|

시장보고서

상품코드

1740834

도로 속도 제한기 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Road Speed Limiter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

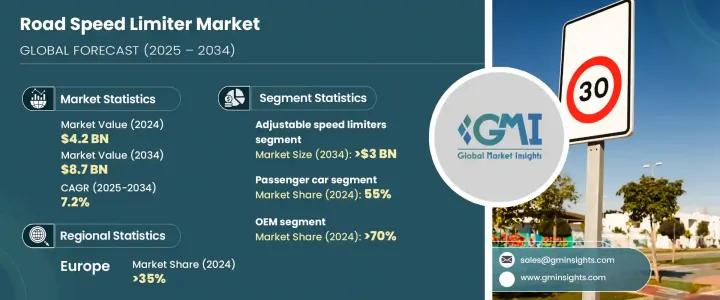

세계의 도로 속도 제한기 시장 규모는 2024년에 42억 달러에 달했고, CAGR 7.2%를 나타내 2034년에는 87억 달러에 이를 것으로 추정됩니다.

이 성장의 원동력이 되고 있는 것은 규제의 강화, 교통 안전에 대한 관심 증가, 기술 혁신의 조합입니다. 이 규제는 교통 사고를 줄이고 배출 가스를 최소화하고보다 안전한 운전 습관을 촉진하는 것을 목표로 하고 있습니다. 소비자의 기대에 부응하기 위해 선진적인 속도 제한기 시스템을 탑재하게 되어 있습니다. 기계의 필요성이 증가하고 있으며, 스마트 모빌리티와 차량 텔레매틱스의 진화로 속도 제한기는 단순한 제어 장치에서 지능형 데이터 구동 시스템으로 변모하고 있습니다.

자동차 기술의 급속한 진보로 속도 제한기의 효율과 인텔리전스는 크게 향상되고 있습니다. 자동차 제조업체는 이러한 업그레이드를 받아들이고 이러한 시스템을 많은 신형 차량에 표준 장비하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 42억 달러 |

| 예측 금액 | 87억 달러 |

| CAGR | 7.2% |

도로 속도 제한기 시장은 제품 유형별로, 조정식 속도 제한기, 인텔리전트 속도 제한기(ISL), 전자식 속도 제한기(ESL), GPS 베이스 시스템, 기계식 속도 제한기로 구분됩니다. 조정식 속도 제한기는 2024년에는 시장 전체의 50% 이상을 차지하는 압도적인 점유율을 차지했고, 2034년에는 30억 달러 이상에 달할 것으로 예측됩니다. 이러한 시스템은 다양한 지역의 주행 조건, 법적 요구 사항, 차량 클래스에 적응하는 데 필요한 유연성을 제공합니다.

차량 유형별로 시장은 승용차와 상용차로 분류됩니다. 2024년에는 승용차가 세계 점유율의 55%를 차지했습니다. 인구밀도가 높은 지역에서 계속 강화되고 있기 때문에 승용차에 탑재되는 속도 제한기 시스템에 대한 수요는 강한 기세를 늘리고 있습니다.

최종 용도별로는 시장은 OEM(상대처 브랜드 제조)과 애프터마켓으로 나눌 수 있습니다. 2024년에는 OEM이 세계 시장의 70% 이상을 차지했습니다. 적극적인 접근 방식은 환경 친화적이고 첨단 기술에 익숙한 자동차에 대한 수요 증가와 일치합니다.

지역별로 유럽이 2024년 세계 점유율의 35% 이상을 차지하며 주요 지역 시장에 부상했습니다. 정첵 규제의 표준이 제조업체에게 최첨단 속도 제어 시스템의 도입을 촉구하고 있습니다.

도로 속도 제한기 분야의 주요 기업으로는 AVS, Autoliv, Continental, Remote Control Technologies(RCT), Denso Corporation, Robert Bosch, Valeo SA, Vodafone Automotive, SABO Electronic Technology, ZF Friedrichshafen 등이 있습니다. 이러한 기업들은 안전성, 연비 효율, 환경성능을 겸비한 선진적 솔루션을 개발하기 위해 연구개발과 전략적 제휴에 많은 투자를 하고 있습니다. 자동차 커넥티비티와 자동화가 진행되고 있는 가운데, 속도 제한기의 미래는 보다 안전하고 깨끗하고 책임있는 모빌리티를 보장하는 스마트한 통합에 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 자동차 OEM

- 속도 제한기 제조업체

- 소프트웨어 및 AI 기반 텔레매틱스 제공업체

- 하드웨어 구성 요소 공급자

- 규제 및 안전 기술 제공업체

- 최종 용도

- 이익률 분석

- 트럼프 대통령의 행정관세

- 무역에 미치는 영향

- 국경을 넘은 규정 준수의 혼란

- 지역 규제의 차이

- 업계에 미치는 영향

- 공급측의 영향(부품 및 기술 공급자)

- 전자부품의 가격변동

- 조달 및 조립 체인 조정

- 수요측에 대한 영향(OEM 및 플릿 오퍼레이터)

- 차량 비용과 가격에 대한 민감성 증가

- 차량 조달 동향의 변화

- 공급측의 영향(부품 및 기술 공급자)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 수직 통합과 부품 현지화

- OEM 및 규제 당국과의 전략적 파트너십

- 적응형 가격 설정과 제품 포지셔닝

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 이익률 분석

- 기술과 혁신의 상황

- 특허 분석

- 가격 동향

- 지역

- 차량

- 주요 뉴스와 대처

- 규제 상황

- 사례 연구

- 영향요인

- 성장 촉진요인

- 엄격한 정부규제와 안전기준

- 차량 시스템의 기술 진보

- 도로 안전과 연비에 대한 의식의 고조

- 상용선대의 운용의 성장

- 업계의 잠재적 위험 및 과제

- 설치 및 유지 보수 비용이 증가

- 성장 촉진요인이나 오퍼레이터로부터의 저항

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계·예측 : 제품별(2021-2034년)

- 주요 동향

- 조절 가능한 속도 제한기

- 지능형 속도 제한기(ISL)

- 전자식 속도 제한기(ESL)

- GPS 기반 속도 제한 시스템

- 기계식 속도 제한기

제6장 시장 추계·예측 : 차량별(2021-2034년)

- 주요 동향

- 승용차

- 상용차

- 소형 상용차(LCV)

- 중형 상용차(MCV)

- 대형 상용차(HCV)

제7장 시장 추계·예측 : 최종 용도별(2021-2034년)

- 주요 동향

- OEM

- 애프터마켓

제8장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 스페인

- 이탈리아

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주 및 뉴질랜드

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 남아프리카

- 사우디아라비아

제9장 기업 프로파일

- Aptiv

- Autograde International

- AutoKontrol

- Autoliv

- AVS LTD

- Continental

- Denso

- Elson

- Highway Digital(Nigeria)Limited

- MKP Parts

- Pricol Limited

- Remote Control Technologies(RCT)

- Robert Bosch

- Rosmerta Technologies

- SABO Electronic Technology

- Sturdy

- Transtronix India

- Valeo

- Vodafone Automotive

- ZF Friedrichshafen

The Global Road Speed Limiter Market was valued at USD 4.2 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 8.7 billion by 2034. This growth is being driven by a combination of regulatory enforcement, rising road safety concerns, and technological innovation. Governments around the world are enforcing stricter safety laws that mandate the installation of speed limiting systems in both commercial and passenger vehicles. These regulations aim to reduce traffic accidents, minimize emissions, and promote safer driving habits. As vehicle production continues to climb globally, manufacturers are increasingly incorporating advanced speed limiter systems to meet compliance and consumer expectations. Simultaneously, rising urbanization and growing vehicle ownership have intensified the need for speed control mechanisms to reduce road congestion and support environmental goals. Moreover, the evolution of smart mobility and vehicle telematics is transforming speed limiters from simple control devices to intelligent, data-driven systems.

The rapid advancement in automotive technology has significantly improved the efficiency and intelligence of speed limiters. New-generation systems are now integrated with GPS, Artificial Intelligence (AI), and various driver assistance technologies, allowing real-time speed adjustments based on road conditions, vehicle location, and traffic patterns. This makes speed limiting more adaptive, responsive, and user-friendly. Vehicle manufacturers are embracing these upgrades, making such systems a standard feature in many new models. As the automotive industry continues its shift toward connected and automated vehicles, the relevance of intelligent speed control is becoming more pronounced. Consumers are also showing a growing preference for safety-oriented features, further pushing the demand for sophisticated speed limiters.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 7.2% |

Based on product type, the road speed limiter market is segmented into adjustable speed limiters, intelligent speed limiters (ISL), electronic speed limiters (ESL), GPS-based systems, and mechanical speed limiters. Adjustable speed limiters held the dominant share in 2024, accounting for over 50% of the total market, and are projected to surpass USD 3 billion by 2034. These systems provide the flexibility needed to adapt to different regional driving conditions, legal requirements, and vehicle classes. Their ability to be modified quickly and easily makes them especially useful for fleets operating across various jurisdictions. This adaptability plays a crucial role in enhancing compliance and preventing violations, making them a preferred solution for commercial operators and logistics providers.

By vehicle type, the market is categorized into passenger cars and commercial vehicles. In 2024, passenger vehicles captured 55% of the global share. A significant portion of this growth can be credited to heightened regulatory pressures targeting passenger safety and the overall increase in personal vehicle ownership worldwide. As automotive safety standards continue to tighten, especially in densely populated regions, demand for embedded speed limiter systems in passenger vehicles is gaining strong momentum. These systems are becoming essential components of modern safety packages, helping to reduce the incidence of speeding and encouraging responsible driving behavior.

On the basis of end use, the market is divided into OEMs (Original Equipment Manufacturers) and aftermarket. In 2024, OEMs held more than 70% of the global market. With rising consumer interest in built-in safety technologies and intelligent driving features, automotive manufacturers are integrating speed limiter systems directly at the production stage. This proactive approach aligns with the growing demand for environmentally friendly and tech-savvy vehicles. OEMs are increasingly embedding adjustable and intelligent speed limiting technologies as part of advanced driver assistance ecosystems, ensuring compliance with evolving legal standards and improving overall vehicle performance and safety.

Geographically, Europe emerged as the leading regional market, commanding over 35% of the global share in 2024. The region's leadership is fueled by its rigorous automotive safety laws and widespread adoption of vehicle safety technologies. Strong policy frameworks and industry-wide standards continue to encourage manufacturers to implement cutting-edge speed control systems. This regulatory support is creating a unified landscape for speed limiter deployment and solidifying the region's dominance in the global market.

Key players in the road speed limiter space include AVS, Autoliv, Continental, Remote Control Technologies (RCT), Denso Corporation, Robert Bosch, Valeo SA, Vodafone Automotive, SABO Electronic Technology, and ZF Friedrichshafen. These companies are investing heavily in R&D and strategic collaborations to develop advanced solutions that combine safety, fuel efficiency, and environmental performance. With vehicle connectivity and automation on the rise, the future of speed limiters lies in smart integrations that ensure safer, cleaner, and more responsible mobility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Automotive OEMs

- 3.2.2 Speed limit device manufacturers

- 3.2.3 Software & AI-based telematics providers

- 3.2.4 Hardware component suppliers

- 3.2.5 Regulatory and safety technology providers

- 3.2.6 End Use

- 3.3 Profit margin analysis

- 3.4 Trump administrative tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Cross-border compliance disruptions

- 3.4.1.2 Regional regulatory divergence

- 3.4.2 Impact on the industry

- 3.4.2.1 Supply-side impact (component & tech suppliers)

- 3.4.2.1.1 Electronic component price fluctuations

- 3.4.2.1.2 Sourcing and assembly chain adjustments

- 3.4.2.2 Demand-side impact (OEMs & fleet operators)

- 3.4.2.2.1 Increased vehicle cost and price sensitivity

- 3.4.2.2.2 Changes in fleet procurement dynamics

- 3.4.2.1 Supply-side impact (component & tech suppliers)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Vertical integration and component localization

- 3.4.4.2 Strategic partnerships with OEMs and regulators

- 3.4.4.3 Adaptive pricing and product positioning

- 3.4.5 Outlook and Future Considerations

- 3.4.1 Impact on trade

- 3.5 Profit margin analysis

- 3.6 Technology & innovation landscape

- 3.7 Patent analysis

- 3.8 Price trend

- 3.8.1 Region

- 3.8.2 Vehicle

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 1.1 Case studies

- 3.11 Impact on forces

- 3.11.1 Growth drivers

- 3.11.1.1 Stringent government regulations and safety standards

- 3.11.1.2 Technological advancements in vehicle systems

- 3.11.1.3 Rising awareness of road safety and fuel efficiency

- 3.11.1.4 Growth in commercial fleet operations

- 3.11.2 Industry pitfalls & challenges

- 3.11.3 High installation and maintenance costs

- 3.11.4 Resistance from drivers and operators

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Adjustable Speed Limiters

- 5.3 Intelligent speed limiters (ISL)

- 5.4 Electronic speed limiters (ESL)

- 5.5 Gps-based speed limiting systems

- 5.6 Mechanical speed limiters

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles (LCV)

- 6.3.2 Medium commercial vehicles (MCV)

- 6.3.3 Heavy commercial vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Aptiv

- 9.2 Autograde International

- 9.3 AutoKontrol

- 9.4 Autoliv

- 9.5 AVS LTD

- 9.6 Continental

- 9.7 Denso

- 9.8 Elson

- 9.9 Highway Digital (Nigeria) Limited

- 9.10 MKP Parts

- 9.11 Pricol Limited

- 9.12 Remote Control Technologies (RCT)

- 9.13 Robert Bosch

- 9.14 Rosmerta Technologies

- 9.15 SABO Electronic Technology

- 9.16 Sturdy

- 9.17 Transtronix India

- 9.18 Valeo

- 9.19 Vodafone Automotive

- 9.20 ZF Friedrichshafen