|

시장보고서

상품코드

1740938

상용차용 크랭크샤프트 시장 : 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Commercial Vehicle Crankshaft Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

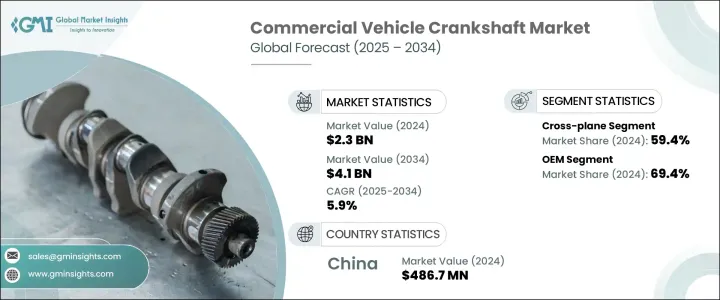

세계의 상용차용 크랭크샤프트 시장 규모는 2024년에 23억 달러로 평가되었고, 상용차 생산 증가와 세계 수송 및 물류 분야의 급속한 확대에 의해 2034년에는 41억 달러에 달할 것으로 예측되며, CAGR 5.9%로 성장할 전망입니다.

전 세계 산업계가 탄소 배출 제로 목표를 향해 경쟁하면서 보다 효율적이고 깨끗한 차량 기술에 대한 필요성이 크랭크샤프트 산업 전반에 걸쳐 상당한 모멘텀을 창출하고 있습니다. 하이브리드, 전기 및 과도기적 파워트레인에 대한 수요가 증가함에 따라 소재 요구 사항과 성능 기대치가 재편되고 있으며, 제조업체는 더 가볍고 내구성이 뛰어난 크랭크샤프트 솔루션을 혁신해야 합니다. 차량 운영업체들은 전통적인 내연기관 시스템과 전기 플랫폼을 연결하는 차세대 상용차에 대한 투자를 늘리면서 효율성과 신뢰성을 모두 제공하는 고성능 부품에 대한 필요성이 높아지고 있습니다. 진화하는 공급망 역학, 더 엄격해진 배기가스 규제, 연비에 대한 관심이 높아지면서 OEM과 공급업체는 기존의 크랭크샤프트 설계를 재구상해야 하는 상황에 직면했습니다. 이제 기업들은 글로벌 차량의 높아지는 기준을 충족하기 위해 더 스마트한 예측 유지보수 기술, 경량 합금, 정밀 제조 기술에 자원을 투입하고 있습니다. 특히 물류 트럭과 버스와 같은 대형 차량 부문에서 차량-그리드(V2G) 시스템의 채택이 증가하면서 엔진 성능을 극대화하는 동시에 지속 가능성을 지원하는 첨단 크랭크샤프트 설계에 대한 필요성이 더욱 강조되고 있습니다.

상용차의 스마트 그리드 시스템 통합이 증가하면서 크랭크샤프트 설계 요건에도 영향을 미치고 있습니다. V2G 네트워크에 참여하는 차량은 이 과도기적 단계에서 여전히 내연기관 또는 하이브리드 엔진에 크게 의존하고 있기 때문에 크랭크샤프트가 배기가스 저감 및 연비 향상을 지원하는 것이 중요합니다. 이러한 추세는 레거시 시스템과 미래 지향적인 모빌리티 솔루션을 결합하려는 자동차 업계의 광범위한 변화와 직접적으로 연관되어 있습니다. 가치 사슬 전반에 걸쳐 OEM과 부품 제조업체는 내열성과 진동 제어 기능이 뛰어난 경량 고강도 크랭크샤프트 개발에 우선순위를 두고 있습니다. 동시에 북미, 유럽, 아시아 전역에서 배기가스 저감을 목표로 하는 규제 인센티브가 고성능 크랭크샤프트 기술에 대한 투자를 가속화하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 23억 달러 |

| 예측 금액 | 41억 달러 |

| CAGR | 5.9% |

2024년 크로스플레인 크랭크샤프트 부문은 59.4%의 시장 점유율로 압도적인 1위를 차지했는데, 이는 우수한 진동 감쇠, 토크 일관성, 동적 균형 덕분입니다. 이러한 기능은 장거리 트럭, 산업용 버스 및 다양한 지형에서 극한의 하중 조건에서 운행되는 기타 대형 차량에 필수적입니다. 또한 크로스플레인 크랭크샤프트는 대배기량 및 하이브리드 엔진과의 호환성을 향상시켜 최적의 연비와 주행성에 필수적인 부드러운 토크 전달을 보장합니다.

판매 채널의 관점에서는 OEM이 2024년에 69.4%의 압도적인 점유율을 차지하고, 2034년까지의 CAGR은 6.8%로 성장할 것으로 예측되고 있습니다.

중국의 상용차용 크랭크샤프트 시장 점유율은 54.2%로 세계를 선도하며 2024년에는 4억 8,670만 달러를 창출했습니다. 중국의 지배력은 막대한 상용차 생산 규모와 수직적으로 통합된 공급망에서 비롯됩니다. 충칭, 지난, 광저우와 같은 도시는 정부 이니셔티브, 숙련된 노동력, 강력한 OEM 파트너십의 지원을 받아 주요 제조 허브로 부상했습니다. 자동화 단조 라인, 로봇 가공, 엄격한 품질 관리에 대한 투자가 중국의 선도적 입지를 강화하고 있습니다.

세계 시장의 주요 기업은 Bharat Forge, thyssenkrupp, MAHLE, Rheinmetall, Kellogg Crankshaft Company, Crower Cams & Equipment, NSI Crankshaft, ZF Friedrichshafen, Nippon Steel, Tianrun Industrial Technology등이 있습니다. 업계 리더들은 진화하는 상용 모빌리티 환경에 발맞춰 고강도, 경량 소재에 대한 R&D를 우선시하고, CNC 자동화를 강화하며, OEM과의 협업을 강화하고, 디지털 통합을 발전시켜 유지보수를 추적하고 배기가스 성능을 최적화하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 제조업자

- 원자재 공급자

- 자동차 OEM

- 유통 채널

- 최종 용도

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복조치

- 업계에 미치는 영향

- 공급측의 영향(원자재)

- 주요 원자재의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(고객에 대한 비용)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원자재)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 이익률 분석

- 기술과 혁신의 상황

- 특허 분석

- 주요 뉴스와 대처

- 규제 상황

- 가격 분석

- 추진

- 지역

- 영향요인

- 성장 촉진요인

- 상용차 수요 증가

- 운송 및 물류 부문의 확장

- 경량 및 고강도 재료의 채택

- 상용차용 크랭크 샤프트의 지속적인 기술 발전

- 업계의 잠재적 위험 및 과제

- 높은 제조 비용

- 공급망 중단

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계 및 예측 : 크랭크샤프트별(2021-2034년)

- 주요 동향

- 평면

- 크로스플레인

- 모듈식

제6장 시장 추계 및 예측 : 재료별(2021-2034년)

- 주요 동향

- 단조 강철

- 주철 및 강철

- 가공 빌렛

제7장 시장 추계 및 예측 : 추진력별(2021-2034년)

- 주요 동향

- 디젤

- 천연가스

제8장 시장 추계 및 예측 : 차량별(2021-2034년)

- 주요 동향

- 소형 상용차(LCV)

- 중형 상용차(MCV)

- 대형 상용차(HCV)

제9장 시장 추계 및 예측 : 판매 채널별(2021-2034년)

- 주요 동향

- OEM

- 애프터마켓

제10장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주 및 뉴질랜드

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

제11장 기업 프로파일

- Aichi Steel

- Atlas Industries

- Bharat Forge

- Bharat gears

- Bryan Tools &Engineering

- China Zhongwang Holdings

- CIE Automotive

- Crower Cams &Equipment Company

- Indian Crankshaft Manufacturing Company(ICM)

- Kellogg Crankshaft Company

- MAHLE

- Metalurgica Riosulense S/A

- Molnar Technologies

- Nippon Steel

- NSI Crankshaft

- Rheinmetall

- Teksid

- thyssenkrupp

- Tianrun Crankshaft

- ZF Friedrichshafen

The Global Commercial Vehicle Crankshaft Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 4.1 billion by 2034, driven by rising commercial vehicle production and the rapid expansion of global transportation and logistics sectors. As industries worldwide race toward zero-emission targets, the need for more efficient, cleaner vehicle technologies is creating significant momentum across the crankshaft industry. The growing demand for hybrid, electric, and transitional powertrains is reshaping material requirements and performance expectations, pushing manufacturers to innovate lighter, more durable crankshaft solutions. Fleet operators are increasingly investing in next-generation commercial vehicles that bridge traditional internal combustion systems with electrified platforms, boosting the need for high-performance components that deliver both efficiency and reliability. Evolving supply chain dynamics, stricter emissions regulations, and a heightened focus on fuel economy are compelling OEMs and suppliers to reimagine traditional crankshaft designs. Companies are now channeling resources into smarter predictive maintenance technologies, lightweight alloys, and precision manufacturing techniques to meet the rising standards of global fleets. The growing adoption of vehicle-to-grid (V2G) systems, particularly in heavy-duty segments like logistics trucks and buses, further highlights the ongoing need for advanced crankshaft designs that support sustainability while maximizing engine performance.

Increased integration of commercial fleets into smart grid systems is also influencing crankshaft design requirements. Vehicles participating in V2G networks still depend heavily on internal combustion or hybrid engines during this transitional phase, making it crucial for crankshafts to support lower emissions and enhanced fuel efficiency. This trend ties directly into the broader automotive shift toward blending legacy systems with future-forward mobility solutions. Across the value chain, OEMs and component manufacturers are prioritizing the development of lightweight, high-strength crankshafts with better heat resistance and vibration control. At the same time, regulatory incentives across North America, Europe, and Asia targeting emissions reduction are accelerating investments in high-performance crankshaft technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $4.1 Billion |

| CAGR | 5.9% |

In 2024, the cross-plane crankshaft segment dominated with a 59.4% market share, largely because of its superior vibration damping, torque consistency, and dynamic balance. These features are vital for long-haul trucks, industrial buses, and other heavy-duty vehicles that operate under extreme load conditions across diverse terrains. Cross-plane crankshafts also enhance compatibility with large displacement and hybrid engines, ensuring smooth torque delivery critical for optimal fuel efficiency and drivability.

From a sales channel standpoint, OEMs accounted for a commanding 69.4% share in 2024 and are projected to grow at a CAGR of 6.8% through 2034. OEMs are increasingly collaborating with crankshaft manufacturers to co-develop application-specific forged designs that prioritize strength, fatigue resistance, and thermal efficiency.

China Commercial Vehicle Crankshaft Market led globally with a 54.2% share, generating USD 486.7 million in 2024. The country's dominance stems from its massive commercial vehicle production scale and vertically integrated supply chain. Cities like Chongqing, Jinan, and Guangzhou have emerged as key manufacturing hubs, supported by government initiatives, skilled labor pools, and strong OEM partnerships. Investments in automated forging lines, robotic machining, and stringent quality control are reinforcing China's leadership position.

Key players in the global market include Bharat Forge, thyssenkrupp, MAHLE, Rheinmetall, Kellogg Crankshaft Company, Crower Cams & Equipment, NSI Crankshaft, ZF Friedrichshafen, Nippon Steel, and Tianrun Industrial Technology. Industry leaders are prioritizing R&D for high-strength, low-weight materials, enhancing CNC automation, forging deeper OEM collaborations, and advancing digital integration to track maintenance and optimize emissions performance, keeping pace with the evolving landscape of commercial mobility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Manufacturers

- 3.2.2 Raw material suppliers

- 3.2.3 Automotive OEM

- 3.2.4 Distribution channel

- 3.2.5 End-use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Trade impact

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (Cost to customers)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Trade impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Pricing analysis

- 3.9.1 Propulsion

- 3.9.2 Region

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising demand for commercial vehicles

- 3.10.1.2 Expansion of transportation and logistics sector

- 3.10.1.3 Adoption of lightweight and high-strength materials

- 3.10.1.4 Ongoing technological advancements in commercial vehicle crankshaft

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High manufacturing cost

- 3.10.2.2 Supply chain disruption

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Crankshaft, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Flat plane

- 5.3 Cross plane

- 5.4 Modular

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Forged steel

- 6.3 Cast iron/steel

- 6.4 Machined billet

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Diesel

- 7.3 Natural gas

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Light Commercial Vehicles (LCV)

- 8.3 Medium Commercial Vehicles (MCV)

- 8.4 Heavy Commercial Vehicles (HCV)

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEMs

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Aichi Steel

- 11.2 Atlas Industries

- 11.3 Bharat Forge

- 11.4 Bharat gears

- 11.5 Bryan Tools & Engineering

- 11.6 China Zhongwang Holdings

- 11.7 CIE Automotive

- 11.8 Crower Cams & Equipment Company

- 11.9 Indian Crankshaft Manufacturing Company (ICM)

- 11.10 Kellogg Crankshaft Company

- 11.11 MAHLE

- 11.12 Metalurgica Riosulense S/A

- 11.13 Molnar Technologies

- 11.14 Nippon Steel

- 11.15 NSI Crankshaft

- 11.16 Rheinmetall

- 11.17 Teksid

- 11.18 thyssenkrupp

- 11.19 Tianrun Crankshaft

- 11.20 ZF Friedrichshafen