|

시장보고서

상품코드

1740866

폴리에틸렌 열성형 포장 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Polyethylene (PE) Thermoform Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

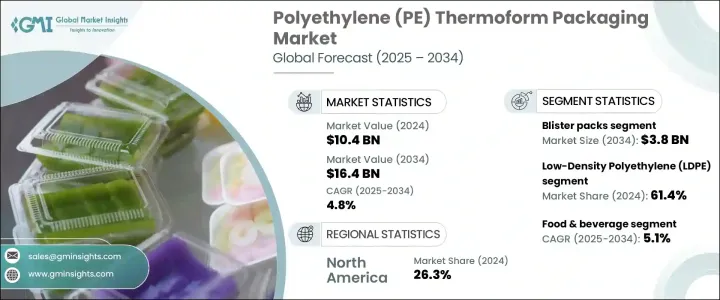

세계의 폴리에틸렌 열성형 포장 시장 규모는 2024년에 104억 달러에 달했고, CAGR 4.8%을 나타내 2034년에는 164억 달러에 이를 것으로 추정됩니다.

이는 전자상거래 산업의 기세가 높아지고 가볍고 내구성이 뛰어나 재활용 가능한 포장 솔루션에 대한 수요가 높아지고 있기 때문에 온라인 쇼핑이 일상적인 소비 행동의 핵심을 차지함에 따라 저렴한, 기능적 디자인, 지속가능성 밸런스가 취해진 폴리에틸렌(PE) 열성형 포장에 주목하는 소매업체가 늘고 있습니다. 폴리에틸렌은 단소재 포장의 동향에도 적합하고 있어 세계의 지속가능성 목표나 플라스틱 폐기물 삭감을 위한 브랜드 주도의 대처에 합치하고 있기 때문에 새로운 견인력이 되고 있습니다.

이 시장은 식품, 퍼스널케어, 의약품, 일렉트로닉스 등의 분야에서도 채용이 급증하고 있으며, 그 배경에는 선반 넣기가 가능하고 개봉을 확인할 수 있어 시각에 호소하는 포장 형태에 대한 요구가 높아지고 있습니다. 재활용성과 순환형 경제 모델이 대두하는 가운데, PE 열성형 솔루션은 차세대 포장의 변화를 추진하는 프런트 러너로 자리매김하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 104억 달러 |

| 예측 금액 | 164억 달러 |

| CAGR | 4.8% |

그러나, 이 업계에 과제가 없는 것은 아닙니다. 현재도 계속되는 무역 분쟁과 미국의 역대 정권이 제정한 관세 제도는 포장 업계의 코스트 역학을 재구축해 왔습니다. 원재료, 특히 폴리머나 특수 필름의 비용을 상승시켜, 제조 비용의 상승을 초래해, 예측 불가능한 공급 체인의 상황을 낳고 있습니다. 그 결과, 제조업체 각사는 사업을 현지화하는지, 공급업체 네트워크를 다양화하여 고위험 시장에 대한 의존도를 낮출 필요가 있습니다.

향후 폴리에틸렌 열성형 포장 시장의 블리스터 팩 분야는 2034년까지 38억 달러에 이를 것으로 예측되고 있습니다. 같은 규제 분야에서는 블리스터 팩은 안전성이 높고, 변조 방지성이 있어, 사용하기 쉬운 단위 용량 포장을 제공해, 용량의 정확성을 서포트해, 제품의 안전성을 향상시킵니다.

저밀도 폴리에틸렌(LDPE) 부문은 계속 세계 시장을 독점하고 있으며, 2024년의 점유율은 61.4%를 차지했습니다. 없이 다양한 형상에 적응할 수 있는 점에서 식품 포장, 헬스 케어, 퍼스널케어의 분야에서 자주 사용되는 소재가 되고 있습니다.

미국의 폴리에틸렌 열성형 포장 시장은 지속가능성과 편의성을 선호하는 소비자의 선호의 진화와 소매의 혁신에 견인되어 2034년까지 35억 달러에 이르는 기세입니다. 또한, 연방 정부 및 주 수준의 순환형 포장 모델을 촉진하는 정책을 통해 재료의 회수를 지원하고 매립 폐기물을 줄이는 PE 기반 형식을 채택하는 것이 기업에 장려되고 있습니다.

폴리에틸렌 열성형 포장 시장의 미래를 형성하는 주요 기업은 Constantia Flexibles, Sealed Air, Amcor plc, Berry Global Inc. Sonoco Products Company 등입니다. 이러한 기업들은 진화하는 규제와 소비자의 기대에 부응하는 최첨단 단일 소재 포장 라인을 개발하기 위해 RandD를 두 배로 늘리고 있습니다. 이러한 기업의 전략에는 재활용 가능한 솔루션에 대한 투자, 주요 식품, 개인 관리, 제약 브랜드와의 제휴, 분야별 요구에 대응하기 위한 소재 및 형식 혁신 등이 포함됩니다. 에코디자인, 공급망 최적화, 제품 커스터마이징에 주력함으로써 시장 리더들은 보다 스마트하고 지속가능한 포장의 미래를 열고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 트럼프 정권의 관세 분석

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 업계에 미치는 영향요인

- 성장 촉진요인

- 가볍고 비용 효율적인 포장 수요 증가

- 지속가능성과 재활용성에 대한 노력의 강화

- 성장하는 전자상거래 분야

- PE 수지 기술의 진보

- 폐쇄 루프 재활용 프로그램에 대한 관심 증가

- 업계의 잠재적 위험 및 과제

- 높은 배리어 용도에 있어서 기술적 한계

- 사용한 폐기물의 오염

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술의 상황

- 장래 시장 동향

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

- 금속화 필름

제5장 시장 추계·예측 : 제품 유형별(2021-2034년)

- 주요 동향

- 블리스터 팩

- 클램쉘

- 병

- 트레이 및 용기

- 뚜껑 필름

- 기타

제6장 시장 추계·예측 : 폴리에틸렌(PE) 유형별(2021-2034년)

- 주요 동향

- 저밀도 폴리에틸렌(LDPE)

- 고밀도 폴리에틸렌(HDPE)

제7장 시장 추계·예측 : 최종 이용 산업별(2021-2034년)

- 주요 동향

- 식품 및 음료

- 의약품 및 헬스케어

- 소비재 및 소매

- 자동차

- 기타

제8장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

제9장 기업 프로파일

- Amcor plc

- Anchor Packaging LLC

- Berry Global Inc.

- Constantia Flexibles

- Greiner Packaging

- Huhtamaki

- Klockner Pentaplast

- Nelipak Healthcare Packaging

- NOVA Chemicals Corporate.

- Pactiv Evergreen Inc.

- Placon

- PlastiPAK INDUSTRIES Inc.

- Schur

- Sealed Air

- Silgan Dispensing Systems

- Sonoco Products Company

- Tekni-Plex, Inc.

- UFlex Limited

The Global Polyethylene Thermoform Packaging Market was valued at USD 10.4 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 16.4 billion by 2034, fueled by the rising momentum of the e-commerce industry, which has led to higher demand for lightweight, durable, and recyclable packaging solutions. As online shopping becomes a core part of everyday consumer behavior, more retailers are leaning toward polyethylene (PE) thermoform packaging for its balance of affordability, functional design, and sustainability benefits. PE's compatibility with mono-material packaging trends adds further traction, aligning with global sustainability goals and brand-led commitments to reduce plastic waste.

The market is also seeing a surge in adoption across sectors like food, personal care, pharmaceuticals, and electronics-driven by the growing need for shelf-ready, tamper-evident, and visually appealing packaging formats. With advancements in thermoforming technologies, manufacturers can now deliver packaging that doesn't compromise on clarity, flexibility, or product protection. As recyclability and circular economy models gain ground, PE thermoform solutions are positioned as a frontrunner in driving next-gen packaging transformations. Rising consumer awareness, coupled with stricter packaging mandates across North America, Europe, and Asia, further reinforces the need for sustainable materials like PE in mass-market applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.4 Billion |

| Forecast Value | $16.4 Billion |

| CAGR | 4.8% |

The industry, however, is not without its challenges. Ongoing trade disputes and tariff structures enacted by prior U.S. administrations have reshaped the cost dynamics of the packaging landscape. These trade policies continue to elevate the cost of imported raw materials-especially polymers and specialty films-causing an uptick in production costs and creating unpredictable supply chain conditions. As a result, manufacturers are under growing pressure to either localize operations or diversify supplier networks to reduce reliance on high-risk markets. Many companies are now reevaluating their procurement strategies and investing in the re-engineering of material compositions that meet both recyclability standards and performance benchmarks. There's also a growing interest in integrating post-consumer recycled content into PE thermoform solutions without compromising on durability, clarity, or molding precision.

Looking ahead, the blister packs segment within the polyethylene (PE) thermoform packaging market is projected to reach USD 3.8 billion by 2034. These packaging formats are gaining traction across pharmaceuticals, cosmetics, and personal care industries due to their superior product visibility, airtight sealing, and ability to extend shelf life. In regulated sectors like healthcare, blister packs offer secure, tamper-resistant, and easy-to-use unit-dose packaging, supporting dosage accuracy and improving product safety. Their barrier properties help protect sensitive products from moisture, oxygen, and light-making them ideal for high-value and perishable goods.

The low-density polyethylene (LDPE) segment continues to dominate the global market, accounting for a 61.4% share in 2024. LDPE stands out for its flexibility, clarity, and ease of thermoforming, making it an optimal choice for trays, containers, lids, and other custom-formed packaging types. Its hygienic, non-stick surface and adaptability to different shapes without sacrificing structural integrity have made it a go-to material in food packaging, healthcare, and personal care sectors. As brands pivot toward mono-material designs to ensure end-of-life recyclability, LDPE's compatibility with these requirements makes it even more valuable in long-term sustainability strategies.

The United States Polyethylene (PE) Thermoform Packaging Market is on track to reach USD 3.5 billion by 2034, driven by evolving consumer preferences and retail innovations that prioritize sustainability and convenience. The growing popularity of ready-to-eat meals, on-the-go snacks, and pre-packaged products has made recyclable thermoform packaging an essential component for U.S. retailers and food service brands. Additionally, federal and state-level policies promoting circular packaging models are encouraging businesses to adopt PE-based formats that support material recovery and reduce landfill waste. These initiatives are further supported by growing consumer demand for eco-conscious packaging options.

Major players shaping the future of the polyethylene thermoform packaging market include Constantia Flexibles, Sealed Air, Amcor plc, Berry Global Inc., and Sonoco Products Company. These companies are doubling down on RandD to develop cutting-edge mono-material packaging lines that meet evolving regulatory and consumer expectations. Their strategies include investing in recyclable solutions, partnering with leading food, personal care, and pharma brands, and innovating across materials and formats to serve sector-specific needs. By focusing on eco-design, supply chain optimization, and product customization, market leaders are setting the stage for a smarter, more sustainable packaging future.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (Raw material)

- 3.2.2.1.1 Price volatility

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (Raw material)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising demand for lightweight and cost-effective packaging

- 3.3.1.2 Increasing sustainability and recyclability initiatives

- 3.3.1.3 Growing e-commerce sector

- 3.3.1.4 Advancements in PE resin technology

- 3.3.1.5 Rising focus on closed-loop recycling programs

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Technical limitations for high-barrier applications

- 3.3.2.2 Contamination in post-consumer waste streams

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

- 4.6 Metalized films

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Blister packs

- 5.3 Clamshells

- 5.4 Bottles

- 5.5 Trays & containers

- 5.6 Lidding films

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Polyethylene (PE) Type, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Low-density polyethylene (LDPE)

- 6.3 High-density polyethylene (HDPE)

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.3 Pharmaceuticals & healthcare

- 7.4 Consumer goods & retail

- 7.5 Automotive

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amcor plc

- 9.2 Anchor Packaging LLC

- 9.3 Berry Global Inc.

- 9.4 Constantia Flexibles

- 9.5 Greiner Packaging

- 9.6 Huhtamaki

- 9.7 Klockner Pentaplast

- 9.8 Nelipak Healthcare Packaging

- 9.9 NOVA Chemicals Corporate.

- 9.10 Pactiv Evergreen Inc.

- 9.11 Placon

- 9.12 PlastiPAK INDUSTRIES Inc.

- 9.13 Schur

- 9.14 Sealed Air

- 9.15 Silgan Dispensing Systems

- 9.16 Sonoco Products Company

- 9.17 Tekni-Plex, Inc.

- 9.18 UFlex Limited