|

시장보고서

상품코드

1740851

냉동 감자 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Frozen Potatoes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

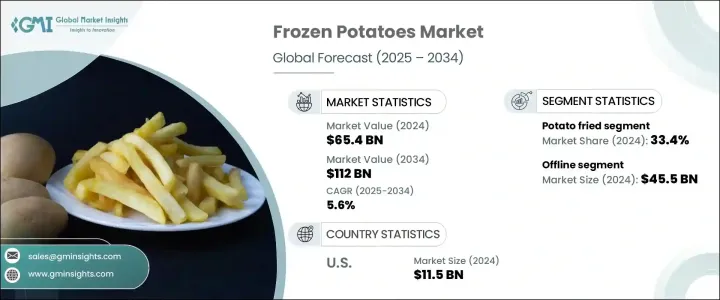

세계의 냉동 감자 시장 규모는 2024년에는 654억 달러로 평가되었고, 소비자의 라이프 스타일 변화와 편리하고 빨리 조리할 수 있는 식품 옵션에 대한 수요 증가로 CAGR 5.6%를 나타내 2034년에는 1,120억 달러에 달할 것으로 예측되고 있습니다.

소비자가 페이스의 빠른 일상 생활과 타이트한 스케줄을 해내는 가운데, 냉동 감자는 가정의 부엌에서도 전문의 푸드서비스 현장에서도 정평이 되고 있습니다. 냉동 감자 제품은 더 이상 전통적인 감자 튀김에 그치지 않고 쐐기, 베이크드 옵션, 글루텐 프리 제품 등 현대 소비자의 진화하는 기대에 부응하도록 조정된 혁신적인 제품을 제공합니다.

건강한 식생활에 대한 의식의 고조와 냉동 기술의 진보가 함께, 시장 상황는 크게 바뀌고 있습니다. 이를 통해 냉동 감자 제품은 세계 냉동고 통로, 메뉴, 식품 택배 플랫폼을 석권하게 될 것으로 보입니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 654억 달러 |

| 예측 금액 | 1,120억 달러 |

| CAGR | 5.6% |

바쁜 도시 지역의 라이프 스타일과 패스트 캐주얼 다이닝의 인기 급상승이 냉동 감자 제품의 성장을 가속하는 주요 요인이 되고 있습니다. 동시에, 보다 많은 소비자가 가정에서의 편리성을 높이기 위해, 냉동고에 범용성이 높은 감자 제품을 스톡하고 있기 때문에 소매 채널도 활황을 나타내고 있습니다.

건강 지향 혁신은 시장 성장에 새로운 국면을 가져오고 있습니다. 저지방, 에어 플라이, 보존료를 사용하지 않는 옵션은 타협이 적은 호화를 요구하는 건강 지향 구매자의 주목을 받고 있습니다. 클린 라벨의 동향은 제조업체에 나트륨 저감, 글루텐 프리, 천연 소재 사용의 제품 투입을 촉진해, 지지를 모으고 있습니다. 이러한 선택은 개인 소비자에게 어필할 뿐만 아니라 균형 잡힌 영양과 식생활 준수가 최우선 사항인 학교, 병원, 기업내 식당 등 시설 환경에서도 채용이 진행되고 있습니다. 맛과 식감이 계속 개선되고 라벨의 투명성이 높아짐에 따라 이러한 몸에 좋은 선택은 주류 시장에도 틈새 시장에도 침투하고 있습니다.

감자 튀김은 현재 시장에서 가장 큰 점유율을 차지하며, 2024년에는 33.4%를 차지했고, 2034년까지의 CAGR은 4.8%를 나타낼 것으로 예측됩니다. 감자 튀김의 인기는 패스트 푸드 체인 수요와 파리와 황금색의 식감을 선호하는 소비자의 뿌리 깊은지지에 근거합니다. 감자 튀김 외에도 쐐기, 채우기, 슬라이스, 거푸집, 청크, 구운 대체품 등의 형태가 기세를 늘리고 있습니다. 이 제품은 다양한 요리 취향과 식사 요구 사항을 충족하며 청크는 풍부한 삶은 요리로, 베이크드 버전은 기름을 사용하지 않고 건강한 지향을 따라 가벼운 선택을 제공합니다.

유통 면에서는 푸드서비스 부문이 2024년에 39.6% 시장 점유율을 차지했고 2034년까지의 CAGR은 5.2%를 나타낼 것으로 보입니다. 레스토랑, 케이터링 서비스, 시설 주방은 효율성을 유지하고 일관된 요리를 제공하기 때문에 냉동 감자 제품에 크게 의존합니다. 소매업도 주요 촉진요인이며, 소비자는 슈퍼마켓, 인근 매장, 온라인 플랫폼에서 조리된 감자 제품을 구입하게 되었습니다.

미국의 냉동 감자 시장만으로도 2024년에는 115억 달러의 매출이 있었으며, 2034년까지 연평균 복합 성장률(CAGR) 4.8%를 나타내 꾸준히 확대될 것으로 예측되고 있습니다. 미국에서는 패스트푸드 문화가 뿌리 깊고, 외식업체의 네트워크가 확립되어 있기 때문에 안정된 수요가 예상됩니다.

세계의 냉동 감자 분야의 주요 기업으로는 McCain Foods Limited, JR Simplot Company, Farm Frites International BV, Lam Weston Holdings, Inc. Cavendish Farms 등이 있습니다. 이 기업은 미식 스타일의 제품 라인에 적극적으로 투자하고, 외식업자와 제휴해, 고성장 지역에 진출해, 생산 효율을 높이기 위해 자동화를 도입하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 파괴적 혁신

- 향후 전망

- 제조업체

- 유통업체

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 무역 통계(HS코드)

- 주요 수출국(2021-2024년)

- 주요 수입국(2021-2024년)

참고 : 위의 무역 통계는 주요 국가에 대해서만 제공됩니다.

- 공급자의 상황

- 이익률 분석

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 편리성이 높은 식품이나 조리된 식품 수요 증가

- 퀵 서비스 레스토랑(QSR)의 세계 확대

- 냉동 식품 소매 인프라 성장

- 업계의 잠재적 위험 및 과제

- 가공식품이나 튀김에 대한 건강에 대한 우려

- 기후 변화의 영향으로 생감자 가격 변동

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 규모와 예측 : 제품 유형별(2021-2034년)

- 주요 동향

- 감자 튀김

- 감자 웨지

- 속을 채운 감자

- 감자 슬라이스

- 감자 다이스

- 감자 각도

- 구운 감자

- 기타

제6장 시장 규모와 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 푸드서비스

- 소매

- 퀵 서비스 레스토랑

- 가구

제7장 시장 규모와 예측 : 유통 채널별(2021-2034년)

- 주요 동향

- 오프라인

- 슈퍼마켓 및 하이퍼마켓

- 편의점

- 전문점

- 온라인

- 전자상거래 플랫폼

- 기업 소유 웹사이트

제8장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

제9장 기업 프로파일

- Agristo

- Aviko BV

- Bart’s Potato Company

- Cavendish Farms

- Farm Frites International BV

- JR Simplot Company

- Lamb Weston Holdings, Inc.

- McCain Foods Limited

- Mydibel Group

- Pohjolan Peruna Oy

The Global Frozen Potatoes Market was valued at USD 65.4 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 112 billion by 2034, fueled by changing consumer lifestyles and an ever-increasing demand for convenient, ready-to-cook food options. As consumers juggle fast-paced routines and tighter schedules, frozen potatoes have become a staple in both household kitchens and professional food service settings. The category's steady rise reflects a broader shift toward convenient meal solutions that don't compromise on taste, quality, or nutritional value. Frozen potato products are no longer limited to traditional French fries-they now span an array of innovative offerings including wedges, baked options, and gluten-free varieties, each tailored to meet the evolving expectations of modern consumers.

Growing awareness around healthier eating habits, combined with advances in freezing technologies, is reshaping the market landscape. Enhanced supply chain logistics, a surge in quick-service restaurant consumption, and increasing penetration into emerging economies further strengthen the market's outlook. With global dining habits leaning toward speed, flavor, and variety, frozen potato products are set to dominate freezer aisles, menus, and food delivery platforms worldwide. This upward trend is underpinned by strategic manufacturer investments in product innovation, clean-label development, and enhanced distribution channels that make frozen potatoes more accessible than ever before.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $65.4 Billion |

| Forecast Value | $112 Billion |

| CAGR | 5.6% |

Busy urban lifestyles and the surging popularity of fast-casual dining are major factors driving the growth of frozen potato products. As people look for quick meal solutions that are both tasty and satisfying, the demand for long shelf-life options is rising. The food service industry plays a critical role in boosting sales, offering frozen potato products that deliver consistency and ease of preparation at scale. Operators rely on these items to streamline kitchen operations, reduce prep time, and meet fluctuating customer demands without sacrificing flavor or quality. At the same time, retail channels are thriving as more consumers stock their freezers with versatile potato items for at-home convenience.

Health-focused innovations are adding a new dimension to market growth. Low-fat, air-fried, and preservative-free options are catching the attention of health-conscious buyers who want indulgence with fewer compromises. Clean-label trends are gaining traction, prompting manufacturers to introduce products with reduced sodium, gluten-free attributes, and natural ingredients. These alternatives don't just appeal to individual consumers-they're also seeing increased uptake in institutional settings like schools, hospitals, and corporate cafeterias where balanced nutrition and dietary compliance are top priorities. As taste and texture continue to improve, and as labels become more transparent, these better-for-you options are penetrating both mainstream and niche markets alike.

Fried potatoes currently hold the largest share of the market, accounting for 33.4% in 2024, and are projected to grow at a CAGR of 4.8% through 2034. Their popularity remains strong due to the demand from fast-food chains and the enduring consumer love for crisp, golden textures. Beyond fries, other formats such as wedges, stuffed varieties, slices, dice, chunks, and baked alternatives are gaining momentum. These products cater to different cooking preferences and dietary needs, with chunks working well in hearty stews, and baked versions offering a lighter, oil-free option that aligns with wellness trends.

In terms of distribution, the food service segment held a 39.6% market share in 2024 and is set to grow at a CAGR of 5.2% through 2034. Restaurants, catering services, and institutional kitchens depend heavily on frozen potato offerings to maintain efficiency and deliver consistent dishes. Retail is also a key growth driver, with consumers increasingly purchasing ready-to-cook potato products from supermarkets, neighborhood stores, and online platforms.

The United States Frozen Potatoes Market alone generated USD 11.5 billion in 2024 and is forecasted to expand steadily at a CAGR of 4.8% through 2034. The nation's strong fast-food culture and well-established network of food service providers ensure consistent demand. Menu innovations across restaurant chains, coupled with the widespread availability of frozen products in grocery stores, club warehouses, and specialty retailers, contribute to the market's sustained momentum.

Key players in the global frozen potatoes space include McCain Foods Limited, J.R. Simplot Company, Farm Frites International B.V., Lamb Weston Holdings, Inc., and Cavendish Farms. These companies are actively investing in gourmet-style product lines, partnering with foodservice operators, expanding into high-growth regions, and embracing automation to enhance production efficiency. With a growing focus on digital marketing and e-commerce, leading brands are reaching consumers more directly and effectively-ensuring strong visibility, accessibility, and customer loyalty across global markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries, 2021-2024 (Kilo Tons)

- 3.3.2 Major importing countries, 2021-2024 (Kilo Tons)

Note: the above trade statistics will be provided for key countries only.

- 3.4 Supplier landscape

- 3.5 Profit margin analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for convenience and ready-to-eat foods

- 3.8.1.2 Expansion of quick service restaurants (QSRs) globally

- 3.8.1.3 Growth in frozen food retail infrastructure

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Health concerns over processed and fried foods

- 3.8.2.2 Volatility in raw potato prices due to climate impact

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Product Type 2021 - 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Potato fried

- 5.3 Potato wedges

- 5.4 Stuffed potatoes

- 5.5 Potato slices

- 5.6 Potato chunks

- 5.7 Potato dices

- 5.8 Baked potato

- 5.9 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Foodservice

- 6.3 Retail

- 6.4 Quick service restaurants

- 6.5 Households

Chapter 7 Market Size and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Offline

- 7.2.1 Supermarkets & hypermarkets

- 7.2.2 Convenience stores

- 7.2.3 Specialty stores

- 7.3 Online

- 7.3.1 E-commerce platforms

- 7.3.2 Company-owned websites

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Agristo

- 9.2 Aviko B.V.

- 9.3 Bart’s Potato Company

- 9.4 Cavendish Farms

- 9.5 Farm Frites International B.V.

- 9.6 J.R. Simplot Company

- 9.7 Lamb Weston Holdings, Inc.

- 9.8 McCain Foods Limited

- 9.9 Mydibel Group

- 9.10 Pohjolan Peruna Oy