|

시장보고서

상품코드

1740885

전기 배선 상호 접속 시스템 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Electrical Wiring Interconnection System (EWIS) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

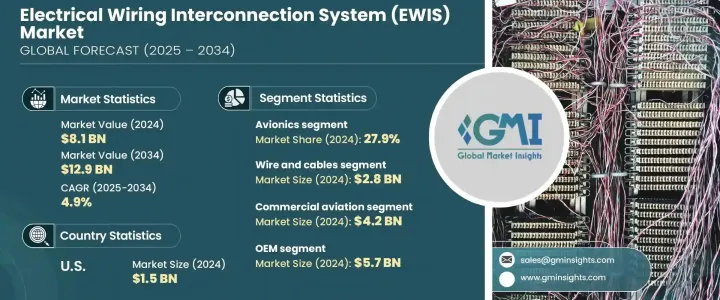

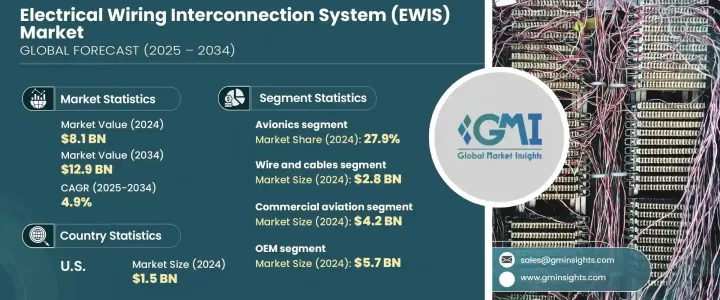

세계의 전기 배선 상호 접속 시스템 시장은 2024년 81억 달러로 평가되었으며 CAGR 4.9%를 나타내 2034년에는 129억 달러에 이를 것으로 추정됩니다.

항공 업계에서는 기내 엔터테인먼트 및 실시간 연결 시스템의 사용이 증가함에 따라 통합 전기 시스템에 대한 수요가 증가하고 있으며 배선 인프라가 재구성되고 있습니다. 이 항공기는 복잡한 전기 및 데이터 전송 작업을 처리할 수 있는 경량이고 고성능의 배선이 필요합니다.

그러나 알루미늄, 구리 및 강철의 관세로 인한 재료비 상승으로 인해 업계는 압력에 직면하고 있습니다. 중국의 전자 부품 및 반도체 수입에 대한 관세는 공급망을 방해하고 차세대 EWIS 부품, 특히 디지털 시스템 및 자동화된 항공기 플랫폼에서 사용되는 부품의 개발에 영향을 미칩니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 81억 달러 |

| 예측 금액 | 129억 달러 |

| CAGR | 4.9% |

와이어·케이블 분야는 내열성, 신호 충실성, 경량 설계를 제공하는 첨단 재료에 수요가 주인으로, 2024년에 28억 달러를 기록했습니다. 현대 항공기는 디지털 기술이나 전기 기술을 점점 도입하게 되어 뿐만 아니라 광섬유 및 배전 솔루션을 포함한 고성능 배선 시스템에 대한 요구가 높아지고 있습니다.

용도별로는 아비오닉스 부문이 2024년에 27.9%의 점유율을 차지했습니다. 라우팅, 전자기 간섭 차폐 및 디지털 대시보드와의 통합은 특히 군용기 및 민간기에서 표준이 되고 있으며, 이러한 시스템은 고급 항공기 서브시스템 내에서 일관된 전력 흐름과 데이터 연결성을 보장합니다.

미국의 전기 배선 상호 접속 시스템 시장은 항공우주 및 방위 분야의 확대로 2024년에 15억 달러를 창출했습니다. 예산 증가에 주력하고 있으며, 고급 EWIS 배포를 지원합니다.

TE Connectivity, Collins Aerospace, Honeywell International Inc. Amphenol Corporation, Safran 등의 대기업은 RandD 시설의 확장, 경량 재료의 기술 혁신에 대한 투자, 모듈 설계 능력의 강화 등의 전략을 채용하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 공급자의 상황

- 이익률 분석

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 민간 및 방위 분야에 있어서의 항공기 납입의 급증

- 경량으로 연비가 좋은 항공기 수요 증가

- 항공기의 전동화 및 전체 전동화로의 이행 증가(MEA/AESA)

- 기내 엔터테인먼트(IFE)와 접속 시스템의 보급이 진행

- 도시형 항공 모빌리티(UAM)와 eVTOL 항공기의 출현

- 업계의 잠재적 위험 및 과제

- 높은 개발·제조 비용

- 엄격한 규제 준수 및 인증 지연

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계·예측 : 구성 요소별(2021-2034년)

- 주요 동향

- 전선 및 케이블(피트당)

- 커넥터

- 전기 접지 및 본딩 장치

- 전기 접속부

- 클램프

- 압력 씰

- 기타

제6장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 동향

- 항공전자공학

- 조종석 제어

- 비행제어시스템(FCS)

- 비행관리시스템(FMS)

- 기타

- 인테리어

- 기내 엔터테인먼트(IFE)

- 갤리선

- 좌석 내 전원

- 객실 관리

- 추진 시스템

- 엔진

- 보조 동력 장치(APU)

- 기타

- 기체

- 날개

- 꼬리

- 기타

제7장 시장 추계·예측 : 항공 유형별(2021-2034년)

- 주요 동향

- 상업용 항공

- 협동체 항공기(NBA)

- 광동체 항공기(WBA)

- 초대형 항공기(VLA)

- 지역 운송 항공기(RTA)

- 군사용 항공

- 전투기

- 운송 항공기

- 군용 헬리콥터

- 비즈니스 및 일반 항공

- 비즈니스 제트기

- 헬리콥터

- 피스톤 항공기

- 터보프롭 항공기

제8장 시장 추계·예측 : 최종 용도별(2021-2034년)

- 주요 동향

- OEM

- 애프터마켓

제9장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- Amphenol Corporation

- Boeing

- Collins Aerospace(Raytheon Technologies)

- Co-Operative Industries Aerospace & Defense(kSARIA)

- Ducommun

- EIS Electronics GmbH

- Elektro Metall Export

- Honeywell International Inc.

- InterConnect Wiring

- JST Sales America

- kSARIA Corporation

- Leonardo

- Molex

- PEI-Genesis

- Pic Wire &Cable(Angelus Corporation)

- Safran

- TE Connectivity

- WL Gore &Associates

The Global Electrical Wiring Interconnection System Market was valued at USD 8.1 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 12.9 billion by 2034, driven by the rapid transition toward all-electric and more-electric aircraft playing a central role in driving this growth. Increased demand for integrated electric systems in aviation, combined with the rising use of in-flight entertainment and real-time connectivity systems, is reshaping wiring infrastructure. The emergence of Urban Air Mobility (UAM) platforms and electric vertical takeoff and landing (eVTOL) aircraft are accelerating innovation across the EWIS landscape. These aircraft require lightweight, high-performance wiring capable of handling complex electrical and data transmission tasks. Rising interest in sustainable aviation and enhanced electrification is increasing dependency on advanced wiring systems that integrate seamlessly with evolving flight technologies.

However, the industry faces pressure due to elevated material costs from tariffs on aluminum, copper, and steel. These metals are critical to producing EWIS components, including connectors, cables, and enclosures. As a result, manufacturers and end-users are experiencing increased production costs. In addition, tariffs on electronic and semiconductor imports from China are hampering supply chains and affecting the development of next-gen EWIS components, particularly those used in digital systems and automated aircraft platforms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.1 Billion |

| Forecast Value | $12.9 Billion |

| CAGR | 4.9% |

The wire and cables segment generated USD 2.8 billion in 2024, largely due to demand for advanced materials that offer thermal resistance, signal fidelity, and lightweight designs. As modern aircraft increasingly incorporate digital and electric technologies, there's a heightened requirement for high-performance wiring systems, including fiber optics and power distribution solutions. Innovations in insulation and shielding technologies enable safer and more efficient operations while helping reduce overall aircraft weight.

In terms of application, the avionics segment held a 27.9% share in 2024. With the digital transformation of cockpit controls, communication systems, and flight data processing, the demand for reliable and compact EWIS is growing significantly. Precision routing, electromagnetic interference shielding, and integration with digital dashboards are now standard, especially in military and commercial fleets. These systems ensure consistent power flow and data connectivity within advanced aircraft subsystems.

U.S. Electrical Wiring Interconnection System (EWIS) Market generated USD 1.5 billion in 2024 due to its expanding aerospace and defense sectors. The country's focus on more electric aircraft, increasing urban air mobility projects, and rising defense budgets support advanced EWIS deployment. Investments in automation and modular wiring systems, along with strong OEM and supplier networks, continue to fuel national demand.

Leading players such as TE Connectivity, Collins Aerospace, Honeywell International Inc., Amphenol Corporation, and Safran are adopting strategies like expanding RandD facilities, investing in lightweight material innovation, and enhancing modular design capabilities. Many are forming strategic partnerships with aircraft manufacturers and defense agencies to co-develop next-gen solutions. Companies focus on digital integration, smart diagnostics, and scalable wiring systems that support rapid aircraft assembly and long-term operational reliability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Surge in aircraft deliveries across commercial and defense segments

- 3.7.1.2 Growth in demand for lightweight and fuel-efficient aircraft

- 3.7.1.3 Rise in shift toward more-electric and all-electric aircraft (MEA/AESA)

- 3.7.1.4 Increasing proliferation of in-flight entertainment (IFE) and connectivity systems

- 3.7.1.5 Emergence of Urban Air Mobility (UAM) and eVTOL Aircraft

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High development and manufacturing costs

- 3.7.2.2 Stringent regulatory compliance and certification delays

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Million, Foot & Units)

- 5.1 Key trends

- 5.2 Wire and cables (per foot)

- 5.3 Connectors

- 5.4 Electrical grounding and bonding devices

- 5.5 Electrical splices

- 5.6 Clamps

- 5.7 Pressure seals

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Avionics

- 6.2.1 Cockpit controls

- 6.2.2 Flight control systems (FCS)

- 6.2.3 Flight management systems (FMS)

- 6.2.4 Others

- 6.3 Interiors

- 6.3.1 Inflight entertainment (IFE)

- 6.3.2 Galleys

- 6.3.3 In-seat power

- 6.3.4 Cabin management

- 6.4 Propulsion system

- 6.4.1 Engine

- 6.4.2 Auxiallry power unit (APU)

- 6.4.3 Other

- 6.5 Airframe

- 6.5.1 Wings

- 6.5.2 Tail

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Aviation Type, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Commercial aviation

- 7.2.1 Narrow body aircraft (NBA)

- 7.2.2 Wide body aircraft (WBA)

- 7.2.3 Very large aircraft (VLA)

- 7.2.4 Regional transport aircraft (RTA)

- 7.3 Military aviation

- 7.3.1 Fighter jets

- 7.3.2 Transport aircraft

- 7.3.3 Military helicopters

- 7.4 Business and general aviation

- 7.4.1 Business jets

- 7.4.2 Helicopters

- 7.4.3 Piston aircraft

- 7.4.4 Turboprop aircraft

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amphenol Corporation

- 10.2 Boeing

- 10.3 Collins Aerospace (Raytheon Technologies)

- 10.4 Co-Operative Industries Aerospace & Defense (kSARIA)

- 10.5 Ducommun

- 10.6 E.I.S. Electronics GmbH

- 10.7 Elektro Metall Export

- 10.8 Honeywell International Inc.

- 10.9 InterConnect Wiring

- 10.10 JST Sales America

- 10.11 kSARIA Corporation

- 10.12 Leonardo

- 10.13 Molex

- 10.14 PEI-Genesis

- 10.15 Pic Wire & Cable (Angelus Corporation)

- 10.16 Safran

- 10.17 TE Connectivity

- 10.18 W. L. Gore & Associates