|

시장보고서

상품코드

1750415

오프 하이웨이 EV 구성 요소 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Off-highway EV Component Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

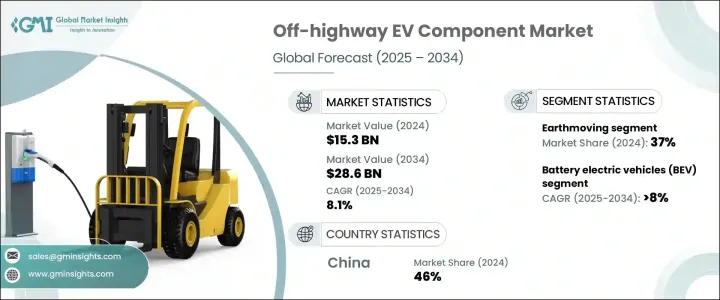

세계의 오프 하이웨이 EV 구성 요소 시장은 2024년에는 153억 달러로 평가되었고, CAGR 8.1%를 나타내 2034년에는 286억 달러에 이를 것으로 예측됩니다.

산업계가 기존의 내연엔진을 대체하는 보다 깨끗한 옵션을 우선하는 가운데, 배출가스의 삭감, 연료소비의 저감, 유지보수 비용의 최소화를 실현하는 전동식 기기가 지지를 모으고 있습니다. 규제의 의무화, 배출 가스 규제법, 환경 의식 증가가 상대방 상표 제품 제조업체에 전동 솔루션에 대한 투자를 촉구하고 있습니다. 게다가 정부와 민간 부문은 스마트 인프라와 그린 개발에 많은 투자를 하고 있으며, 오프 하이웨이 EV 구성 요소에 대한 수요를 더욱 높이고 있습니다.

로더, 도저, 크레인과 같은 전동 장비의 채택은 대규모 도시 개발 및 인프라 프로젝트의 환경 발자국를 줄이는 데 필수적입니다. 전동화뿐만 아니라 예측 진단, 플릿 연결, 스마트 텔레매틱스와 같은 디지털 기술의 통합은 오프 하이웨이 분야의 작업 효율을 재정의합니다. 이러한 진보는 가혹하고 고부하 환경을 위해 조정된 고도로 전문화된 전자 부품에 대한 수요에 박차를 가하고 있습니다. 원격 모니터링 및 실시간 데이터 기능을 갖춘 장비는 더 나은 가동 시간과 수명 주기 비용 관리를 지원하여 함대 운영자가 현장 작업의 성능을 최적화하는 데 도움이 됩니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 153억 달러 |

| 예측 금액 | 286억 달러 |

| CAGR | 8.1% |

다양한 프로젝트 현장에서의 전동 굴삭기, 로더 및 유사한 장비의 높은 사용률로 견인되었으며, 용도 카테고리 중에서 토목 분야가 2024년에 37%의 점유율을 차지하고, 최대 점유율을 획득했습니다. 지역에서 운영할 필요성이 증가함에 따라 전동화에 적합합니다. OEM과 시스템 공급업체는 공공 및 민간 프로젝트 모두에서 증가하는 수요를 충족시키기 위해 차세대 배터리 팩, 전기 드라이브 트레인 및 냉각 시스템을 지원합니다.

2024년 오프 하이웨이 EV 구성 요소 시장에서는 배터리 전기자동차(BEV)가 66%의 점유율을 차지하며, 가장 큰 비율을 차지했습니다. 터널, 밀집된 도시의 작업 현장, 실내 농업 시설 등 폐쇄적 또는 제한된 환경에의 적합성은 그 유용성을 한층 더 높입니다.

중국의 오프 하이웨이 EV 구성 요소 시장 점유율은 46%를 나타낼 것으로 2024년에는 32억 5,000만 달러를 창출했습니다. 엔지니어링 기술에서 첨단 제조 능력을 갖춘 중국은 고성능 EV 구성 요소를 대규모로 공급하고 있습니다.

시장 포지션을 강화하기 위해 Tata Elxsi, Volvo AB, Komatsu, Liebherr, and Deere & Company 등의 기업은 수직 통합과 장기적인 제휴에 주력하고 있습니다. 차세대 배터리 시스템, 파워 일렉트로닉스, 디지털 플랫폼에의 전략적 투자에 의해 이러한 기업은 전동화의 동향을 리드할 수 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 원재료 공급자

- Tier 1 자동차 부품 공급업체

- 오프 하이웨이 시스템에 특화된 인티 그레이터

- 오프 하이웨이 차량 OEM

- 기술 공급자

- 이익률 분석

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 타국에 의한 보복조치

- 업계에 미치는 영향

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 기술과 혁신의 상황

- 가격 동향

- 지역

- 성분

- 코스트 내역 분석

- 특허 분석

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 세계의 각국 정부는 온실가스 배출을 억제하기 위해 점점 엄격한 규제를 실시하고 있습니다.

- 건설, 광업, 농업기계의 전동화

- 배터리와 모터 기술의 발전

- 스마트 시티, 광업 자동화, 기계화 농업에 대한 투자 증가

- OEM과 Tier 1 공급업체의 협업

- 업계의 잠재적 위험 및 과제

- 높은 초기 구입 비용

- 배터리 기술의 한계

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계·예측 : 구성 요소별(2021-2034년)

- 주요 동향

- 배터리 팩

- 전기 모터

- 컨트롤러

- 인버터

- 파워 일렉트로닉스

- 열 관리 시스템

- 차재 충전기

- 전동 파워 스티어링 시스템

- 기타

제6장 시장 추계·예측 : 추진력별(2021-2034년)

- 주요 동향

- 배터리 전기자동차(BEV)

- 플러그인 하이브리드 전기자동차(PHEV)

- 하이브리드 전기자동차(HEV)

- 연료전지 전기자동차(FCEV)

제7장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 동향

- 자재관리

- 토목 공사

- 수확

- 운송 및 운반

- 굴착 및 발파

제8장 시장 추계·예측 : 차량별(2021-2034년)

- 주요 동향

- 전기 건설 차량

- 굴삭기

- 불도저

- 로더

- 전기 농업용 차량

- 트랙터

- 수확기

- 분무기

- 전기 광산 차량

- 운반 트럭

- 드릴

- 기타

제9장 시장 추계·예측 : 판매 채널별(2021-2034년)

- 주요 동향

- OEM

- 애프터마켓

제10장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주 및 뉴질랜드

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

제11장 기업 프로파일

- Bell Equipment

- Caterpillar

- CNH Industrial

- Dana

- Deere &Company

- 두산

- Epiroc

- Hitachi Construction Machinery

- JCB

- Komatsu

- Kubota

- Liebherr

- Manitou Group

- Sandvik

- Sona Comstar

- Sumitomo Heavy Industries

- Tata AutoComp

- Tata Elxsi

- Terex

- Volvo AB

The Global Off-highway EV Component Market was valued at USD 15.3 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 28.6 billion by 2034, fueled by the accelerating transition toward electrified construction, mining, and agricultural machinery. As industries prioritize cleaner alternatives to traditional combustion engines, electric-powered equipment is gaining traction for reduced emissions, lower fuel consumption, and minimized maintenance costs. Regulatory mandates, emission control laws, and rising environmental awareness are pressuring original equipment manufacturers to invest in electric solutions. Additionally, governments and private sectors are investing heavily in smart infrastructure and green development, further increasing the demand for off-highway EV components.

The adoption of electric equipment such as loaders, dozers, and cranes is essential in reducing the environmental footprint of major urban development and infrastructure projects. Beyond electrification, the integration of digital technologies-such as predictive diagnostics, fleet connectivity, and smart telematics-is redefining operational efficiency in off-highway segments. These advancements fuel demand for highly specialized electronic components tailored for rugged, high-duty environments. Equipment with remote monitoring and real-time data capabilities supports better uptime and lifecycle cost control, helping fleet operators optimize performance in field operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.3 Billion |

| Forecast Value | $28.6 Billion |

| CAGR | 8.1% |

Among application categories, the earthmoving segment captured the largest share in 2024, accounting for 37% share, driven by the high usage of electric excavators, loaders, and similar equipment across diverse project sites. Earthmoving machinery is well-suited for electrification, given its consistent usage patterns and the increasing need to operate in emission-regulated zones. OEMs and system suppliers are responding with next-gen battery packs, electric drivetrains, and cooling systems to meet growing demand in both public and private projects.

In 2024, battery electric vehicles (BEVs) captured the largest portion in the off-highway EV component market, making up 66% share, driven by their ability to operate without tailpipe emissions, a major advantage in today's push for greener construction and mining operations. BEVs also offer operational efficiency and long-term cost benefits, thanks to lower fuel consumption, reduced mechanical complexity, and minimal maintenance requirements. Their compatibility with closed or restricted environments, such as tunnels, dense urban job sites, and indoor agriculture facilities, further enhances their utility. The quiet operation of BEVs also makes them increasingly favored in noise-regulated environments, supporting broader adoption across multiple off-highway sectors.

China Off-highway EV Component Market held 46% share and generated USD 3.25 billion in 2024, underpinned by consistent support from national policies aimed at reducing industrial emissions and improving equipment efficiency. With advanced manufacturing capabilities, especially in battery production and electric powertrain technologies, China supplies high-performance EV components at scale. The nation's comprehensive EV infrastructure, combined with widespread deployment across agriculture, mining, and construction sectors, continues to reinforce its leadership and accelerate the region's overall market expansion.

To reinforce their market positions, companies such as Tata Elxsi, Volvo AB, Komatsu, Liebherr, and Deere & Company are focusing on vertical integration and long-term collaborations. Strategic investments in next-gen battery systems, power electronics, and digital platforms enable these firms to lead electrification trends. Partnerships with tech providers and co-development of customized solutions allow these players to cater to sector-specific needs while maintaining cost competitiveness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Tier 1 automotive suppliers

- 3.2.3 Specialized off-highway system integrators

- 3.2.4 Off-highway vehicle OEM

- 3.2.5 Technology providers

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Price trends

- 3.6.1 Region

- 3.6.2 Component

- 3.7 Cost breakdown analysis

- 3.8 Patent analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Governments worldwide are implementing increasingly strict regulations to curb greenhouse gas emissions

- 3.11.1.2 Electrification of construction, mining & agriculture equipment

- 3.11.1.3 Advancements in battery & motor technologies

- 3.11.1.4 Increased investments in smart cities, mining automation, and mechanized agriculture

- 3.11.1.5 OEM & tier-1 supplier collaborations

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial purchase cost

- 3.11.2.2 Battery technology limitations

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Battery packs

- 5.3 Electric motors

- 5.4 Controllers

- 5.5 Inverters

- 5.6 Power electronics

- 5.7 Thermal management systems

- 5.8 Onboard chargers

- 5.9 Electric power steering systems

- 5.10 Others

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Battery electric vehicles (BEV)

- 6.3 Plug-in hybrid electric vehicles (PHEV)

- 6.4 Hybrid electric vehicles (HEV)

- 6.5 Fuel cell electric vehicles (FCEV)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Material handling

- 7.3 Earthmoving

- 7.4 Harvesting

- 7.5 Transport & hauling

- 7.6 Drilling & blasting

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Electric construction vehicles

- 8.2.1 Excavators

- 8.2.2 Bulldozers

- 8.2.3 Loaders

- 8.3 Electric agricultural vehicles

- 8.3.1 Tractors

- 8.3.2 Harvesters

- 8.3.3 Sprayers

- 8.4 Electric mining vehicles

- 8.4.1 Haul trucks

- 8.4.2 Drills

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Original Equipment Manufacturers (OEM)

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Bell Equipment

- 11.2 Caterpillar

- 11.3 CNH Industrial

- 11.4 Dana

- 11.5 Deere & Company

- 11.6 Doosan

- 11.7 Epiroc

- 11.8 Hitachi Construction Machinery

- 11.9 JCB

- 11.10 Komatsu

- 11.11 Kubota

- 11.12 Liebherr

- 11.13 Manitou Group

- 11.14 Sandvik

- 11.15 Sona Comstar

- 11.16 Sumitomo Heavy Industries

- 11.17 Tata AutoComp

- 11.18 Tata Elxsi

- 11.19 Terex

- 11.20 Volvo AB