|

시장보고서

상품코드

1750431

비스킷 및 크래커 시장 : 기회 및 촉진요인, 산업 동향 분석, 예측(2025-2034년)Biscuits and Crackers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

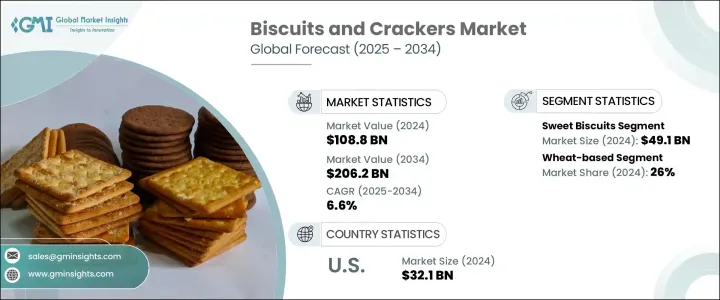

세계의 비스킷과 크래커 시장은 2024년 1,088억 달러로, 소비자의 페이스의 빠른 라이프 스타일에 맞춘 편리하고 운반 가능한 스낵 옵션에의 기호의 높음에 추진되어, CAGR 6.6%로 성장하여 2034년에는 2,062억 달러에 달한다.

도시화와 포장 식품에 대한 접근성 향상은 특히 신흥국 시장 수요를 더욱 높여줍니다. 구미의 식습관에 접할 기회가 늘어나, 도시의 인구가 증가하고 있는 것이 소비 동향을 가속시키고 있습니다. 건강 지향의 향상과 기능적이고 몸에 좋은 간식 과자로의 전환도 제품 개발의 형태를 바꾸고 있습니다.

소비자는 낮은 탄수화물, 고단백질, 글루텐 프리, 식물성 등 특정식이 요건에 부합하는 선택을 요구하고 있으며, 각 브랜드는 보다 깨끗한 표시와 영양이 풍부한 원료를 사용한 혁신을 추진하고 있습니다. 이 건강 지향의 동향은 기존의 스낵 과자에 슈퍼 푸드, 프로바이오틱스, 천연 감미료 등을 도입하도록 촉구하여 스낵 과자의 매력을 높이고 있습니다. 또한 디지털 상거래의 급증으로 인해 이러한 제품은 세계의 광범위한 소비자층에게 더욱 친숙해지고 있습니다. 온라인 플랫폼은 제품에 대한 도달범위를 넓힐 뿐만 아니라 개인화된 추천 및 정기 구매 모델을 제공함으로써 제조업체가 소비자와 직접 관련되어 다양한 계층의 브랜드 충성도를 구축할 수 있게 합니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 1,088억 달러 |

| 예측 금액 | 2,062억 달러 |

| CAGR | 6.6% |

제품의 다양화가 계속 시장을 형성하고 있으며, 스위트 비스킷 부문은 2024년에 491억 달러를 창출합니다. 한편, 향기로운 크래커는 건강 지향 소비자가 대체품을 요구하고 있기 때문에 특히 글루텐 프리와 단백질 강화 옵션으로 주목도가 높아지고 있습니다.

밀 기반 비스킷과 크래커는 2024년에 285억 달러 시장 가치를 확보했으며, 26%의 점유율을 차지하고 있습니다. 중립적인 맛과 안정적인 소성 특성을 지원하고 단맛을 지원합니다.

미국 비스킷과 크래커 2024년 시장 규모는 321억 달러로 2034년까지 연평균 복합 성장률(CAGR) 6.9%로 성장할 전망입니다. 이 나라는 가처분 소득의 높이, 스낵 문화의 정착, 소매점의 보급을 배경으로, 여전히 세계 최대이고 가장 성숙한 스낵 시장의 하나입니다. 수요는 소비자의 건강 지향과 일치하여 견인력을 늘리고 있습니다.

업계의 주요 기업으로는 Glupo Binbo, Nessle SA, Monderys International, British Industrial Limited, Kellogg Company 등이 있습니다. 소매업체와의 제휴와 같은 중점 전략을 통해, 시장에서의 지위를 강화하고 있습니다. 새로운 웰니스 동향을 도입해, 지역의 기호에 맞추어 제품을 커스터마이즈 하는 것으로, 세계의 소비자의 다이나믹한 요구에 부응하면서, 브랜드 로얄티를 높이는 것을 목표로 하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 시장 소개

- 업계 밸류체인 분석

- 제품 개요

- 비스킷과 크래커의 제조 공정

- 성분의 기능성

- 보존 기간 기술

- 풍미 개발 기술

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 공급측의 영향(원재료)

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 무역 통계(HS코드)

- 주요 수출국, 2021-2024

- 주요 수입국, 2021-2024

참고: 위의 무역 통계는 주요 국가에 대해서만 제공됩니다.

- 공급자의 상황

- 이익률 분석

- 주요 뉴스와 대처

- 규제 상황

- 식품안전규제

- 라벨 요건

- 오가닉 및 내츄럴 제품 인증

- 영양 강조 표시 규제

- 알레르기 표시 요건

- 영향요인

- 성장 촉진요인

- 도시의 소매 채널에서는 소분한 운반용의 비스킷 팩 수요가 높아지고 있습니다.

- 글루텐 프리, 고섬유, 고단백질 비스킷 제품에 대한 소비자의 관심이 높아지고 있습니다.

- 신흥 경제 국가에서 조직화 된 소매 및 전자상거래 플랫폼 확대

- 성인 소비자를 타겟으로 한 고급스럽고 호화스러운 비스킷의 각종 제품 혁신

- 업계의 잠재적 위험 및 과제

- 원재료 가격, 특히 밀, 설탕, 식용유의 가격 변동

- 구운 과자 제품에 포함되는 당분과 트랜스 지방산에 관한 규제 압력

- 성장 촉진요인

- 제조 공정 분석

- 원단 준비 방법

- 성형 및 절단 기술

- 베이킹 기술

- 냉각 및 포장 공정

- 원재료 분석 및 조달 전략

- 가격 분석

- 지속가능성과 환경영향 평가

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 시장 점유율 분석

- 전략적 틀

- 합병과 인수

- 합작투자와 콜라보레이션

- 신제품 개발

- 확대 전략

- 경쟁 벤치마킹

- 벤더 상황

- 경쟁 포지셔닝 매트릭스

- 전략적 대시보드

- 브랜드 포지셔닝과 소비자 인식 분석

- 신규 참가자를 위한 시장 진출 전략

- 비공개 라벨 분석 및 전략

제5장 시장 추계 및 예측 : 제품 유형별, 2021-2034년

- 주요 동향

- 달콤한 비스킷

- 쿠키

- 크림이 들어간 비스킷

- 초콜릿 코팅 비스킷

- 쇼트 브레드

- 웨이퍼

- 기타 달콤한 비스킷

- 풍미 풍부한 비스킷과 크래커

- 일반 크래커

- 맛 크래커

- 치즈 크래커

- 짠맛 크래커

- 크리스프 브레드

- 기타 풍미 풍부한 비스킷과 크래커

- 소화 비스킷

- 일반 다이제스티브

- 초콜릿 코팅된 다이제스티브

- 기타 소화제

- 건강 및 웰빙 비스킷

- 고섬유 비스킷

- 저당 및 무당 비스킷

- 저지방 비스킷

- 단백질 강화 비스킷

- 기능성 비스킷

- 샌드위치 비스킷

- 조식용 비스킷

- 장인 수제 특제 비스킷

- 기타 제품 유형

제6장 시장 추계 및 예측 : 식재별, 2021-2034년

- 주요 동향

- 밀베이스

- 정제 밀가루

- 전립 밀가루

- 글루텐 프리

- 쌀가루 베이스

- 콘플라워 베이스

- 아몬드 분말베이스

- 기타 글루텐 프리 밀가루

- 멀티 그레인

- 귀리 베이스

- 호밀 베이스

- 유기농 원료

- 비유전자 재조합 원료

- 기타 성분의 유형

제7장 시장 추계 및 예측 : 포장 형태별, 2021-2034년

- 주요 동향

- 경질 포장

- 골판지 상자

- 플라스틱 용기

- 금속캔

- 기타 경질 포장

- 연포장

- 플라스틱 파우치

- 플로랩

- 종이 가방

- 기타 연포장

- 트레이 및 클램쉘

- 멀티팩 형식

- 싱글 서브 포장

- 지속 가능한 포장 솔루션

- 생분해성 포장

- 재활용 가능한 포장

- 퇴비화 가능한 포장

제8장 시장추계 및 예측 : 가격대별, 2021-2034년

- 주요 동향

- 경제

- 미드레인지

- 프리미엄

- 초고급 및 장인기

제9장 시장추계 및 예측 : 유통 채널별, 2021-2034년

- 주요 동향

- 슈퍼마켓 및 하이퍼마켓

- 편의점

- 전문점

- 온라인 소매

- 푸드서비스

- 카페 및 레스토랑

- 호텔 및 케이터링

- 시설 내 케이터링

- 자동판매기

- 소비자 직접 판매

- 기타 유통 채널

제10장 시장추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 기타 라틴아메리카

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

제11장 기업 프로파일

- Arnott's Biscuits Limited

- Bahlsen GmbH &Co. KG

- Barilla G. e R. Fratelli SpA

- Britannia Industries Ltd.

- Burton's Biscuit Company

- Campbell Soup Company(Pepperidge Farm)

- Dare Foods Limited

- Fox's Biscuits(2 Sisters Food Group)

- General Mills, Inc.

- Grupo Bimbo

- ITC Limited

- Kellogg Company

- Keebler(Ferrero)

- Kind LLC

- Kashi Company(Kellogg)

- Lotus Bakeries

- Lotte Confectionery Co.,Ltd.

- Mary's Gone Crackers

- Meiji Holdings Co.,Ltd.

- Mondelez International, Inc.

- Nairn's Oatcakes Limited

- Nestle SA

- Orion Corporation

- Parle Products Pvt. Ltd.

- PepsiCo, Inc.(Frito-Lay)

- Ryvita Company Limited(ABF)

- Snyder's-Lance, Inc.(Campbell Soup Company)

- United Biscuits(pladis)

- Walkers Shortbread Ltd.

- Yildiz Holding(Ulker)

The Global Biscuits and Crackers Market was valued at USD 108.8 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 206.2 billion by 2034, fueled by consumers' rising preference for convenient and portable snack options that align with fast-paced lifestyles. Urbanization and evolving access to packaged food further push market demand, especially in developing regions. Increased exposure to Western eating habits and a rising urban population are accelerating consumption trends. A growing emphasis on health and wellness, paired with a shift toward functional and better-for-you snacks, is also reshaping product development.

Consumers seek options that align with specific dietary needs, such as low-sugar, high-protein, gluten-free, and plant-based formulations, pushing brands to innovate with cleaner labels and nutrient-rich ingredients. This health-conscious trend is also encouraging the incorporation of superfoods, probiotics, and natural sweeteners into traditional snack profiles to enhance their appeal. Additionally, the surge in digital commerce is making these products more accessible to a broader consumer base globally. Online platforms are not only expanding product reach but also offering personalized recommendations and subscription models, allowing manufacturers to engage directly with consumers and build brand loyalty across diverse demographics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $108.8 Billion |

| Forecast Value | $206.2 Billion |

| CAGR | 6.6% |

Product diversification continues to shape the market, with the sweet biscuits segment generating USD 49.1 billion in 2024. This segment remains dominant due to its widespread appeal and continuous innovation in flavor and texture, despite growing awareness around sugar intake. Meanwhile, savory crackers are witnessing increased attention, particularly gluten-free and protein-enriched options, as health-conscious consumers seek alternatives. These varieties cater to those prioritizing nutrition without sacrificing taste, creating opportunities for new launches.

Wheat-based biscuits and crackers secured USD 28.5 billion market value in 2024, holding a 26% share. Their dominance stems from wheat's cost-effectiveness, reliable global supply, and flexibility in formulation, which allows for seamless flavor adaptation. Manufacturers favor wheat for its neutral taste and consistent baking properties, which support sweet and savory applications. While demand for gluten-free and multi-grain offerings rises, wheat remains the staple base, especially in price-sensitive regions where affordability is critical.

U.S. Biscuits and Crackers Market generated USD 32.1 billion in 2024 and is set to grow at a 6.9% CAGR through 2034. The country remains one of the largest and most mature snack markets in the world, driven by high disposable income, an ingrained snacking culture, and widespread retail availability. Demand for plant-based, allergen-free, and low-carb biscuit options is also gaining traction, aligning with consumer focus on wellness. Private labels in grocery chains have further contributed to market value, providing quality offerings that complement premium brands without sacrificing affordability.

Key players in the industry include Grupo Bimbo, Nestle S.A., Mondelez International Inc., Britannia Industries Limited, and Kellogg Company. These companies are strengthening their market position through focused strategies such as portfolio diversification, investment in healthier product lines, regional expansion, and partnerships with digital retailers. By tapping into emerging wellness trends and customizing offerings for local tastes, they aim to boost brand loyalty while meeting the dynamic needs of global consumers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research methodology

- 1.3 Research scope & assumptions

- 1.4 List of data sources

- 1.5 Market estimation technique

- 1.6 Market segmentation & breakdown

- 1.7 Research limitations

Chapter 2 Executive Summary

- 2.1 Segment highlights

- 2.2 Competitive landscape snapshot

- 2.3 Regional market outlook

- 2.4 Key market trends

- 2.5 Future market outlook

Chapter 3 Industry Insights

- 3.1 Market introduction

- 3.2 Industry value chain analysis

- 3.3 Product overview

- 3.3.1 Biscuit & cracker manufacturing process

- 3.3.2 Ingredient functionality

- 3.3.3 Shelf-life technologies

- 3.3.4 Flavor development techniques

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Demand-side impact (selling price)

- 3.4.3.1 Price transmission to end markets

- 3.4.3.2 Market share dynamics

- 3.4.3.3 Consumer response patterns

- 3.4.4 Key companies impacted

- 3.4.5 Strategic industry responses

- 3.4.5.1 Supply chain reconfiguration

- 3.4.5.2 Pricing and product strategies

- 3.4.5.3 Policy engagement

- 3.4.6 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Trade statistics (HS code)

- 3.5.1 Major exporting countries, 2021-2024 (kilo tons)

- 3.5.2 Major importing countries, 2021-2024 (kilo tons)

Note: the above trade statistics will be provided for key countries only.

- 3.6 Supplier landscape

- 3.7 Profit margin analysis

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.9.1 Food safety regulations

- 3.9.2 Labeling requirements

- 3.9.3 Organic & natural product certifications

- 3.9.4 Nutritional claim regulations

- 3.9.5 Allergen labeling requirements

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising demand for portion-controlled and on-the-go biscuit packs in urban retail channels.

- 3.10.1.2 Increased consumer interest in gluten-free, high-fiber, and protein-enriched biscuit formulations.

- 3.10.1.3 Expansion of organized retail and e-commerce platforms in developing economies.

- 3.10.1.4 Product innovation in premium and indulgent biscuit varieties targeting adult consumers.

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Volatility in raw material prices, especially wheat, sugar, and edible oils.

- 3.10.2.2 Regulatory pressures around sugar content and trans fats in baked snack products.

- 3.10.1 Growth drivers

- 3.11 Manufacturing process analysis

- 3.11.1 Dough preparation methods

- 3.11.2 Forming & cutting techniques

- 3.11.3 Baking technologies

- 3.11.4 Cooling & packaging processes

- 3.12 Raw material analysis & procurement strategies

- 3.13 Pricing analysis

- 3.14 Sustainability & environmental impact assessment

- 3.15 Growth potential analysis

- 3.16 Porter's analysis

- 3.17 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Market Share Analysis

- 4.6 Strategic Framework

- 4.6.1 Mergers & Acquisitions

- 4.6.2 Joint Ventures & Collaborations

- 4.6.3 New Product Developments

- 4.6.4 Expansion Strategies

- 4.7 Competitive Benchmarking

- 4.8 Vendor Landscape

- 4.9 Competitive Positioning Matrix

- 4.10 Strategic Dashboard

- 4.11 Brand Positioning & Consumer Perception Analysis

- 4.12 Market Entry Strategies for New Players

- 4.13 Private Label Analysis & Strategies

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Sweet biscuits

- 5.2.1 Cookies

- 5.2.2 Cream-filled biscuits

- 5.2.3 Chocolate-coated biscuits

- 5.2.4 Shortbread

- 5.2.5 Wafers

- 5.2.6 Other sweet biscuits

- 5.3 Savory biscuits & crackers

- 5.3.1 Plain crackers

- 5.3.2 Flavored crackers

- 5.3.3 Cheese crackers

- 5.3.4 Saltines

- 5.3.5 Crispbreads

- 5.3.6 Other savory biscuits & crackers

- 5.4 Digestive biscuits

- 5.4.1 Plain digestives

- 5.4.2 Chocolate-coated digestives

- 5.4.3 Other digestives

- 5.5 Health & wellness biscuits

- 5.5.1 High-fiber biscuits

- 5.5.2 Low-sugar/sugar-free biscuits

- 5.5.3 Low-fat biscuits

- 5.5.4 Protein-enriched biscuits

- 5.5.5 Functional biscuits

- 5.6 Sandwich biscuits

- 5.7 Breakfast biscuits

- 5.8 Artisanal & specialty biscuits

- 5.9 Other product types

Chapter 6 Market Estimates & Forecast, By Ingredient Type, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Wheat-based

- 6.2.1 Refined wheat flour

- 6.2.2 Whole wheat flour

- 6.3 Gluten-free

- 6.3.1 Rice flour-based

- 6.3.2 Corn flour-based

- 6.3.3 Almond flour-based

- 6.3.4 Other gluten-free flours

- 6.4 Multi-grain

- 6.5 Oat-based

- 6.6 Rye-based

- 6.7 Organic ingredients

- 6.8 Non-GMO ingredients

- 6.9 Other ingredient types

Chapter 7 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Rigid packaging

- 7.2.1 Paperboard boxes

- 7.2.2 Plastic containers

- 7.2.3 Metal tins

- 7.2.4 Other rigid packaging

- 7.3 Flexible packaging

- 7.3.1 Plastic pouches

- 7.3.2 Flow wraps

- 7.3.3 Paper bags

- 7.3.4 Other flexible packaging

- 7.4 Trays & clamshells

- 7.5 Multi-pack formats

- 7.6 Single-serve packaging

- 7.7 Sustainable packaging solutions

- 7.7.1 Biodegradable packaging

- 7.7.2 Recyclable packaging

- 7.7.3 Compostable packaging

Chapter 8 Market Estimates & Forecast, By Price Segment, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Economy

- 8.3 Mid-range

- 8.4 Premium

- 8.5 Super-premium & artisanal

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Supermarkets & hypermarkets

- 9.3 Convenience stores

- 9.4 Specialty stores

- 9.5 Online retail

- 9.6 Foodservice

- 9.6.1 Cafes & restaurants

- 9.6.2 Hotels & catering

- 9.6.3 Institutional catering

- 9.7 Vending machines

- 9.8 Direct-to-consumer

- 9.9 Other distribution channels

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.3.7 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Arnott's Biscuits Limited

- 11.2 Bahlsen GmbH & Co. KG

- 11.3 Barilla G. e R. Fratelli S.p.A.

- 11.4 Britannia Industries Ltd.

- 11.5 Burton's Biscuit Company

- 11.6 Campbell Soup Company (Pepperidge Farm)

- 11.7 Dare Foods Limited

- 11.8 Fox's Biscuits (2 Sisters Food Group)

- 11.9 General Mills, Inc.

- 11.10 Grupo Bimbo

- 11.11 ITC Limited

- 11.12 Kellogg Company

- 11.13 Keebler (Ferrero)

- 11.14 Kind LLC

- 11.15 Kashi Company (Kellogg)

- 11.16 Lotus Bakeries

- 11.17 Lotte Confectionery Co., Ltd.

- 11.18 Mary's Gone Crackers

- 11.19 Meiji Holdings Co., Ltd.

- 11.20 Mondelez International, Inc.

- 11.21 Nairn's Oatcakes Limited

- 11.22 Nestle S.A.

- 11.23 Orion Corporation

- 11.24 Parle Products Pvt. Ltd.

- 11.25 PepsiCo, Inc. (Frito-Lay)

- 11.26 Ryvita Company Limited (ABF)

- 11.27 Snyder's-Lance, Inc. (Campbell Soup Company)

- 11.28 United Biscuits (pladis)

- 11.29 Walkers Shortbread Ltd.

- 11.30 Yildiz Holding (Ulker)