|

시장보고서

상품코드

1750298

얇은 벽 포장(Thin Wall Packaging) 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Thin Wall Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

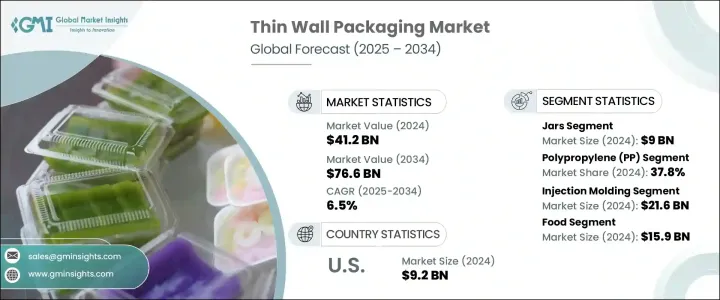

세계의 얇은 벽 포장 시장은 2024년 412억 달러로 평가되었고, 라이프 스타일 패턴의 변화, 간편한 식품 옵션에 대한 수요 증가, 외식 채널 확대 등을 배경으로 CAGR 6.5%로 성장해 2034년까지 766억 달러에 달할 것으로 예측되고 있습니다.

도시의 중심부가 성장하여 소비자의 일상 생활이 바쁘게 되면서, 경량으로 내구성이 있어, 비용 효율이 높은 포장 형태의 매력이 강해지고 있습니다. 신속한 생산과 재료 사용을 줄일 수 있으며, 오늘날의 빠른 소매 및 식품 배달 생태계에 맞는 형식으로 현대 공급망의 요구를 지원합니다.

휴대가 가능하고 전자 레인지로 따뜻해지고 재밀봉 가능한 용기에 대한 수요가 높아지는 가운데, 얇은 벽 포장은 도시에서의 식품 소비에 빠뜨릴 수 없는 것이 되고 있습니다. 얇은 벽 용기는 현재 유제품, 냉동 식품, 스낵 과자 포장에 널리 선택되어 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 412억 달러 |

| 예측 금액 | 766억 달러 |

| CAGR | 6.5% |

힝일; 부문은 2024년에 90억 달러를 만들어, 얇은 벽 포장에서 우위를 나타내고 있습니다. 이 용기는 경량 구조, 재료 사용량의 삭감, 비용 효율적인 생산에 의해 식품, 퍼스널케어, 가정용 제품의 카테고리로 널리 사용되고 있습니다. 자동차와 소비자 모두에게 범용성과 기능성을 제공합니다. 인기가 높아지고 있는 것은 저렴한 가격뿐만 아니라, 편리성, 사용의 용이성, 지속가능성에 대한 소비자의 기호에도 기인하고 있습니다.

폴리프로필렌(PP) 부문은 2024년에 37.8%의 점유율을 차지했습니다. 내습성과 화학적 안정성은 식품 용도에 적합합니다. 강화된 PP 배합은 내구성을 손상시키지 않고 벽을 얇게 만들 수 있어 가능해 기업은 규제상의 압력을 충족하면서 이산화탄소 배출량을 삭감할 수 있습니다.

미국의 얇은 벽 포장(2024년) 시장 규모는 92억 달러에 달했습니다. 전자상거래나 택배 서비스 대두가 재료 감축과 환경 컴플라이언스를 선호하는 포장 혁신을 촉진하고 있습니다.

세계 얇은 벽 포장 산업의 주요 기업은 ILIP Srl, Packcor GmbH, Amcor plc, Greiner Packaging International GmbH, Berry Global Inc.입니다. 얇은 벽 포장 세계 시장에서 주요 기업은 시장에서의 존재감을 높이기 위해 지속 가능한 혁신, 전략적 합병, 지역 확대에 다액의 투자를 실시했습니다. 일부 기업은 식음료 브랜드와 제휴하여 선반에 진열을 개선하고 신선도를 오래 유지하는 맞춤형 솔루션을 제공합니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 공급자의 상황

- 이익률 분석

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 인스턴트 식품이나 조리된 식품 수요의 급증

- 지속가능성과 경량화 노력의 성장

- 푸드 딜리버리와 QSR 채널의 상승

- 신흥 경제의 급속한 도시화

- 사출 성형과 인몰드 라벨링(IML)의 진보

- 업계의 잠재적 위험 및 과제

- 플라스틱의 사용에 관한 엄격한 환경 규제

- 신선식품에 대한 배리어성의 한계

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계 및 예측 : 제품 유형별, 2021-2034년

- 주요 동향

- 컵

- 탭 용기

- 트레이

- 항아리

- 뚜껑

- 기타 용기

제6장 시장 추계 및 예측 : 재질별, 2021-2034년

- 주요 동향

- 폴리프로필렌(PP)

- 폴리에틸렌(PE)

- 고밀도 폴리에틸렌(HDPE)

- 저밀도 폴리에틸렌(LDPE)

- 폴리스티렌(PS)

- 폴리에틸렌테레프탈레이트(PET)

- 폴리염화비닐(PVC)

- 기타

제7장 시장 추계 및 예측 : 생산 공정별, 2021-2034년

- 주요 동향

- 열성형

- 사출 성형

- 기타

제8장 시장 추계 및 예측 : 용도별, 2021-2034년

- 주요 동향

- 식품

- 유제품

- 조리된 식품

- 베이커리 및 과자류

- 고기, 닭고기 및 해산물

- 음료

- 퍼스널케어 및 화장품

- 가정용품

- 전기 및 전자공학

- 의약품 및 영양 보조 식품

- 산업

제9장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- ALPLA Group

- Akshar Plastic

- Amcor Plc

- Berry Global Inc.

- Borouge

- Chemco Plast

- Cosmo Films

- Double H Plastics

- EVCO Plastics

- Greiner Packaging International GmbH

- ILIP Srl

- IPL Plastics Inc.

- Mold-Masters

- Paccor

- Prabhoti Plastic Industries

- SABIC

- SP International Industries Pvt. Ltd.

The Global Thin Wall Packaging Market was valued at USD 41.2 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 76.6 billion by 2034, driven by shifting lifestyle patterns, increasing demand for convenience food options, and expanding foodservice channels. As urban centers grow and consumer routines become more hectic, the appeal of lightweight, durable, and cost-efficient packaging formats has intensified. Thin-wall packaging enables quicker production turnaround and reduced material use while delivering product integrity. It also supports modern supply chain needs with formats that fit today's fast-paced retail and food delivery ecosystems.

With rising demand for portable, microwaveable, and resealable containers, thin wall formats have become indispensable across urban food consumption. These packages align with consumers' preference for on-the-go meals and instant snacks, especially in high-density regions. Thanks to their barrier properties and structural integrity, thin wall containers help extend shelf life while supporting sustainability goals. They're now widely chosen for packaging dairy, frozen entrees, and snack foods. Consumers gravitate toward these options for practicality, especially as packaging trends lean more toward minimalism and eco-consciousness. Jars are popular for their reusable nature and suitability across personal care, household goods, and food applications. They offer an effective seal that maintains freshness while being easy to handle.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $41.2 Billion |

| Forecast Value | $76.6 Billion |

| CAGR | 6.5% |

The jars segment generated USD 9 billion in 2024, marking its dominance within the thin wall packaging landscape. These containers are extensively used across food, personal care, and household product categories due to their lightweight structure, reduced material usage, and cost-effective production. Jars offer an ideal packaging solution for a wide range of applications, providing both manufacturers and consumers with versatility and functionality. Their growing popularity stems not only from their affordability but also from consumer-driven preferences for convenience, ease of use, and sustainability. Reusability and easy storage make jars a preferred option, especially for products that require repeated access or portion control.

The polypropylene (PP) segment held a 37.8% share in 2024. This polymer's blend of strength, light weight, and affordability makes it ideal for thin wall packaging, especially in fast-cycle injection molding. Its moisture resistance and chemical stability make it a preferred choice for food-grade applications. Enhanced PP formulations allow thinner walls without compromising durability, enabling companies to reduce carbon footprints while meeting regulatory pressures.

United States Thin Wall Packaging Market generated USD 9.2 billion in 2024. Increased consumption of prepared meals and snacks has fueled demand for lightweight, protective packaging solutions. Additionally, the rise of e-commerce and home delivery services has prompted packaging innovations that prioritize material reduction and environmental compliance. This trend is further accelerated by growing consumer awareness and government-led sustainability initiatives.

Leading companies in the Global Thin Wall Packaging Industry comprise ILIP S.r.l., Paccor GmbH, Amcor plc, Greiner Packaging International GmbH, and Berry Global Inc. Key players in the Global Thin Wall Packaging Market are investing heavily in sustainable innovation, strategic mergers, and regional expansion to enhance market presence. Companies are focusing on lightweight design technologies and adopting recyclable materials like bio-based polypropylene to align with green packaging mandates. Several have partnered with food and beverage brands to offer customized solutions that improve shelf appeal and extend freshness. Expanding production capacity in high-growth regions such as North America and Asia Pacific is a top priority, alongside adopting advanced injection molding machinery to improve speed and efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Surge in demand for convenience and ready-to-eat foods

- 3.7.1.2 Growth in sustainability and lightweighting initiatives

- 3.7.1.3 Rise of food delivery and QSR channels

- 3.7.1.4 Rapid urbanization in emerging economies

- 3.7.1.5 Increasing advancements in injection molding and in-mold labeling (IML)

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Stringent environmental regulations on plastic use

- 3.7.2.2 Limited barrier properties for perishable goods

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Cups

- 5.3 Tubs

- 5.4 Trays

- 5.5 Jars

- 5.6 Lids

- 5.7 Other containers

Chapter 6 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Polypropylene (PP)

- 6.3 Polyethylene (PE)

- 6.3.1 High-density polyethylene (HDPE)

- 6.3.2 Low-density polyethylene (LDPE)

- 6.4 Polystyrene (PS)

- 6.5 Polyethylene terephthalate (PET)

- 6.6 Polyvinyl chloride (PVC)

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Production Process, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Thermoforming

- 7.3 Injection molding

- 7.4 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Food

- 8.2.1 Dairy products

- 8.2.2 Ready-to-eat meals

- 8.2.3 Bakery & confectionery

- 8.2.4 Meat, poultry & seafood

- 8.3 Beverages

- 8.4 Personal care & cosmetics

- 8.5 Household products

- 8.6 Electrical & electronics

- 8.7 Pharmaceuticals & nutraceuticals

- 8.8 Industrial

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ALPLA Group

- 10.2 Akshar Plastic

- 10.3 Amcor Plc

- 10.4 Berry Global Inc.

- 10.5 Borouge

- 10.6 Chemco Plast

- 10.7 Cosmo Films

- 10.8 Double H Plastics

- 10.9 EVCO Plastics

- 10.10 Greiner Packaging International GmbH

- 10.11 ILIP S.r.l.

- 10.12 IPL Plastics Inc.

- 10.13 Mold-Masters

- 10.14 Paccor

- 10.15 Prabhoti Plastic Industries

- 10.16 SABIC

- 10.17 SP International Industries Pvt. Ltd.