|

시장보고서

상품코드

1740881

알루미늄 시트 및 코일 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Aluminum Sheets and Coils Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

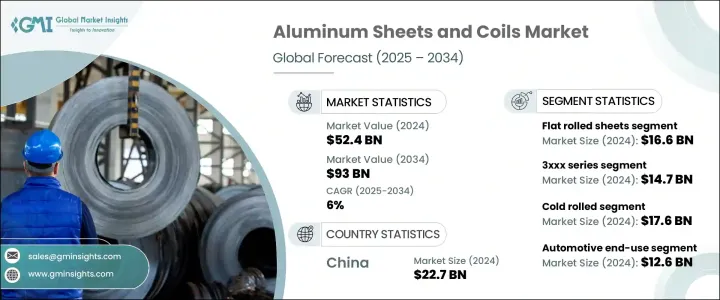

세계의 알루미늄 시트 및 코일 시장 규모는 2024년에는 524억 달러에 달했고, CAGR 6%를 나타내 2034년에는 930억 달러에 이를 것으로 추정되고 있습니다.

이 성장은 산업 생산성의 지속적인 상승과 지속 가능한 재료에 대한 선호도에 크게 기여하고 있습니다. 무엇보다도 제품의 경량화에 공헌할 수 있는 알루미늄은 필수적인 존재가 되고 있습니다. 자동화나 디지털화 등 진화하는 제조 기술은 증대하는 세계적 수요에 대응하기 때문에 보다 신속하고 정밀한 생산을 가능하게 하고 있습니다. 이러한 효율화는 매우 중요합니다. 시장은 치열한 경쟁과 각 지역에서 증가하는 저 배출 가스 생산 솔루션의 추진에 의해 형성되고 있으며, 세계의 지속가능성 목표에 따라 비용 효율적인 고성능 알루미늄 솔루션의 필요성이 높아지고 있습니다.

평판압연 알루미늄 시트 및 코일은 2024년에 166억 달러 시장 규모를 기록했으며, 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 5.7%를 나타낼 것으로 예측됩니다. 특히 내구성, 유연성, 경량성이 대량생산에서 중시되는 경우, 그 적응성과 경제성이 기간산업 전체의 가장 중요한 선택이 됩니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 524억 달러 |

| 예측 금액 | 930억 달러 |

| CAGR | 6% |

클래드판과 양극산화판은 내식성, 외관, 표면 내구성을 필요로 하는 용도로 계속 관심을 모으고 있습니다. 이러한 알루미늄은 정밀함이 요구되는 분야에서 선호되고 있어 표면의 완전성을 향상시키기 위한 코팅 기술이나 합금 조성의 혁신을 촉진하고 있습니다.

패턴, 파형, 천공 알루미늄 판 등의 동향은 성능과 구조를 강화하는 기능적 디자인에 대한 경향을 반영하여 미적 및 공업적 용도와 관련성을 발견하고 있습니다.

합금유형 중 3xxx시리즈가 2024년 147억 달러의 평가액에 달했고 2034년까지 연평균 복합 성장률(CAGR) 6.1%를 나타낼 것으로 예측됩니다. 이 시리즈는 1xxx그룹과 나란히 내식성, 전도성, 코스트 퍼포먼스의 높이로부터 시장 점유율을 독점하고 있습니다.

한편, 5xxx 및 6xxx 시리즈는 고강도, 용접 가능한 알루미늄을 필요로 하는 분야, 특히 인프라와 중요한 용도에서 안정적인 수요를 계속 얻고 있습니다.

가공 방법에 관해서는 냉간 압연 알루미늄 부문은 2024년에 176억 달러로 평가되었고, 2034년까지 연평균 복합 성장률(CAGR) 6.4%를 나타낼 것으로 예측됩니다. 이 카테고리는 우수한 표면 마감, 엄격한 공차, 강화된 기계적 특성 등의 이점이 있으며, 중요한 용도로 폭넓게 사용되고 있습니다.

자동차 부문에서 사용되는 알루미늄 시트 및 코일은 2024년 126억 달러를 차지했고 24% 시장 점유율을 차지했으며 예측 기간 동안 CAGR 6.1%를 나타낼 전망입니다. 이러한 재료는 특히 차량의 경량화와 연비 향상을 실현하기 위해 현대 차량 설계에 필수적인 것입니다.

건축 및 건설 업계도 수요에 크게 공헌하고 있으며, 알루미늄의 탄력성, 경량성, 미관을 살린 구조, 지붕, 단열의 요구가 있습니다.

지역별로는 중국이 2024년 227억 달러의 평가액으로 시장을 선도했고 2034년까지 연평균 복합 성장률(CAGR) 5.9%를 나타낼 것으로 예측됩니다. 높은 국내 수요와 세계에서 가장 대규모 알루미늄 생산능력을 가진 중국은 여전히 압도적인 힘을 자랑하고 있습니다.

주요 시장 진출기업은 Alcoa Corporation, China Hongqiao Group, Rusal, Rio Tinto, Norsk Hydro ASA 등이 있습니다. 이러한 기업은 낮은 배출 기술과 지속 가능한 알루미늄 제조에 대한 전략적 투자를 통해 생산 능력을 향상시키고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 파괴적 혁신

- 향후 전망

- 제조업체

- 유통업체

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 무역 통계(HS코드)

- 주요 수출국

- 주요 수입국

- 이익률 분석

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 자동차 업계에서 경량 소재 수요 증가

- 지속 가능한 인프라를 향한 정부의 대처

- 항공우주 및 방위부문의 성장

- 가전제품 수요 증가

- 업계의 잠재적 위험 및 과제

- 원재료 가격 변동

- 알루미늄 생산의 환경 영향

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계·예측 : 제품 유형별(2021-2034년)

- 주요 동향

- 평평한 압연 시트

- 코일 시트

- 클래드 시트

- 아노다이징 시트

- 패턴 시트

- 골판지 시트

- 천공 시트

제6장 시장 추계·예측 : 그레이드/합금 유형별(2021-2034년)

- 주요 동향

- 1xxx 시리즈

- 2xxx 시리즈

- 3xxx 시리즈

- 5xxx 시리즈

- 6xxx 시리즈

- 7xxx 시리즈

- 8xxx 시리즈

제7장 시장 추계·예측 : 가공 방법별(2021-2034년)

- 주요 동향

- 냉간 압연

- 열간 압연

- 상용 주조

- 직접 냉각(DC) 주조

제8장 시장 추계·예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 자동차

- 건축 및 건설

- 항공우주

- 전기 및 전자공학

- 식품 및 음료

- 기계 및 장치

- 내구 소비재

- 기타

제9장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- Alcoa Corporation

- Novelis Inc.

- Arconic Corporation

- Kaiser Aluminum

- Hindalco Industries

- Constellium SE

- UACJ Corporation

- Norsk Hydro ASA

- JW Aluminum

- Aleris Corporation

- Hindalco Industries Ltd.

- BALCO(Bharat Aluminium)

- China Hongqiao Group

The Global Aluminum Sheets And Coils Market was valued at USD 52.4 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 93 billion by 2034. This growth stems largely from the ongoing rise in industrial productivity and the increasing preference for sustainable materials. Aluminum's lightweight properties make it ideal for sectors aiming to improve energy efficiency and reduce emissions. As industries embrace electrification and advanced technologies, aluminum is becoming more integral due to its ability to contribute to lower product weight without compromising strength. The accelerating shift toward cleaner energy and transportation, especially the rising demand for electric mobility, is also fueling market expansion. Alongside this, evolving manufacturing techniques, such as automation and digitalization, are enabling faster, more precise production to match growing global demand. These efficiencies are critical as producers race to meet the needs of industries prioritizing lightweight, durable, and recyclable materials. The market is also shaped by fierce competition and the increasing push for low-emission production solutions across regions, reinforcing the need for cost-effective, high-performance aluminum solutions that align with global sustainability goals.

Flat rolled aluminum sheets and coils commanded a market size of USD 16.6 billion in 2024 and are expected to grow at a CAGR of 5.7% from 2025 to 2034. Their adaptability and economic feasibility make them a top choice across core industries, especially where durability, flexibility, and lightweight characteristics are valued for mass production. These materials are commonly favored due to their ease of handling and compatibility with multiple manufacturing processes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $52.4 Billion |

| Forecast Value | $93 Billion |

| CAGR | 6% |

Clad and anodized sheets continue to attract interest for applications requiring corrosion resistance, visual appeal, and surface durability. These aluminum variants are preferred in precision-demanding sectors and are prompting innovation in coating technologies and alloy compositions to improve surface integrity. Their increased adoption is intensifying competition in specialized product categories.

Textured variants like patterned, corrugated, and perforated aluminum sheets find relevance in aesthetic and industrial applications, reflecting a trend towards functional design that also enhances performance and structure. These types are gaining attention for their versatility in structural reinforcement and architectural detailing.

Among alloy types, the 3xxx series reached a valuation of USD 14.7 billion in 2024 and is forecasted to grow at a CAGR of 6.1% through 2034. This series, along with the 1xxx group, dominates market share due to its corrosion resistance, electrical conductivity, and cost-effectiveness. These grades are especially popular in sectors where functional performance and affordability are key factors, and producers are focused on maintaining high output efficiency and consistent quality while keeping costs competitive.

Meanwhile, the 5xxx and 6xxx series continue to find steady demand in sectors requiring high-strength, weldable aluminum, notably in infrastructure and heavy-duty applications. Higher-grade aluminum from the 2xxx, 7xxx, and 8xxx series fulfills the need for performance in technologically advanced markets, where durability and precision are crucial.

In terms of processing methods, the cold rolled aluminum segment held a market value of USD 17.6 billion in 2024 and is anticipated to grow at a CAGR of 6.4% through 2034. This category benefits from superior surface finish, tight tolerances, and enhanced mechanical properties, contributing to its extensive use across critical applications. While hot rolled variants are less precise, they are often chosen for their strength and reliability in demanding environments.

Aluminum sheets and coils used in the automotive sector accounted for USD 12.6 billion in 2024, representing a 24% market share and are poised to grow at 6.1% CAGR through the forecast period. These materials are integral in modern vehicle design, particularly for reducing vehicle weight and achieving better fuel efficiency. Their application spans structural components and energy storage systems, as manufacturers continue to incorporate more aluminum into mainstream vehicle architecture.

The building and construction industry also contributes significantly to demand, leveraging aluminum's resilience, light weight, and aesthetic properties for structural, roofing, and insulation needs. In packaging and electronics, aluminum remains a reliable choice due to its safety, recyclability, and resistance to contamination. The global emphasis on recycling further enhances its value in consumer packaging applications.

In regional terms, China led the market with a valuation of USD 22.7 billion in 2024, and it is expected to expand at a CAGR of 5.9% through 2034. With high domestic demand and the world's most extensive aluminum production capacity, China remains a dominant force. Meanwhile, the United States continues to register stable consumption patterns, bolstered by policy shifts supporting infrastructure development and energy transformation. However, both nations navigate complex global trade dynamics, which are shaping sourcing strategies and encouraging localized supply chains.

Major market participants include Alcoa Corporation, China Hongqiao Group, Rusal, Rio Tinto, and Norsk Hydro ASA. These companies are advancing production capabilities through low-emission technologies and strategic investments in sustainable aluminum manufacturing. Industry leaders are focusing on digital innovation, high-grade alloys, and expanding recycling operations to remain competitive in a rapidly evolving market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising demand for lightweight materials in automotive industry

- 3.7.1.2 Government initiatives for sustainable infrastructure

- 3.7.1.3 Growth in aerospace and defense sector

- 3.7.1.4 Expanding demand in consumer electronics

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Fluctuating raw material prices

- 3.7.2.2 Environmental impact of aluminum production

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 Pestel analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Flat rolled sheets

- 5.3 Coiled sheets

- 5.4 Clad sheets

- 5.5 Anodized sheets

- 5.6 Patterned sheets

- 5.7 Corrugated sheets

- 5.8 Perforated sheets

Chapter 6 Market Estimates & Forecast, By Grade/Alloy Type, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 1xxx series

- 6.3 2xxx series

- 6.4 3xxx series

- 6.5 5xxx series

- 6.6 6xxx series

- 6.7 7xxx series

- 6.8 8xxx series

Chapter 7 Market Estimates & Forecast, By Processing Method, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Cold rolled

- 7.3 Hot rolled

- 7.4 Continuous casting

- 7.5 Direct chill (DC) casting

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Building & construction

- 8.4 Aerospace

- 8.5 Electrical & electronics

- 8.6 Food & beverage

- 8.7 Machinery & equipment

- 8.8 Consumer durables

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Alcoa Corporation

- 10.2 Novelis Inc.

- 10.3 Arconic Corporation

- 10.4 Kaiser Aluminum

- 10.5 Hindalco Industries

- 10.6 Constellium SE

- 10.7 UACJ Corporation

- 10.8 Norsk Hydro ASA

- 10.9 JW Aluminum

- 10.10 Aleris Corporation

- 10.11 Hindalco Industries Ltd.

- 10.12 BALCO (Bharat Aluminium)

- 10.13 China Hongqiao Group