차는 2024년에 시장의 68%를 차지하고 최대 점유율을 차지하며, 이 부문은 2034년까지 연평균 복합 성장률(CAGR) 5% 이상으로 성장할 것으로 예측됩니다. 이 동향을 뒷받침하는 것은 특히 개발도상지역에서의 자동차 생산 증가입니다. 터보차징이나 가변 밸브 타이밍 등의 기술에 의해 엔진 시스템이 고도화됨에 따라 이러한 개량에 대응할 수 있는 캠 샤프트 수요가 높아지고 있습니다. 엄격한 배기 가스 규제는 자동차 제조업체가 첨단 캠 샤프트 기술의 통합을 촉진하고 있습니다. 내연 기관을 계속 사용하는 하이브리드 자동차 및 전기자동차는 성능과 효율성을 균형있게 설계된 맞춤형 캠 샤프트에 대한 수요를 더욱 높입니다.

판매 채널의 경우 시장은 상대방 상표 제품 제조업체(OEM)와 애프터마켓으로 분류됩니다. 2024년 시장 점유율은 애프터마켓 부문이 72%로 우위를 차지하고 있으며, 2025년부터 2034년까지 CAGR 6% 이상으로 성장할 것으로 예측되고 있습니다. 자동차 소유자 중에는 스스로 업그레이드 및 커스터마이징하는 사람이 늘어나고 있으며, 애프터마켓의 캠 샤프트 제품의 인기가 높아지고 있습니다. 이러한 부품은 전자상거래 플랫폼에서 쉽게 사용할 수 있으므로 소비자는 제품을 비교하고 리뷰를 읽고 충분한 정보를 얻은 후에 구입할 수 있습니다. SUV, 픽업 트럭, 오프로드 모델과 같은 차량에는 고성능 부품이 필요하며 특히이 분야를 견인하고 있습니다. 제조업체 각사는 출력과 연비의 요구에 대응하는 성능 특화형 캠 샤프트의 혁신으로, 이 수요에 응하고 있습니다.

2024년에는 중국이 아시아태평양에서 압도적인 지위를 차지하고 시장 전체의 약 38%를 차지하며 17억 4,000만 달러의 매출을 창출했습니다. 자동차 보유 대수의 지속적인 증가와 에너지 효율적인 운송을 목표로 하는 정부의 뒷받침이 최신 캠 샤프트 기술에 대한 수요를 지지하고 있습니다. 또한 이 나라의 견고한 자동차 제조 생태계는 OEM과 애프터마켓 채널 모두에서 안정적인 수요를 확보하는데 중요한 역할을 하고 있습니다. 도시 지역의 소비자는 성능 업그레이드를 위해 내구성이 높고 저렴한 캠 샤프트를 요구하고 있으며, 이는이 주요 지역에서 애프터마켓 분야의 확대를 지원합니다.

자동차 캠 샤프트 분야의 주요 기업은 정밀 공학과 고강도 재료로 한계에 도전하는 세계 주요 제조업체를 포함합니다. 이 회사는 스마트 캠 샤프트 시스템과 가변 밸브 타이밍 기능의 통합에 주력하고 있으며, 이를 통해 엔진은 다양한 주행 조건에 적응하고 연료 사용량을 향상시킬 수 있습니다. 이러한 기술은 하이브리드 차량과 미래의 차량 플랫폼에 필수적이며, 캠 샤프트는 모든 차량 범주에서 신뢰할 수 있고 고성능 엔진을 확보하면서 최신 효율 및 배출 가스 기준을 충족하는 데 중요한 구성 요소입니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 제조업자

- 원재료 공급자

- 자동차 OEM

- 유통 채널

- 최종 용도

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(고객에 대한 비용)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 이익률 분석

- 기술과 혁신의 상황

- 특허 분석

- 주요 뉴스와 대처

- 규제 상황

- 가격 동향 분석

- 제품

- 지역

- 코스트 내역 분석

- 영향요인

- 성장 촉진요인

- 세계 자동차 생산 증가

- 엔진 설계의 기술적 진보

- 고성능차 및 고급차 수요 증가

- 재료 및 제조 개선

- 하이브리드차 도입

- 업계의 잠재적 위험 및 과제

- 제조업에의 고액의 자본 투자

- 전기자동차(EV)로의 이행

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계 및 예측 : 제품별, 2021-2034년

- 주요 동향

- 주조 캠 샤프트

- 단조 캠 샤프트

- 조립된 캠 샤프트

제6장 시장 추계 및 예측 : 차량별, 2021-2034년

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV

- 상용차

- 소형 상용차

- 중형 상용차

- 대형 상용차

제7장 시장 추계 및 예측 : 판매 채널별, 2021-2034년

- 주요 동향

- OEM

- 애프터마켓

제8장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주 및 뉴질랜드

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

제9장 기업 프로파일

- Aichi Forge

- Camshaft Machine

- Comp Performance

- Crane Cams

- Elgin Industries

- Engine Power Components

- Estas Camshaft

- Hirschvogel

- JD Norman

- KAUTEX TEXTRON

- Linamar

- Mahle

- Musashi Seimitsu

- Piper Cams

- Precision Camshafts

- Riken

- Schaeffler

- Shadbolt

- ThyssenKrupp

- Varroc Group

The Global Automotive Camshaft Market was valued at USD 4.6 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 7.8 billion by 2034. This growth is being fueled by the increasing need for high-performance engines and the consistent rise in vehicle production across the globe. Both passenger and commercial vehicle manufacturers are adopting modern engine technologies, placing camshafts at the core of engine enhancement strategies. Automakers are investing in next-generation camshaft designs that integrate lightweight materials, precision engineering, and advanced technologies like variable valve timing. These innovations help optimize power output, enhance fuel efficiency, and reduce emissions while ensuring smoother acceleration and improved responsiveness in various vehicle classes. Camshafts are also instrumental in extending engine longevity, making them essential not just for high-performance models but also for everyday vehicles. The growing interest in enhanced engine performance and fuel economy is not limited to North America. Rising disposable income, increased vehicle ownership, and a growing demand for efficient vehicles are driving strong demand in emerging markets across Asia-Pacific and Latin America. This widespread trend is helping to shape the future of camshaft development and manufacturing around the world.

The automotive camshaft market is segmented by product into cast, forged, and assembled camshafts. Cast camshafts accounted for approximately 55% of the market in 2024 and are projected to grow at a CAGR of over 6% through 2034. Their widespread use is attributed to their cost-efficiency and the ease of mass production. Cast camshafts continue to be the top choice for large-scale manufacturing, particularly for vehicles in the economy and mid-range segments. Advancements in casting techniques, such as improved metallurgical methods and mold designs, are helping enhance the performance and durability of cast camshafts. These developments make cast versions more competitive with forged alternatives, further solidifying their dominance. Cast camshafts are substantially more affordable to produce than forged ones, a key factor contributing to their adoption in both developed and emerging automotive markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.6 Billion |

| Forecast Value | $7.8 Billion |

| CAGR | 5.4% |

When it comes to vehicle types, the camshaft market is divided into passenger cars and commercial vehicles. Passenger cars held the largest share in 2024, accounting for 68% of the market, and this segment is expected to grow at a CAGR of more than 5% through 2034. Increasing vehicle production, especially in developing regions, continues to support this trend. As engine systems become more advanced with technologies like turbocharging and variable valve timing, the demand for camshafts that can keep up with these improvements is rising. Stringent emissions standards are also encouraging automakers to integrate more sophisticated camshaft technologies. Hybrid and electric vehicles that continue to use internal combustion engines further boost the demand for custom-engineered camshafts designed to balance performance and efficiency.

In terms of sales channels, the market is categorized into original equipment manufacturers (OEMs) and the aftermarket. The aftermarket segment dominated in 2024 with a market share of 72% and is projected to grow at a CAGR of more than 6% from 2025 to 2034. A growing number of vehicle owners are turning to do-it-yourself upgrades and customizations, increasing the popularity of aftermarket camshaft products. These components are easily accessible via e-commerce platforms, allowing consumers to compare products, read reviews, and make informed purchases. The need for high-performance components in vehicles such as SUVs, pickup trucks, and off-road models is especially driving this segment. Manufacturers are responding to the demand with performance-specific camshaft innovations that cater to power and fuel efficiency needs.

In 2024, China held a dominant position in the Asia-Pacific region, capturing about 38% of the total market and generating USD 1.74 billion in revenue. Continued growth in vehicle ownership and the government's push toward energy-efficient transportation are sustaining demand for modern camshaft technologies. The robust automotive manufacturing ecosystem in the country also plays a significant role in ensuring consistent demand across both OEM and aftermarket channels. Urban consumers are increasingly seeking durable and affordable camshafts for performance upgrades, which supports the expansion of the aftermarket segment in this key region.

Leading companies in the automotive camshaft space include major global manufacturers that are pushing boundaries with precision engineering and high-strength materials. These players are focused on smart camshaft systems and integrating variable valve timing features, which allow engines to adapt to different driving conditions and improve fuel usage. With these technologies becoming vital in hybrid and future vehicle platforms, camshafts remain a critical component in meeting modern efficiency and emissions standards while ensuring reliable and high-performing engines across all vehicle categories.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Manufacturers

- 3.2.2 Raw material suppliers

- 3.2.3 Automotive OEM

- 3.2.4 Distribution channel

- 3.2.5 End use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Trade impact

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (Cost to customers)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Trade impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Pricing trend analysis

- 3.9.1 Product

- 3.9.2 Region

- 3.10 Cost breakdown analysis

- 3.11 Impact on forces

- 3.11.1 Growth drivers

- 3.11.1.1 Rising global vehicle production

- 3.11.1.2 Technological advancements in engine design

- 3.11.1.3 Increased demand for performance and luxury vehicles

- 3.11.1.4 Improvements in materials and manufacturing

- 3.11.1.5 Hybrid vehicle adoption

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High capital investment for manufacturing

- 3.11.2.2 Shifts toward electric vehicles (EVs)

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Cast camshaft

- 5.3 Forged camshaft

- 5.4 Assembled camshaft

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles

- 6.3.2 Medium commercial vehicles

- 6.3.3 Heavy commercial vehicles

Chapter 7 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 Saudi Arabia

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 Aichi Forge

- 9.2 Camshaft Machine

- 9.3 Comp Performance

- 9.4 Crane Cams

- 9.5 Elgin Industries

- 9.6 Engine Power Components

- 9.7 Estas Camshaft

- 9.8 Hirschvogel

- 9.9 JD Norman

- 9.10 KAUTEX TEXTRON

- 9.11 Linamar

- 9.12 Mahle

- 9.13 Musashi Seimitsu

- 9.14 Piper Cams

- 9.15 Precision Camshafts

- 9.16 Riken

- 9.17 Schaeffler

- 9.18 Shadbolt

- 9.19 ThyssenKrupp

- 9.20 Varroc Group