|

시장보고서

상품코드

1750320

알루미늄 포일 시장 : 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Aluminum Foil Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

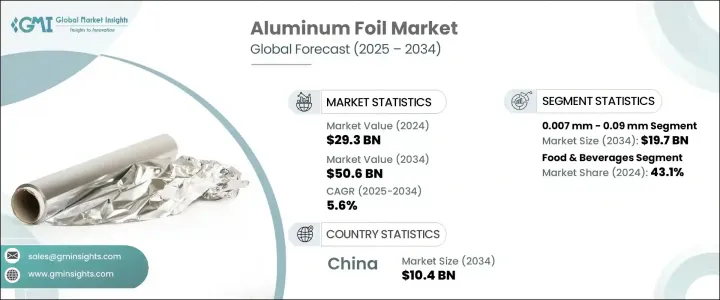

세계의 알루미늄 포일 시장은 2024년에는 293억 달러로 평가되었고, CAGR 5.6%로 성장할 전망이며, 2034년에는 506억 달러에 이를 것으로 추정되고 있습니다.

이 성장의 주요 요인은 식품 및 의약품의 포장 부문에서 수요 증가, 산업용 단열 포장 및 자동차용 차열재에 대한 용도 증가입니다. 알루미늄 포일은 경량성, 강력한 배리어성, 재활용성으로 알려져 있기 때문에 특히 지속가능한 재료에 대한 관심이 세계적으로 높아짐에 따라 최신 포장 솔루션의 중요한 재료가 되고 있습니다. 개발도상국에서는 포장 식품의 소비 급증이 시장 확대에 더욱 기여하고 있으며, 제조업체 및 공급업체는 진화하는 포장 기준에 대응할 필요가 있습니다.

환경 규제와 포장 규제에 대한 대응, 편리하고 사용하기 쉬운 제품에 대한 소비자 기호, 포장 자재의 재활용 가능성에 대한 관심 증가 등 다양한 요인이 겹쳐 이 성장이 가속하고 있습니다. 특히 의약품 부문에서는 제품의 유통기한 및 오염방지에 관한 엄격한 요건이 있기 때문에 알루미늄 호일이 중요한 역할을 하고 있습니다. 이러한 배경으로부터, 포일 라미네이트의 수요는 높아질 것으로 예상됩니다. 또한 기술의 진보가 새로운 시장 기회를 이끌어 내고 있습니다. 예를 들어 활성과 생분해성 포일 솔루션, 나노 라미네이트 제품, 포일 기반 복합재료 등이며, 이들 모두 더 높은 성능과 지속가능성의 이점을 기재하고 있습니다. 한편, 건축이나 자동차등의 산업에서는, 보다 경량으로 에너지 효율이 높은 재료로의 전환이 진행되고 있어, 포장 이외의 알루미늄박의 용도가 한층 더 퍼지고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 293억 달러 |

| 예측 금액 | 506억 달러 |

| CAGR | 5.6% |

녹색 에너지를 이용한 제련과 재활용 능력 등, 보다 깨끗한 생산 공정에 초점을 맞춘 투자도 환경 부하 저감에 기여하고 있습니다. 이러한 노력은 밸류체인을 재구성하고 알루미늄 포일 제조 산업의 전반적인 지속가능성을 높일 것으로 예측됩니다. 각국이 생산 설비를 현대화하고 친환경 운영으로 전환함에 따라 장기적인 이익이 이 부문의 성장을 계속 지원할 것으로 예측됩니다.

알루미늄 포일 시장을 두께별로 분류하면 0.007mm-0.09mm, 0.09mm-0.2mm, 0.2mm-0.4mm, 기타 등의 카테고리가 있습니다. 이 중 0.007mm-0.09mm 부문이 최대의 수익 점유율을 차지하고, 2024년에는 113억 달러를 창출합니다. 이 부문은 CAGR 5.8%로 성장할 전망이며, 2034년에는 197억 달러에 이를 것으로 예측됩니다. 그 이점은 식품 포장, 의약품, 가정용 랩, 산업용 단열재 등 다양한 용도에 적응할 수 있기 때문입니다. 비용 효과, 장벽 강도 및 유연성의 균형은 소비자 요구와 상업 요구 모두에게 선호되는 선택입니다. 특히, 습기, 산소, 빛으로부터 내용물을 차단하는 능력이 높게 평가되고 있어 일회용의 상품이나 리사이클 가능한 포맷에 최적입니다.

최종 이용 산업의 관점에서 시장은 식품, 의약품, 퍼스널케어, 화장품, 가정용, 산업용, 기타로 분류됩니다. 식음료 부문은 2024년에 가장 큰 점유율을 차지하고 세계 시장 수익의 43.1%를 차지했습니다. 이 부문에서 포일의 광범위한 사용은 습기, 빛, 공기 등의 외부 요소로부터의 효과적인 보호가 원동력이 되고 있습니다. 포일은 저장 기간을 연장하여 제품의 신선도를 유지하고 안전성을 확보하는 데 도움이 됩니다. 포일은 연질 파우치, 뚜껑, 용기, 라미네이트 랩 등 다양한 소모품에 폭넓게 사용됩니다.

지역별로 중국 시장은 2024년 59억 달러의 매출을 기록하였고, CAGR 5.8%를 기록할 전망이며, 2034년에는 104억 달러에 달할 것으로 예측되고 있습니다. 중국은 계속해서 세계의 생산량을 독점하고 있어 2025년까지 세계의 알루미늄 포일 생산량의 약 60%를 차지할 것으로 추정됩니다. 국내 생산 수준도 소비 확대에 대한 광범위한 동향을 반영하여 큰 폭의 성장세를 나타내고 있습니다. 과잉 생산 능력과 환경 문제 등의 과제에 대응하기 위해 국내는 1차 제련 사업의 확대에서 방향을 틀어 보다 환경 친화적인 대안으로 이행하고 있습니다. 여기에는 신재생 에너지의 이용이나 재활용 능력의 강화가 포함되어 2027년까지 연간 1,500만 톤 이상의 알루미늄을 재활용하는 것을 목표로 하고 있습니다.

세계 알루미늄 포일 산업은 2024년 시점에서 주요 기업 5개사가 총 40% 이상 시장 점유율을 차지하고 완만한 통합이 계속되고 있습니다. 많은 기업들은 헬스케어, 단열재, 일렉트로닉스 등의 산업에서 높아지는 선진적 포일 타입의 수요에 대응하기 위해 신흥 시장에 주력하고 있습니다. 이 전략적 전환은, 생산량의 확대 뿐만이 아니라, 엠보스 가공, 다층화, 경도 향상등의 기능을 갖춘 프리미엄 포일 등, 제품 제공의 혁신도 중시하고 있습니다. 시장의 진화에 따라 경쟁 역학은 지속 가능성, 기술 혁신, 세계 무역의 조정에 의해 형성될 가능성이 높습니다.

목차

제1장 조사 방법 및 범위

제2장 주요 요약

제3장 산업 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 혁신

- 장래의 전망

- 제조업자

- 리셀러

- 트럼프 정권의 관세 영향 : 구조화된 개요

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 산업에 미치는 영향

- 공급측의 영향(원료)

- 주요 원료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에 대한 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원료)

- 영향을 받는 주요 기업

- 전략적인 산업 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 시책관여

- 전망 및 향후 검토 사항

- 무역에 미치는 영향

- 공급자의 상황

- 이익률 분석

- 주요 뉴스 및 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 원료 가격의 변동

- 대체 포장재와의 경쟁

- 환경 문제

- 알루미늄 침출과 관련된 건강 문제

- 산업의 잠재적 리스크 및 과제

- 원료 가격의 변동

- 대체 포장재와의 경쟁

- 환경 문제

- 알루미늄 침출과 관련된 건강 문제

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

- 밸류체인 분석

- 원료 공급업체

- 알루미늄 포일 제조업체

- 컨버터 및 프로세서

- 리셀러

- 최종 용도

- 가격 분석

- 비용 구조 분석

- 가격 동향 분석

- 가격 예측

- 기술

- 제조 공정 개요

- 주조

- 열간 압연

- 냉간 압연

- 어닐링

- 마무리 및 슬릿

- 기술적 진보

- 알루미늄 포일 생산의 자동화

- 품질 관리 기술

- 제조 공정 개요

- 규제 프레임워크

- 식품 접촉 재료 규제

- FDA 규제(미국)

- EU 규정

- 기타 중동 및 아프리카 규제

- 환경규제

- 무역 시책 및 관세

- 규제가 시장 성장에 미치는 영향

제4장 경쟁 구도

- 서문

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추정 및 예측 : 두께별(2021-2034년)

- 주요 동향

- 0.007mm-0.09mm

- 0.09mm-0.2mm

- 0.2mm-0.4mm

- 기타

제6장 시장 추정 및 예측 : 포일 유형별(2021-2034년)

- 주요 동향

- 인쇄 알루미늄 포일

- 비인쇄 알루미늄 포일

- 라미네이트 가공 알루미늄 포일

- 안감 첨부 알루미늄 포일

- 기타

제7장 시장 추정 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 가방 및 파우치

- 랩 및 롤

- 물집

- 뚜껑

- 라미네이트 튜브

- 트레이

- 기타

제8장 시장 추정 및 예측 : 최종 이용 산업별(2021-2034년)

- 주요 동향

- 음식

- 베이커리 및 과자류

- 레이디 트윗 밀

- 유제품

- 음료

- 기타

- 의약품

- 물집 포장

- 스트립 포장

- 기타

- 퍼스널케어 및 화장품

- 가정용

- 산업용

- 단열

- 전기용도

- 기타

- 기타

제9장 시장 추정 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 기타 라틴아메리카

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

제10장 기업 프로파일

- Alcoa Corporation

- Aleris Corporation

- Alufoil Products

- Amco India

- Amcor

- Assan Aluminyum

- China Hongqiao Group

- Constellium

- Ess Dee Aluminium

- Eurofoil

- Hindalco Industries

- Huawei Aluminum

- Norsk Hydro

- Novelis

- Reynolds Consumer Products

- Symetal Aluminium Foil Industry

- UACJ Corporation

- United Company RUSAL

- Xiamen Xiashun Aluminium Foil

- Zhejiang Junma Aluminium Industry

The Global Aluminum Foil Market was valued at USD 29.3 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 50.6 billion by 2034. This growth is primarily fueled by rising demand across the food and pharmaceutical packaging sectors, as well as increasing applications in industrial insulation and automotive thermal shielding. As aluminum foil is known for its lightweight nature, strong barrier properties, and recyclability, it has become a key material in modern packaging solutions, especially as the focus on sustainable materials gains momentum worldwide. In developing nations, the surge in consumption of packaged foods is further contributing to market expansion, pushing manufacturers and suppliers to meet evolving packaging standards.

A combination of factors is accelerating this growth, including compliance with environmental and packaging regulations, consumer preference for convenient and easy-to-use products, and growing attention to the recyclability of packaging materials. Particularly in the pharmaceutical space, aluminum foil plays a vital role due to strict requirements surrounding product shelf life and contamination prevention. The demand for foil laminates is expected to climb in this context. Additionally, technological advancements are unlocking new market opportunities, such as active and biodegradable foil solutions, nano-laminated products, and foil-based composites, all of which offer greater performance and sustainability benefits. Meanwhile, industries such as construction and automotive are turning to lighter, more energy-efficient materials, further widening the use of aluminum foil beyond packaging.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.3 Billion |

| Forecast Value | $50.6 Billion |

| CAGR | 5.6% |

Investments focused on cleaner production processes, such as green energy-powered smelting and recycling capabilities, are also contributing to reduced environmental impact. These efforts are likely to reshape the value chain, enhancing the overall sustainability of aluminum foil manufacturing. As countries modernize production facilities and shift toward eco-conscious operations, the long-term benefits will continue to support growth in the sector.

When segmented by thickness, the aluminum foil market includes categories such as 0.007 mm - 0.09 mm, 0.09 mm - 0.2 mm, 0.2 mm - 0.4 mm, and others. Among these, the 0.007 mm - 0.09 mm segment accounted for the largest revenue share, generating USD 11.3 billion in 2024. This segment is forecast to reach USD 19.7 billion by 2034, growing at a CAGR of 5.8%. Its dominance is attributed to its adaptability across various applications, including food packaging, pharmaceutical products, household wraps, and industrial insulation. The balance of cost-effectiveness, barrier strength, and flexibility makes it a preferred choice for both consumer and commercial needs. It is especially valued for its ability to shield contents from moisture, oxygen, and light, making it ideal for single-use items and recyclable formats.

In terms of end-use industries, the market is categorized into food and beverages, pharmaceuticals, personal care and cosmetics, household, industrial, and others. The food and beverages segment held the largest share in 2024, accounting for 43.1% of global market revenue. The widespread use of foil in this sector is driven by its effective protection against external elements such as moisture, light, and air. It helps extend shelf life, maintain product freshness, and ensure safety-key requirements in the packaged food industry. Foil finds extensive use in flexible pouches, lids, containers, and laminated wraps, serving a variety of consumable products.

Regionally, the market in China recorded a revenue of USD 5.9 billion in 2024 and is projected to reach USD 10.4 billion by 2034, registering a CAGR of 5.8%. China continues to dominate global production, accounting for roughly 60% of the world's aluminum foil output by 2025. Domestic production levels have also witnessed significant growth, reflecting a broader trend toward increased consumption. In response to challenges like overcapacity and environmental concerns, the country is steering away from expanding primary smelting operations and moving toward greener alternatives. These include utilizing renewable energy sources and enhancing recycling capabilities, with a targeted goal to recycle over 15 million tons of aluminum annually by 2027.

The global aluminum foil industry remains moderately consolidated, with five leading companies collectively holding over 40% market share as of 2024. Many businesses are focusing on emerging markets to meet the growing demand for advanced foil types across industries like healthcare, insulation, and electronics. This strategic shift emphasizes not just expansion in output but also innovation in product offerings, including premium foils with features like embossing, multi-layering, and increased hardness. As the market evolves, competitive dynamics are likely to be shaped by sustainability, technological innovation, and global trade alignment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact of trump administration tariffs - structured overview

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Fluctuating raw material prices

- 3.7.1.2 Competition from alternative packaging materials

- 3.7.1.3 Environmental concerns

- 3.7.1.4 Health concerns related to aluminum leaching

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Fluctuating raw material prices

- 3.7.2.2 Competition from alternative packaging materials

- 3.7.2.3 Environmental concerns

- 3.7.2.4 Health concerns related to aluminum leaching

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Value chain analysis

- 3.11.1 Raw material suppliers

- 3.11.2 Aluminum foil manufacturers

- 3.11.3 Converters & processors

- 3.11.4 Distributors

- 3.11.5 End use

- 3.12 Pricing analysis

- 3.12.1 Cost structure analysis

- 3.12.2 Price trends analysis

- 3.12.3 Price forecast

- 3.13 Technology landscape

- 3.13.1 Manufacturing process overview

- 3.13.1.1 Casting

- 3.13.1.2 Hot rolling

- 3.13.1.3 Cold rolling

- 3.13.1.4 Annealing

- 3.13.1.5 Finishing & slitting

- 3.13.2 Technological advancements

- 3.13.3 Automation in aluminum foil production

- 3.13.4 Quality control technologies

- 3.13.1 Manufacturing process overview

- 3.14 Regulatory framework

- 3.14.1 Food contact materials regulations

- 3.14.2 Fda regulations (us)

- 3.14.3 Eu regulations

- 3.14.4 Other regional regulations

- 3.15 Environmental regulations

- 3.15.1 Trade policies & tariffs

- 3.15.2 Impact of regulations on market growth

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Thickness, 2021 - 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 0.007 mm - 0.09 mm

- 5.3 0.09 mm - 0.2 mm

- 5.4 0.2 mm - 0.4 mm

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Foil Type, 2021 - 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Printed aluminum foil

- 6.3 Unprinted aluminum foil

- 6.4 Laminated aluminum foil

- 6.5 Backed aluminum foil

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Bags & pouches

- 7.3 Wraps & rolls

- 7.4 Blisters

- 7.5 Lids

- 7.6 Laminated tubes

- 7.7 Trays

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.1.1 Food & beverages

- 8.1.2 Bakery & confectionery

- 8.1.3 Ready-to-eat meals

- 8.1.4 Dairy products

- 8.1.5 Beverages

- 8.1.6 Others

- 8.2 Pharmaceuticals

- 8.2.1 Blister packaging

- 8.2.2 Strip packaging

- 8.2.3 Others

- 8.3 Personal care & cosmetics

- 8.4 Household

- 8.5 Industrial

- 8.5.1 Heat insulation

- 8.5.2 Electrical applications

- 8.5.3 Others

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of MEA

Chapter 10 Company Profiles

- 10.1 Alcoa Corporation

- 10.2 Aleris Corporation

- 10.3 Alufoil Products

- 10.4 Amco India

- 10.5 Amcor

- 10.6 Assan Aluminyum

- 10.7 China Hongqiao Group

- 10.8 Constellium

- 10.9 Ess Dee Aluminium

- 10.10 Eurofoil

- 10.11 Hindalco Industries

- 10.12 Huawei Aluminum

- 10.13 Norsk Hydro

- 10.14 Novelis

- 10.15 Reynolds Consumer Products

- 10.16 Symetal Aluminium Foil Industry

- 10.17 UACJ Corporation

- 10.18 United Company RUSAL

- 10.19 Xiamen Xiashun Aluminium Foil

- 10.20 Zhejiang Junma Aluminium Industry