|

시장보고서

상품코드

1740916

자동차용 디스크 커플링 시장 : 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Automotive Disc Couplings Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

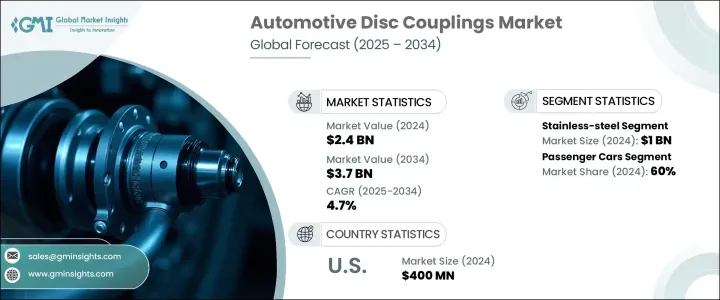

세계의 자동차용 디스크 커플링 시장 규모는 2024년에 24억 달러로 평가되었고, 2034년에는 37억 달러에 이를 것으로 예측되며, CAGR 4.7%로 성장할 전망입니다.

자동차 제조업체들이 전동화 및 자동화로 전환함에 따라 디스크 커플링은 기능성과 미학을 모두 우선시하는 고성능 시스템을 지원하는 데 필수적인 요소가 되었습니다. 이러한 부품은 특히 원활한 통합과 사용자 중심 경험이 표준이 된 전기자동차(EV)와 자율 주행 플랫폼에서 기계 및 전자 하위 시스템을 연결하는 데 중요한 역할을 합니다.

자동차 산업은 차세대 모빌리티와 더 스마트한 차량 내 기술에 중점을 두고 빠르게 진화하고 있습니다. 운전자의 선호도가 보다 직관적이고 몰입감 있는 운전 경험으로 변화함에 따라 디스크 커플링은 기존의 스위치와 컨트롤을 뛰어넘는 혁신적인 시스템 개발을 가능하게 하고 있습니다. 소비자들은 터치 반응형 다기능 표면, 통합 햅틱, 스마트 인터페이스를 제공하는 차량을 찾고 있으며, 디스크 커플링은 하드웨어와 소프트웨어 간의 격차를 해소하여 안전, 반응성, 편안함을 향상시키는 데 도움이 됩니다. 자동차 제조업체는 열악한 조건, 진동, 높은 하중을 견딜 수 있는 안정적이고 가벼운 고강도 부품을 요구하는 첨단 구동계 및 제어 기술을 점점 더 많이 채택하고 있습니다. 이러한 수요가 증가함에 따라 디스크 커플링은 전기 구동계, 인포테인먼트 모듈 및 실내 제어 시스템에 통합되어 보다 원활한 작동과 에너지 효율 향상을 보장하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 24억 달러 |

| 예측 금액 | 37억 달러 |

| CAGR | 4.7% |

기술은 자동차용 디스크 커플링의 기능을 계속 재정의하고 있습니다. 최신 개발품은 지능형 차량 시스템의 성장 추세에 맞춰 임베디드 센서와 3D 터치 표면을 특징으로 합니다. 이러한 혁신은 특히 핸즈프리, 음성 제어, 반응형 사용자 인터페이스를 제공하기 위해 차량 내 기술이 발전하고 있는 전기차 및 자율 주행 차량과 관련이 있습니다. 자동차 제조업체들이 기존 컨트롤의 복잡성을 줄이고 운전자 상호작용을 강화하기 위해 노력하는 가운데, 디스크 커플링은 깔끔한 대화형 대시보드와 중앙 집중식 컨트롤 허브로의 전환을 가능하게 합니다. 햅틱 피드백, 동적 주변 조명, 적응형 인포테인먼트 시스템과 같은 기능은 정밀한 기계-전자 연결에 의존하기 때문에 디스크 커플링은 필수 불가결한 요소입니다.

재료별로 보면 스테인리스 스틸, 알루미늄, 플라스틱 디스크 커플링으로 시장이 세분화됩니다. 이 중 스테인리스 스틸은 2024년 약 10억 달러의 가치로 시장을 주도하고 있습니다. 이러한 우위는 고성능 및 전기자동차에 사용되는 주요 특성인 우수한 강도, 내열성, 높은 내구성에서 비롯됩니다. 스테인리스 스틸 커플링은 강렬한 진동과 극한 조건을 효율적으로 처리할 수 있어 장기적인 신뢰성과 성능 일관성이 중요한 용도에 이상적입니다. 자동차 제조업체들이 지속 가능한 고출력 드라이브 트레인을 강조함에 따라 스테인리스 스틸은 성능과 수명을 위해 설계하는 엔지니어들에게 여전히 인기 있는 재료입니다.

최종 용도에 따라 자동차용 디스크 커플링 시장은 승용차와 상용차로 분류됩니다. 승용차는 2024년 전 세계 시장의 60%를 차지할 것으로 예상됩니다. 이러한 강세는 소비자 차량의 전기 및 자율주행 기술 채택이 증가하고 있기 때문입니다. OEM은 스마트 인터페이스, 경량화된 구동계 부품, 매끄러운 실내 제어를 통해 주행 경험을 최적화하는 데 더욱 집중하고 있으며, 이를 위해 견고한 디스크 커플링 시스템의 통합이 요구되고 있습니다. 소형 전기차부터 고급 자율주행차에 이르기까지 디스크 커플링은 인포테인먼트에서 동력 전달에 이르는 모든 요소가 원활하고 안전하게 작동하도록 보장합니다.

지역적으로 북미 자동차용 디스크 커플링 시장은 2024년에 4억 달러의 매출을 올렸습니다. 미국 자동차 산업은 최첨단 드라이브 트레인 기술 구현을 지속적으로 선도하고 있습니다. 국내 자동차 제조업체들은 전동화에 막대한 투자를 하고 있으며 성능과 운전자 승차감을 향상시키기 위해 첨단 디스크 커플링을 도입하고 있습니다. 미국 전역에서 전기차 도입이 탄력을 받으면서 전기 구동계의 열 부하와 진동을 처리할 수 있는 고품질 커플링에 대한 필요성이 크게 증가하고 있습니다. 이 지역은 또한 차량 전기화 목표를 지원하기 위해 가볍고 효율적인 부품을 개발하기 위한 연구 활동이 증가하고 있습니다.

세계 자동차용 디스크 커플링 시장의 주요 기업으로는 Flender, Dodge, Regal Rexnord, RENK-MAAG, Voith, John Crane, ESCO, Timken, REICH, Rathi Transpower 등이 있습니다. 이 기업들은 전략적 제휴, 지속적인 제품 혁신, 연구 개발에 중점을 두어 경쟁력을 강화하고 있습니다. 이들은 차세대 자동차 플랫폼과의 호환성을 개선하기 위해 가볍고 부식에 강한 재료와 모듈식 커플링 설계에 투자하고 있습니다. 또한 이들 기업 중 다수는 에너지 효율 및 성능 중심 솔루션에 대한 진화하는 소비자의 기대와 OEM 요구 사항에 부합하는 스마트 기능을 통합하여 제품 기능을 발전시키고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 원자재 공급자

- 부품 공급업체

- 제조업자

- 기술 공급자

- 유통 채널 분석

- 최종 용도

- 이익률 분석

- 공급자의 상황

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원자재)

- 주요 원자재의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원자재)

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 무역에 미치는 영향

- 기술과 혁신의 상황

- 특허 분석

- 규제 상황

- 코스트 내역 분석

- 주요 뉴스와 대처

- 영향요인

- 성장 촉진요인

- 전기차와 자율주행차로의 전환

- 재료 및 감지 기술의 발전

- 전기차와 자율주행차로의 전환

- 맞춤형 및 브랜드 차별화를 위한 OEM

- 업계의 잠재적 위험 및 과제

- 높은 개발 및 통합 비용

- 레거시 시스템과의 호환성 문제

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계 및 예측 : 유형별(2021-2034년)

- 주요 동향

- 플렉시블 커플링

- 리지드 커플링

- 디스크 커플링

제6장 시장 추계 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV

- 상용차

- 소형 상용차(LCV)

- 중형 상용차(MCV)

- 대형 상용차(HCV)

제7장 시장 추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 드라이브 트레인 시스템

- 변속기 시스템

- 파워트레인 시스템

제8장 시장 추계 및 예측 : 재료별(2021-2034년)

- 주요 동향

- 스테인리스 스틸

- 알루미늄

- 플라스틱

제9장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 프랑스

- 영국

- 스페인

- 이탈리아

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주 및 뉴질랜드

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 남아프리카

- 사우디아라비아

제10장 기업 프로파일

- Altra

- ASA Electronics

- Challenge

- Coupling

- CURRAX

- Dodge

- ESCO

- Flender

- John Crane

- Korea Coupling

- Lovejoy

- RW Coupling

- Rathi Transpower

- Regal Rexnord

- REICH

- RENK-MAAG

- Renold

- Timken

- Tsubakimoto

- Voith

The Global Automotive Disc Couplings Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 3.7 billion by 2034, fueled by the increasing demand for sophisticated, interactive vehicle interiors and the rising integration of smart technologies into the automotive sector. As vehicle manufacturers continue transitioning toward electrification and automation, disc couplings have become vital in supporting high-performance systems that prioritize both functionality and aesthetics. These components play a crucial role in linking mechanical and electronic subsystems, especially in electric vehicles (EVs) and autonomous platforms, where seamless integration and user-centric experiences are now the norm.

The automotive industry is evolving rapidly, with a sharp focus on next-gen mobility and smarter in-cabin technologies. As driver preferences shift toward more intuitive and immersive driving experiences, disc couplings are enabling the development of innovative systems that go beyond traditional switches and controls. Consumers are looking for vehicles that offer touch-responsive, multifunctional surfaces, integrated haptics, and smart interfaces-and disc couplings help bridge the gap between hardware and software, enhancing safety, responsiveness, and comfort. Automakers are increasingly embracing advanced drivetrain and control technologies that demand reliable, lightweight, and high-strength components capable of withstanding harsh conditions, vibrations, and high loads. With this demand on the rise, disc couplings are being integrated into electric drivetrains, infotainment modules, and interior control systems to ensure smoother operation and improved energy efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $3.7 Billion |

| CAGR | 4.7% |

Technology continues to redefine the functionality of automotive disc couplings. The latest developments feature embedded sensors and 3D touch surfaces that align with the growing trend of intelligent vehicle systems. These innovations are particularly relevant in EVs and autonomous vehicles, where in-cabin technology is evolving to deliver hands-free, voice-controlled, and responsive user interfaces. As automakers work to reduce the complexity of traditional controls and enhance driver interaction, disc couplings enable the shift toward clean, interactive dashboards and centralized control hubs. Features like haptic feedback, dynamic ambient lighting, and adaptive infotainment systems rely on precise mechanical-electronic connectivity-making disc couplings indispensable.

In terms of material segmentation, the market includes stainless steel, aluminum, and plastic disc couplings. Among these, stainless steel led the market with a valuation of around USD 1 billion in 2024. This dominance stems from its superior strength, resistance to heat, and high durability-key attributes for use in high-performance and electric vehicles. Stainless steel couplings can efficiently handle intense vibrations and extreme conditions, making them ideal for applications where long-term reliability and performance consistency are non-negotiable. As automakers emphasize sustainable and high-output drivetrains, stainless steel remains the go-to material for engineers designing for performance and longevity.

Based on end use, the automotive disc couplings market is categorized into passenger cars and commercial vehicles. Passenger cars accounted for 60% of the global market in 2024. This stronghold is attributed to the increasing adoption of electric and autonomous technologies in consumer vehicles. OEMs are placing greater focus on optimizing the driving experience with smart interfaces, lightweight drivetrain components, and seamless interior controls-all of which demand the integration of robust disc coupling systems. From compact EVs to high-end autonomous cars, disc couplings ensure that every element, from infotainment to power transmission, operates smoothly and safely.

Regionally, the North America Automotive Disc Couplings Market generated USD 400 million in 2024. The U.S. automotive industry continues to lead with the implementation of cutting-edge drivetrain technologies. Domestic automakers are investing heavily in electrification and are incorporating advanced disc couplings to boost performance and driver comfort. With EV adoption gaining momentum across the U.S., the need for high-quality couplings that can handle thermal loads and vibration in electric drivetrains is growing substantially. This region is also witnessing increased research activity aimed at developing lightweight, efficient components to support vehicle electrification targets.

Key players in the global automotive disc couplings market include Flender, Dodge, Regal Rexnord, RENK-MAAG, Voith, John Crane, ESCO, Timken, REICH, and Rathi Transpower. These companies are sharpening their competitive edge through strategic alliances, continuous product innovation, and a strong emphasis on research and development. They are investing in lightweight, corrosion-resistant materials and modular coupling designs to improve compatibility with next-gen automotive platforms. Many of these players are also advancing product capabilities by integrating smart features that align with evolving consumer expectations and OEM requirements for energy efficiency and performance-driven solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.1 Impact on trade

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Cost breakdown analysis

- 3.7 Key news & initiatives

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Shift toward electric and autonomous vehicles

- 3.8.1.2 Advancements in material and sensing technology

- 3.8.1.3 Shift toward electric and autonomous vehicles

- 3.8.1.4 OEM initiatives for customization and brand differentiation

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High development and integration costs

- 3.8.2.2 Compatibility issues with legacy systems

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Flexible couplings

- 5.3 Rigid couplings

- 5.4 Disc couplings

Chapter 6 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial Vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Medium Commercial Vehicles (MCV)

- 6.3.3 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Drivetrain system

- 7.3 Transmission system

- 7.4 Powertrain system

Chapter 8 Market Estimates & Forecast, By Material 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Stainless steel

- 8.3 Aluminum

- 8.4 Plastic

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Altra

- 10.2 ASA Electronics

- 10.3 Challenge

- 10.4 Coupling

- 10.5 CURRAX

- 10.6 Dodge

- 10.7 ESCO

- 10.8 Flender

- 10.9 John Crane

- 10.10 Korea Coupling

- 10.11 Lovejoy

- 10.12 R+W Coupling

- 10.13 Rathi Transpower

- 10.14 Regal Rexnord

- 10.15 REICH

- 10.16 RENK-MAAG

- 10.17 Renold

- 10.18 Timken

- 10.19 Tsubakimoto

- 10.20 Voith