|

시장보고서

상품코드

1740855

바이오의약품 포장 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Biopharmaceutical Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

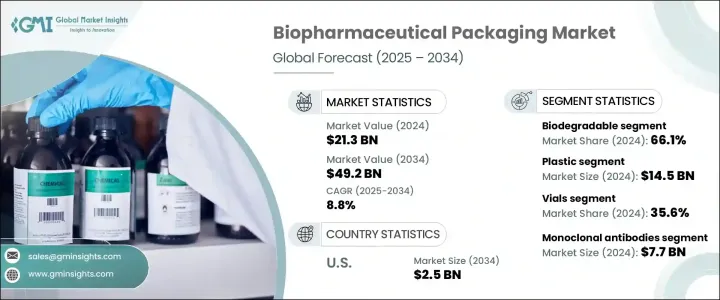

세계의 바이오의약품 포장 시장은 2024년에 213억 달러로 평가되었으며, 2034년에는 CAGR 8.8%를 나타내 492억 달러에 이를 것으로 추정됩니다.

바이오의약품 업계가 단일클론항체, 세포 및 유전자 치료, mRNA 기반의 의약품 등 복잡하고 고가치의 치료법에 대한 주력을 계속 확대하고 있기 때문에 첨단 포장 솔루션의 중요성이 급격히 높아지고 있습니다. 게다가, 더 많은 생물학적 제제가 세계 시장에 진입함에 따라 무균성을 확보하고 실시간 모니터링을 가능하게 하며 지속가능성 목표에 따른 포장 형태가 더욱 강력하게 요구되고 있습니다.

보다 혁신적이고 견고한 포장 솔루션으로의 전환은 콜드체인 물류에 대한 투자 확대와 생물 제제의 세계 소비자층 확대로 더욱 강화되고 있습니다. 지속가능성을 중시하는 경향이 강해지고 있는 것도, 설계의 선택에 영향을 주고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 213억 달러 |

| 예측 금액 | 492억 달러 |

| CAGR | 8.8% |

무역정책의 변화, 특히 의약품 관련 수입품에 부과된 보복관세는 시장 역학에 새로운 복잡성을 더하고 있습니다. 제조 비용이 상승하고 밸류체인 전반의 조달 전략에 영향을 미치고 있습니다. 기업은 현재 규정 준수와 품질 기준을 유지하면서 투입 비용의 상승을 상쇄하기 위해 현지에 뿌리를 둔 공급 체인과 대체 조달 모델을 모색하고 있습니다.

동시에 기술은 바이오의약품의 포장과 모니터링의 방식을 바꾸고 있습니다. 특히 온도에 민감한 생물 제제에서는 스마트 포장 형태가 게임 체인저가 되고 있습니다. 이러한 지능형 시스템은 낭비를 최소화하고 위험한 제품의 위험을 줄이고 환자의 안전성을 전반적으로 향상시키는 데 도움이 됩니다.

2024년에는 생분해성 포장재료가 세계 시장의 66.1%를 차지했고 지속가능성에 대한 결정적인 변화를 보여주었습니다. 성소재는 크게 진화하여 현재는 의약품 용도에 필요한 내구성, 내약품성, 배리어성을 갖추고 있습니다.

이러한 변화에도 불구하고 2024년 시장 규모는 145억 달러로 플라스틱 포장이 여전히 지배적인 지위를 차지했습니다. 세이프 클로저나 일회용 시스템과 같은 특수 부품과의 호환성을 필요로 하는 용도로 선호되고 있습니다.폴리머 과학의 끊임없는 진보에 의해 플라스틱 포장의 성능은 향상되어, 의약품의 보관이나 유통에 있어서 점점 엄격해지는 요구에 응할 수 있게 되었습니다.

미국의 바이오의약품 포장 시장은 이 나라의 강력한 의약품 제조 생태계와 바이오테크놀러지의 혁신에 견인되어 2034년까지 25억 달러에 이를 것으로 예측되고 있습니다. 업계가 약물전달나 규정 준수에 있어서의 새로운 과제나 기회에 적응해 나가는 가운데, 스마트하고 트레이서블, 한편 환경에 배려한 포장 형태가 불가결해지고 있습니다.

Amcor, Schott AG, Gerresheimer AG, Becton, Dickinson & Co. CCL Industries와 같은 기업은 앞으로 가기 위해 R&D에 적극적으로 투자하고 있습니다. 시각화와 규제 조정을 위한 디지털 툴의 도입을 실시했습니다. 세계 시장이 성숙하는 가운데, 바이오의약품 포장에 있어서의 전략적 혁신은 세계의 최첨단 치료를 안전하고 효율적으로 제공하기 위한 중심적 존재로 계속 될 것으로 보입니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 트럼프 정권의 관세 분석

- 무역에 미치는 영향

- 무역량의 혼란

- 보복조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 업계에 미치는 영향요인

- 성장 촉진요인

- 지속 가능하고 환경 친화적인 포장 솔루션에 대한 수요 증가

- 헬스케어 인프라의 세계 전개와 근대화

- 만성 질환이나 생활 습관병 증가

- 스마트 포장 시스템 등의 급속한 기술 혁신

- 바이오의약품과 맞춤형 의료의 연구개발에 대한 투자 증가

- 업계의 잠재적 위험 및 과제

- 초기 투자와 운영 비용이 증가

- 복잡한 공급망 물류와 엄격한 품질 기준

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술의 상황

- 향후 시장 동향

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계·예측 : 유형별(2021-2034년)

- 주요 동향

- 생분해성

- 비생분해성

제6장 시장 추계·예측 : 재료별(2021-2034년)

- 주요 동향

- 플라스틱

- 폴리염화비닐(PVC)

- 폴리프로필렌(PP)

- 폴리에틸렌 테레프탈레이트(PET)

- 폴리스티렌(PS)

- 폴리에틸렌(PE)

- HDPE

- LDPE

- LLDPE

- 기타

- 유리

제7장 시장 추계·예측 : 제품별(2021-2034년)

- 주요 동향

- 바이알

- 앰풀

- 병

- 프리필드 주사기

- 카트리지

제8장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 동향

- 백신

- 사이토카인

- 효소

- 단일클론항체

- 유전자 치료

- 기타

제9장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 호주

- 한국

- 일본

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

제10장 기업 프로파일

- Adelphi

- Amcor

- Becton, Dickinson &Co.

- Berry Global

- CCL Industries

- Gerresheimer AG

- LOG Pharma Packaging

- Medical Packaging Inc. LLC

- Merck KGaA

- PCI

- Piramal Glass Private Limited

- Schott AG

- Shandong Pharmaceutical Glass Co

- Sonoco

- Stevanato Group

- West Pharmaceutical Services, Inc.

The Global Biopharmaceutical Packaging Market was valued at USD 21.3 billion in 2024 and is estimated to grow at a CAGR of 8.8% to reach USD 49.2 billion by 2034, fueled by the rising demand for specialized packaging solutions capable of preserving the integrity and efficacy of sensitive biological drugs. As the biopharma sector keeps expanding its focus on complex, high-value therapies-including monoclonal antibodies, cell and gene therapies, and mRNA-based drugs-the importance of advanced packaging solutions is rising sharply. Biopharmaceuticals are highly sensitive to environmental changes, requiring controlled storage and transportation conditions. This has led to a surge in demand for innovative materials and technologies designed to protect drug stability throughout the supply chain. With regulatory authorities around the globe tightening packaging safety standards, pharmaceutical companies are rethinking how they protect their biologics. On top of that, as more biologics enter the global market, there's a stronger push for packaging formats that ensure sterility, enable real-time monitoring, and align with sustainability goals.

The shift toward more innovative and robust packaging solutions is further supported by growing investments in cold chain logistics and an expanding global base of biologic drug consumers. Biopharmaceutical companies are responding by adopting high-performance materials that can endure extreme temperatures and maintain product efficacy from manufacturing sites to point-of-care delivery. Rising emphasis on sustainability is also influencing design choices. As healthcare providers and end users alike demand safer and greener options, packaging firms are accelerating the development of recyclable, biodegradable, and reusable solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.3 Billion |

| Forecast Value | $49.2 Billion |

| CAGR | 8.8% |

Trade policy shifts, especially the retaliatory tariffs placed on pharma-related imports, have added another layer of complexity to market dynamics. These tariffs are increasing raw material costs, particularly for high-grade plastics and pharmaceutical-grade glass sourced internationally. The resulting cost surge has made domestic manufacturing more expensive, which is impacting procurement strategies across the value chain. Companies are now exploring localized supply chains and alternative sourcing models to offset rising input costs while maintaining compliance and quality standards.

At the same time, technology is reshaping how biopharmaceutical products are packaged and monitored. Smart packaging formats are becoming a game changer, especially for temperature-sensitive biologics. Solutions integrated with RFID tags and sensors are enabling real-time tracking of critical parameters like temperature, humidity, and product integrity. These intelligent systems help minimize waste, reduce the risk of compromised products, and improve overall patient safety. As demand for precision in drug delivery and storage continues to grow, smart packaging is quickly moving from a luxury to a necessity in this high-stakes industry.

In 2024, biodegradable packaging materials accounted for 66.1% of the global market, underlining a decisive shift toward sustainability. This trend reflects not just a response to growing environmental awareness among consumers but also stronger regulatory pressure to phase out single-use plastics in pharmaceutical applications. Biodegradable materials have evolved significantly and now offer the durability, chemical resistance, and barrier protection required for pharmaceutical use. These innovations have helped biodegradable packaging move beyond niche status, making it a competitive alternative to traditional plastic solutions across a broad range of drug formats.

Despite this shift, plastic packaging still held a dominant position in 2024, with a market value of USD 14.5 billion. Its widespread use continues to be supported by its cost-effectiveness, design flexibility, and excellent protective qualities. Plastics are especially favored in applications requiring tamper-evident features, high moisture resistance, and compatibility with specialized components like child-safe closures and single-use systems. Continuous advancements in polymer science have enhanced the performance of plastic packaging, enabling it to meet the increasingly stringent demands of pharmaceutical storage and distribution.

The U.S. Biopharmaceutical Packaging Market is projected to hit USD 2.5 billion by 2034, driven by the country's strong pharmaceutical manufacturing ecosystem and innovation in biotech. A combination of strict regulatory standards and rising consumer expectations around safety, integrity, and sustainability is pushing packaging firms to innovate faster. Smart, traceable, and eco-conscious packaging formats are becoming essential as the industry adapts to new challenges and opportunities in drug delivery and compliance.

Companies like Amcor, Schott AG, Gerresheimer AG, Becton, Dickinson & Co., and CCL Industries are actively investing in R&D to stay ahead. These firms are partnering with pharmaceutical companies to co-develop next-gen packaging solutions, scale up eco-friendly alternatives, and adopt digital tools for supply chain visibility and regulatory alignment. As the global market matures, strategic innovation in biopharmaceutical packaging will remain central to supporting the safe and efficient delivery of the world's most advanced therapies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research Approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.2 Supply-side impact (raw materials)

- 3.2.2.1 Price volatility in key materials

- 3.2.2.2 Supply chain restructuring

- 3.2.2.3 Production cost implications

- 3.2.3 Demand-side impact (selling price)

- 3.2.3.1 Price transmission to end markets

- 3.2.3.2 Market share dynamics

- 3.2.3.3 Consumer response patterns

- 3.2.4 Key companies impacted

- 3.2.5 Strategic industry responses

- 3.2.5.1 Supply chain reconfiguration

- 3.2.5.2 Pricing and product strategies

- 3.2.5.3 Policy engagement

- 3.2.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growing demand for sustainable and eco-friendly packaging solutions

- 3.3.1.2 Global expansion and modernization of healthcare infrastructure

- 3.3.1.3 The growing prevalence of chronic and lifestyle diseases

- 3.3.1.4 Rapid technological innovations such as smart packaging systems

- 3.3.1.5 Rising investments in R&D for biologics and personalized medicines

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High initial investment and operational costs

- 3.3.2.2 Complex supply chain logistics and stringent quality standards

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn & Units)

- 5.1 Key trends

- 5.2 Biodegradable

- 5.3 Non-biodegradable

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn & Units)

- 6.1 Key trends

- 6.2 Plastic

- 6.2.1 Polyvinyl Chloride (PVC)

- 6.2.2 Polypropylene (PP)

- 6.2.3 Polyethylene Terephthalate (PET)

- 6.2.4 Polystyrene (PS)

- 6.2.5 Polyethylene (PE)

- 6.2.5.1 HDPE

- 6.2.5.2 LDPE

- 6.2.5.3 LLDPE

- 6.2.6 Others

- 6.3 Glass

Chapter 7 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn & Units)

- 7.1 Key trends

- 7.2 Vials

- 7.3 Ampoules

- 7.4 Bottles

- 7.5 Pre-filled syringes

- 7.6 Cartridges

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn & Units)

- 8.1 Key trends

- 8.2 Vaccines

- 8.3 Cytokines

- 8.4 Enzymes

- 8.5 Monoclonal antibodies

- 8.6 Gene therapies

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Australia

- 9.4.4 South Korea

- 9.4.5 Japan

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 U.A.E.

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Adelphi

- 10.2 Amcor

- 10.3 Becton, Dickinson & Co.

- 10.4 Berry Global

- 10.5 CCL Industries

- 10.6 Gerresheimer AG

- 10.7 LOG Pharma Packaging

- 10.8 Medical Packaging Inc., LLC

- 10.9 Merck KGaA

- 10.10 PCI

- 10.11 Piramal Glass Private Limited

- 10.12 Schott AG

- 10.13 Shandong Pharmaceutical Glass Co

- 10.14 Sonoco

- 10.15 Stevanato Group

- 10.16 West Pharmaceutical Services, Inc.