|

시장보고서

상품코드

1740896

객실 관리 시스템 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Cabin Management System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

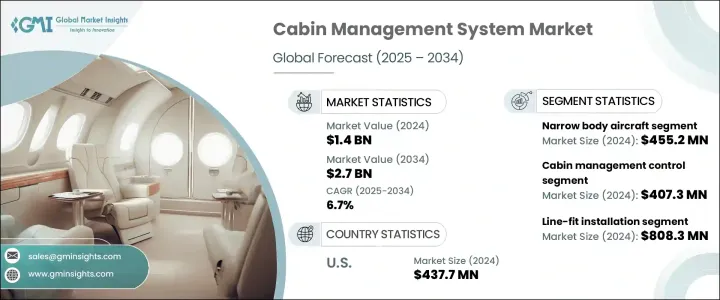

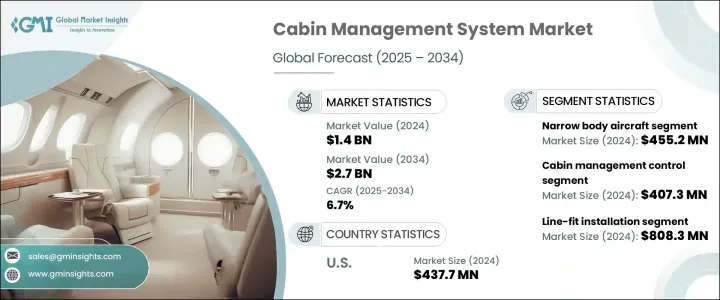

세계의 객실 관리 시스템 시장 규모는 2024년에는 14억 달러에 달했고, CAGR 6.7%를 나타내 2034년에는 27억 달러에 이를 것으로 예측됩니다.

이 시장 성장의 주요 원동력은 여객의 쾌적성을 높이는 것에 중점을 두게 되었고, 하이엔드 항공기의 확대입니다. 회사는 프리미엄 기내 경험을 제공하는 데 중점을 두고 있으며, 이는 고급 객실 관리 시스템(CMS) 기술의 필요성을 부추기고 있습니다. 이 시스템은 조명, 온도, 엔터테인먼트 및 통신 인터페이스를 포함한 다양한 객실 기능의 원활한 제어를 가능하게 해, 이들 모두가 승객의 만족도와 브랜드 충성도를 대폭 향상시킵니다. 또, 강화된 CMS 솔루션은 무선 기술, 리얼타임 적응성, 지능적인 자동화를 서포트하도록 진화하고 있어, 보다 스마트하고 개인화된 캐빈 설정을 가능하게 합니다.

최근 몇 년 동안 세계 무역 정책의 변화가 객실 관리 시스템 시장에 영향을 미치고 있습니다. 이 변화는 현지 제조 생태계를 지원했지만 동시에 CMS 가격 및 세계 제품 공급에서보다 광범위한 전환에 기여했습니다. CMS의 도입과 업그레이드에 드는 비용이 증가함에 따라 운영 비용이 증가하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 14억 달러 |

| 예측 금액 | 27억 달러 |

| CAGR | 6.7% |

세계 항공 여객 수 증가와 항공 업계의 경쟁 압력으로 인해 혁신적인 CMS 솔루션에 대한 수요가 급증하고 있습니다. 음성 인식 툴, AI 기반의 커스터마이징과의 통합을 특징으로 하며, 이들 모두가 원활한 기내 체험을 제공하도록 설계되어 있습니다.이러한 기능 강화로, 항공사는 에너지 효율, 소음 제어, 시스템의 신뢰성 등의 면에서 최신의 규제 기준을 충족하면서 일관된 프리미엄 서비스를 제공할 수 있게 됩니다.

항공기 유형별로 협동체는 2024년 평가액 4억 5,520만 달러로 시장을 선도했습니다. 또한, 신흥 시장에서의 국내 여행 증가에 의해 항공기의 중량이나 운항 경비를 증가시키는 일 없이 여객 제어를 강화하는 선진적이면서 비용 효율적인 CMS 셋업에 수요가 높아지고 있습니다.

구성 요소별로는 객실 관리 컨트롤러가 2024년에 최대의 점유율을 차지해, 4억 730만 달러를 창출했습니다. 복수의 객실 기능을 관리할 수 있는 집중 제어 유닛에 대한 수요는 특히 스마트 센서나 자동화되어 객실 기술의 상승에 따라 급증하고 있습니다. 항공사나 제조업체는 업그레이드나 교환이 용이해, 다운타임이나 유지관리의 수고를 경감할 수 있는 모듈식으로 컴팩트, 저소비 전력의 컨트롤러를 우선하고 있습니다.

설치 유형별로 LINE-FIT 부문이 2024년에 8억 830만 달러로 시장 리더로 부상했습니다. 고급 항공기 구매자는 고급 멀티미디어 기능, 역동적인 조명, 스마트 제어 기능을 지원하고 제조 직후의 고급 기내 환경을 제공하는 완벽하게 통합 된 시스템을 특히 열망합니다.

지역별로는 미국이 2024년에 4억 3,770만 달러의 평가액으로 객실 관리 시스템 시장을 독점했습니다. 네스항공에서는 시장의 성장을 견인하고 있으며, 주요 OEM과 유지보수 제공업체의 존재가 개수와 신규 설치 모두를 지원하여 미국의 주요 시장으로서의 지위를 강화하고 있습니다.

객실 관리 시스템을 둘러싼 환경은 기존의 세계 기업와 혁신적인 신흥 기업이 혼재하여 여전히 매우 단편적입니다. 디지털 캐빈 에코시스템으로의 폭넓은 마이그레이션을 반영합니다. 항공 업계는 보다 전기적이고 연결된 항공 플랫폼에 대한 폭넓은 동향을 반영하여 개인화 및 운영 효율성을 향상시키는 지능형 모듈형 아키텍처로 빠르게 전환하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향

- 주요 부품의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 업계에 미치는 영향요인

- 성장 촉진요인

- 기내 승객의 편안함에 대한 수요 증가

- 비즈니스 제트와 VIP 항공기 함대 확대

- 장거리편 증가

- 항공기 생산 증가

- 스마트 디바이스와의 통합

- 업계의 잠재적 위험 및 과제

- 설치 및 유지 보수 비용이 증가

- 시스템 호환성 문제

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술의 상황

- 향후 시장 동향

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계·예측 : 항공기 유형별(2021-2034년)

- 주요 동향

- 협동체 항공기

- 광동체 항공기

- 지역 제트기

- 비즈니스 제트기

제6장 시장 추계·예측 : 구성 요소별(2021-2034년)

- 주요 동향

- 객실 관리 컨트롤러

- 제어 디스플레이 및 사용자 인터페이스

- 오디오/비디오 인터페이스 모듈

- 객실 관리 소프트웨어

- 연결 모듈

- 기타

제7장 시장 추계·예측 : 설치 유형별(2021-2034년)

- 주요 동향

- 라인-핏 설치

- 개조 설치

제8장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

제9장 기업 프로파일

- Alto Aviation

- Astronics

- BAE Systems

- Bombardier

- Collins

- Diehl Aviation

- Gogo Business Aviation

- Heads Up Technologies

- Honeywell

- KID Systeme

- Lufthansa Technik

- Rosen Aviation

- Safran Cabin

- Satcom Direct

- STG Aerospace

- Thales

The Global Cabin Management System Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 2.7 billion by 2034. This market's growth is primarily driven by a rising emphasis on enhancing passenger comfort, combined with the expansion of high-end aircraft fleets. As air travel continues to recover and expand globally, airline operators are placing a greater focus on offering a premium in-flight experience, which is fueling the need for advanced CMS technologies. These systems enable seamless control over various cabin features, including lighting, temperature, entertainment, and communication interfaces, all of which significantly improve passenger satisfaction and brand loyalty. Enhanced CMS solutions are also evolving to support wireless technology, real-time adaptability, and intelligent automation, allowing smarter and more personalized cabin settings.

In recent years, shifting global trade policies have impacted the CMS market. Tariff regulations imposed on imports from certain countries raised production costs for manufacturers relying on foreign components. These cost hikes, in turn, led to increased prices of CMS products, affecting both suppliers and airline buyers. This situation encouraged many manufacturers to reevaluate their supply chain strategies, with several opting for domestic production or sourcing alternatives from other regions. Although this change supported local manufacturing ecosystems, it also contributed to a broader shift in CMS pricing and global product availability. Airlines, particularly those focused on cost management, have faced increased operational costs due to the higher expense of CMS installations and upgrades. Nevertheless, these developments are gradually fostering a more resilient and localized supply structure for the industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.7 Billion |

| CAGR | 6.7% |

With rising global air passenger numbers and competitive pressures in the aviation sector, the demand for innovative CMS solutions continues to surge. Airlines are increasingly adopting smart and intuitive technologies that align with growing consumer expectations. CMS platforms now feature integrations with Internet of Things (IoT) sensors, app-based control systems, voice recognition tools, and AI-based customization, all designed to deliver a seamless onboard experience. These enhancements support airlines in delivering consistent, premium service while meeting modern regulatory standards in terms of energy efficiency, noise control, and system reliability.

In terms of aircraft types, the narrow-body aircraft segment led the market with a valuation of USD 455.2 million in 2024. The popularity of these aircraft in cost-conscious and short-haul operations is propelling the need for lightweight, efficient, and affordable CMS installations. Growing domestic air travel in emerging markets has also intensified demand for advanced yet cost-effective CMS setups that offer enhanced passenger control without increasing aircraft weight or operational expense.

By component, cabin management controllers accounted for the largest share in 2024, generating USD 407.3 million. The demand for centralized control units capable of managing multiple cabin functionalities has surged, particularly with the rise in smart sensors and automated cabin technologies. Airlines and manufacturers are prioritizing modular, compact, and low-power controllers that can be easily upgraded or replaced, helping reduce downtime and maintenance efforts.

Based on installation type, the line-fit segment emerged as the market leader with a value of USD 808.3 million in 2024. The increasing number of new aircraft deliveries has led to a growing preference for factory-installed CMS setups. Buyers of premium aircraft are especially keen on fully integrated systems that support advanced multimedia functions, dynamic lighting, and smart control capabilities, delivering a high-end cabin environment straight from production.

Regionally, the United States dominated the CMS market with a valuation of USD 437.7 million in 2024. The country's strong demand for luxurious CMS upgrades and advanced connectivity options, particularly in private and business aviation, continues to drive market growth. In addition, the presence of major OEMs and maintenance providers supports both retrofit and new installation activities, reinforcing the U.S.'s position as a key market.

The cabin management system landscape remains highly fragmented, with a mix of established global players and innovative startups. The top three companies collectively control over 29.7% of the market, focusing heavily on next-generation solutions. These advancements reflect a wider transition from isolated hardware systems to fully integrated digital cabin ecosystems. The industry is rapidly moving toward intelligent, modular architectures that offer enhanced personalization and operational efficiency, reflecting the broader trend toward more electric and connected aviation platforms.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising demand for in-flight passenger comfort

- 3.3.1.2 Expansion of business jet and vip aircraft fleets

- 3.3.1.3 Growth in long-haul flights

- 3.3.1.4 Increase in aircraft production

- 3.3.1.5 Integration with smart devices

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High installation and maintenance costs

- 3.3.2.2 System compatibility issues

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Aircraft Type, 2021 - 2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Narrow-body aircraft

- 5.3 Wide-body aircraft

- 5.4 Regional jets

- 5.5 Business jets

Chapter 6 Market Estimates and Forecast, By Component, 2021 - 2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Cabin management controllers

- 6.3 Control displays and user interfaces

- 6.4 Audio/video interface modules

- 6.5 Cabin management software

- 6.6 Connectivity modules

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Installation Type, 2021 - 2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 Line-fit installation

- 7.3 Retrofit installation

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alto Aviation

- 9.2 Astronics

- 9.3 BAE Systems

- 9.4 Bombardier

- 9.5 Collins

- 9.6 Diehl Aviation

- 9.7 Gogo Business Aviation

- 9.8 Heads Up Technologies

- 9.9 Honeywell

- 9.10 KID Systeme

- 9.11 Lufthansa Technik

- 9.12 Rosen Aviation

- 9.13 Safran Cabin

- 9.14 Satcom Direct

- 9.15 STG Aerospace

- 9.16 Thales