|

시장보고서

상품코드

1740833

자동차용 휠 스핀들 시장 기회, 성장 촉진 요인, 산업 동향 분석, 예측(2025-2034년)Automotive Wheel Spindle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

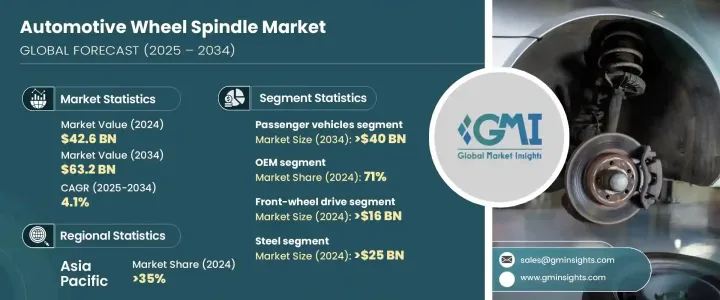

자동차용 휠 스핀들 세계 시장 규모는 2024년 426억 달러로 평가되었고, 2034년까지 CAGR 4.1%로 성장할 전망이며, 632억 달러에 달할 것으로 추정됩니다. 자동차(EV)는 전기 모터가 생산하는 토크 패턴의 차이와 배터리로 인한 무게 증가로 인해 휠 어셈블리에 새로운 설계를 요구합니다.

게다가, 특히 북미나 유럽 등의 지역에서는 신모델의 구입보다도 차량의 개수를 선호하는 경향이 강해지고 있기 때문에 애프터마켓 분야는 큰 성장을 이루고 있습니다. 부품 교체 및 업그레이드를 선택합니다. 이 동향은 자동차 보유 대수가 많고 자동차 유지 보수 문화가 뿌리 깊고 비용 효율성과 지속가능성이 우선하는 시장에서 특히 두드러집니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 426억 달러 |

| 예측 금액 | 632억 달러 |

| CAGR | 4.1% |

승용차 부문은 2024년에 280억 달러를 차지했으며, 상용차에 비해 승용차의 세계적 수요가 높기 때문에 2034년에는 400억 달러에 이를 것으로 예측됩니다. 제조업체는 승차감, 안전성, 핸들링의 정확성에 대한 소비자의 기대의 고조에 대응하기 위해 혁신적인 스핀들 설계를 채택하고 있습니다. 전기자동차와 하이브리드 자동차의 상승은 향상된 성능과 경량 특성을 가진 고급 스핀들 수요에 기여합니다.

최종 용도에 따라 시장은 OEM 부문과 애프터마켓 부문으로 나뉩니다. OEM 부문은 2024년에 71%의 점유율을 차지했고 예측 기간을 통해 성장을 계속할 것으로 예측됩니다. 스핀들은 조립 공정에서 신차에 내장되어 OEM이 휠 스핀들 수요의 주요 견인 역할을 하고 있습니다. 전기자동차용 경량 스핀들에 대한 관심이 높아짐에 따라 OEM은 숙련된 스핀들 공급업체에 대한 의존도를 높이고 있습니다. 이러한 장기 계약은 스핀들 기술과 설계 혁신을 촉구하는 동시에 안정성을 제공합니다.

아시아태평양 자동차용 휠 스핀들의 2024년 점유율은 35%로 중국이 이 지역을 선도하고 있습니다. 전기자동차의 도입을 촉진하는 정부의 정책이, 고성능 및 저중량의 스핀들 수요를 더욱 촉진하고 있습니다. 지역공급자 클러스터는 연구개발에 대한 투자와 함께 스핀들 기술의 혁신에 박차를 가하고 있습니다.

세계 자동차용 휠 스핀들 산업의 주요 기업은 ZF Friedrichshafen AG, Hyundai Mobis, ThysenKrupp AG, Hitachi Astemo, Magna International, Schaeffler AG, JTEKT Corporation이 포함되어 있습니다. 시장에서의 존재감을 높이기 위해, 자동차용 휠 스핀들 업계의 기업은 몇개의 전략에 주력하고 있습니다. 대규모 솔루션을 추구하는 전기자동차 제조업체의 특정 요구를 충족시키기 위해 기술 혁신에 많은 투자를 실시하고 있으며, 많은 제조업체들은 스핀들의 적시 공급을 보장하고 생산 지연을 최소화하기 위해 공급망 네트워크를 개선하고 급성장하는 시장에서 경쟁력을 유지하는 데 도움이 됩니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 원재료 공급자

- 부품 제조업체

- 애프터마켓 공급자 및 판매자

- 최종 사용자

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 주요 원재료의 가격 변동

- 공급망 재구성

- 최종 시장에의 가격 전달

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 무역에 미치는 영향

- 이익률 분석

- 기술과 혁신의 상황

- 주요 뉴스와 대처

- 비용 분석

- 가격 분석

- 제품

- 지역

- 특허 분석

- 규제 상황

- 영향요인

- 성장 촉진요인

- 세계 자동차 생산 증가

- 전기자동차(EV)로의 이행

- 애프터마켓 수요 증가

- ADAS, 자율 시스템 등 차량 기술의 급속한 진보

- 업계의 잠재적 위험 및 과제

- 원재료 가격 변동

- 공급망의 혼란

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추정 및 예측 : 차량별, 2021년-2034년

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV

- 상용차

- 경상용차(LCV)

- 중형 상용차(MCV)

- 대형 상용차(HCV)

제6장 시장 추정 및 예측 : 제품별, 2021년-2034년

- 주요 동향

- 프론트 스핀들

- 리어 스핀들

- 스티어링 너클 스핀들

제7장 시장 추정 및 예측 : 재료별, 2021년-2034년

- 주요 동향

- 강철

- 알루미늄

- 복합재료

제8장 시장 추정 및 예측 : 휠 드라이브, 2021년-2034년

- 주요 동향

- 전륜 구동(FWD)

- 후륜구동(RWD)

- 전륜 구동(AWD)

제9장 시장 추정 및 예측 : 용도별, 2021년-2034년

- 주요 동향

- 서스펜션 시스템

- 스티어링 시스템

제10장 시장 추정 및 예측 : 최종 용도별, 2021년-2034년

- 주요 동향

- OEM

- 애프터마켓

제11장 시장 추정 및 예측 : 지역별, 2021년-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

제12장 기업 프로파일

- American Axle &Manufacturing Holdings

- Benteler Automotive

- Bharat Forge

- BRIST Axle Systems

- Cardone Industries

- Dana

- GKN Automotive

- Hitachi Astemo

- Hyundai Mobis

- JTEKT

- Linamar

- Magna International

- MAT Foundry Group

- Meritor

- MevoTech

- NSK

- NTN

- Schaeffler

- ThyssenKrupp

- ZF Friedrichshafen

The Global Automotive Wheel Spindle Market was valued at USD 42.6 billion in 2024 and is estimated to grow at 4.1% CAGR to reach USD 63.2 billion by 2034 driven by the recovery of the automotive sector, particularly in developing nations, which is increasing vehicle production. As manufacturers scale production to meet the rising consumer demand, the need for essential components like wheel spindles grows correspondingly. The shift toward electric and hybrid vehicles is also helpful in driving this market. Electric vehicles (EVs) require new designs for wheel assemblies due to different torque patterns produced by electric motors and the added weight from batteries. This transition creates strong demand for lightweight, high-strength wheel spindles, as manufacturers look to optimize performance and efficiency.

Moreover, the aftermarket segment is experiencing significant growth due to the increasing preference for vehicle refurbishment over purchasing new models, particularly in regions like North America and Europe. As vehicles age, many consumers and fleet operators choose to replace or upgrade parts, such as wheel spindles, to extend the lifespan of their vehicles while avoiding the high costs of new purchases. This trend is particularly prevalent in markets with large vehicle populations and strong vehicle maintenance cultures, where cost-effectiveness and sustainability are prioritized. The rising demand for replacement parts in these regions is driving the growth of the aftermarket segment, making it an essential part of the overall market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $42.6 Billion |

| Forecast Value | $63.2 Billion |

| CAGR | 4.1% |

The passenger vehicle segment accounted for USD 28 billion in 2024 and is expected to reach USD 40 billion by 2034 attributed to the high global demand for passenger cars compared to commercial vehicles. Manufacturers adopt innovative spindle designs to meet growing consumer expectations for ride comfort, safety, and handling precision. The rise of electric and hybrid automobiles contributes to the demand for advanced spindles with improved performance and lightweight characteristics.

Based on end-use, the market is divided into original equipment manufacturers (OEM) and aftermarket segments. The OEM segment accounted for 71% share in 2024 and is expected to continue growing throughout the forecast period. OEMs are the primary drivers of wheel spindle demand, as spindles are integrated into new vehicles during the assembly process. The growing focus on lightweight spindles for electric vehicles pushes OEMs to rely more heavily on skilled spindle suppliers. These long-term contracts provide stability while encouraging innovation in spindle technology and design.

Asia Pacific Automotive Wheel Spindle Market held a 35% share in 2024, with China leading the region. The country's automotive industry is expanding rapidly, driven by a strong manufacturing base and the increasing production of electric vehicles. Government policies that promote electric vehicle adoption are further driving demand for high-performance, low-weight spindles. Local supplier clusters, along with investments in research and development, are fueling innovation in spindle technology.

The leading companies in the Global Automotive Wheel Spindle Industry include ZF Friedrichshafen AG, Hyundai Mobis, ThyssenKrupp AG, Hitachi Astemo, Magna International, Schaeffler AG, and JTEKT Corporation. To strengthen their market presence, companies in the automotive wheel spindle industry focus on several strategies. These include forming strategic partnerships with OEMs, advancing research and development in lightweight and high-performance materials, and expanding their manufacturing capabilities in emerging markets. Additionally, companies are investing heavily in innovation to meet the specific needs of electric vehicle manufacturers, which are seeking tailored solutions to enhance the efficiency of their vehicles. Furthermore, many players are improving their supply chain networks to ensure timely delivery of spindles and minimize production delays, helping them to maintain a competitive edge in a fast-growing market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Aftermarket suppliers and distributors

- 3.2.4 End users

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Impact on trade

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on the Industry

- 3.3.2.1 Price volatility in key materials

- 3.3.2.2 Supply chain restructuring

- 3.3.2.3 Price transmission to end markets

- 3.3.3 Strategic industry responses

- 3.3.3.1 Supply chain reconfiguration

- 3.3.3.2 Pricing and product strategies

- 3.3.1 Impact on trade

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Cost analysis

- 3.8 Pricing analysis

- 3.8.1 Product

- 3.8.2 Region

- 3.9 Patent analysis

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Rising global vehicle production

- 3.11.1.2 Shift toward Electric Vehicles (EVs)

- 3.11.1.3 Growing aftermarket demand

- 3.11.1.4 Rapid advancements in vehicle technologies such as ADAS, autonomous systems

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 Raw material price volatility

- 3.11.2.2 Supply chain disruptions

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchback

- 5.2.2 Sedan

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light Commercial Vehicle (LCV)

- 5.3.2 Medium Commercial Vehicle (MCV)

- 5.3.3 Heavy Commercial Vehicle (HCV)

Chapter 6 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Front spindle

- 6.3 Rear spindle

- 6.4 Steering knuckle spindle

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Steel

- 7.3 Aluminum

- 7.4 Composite materials

Chapter 8 Market Estimates & Forecast, By Wheel Drive, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Front-Wheel Drive (FWD)

- 8.3 Rear-Wheel Drive (RWD)

- 8.4 All-Wheel Drive (AWD)

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Suspension system

- 9.3 Steering system

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 American Axle & Manufacturing Holdings

- 12.2 Benteler Automotive

- 12.3 Bharat Forge

- 12.4 BRIST Axle Systems

- 12.5 Cardone Industries

- 12.6 Dana

- 12.7 GKN Automotive

- 12.8 Hitachi Astemo

- 12.9 Hyundai Mobis

- 12.10 JTEKT

- 12.11 Linamar

- 12.12 Magna International

- 12.13 MAT Foundry Group

- 12.14 Meritor

- 12.15 MevoTech

- 12.16 NSK

- 12.17 NTN

- 12.18 Schaeffler

- 12.19 ThyssenKrupp

- 12.20 ZF Friedrichshafen