|

시장보고서

상품코드

1740824

자동차용 스마트 서피스 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Automotive Smart Surface Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

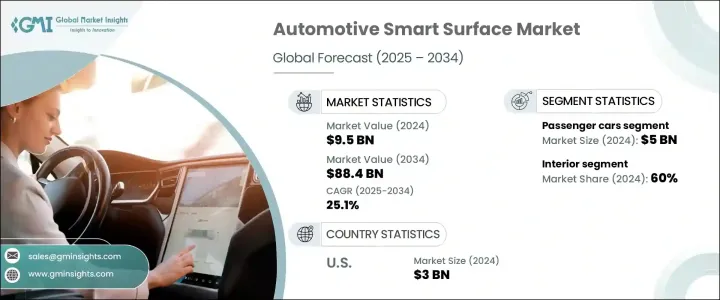

세계의 자동차용 스마트 서피스 시장 규모는 2024년 95억 달러에 달했고, CAGR 25.1%로 성장해 2034년까지 884억 달러에 이를 것으로 예측됩니다.

이 흥미로운 성장은 커넥티드 자동차 인테리어의 통합 증가, 소재와 휴먼 머신 인터페이스(HMI)의 기술 진보, 보다 고급 디지털 차량 내 경험으로 소비자의 강한 시프트에 의해 촉진됩니다. 자동차에서 첨단 기술에 수요가 높아짐에 따라, 시장에도 기술 혁신의 파도가 밀려 있어, 보다 스마트하고 직관적인 시스템이 차량 설계의 표준이 되고 있습니다.

자동차의 스마트 서피스는 더 이상 단순한 미적 기능을 완수하는 것이 아닙니다. 양식과 제스처 기반의 새로운 컨트롤이 도입되었습니다. 또한, 전기자동차와 자율 주행 차량에서는 개인화되고 연결되고 공간 절약적인 솔루션에 대한 수요가 계속해서 이 시장을 견인하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 95억 달러 |

| 예측 금액 | 884억 달러 |

| CAGR | 25.1% |

자기 수복 코팅, 표면 통합형 센서, 곡면 3D 인터페이스 등의 중요한 기술 혁신은 차실 설계에 혁명을 가져오고 있습니다. 스마트 서피스 기술에 중점을 두고 있습니다. 공유 모빌리티으로의 전환과 프리미엄 전기자동차(EV)의 인기가 높아짐에 따라 깨끗하고 사용자 정의 가능한 시각적으로 통합된 스마트 인테리어 요소가 더욱 가속화되었습니다.

차량 카테고리별로 승용차 부문은 2024년에 50억 달러를 창출해 예측 기간을 통해 우위를 유지할 것으로 예측됩니다. EV와 자율주행 모델의 보급에 의해 자동차 제조업체는 터치 컨트롤, 앰비언트 조명, 센서 구동형 인터페이스를 짜넣은 응답성이 높은 표면의 통합을 진행하고 있어, 미래적이고 고기능인 차내 환경을 요구하는 경향이 더욱 강해지고 있습니다.

서피스 유형 중 인테리어의 스마트 서피스는 2024년에 60%의 점유율을 차지했습니다. 이 혁신은 사용자의 편의성을 높일뿐만 아니라 브랜드 가치가 최첨단 기술의 통합과 밀접하게 연결되어있는 고급 EV 및 하이엔드 자동차에서도 매우 중요합니다.

미국의 자동차용 서피스 시장은 2024년에 30억 달러를 창출해 2034년까지의 CAGR은 25.4%가 될 것으로 예상되고 있습니다. HMI 시스템, 대화형 대시보드, 프리미엄 및 미드레인지 모델에 대한 응답성이 높은 인테리어 패널의 개발에 점차 협력하고 있습니다.

Faurecia, Covestro, Hyundai, Dura, Canatu, Gentex, Continental, TactoTek, KURZ, Flex 등 시장의 주요 기업은 자동차 스마트 서피스의 미래를 적극적으로 형성하고 있습니다. 지속 가능하고 경량인 기재를 우선하는 제품 유형도 있으면, 지역 수요에 응하기 위해서 현지 생산에 투자해, 모든 차종에 있어서 에너지 효율, 안전성, 원활한 유저 인터랙션을 확보하는 제품 유형도 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 원재료 공급자

- 부품 공급업체

- 제조업자

- 테크놀로지 프로바이더

- 유통 채널 분석

- 최종 용도

- 이익률 분석

- 공급자의 상황

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 무역에 미치는 영향

- 기술과 혁신의 상황

- 특허 분석

- 규제 상황

- 코스트 내역 분석

- 주요 뉴스와 대처

- 영향요인

- 성장 촉진요인

- 차재 커넥티비티와 UX 수요 증가

- 재료와 제조에서의 기술 진보

- 전기차와 자율주행차의 성장

- OEM은 경량화와 설계 통합에 주력

- 업계의 잠재적 위험 및 과제

- 높은 생산 비용

- 내구성과 환경 감도

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계 및 예측 : 지상, 2021-2034년

- 주요 동향

- 인테리어

- 외관

제6장 시장 추계 및 예측 : 차량별, 2021-2034년

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV

- 상용차

제7장 시장 추계 및 예측 : 용도별, 2021-2034년

- 주요 동향

- 교통기관

- 일렉트로닉스

- 공사

- 의료 및 헬스케어

- 에너지

- 기타

제8장 시장 추계 및 예측 : 기술별 2021-2034년

- 주요 동향

- 터치스크린 인터페이스

- 자기 복구 표면

- 임베디드 센서

- 적응형 표면

- 셀프 클리닝 표면

제9장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 프랑스

- 영국

- 스페인

- 이탈리아

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주 및 뉴질랜드

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 남아프리카

- 사우디아라비아

제10장 기업 프로파일

- 3M

- BASF

- Canatu

- Continental

- Covestro

- Dura

- Faurecia

- Flex

- Gentex

- Hyundai Mobis

- KURZ

- LG

- Marelli

- Motherson

- Panasonic

- Preh

- Sekisui

- TactoTek

- Toyota Boshoku

- Yanfeng

The Global Automotive Smart Surface Market was valued at USD 9.5 billion in 2024 and is estimatedected to grow at a CAGR of 25.1% to reach USD 88.4 billion by 2034. This impressive growth is fueled by the increasing integration of connected vehicle interiors, technological advancements in materials and human-machine interfaces (HMIs), and a strong consumer shift toward more advanced digital in-cabin experiences. With the rise of electric and autonomous vehicles, automakers are under increasing pressure to enhance vehicle interiors by blending design and functionality, placing smart surfaces at the heart of this transformation. As demand for advanced technology in vehicles grows, the market is also witnessing a wave of innovation, with smarter, more intuitive systems becoming a standard in vehicle designs.

Smart surfaces in vehicles no longer serve merely an aesthetic function. These cutting-edge surfaces incorporate touch-responsive controls, dynamic lighting, haptic feedback, and digital displays into key interior components such as dashboards, door panels, and center consoles. As traditional physical buttons phase out, new capacitive and gesture-based controls are being implemented to enhance driver convenience and improve cabin ergonomics. The growth of this technology is propelled by the progress in printable electronics and transparent conductive materials, which are pivotal in supporting safety systems and infotainment functions. Moreover, the demand for personalized, connected, and space-saving solutions in electric and autonomous vehicles continues to drive this market forward.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.5 Billion |

| Forecast Value | $88.4 Billion |

| CAGR | 25.1% |

Key innovations such as self-healing coatings, surface-integrated sensors, and curved 3D interfaces are revolutionizing cabin design. As consumers increasingly demand user-friendly, high-tech environments, automotive OEMs are heavily investing in smart surface technologies that meet these evolving expectations. The shift toward shared mobility and the increasing popularity of premium electric vehicles (EVs) further accelerate the need for clean, customizable, and visually integrated smart interior elements.

In terms of vehicle categories, the passenger cars segment generated USD 5 billion in 2024 and is expected to maintain its dominance throughout the forecast period. This segment benefits from the rising consumer demand for in-cabin digital features, which enhance comfort, interactivity, and personalization. The widespread adoption of EVs and autonomous models is pushing automakers to integrate responsive surfaces with embedded touch controls, ambient lighting, and sensor-driven interfaces, further aligning with the trend toward futuristic, highly functional cabin environments.

Among surface types, interior smart surfaces accounted for a 60% share in 2024. As vehicle manufacturers move away from traditional controls, they are investing in multifunctional, seamless displays with capacitive touch, haptic feedback, and dynamic lighting features. These innovations not only enhance user convenience but are also crucial in luxury EVs and high-end vehicles, where brand value is closely tied to the integration of cutting-edge technology.

The United States automotive smart surface market generated USD 3 billion in 2024 and is expected to experience a CAGR of 25.4% through 2034. This growth is driven by the country's advanced R&D ecosystem, early adoption of next-generation technologies, and a growing luxury EV market. U.S.-based OEMs and Tier 1 suppliers are increasingly working together to develop intelligent HMI systems, interactive dashboards, and responsive interior panels for premium and mid-range models. These systems are also being integrated into broader smart mobility trends, such as driver assistance technologies, AI assistants, and connected infotainment ecosystems.

Leading players in the market, including Faurecia, Covestro, Hyundai, Dura, Canatu, Gentex, Continental, TactoTek, KURZ, and Flex, are actively shaping the future of automotive smart surfaces. To strengthen their market position, these companies are focusing on partnerships with automotive OEMs, scaling R&D for multifunctional materials, and developing modular platforms that can adapt to evolving vehicle electronics. Some players are also prioritizing sustainable and lightweight substrates, while others are investing in localized production to better serve regional demands, ensuring energy efficiency, safety compliance, and seamless user interaction across all vehicle types.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End Use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.1 Impact on trade

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Cost breakdown analysis

- 3.7 Key news & initiatives

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for in-vehicle connectivity and UX

- 3.8.1.2 Technological advancements in materials & manufacturing

- 3.8.1.3 Growth in electric and autonomous vehicles

- 3.8.1.4 OEM focus on weight reduction and design integration

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High production costs

- 3.8.2.2 Durability and environmental sensitivity

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Surface, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Interior

- 5.3 Exterior

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Transportation

- 7.3 Electronics

- 7.4 Construction

- 7.5 Medical & healthcare

- 7.6 Energy

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Technology 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Touchscreen interfaces

- 8.3 Self-Healing surfaces

- 8.4 Embedded sensors

- 8.5 Adaptive surfaces

- 8.6 Self-cleaning surfaces

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 3M

- 10.2 BASF

- 10.3 Canatu

- 10.4 Continental

- 10.5 Covestro

- 10.6 Dura

- 10.7 Faurecia

- 10.8 Flex

- 10.9 Gentex

- 10.10 Hyundai Mobis

- 10.11 KURZ

- 10.12 LG

- 10.13 Marelli

- 10.14 Motherson

- 10.15 Panasonic

- 10.16 Preh

- 10.17 Sekisui

- 10.18 TactoTek

- 10.19 Toyota Boshoku

- 10.20 Yanfeng