|

시장보고서

상품코드

1750443

반려조류 건강 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Pet Bird Health Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

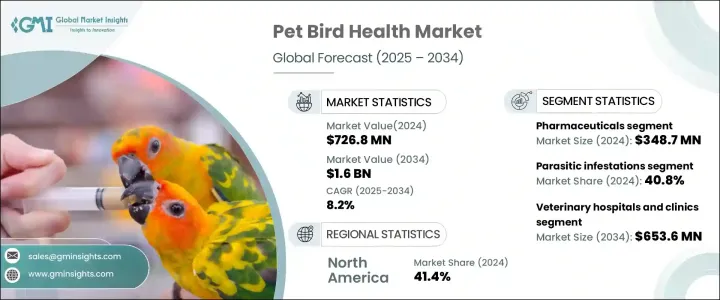

세계의 반려조류 건강 시장은 2024년 7억 2,680만 달러로 평가되었으며, 2034년까지 CAGR 8.2%로 성장하여 16억 달러에 이를 것으로 추정됩니다.

조류 질환의 조기 진단을 요구하는 사람이 늘어남에 따라, 화상 기술, 비침습적 진단, 행동 평가의 이용이 현저하게 증가하고 있습니다. 예방 의료가 주류가 됨에 따라, 진단학, 영양학, 조류 의학의 진보는 조류의 건강 관리 방법을 세계적으로 바꾸고 있습니다.

종합적인 웰빙 관리에 대한 관심 증가는 특별한 보충제, 치유된 치료 및 다양한 조류 종에 맞는 개별화 된 수의학 전략에 대한 수요를 부추깁니다. 반려동물의 새의 사육에 초점을 맞춘 교육적 아웃리치는 컴패니언 버드의 치료 어드히어런스의 향상과 생활 환경의 향상에 연결되어, 의식의 향상에 유지하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 7억 2,680만 달러 |

| 예측 금액 | 16억 달러 |

| CAGR | 8.2% |

2024년에는 의약품 분야가 3억 4,870만 달러로 시장을 선도했으며, 이것은 조류의 다양한 세균 및 진균 감염증을 관리할 필요성이 높아지고 있는 것을 반영하고 있습니다. 인정 조류 수의사의 수가 증가하고 있기 때문에 처방이 증가하고 있어 제약회사는 제품 라인업의 확충을 도모하고 있습니다. 또한, 조류용으로 특별히 설계된 항기생충약이나 영양 요법이 시장에서 인기를 모으고 있습니다.

기생충의 만연은 2024년에는 40.8%의 점유율을 차지하며 반려조류 건강에 널리 영향을 주고 있는 것을 뒷받침하고 있습니다. 이로 인해 발생하는 병태는 종종 식욕 부진, 소화 불량, 면역력 저하를 초래합니다.

미국 반려조류 건강 시장 규모는 2024년 2억 7,290만 달러이며, 반려조류 사육수 증가, 수의학에 대한 접근 개선, 예방건강에 대한 소비자의 관심의 고조에 지지되고 있습니다. 새에 보험을 요구하는 주인이 늘어나, 정기 검진이나 진단이 표준이 되고 있습니다. 온라인 소매 채널을 통해 새의 건강 제품을 입수할 수 있게 된 것으로, 소비자의 관심도 높아지고 있습니다.

Vetnil, IDEXX, Vetafarm, Virbac, Merck &Co. Diagnostics와 같은 기업은 종에 특화된 솔루션의 개발, 전자상거래 플랫폼의 시작, 수의학 교육 프로그램의 확대에 의해 발판을 굳히고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 조류의 건강과 복지에 대한 의식의 고조

- 조류의 사육과 이국적인 반려동물의 동향 증가

- 조류의 진단과 치료의 진보

- 업계의 잠재적 위험 및 과제

- 종 특이적인 수의약의 입수가 한정되어 있습니다.

- 조류의 치료비가 고액이여서 보험의 보급률이 낮습니다.

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 장래 시장 동향

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장추계 및 예측 : 제품 및 서비스별, 2021-2034년

- 주요 동향

- 의약품

- 약물

- 백신

- 영양보조식품

- 진단과 감시

- 진단 기기

- 감시장치

- 소모품

- 서비스

제6장 시장추계 및 예측 : 용도별, 2021-2034년

- 주요 동향

- 기생충 감염

- 세균 감염증

- 기타 용도

제7장 시장 추계 및 예측 : 최종 용도별, 2021-2034년

- 주요 동향

- 동물병원 및 진료소

- 반려동물 새 주인(홈 케어)

- 조류 사육장 및 조류 보호구

- 기타 용도

제8장 시장추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제9장 기업 프로파일

- AdvaCare Pharma

- Bimeda

- CJ Wildlife

- Hidrolab

- HomeoPet

- IDEXX

- INDICAL BIOSCIENCE

- Meadow's Animal Healthcare

- Merck &Co.

- Pranidhi Veterinary Diagnostics

- Thermo Fisher Scientific

- Vetafarm

- vetagenix

- Vetnil

- VioVet

- Virbac

- Wildlife Computers

- Zhejiang Pushkang Biotechnology

The Global Pet Bird Health Market was valued at USD 726.8 million in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 1.6 billion by 2034, propelled by the increasing recognition of avian health conditions and the adoption of preventative care approaches by bird owners and veterinarians alike. With more people seeking early diagnosis for avian ailments, there has been a noticeable uptick in the use of imaging technologies, non-invasive diagnostics, and behavioral assessments. As preventive care becomes more mainstream, advancements in diagnostics, nutritional science, and avian medicine continue to transform how bird health is managed globally.

Increased interest in comprehensive wellness care fuels demand for specialized supplements, targeted treatments, and personalized veterinary strategies tailored to various bird species. Technological tools now assist with early disease detection, improving bird longevity and overall quality of life. Telehealth solutions and mobile veterinary services bridge care gaps, especially in remote regions. Educational outreach focused on pet bird husbandry helps in driving awareness, leading to higher treatment adherence and better living conditions for companion birds. Collectively, these factors are sustaining the market's upward trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $726.8 Million |

| Forecast Value | $1.6 Billion |

| CAGR | 8.2% |

The pharmaceuticals segment led the market with USD 348.7 million in 2024, reflecting the growing need to manage a range of avian bacterial and fungal infections. This segment continues to see innovation in drug formats-from oral treatments to topical formulations, which are delivering better therapeutic results. The growing number of certified avian veterinarians is increasing prescriptions, prompting pharmaceutical firms to broaden their product offerings. Additionally, antiparasitic and nutritional therapies specifically designed for birds are gaining traction in the market.

Parasitic infestations held a 40.8% share in 2024, underscoring their widespread impact on pet bird health. Both internal and external parasites continue to pose threats to avian wellness. Conditions caused by intestinal worms and protozoa often result in appetite loss, digestive issues, and weakened immunity. Rising awareness about these risks has led to greater use of anti-parasitic solutions, including medicated feeds, topical agents, and preventative supplements.

U.S. Pet Bird Health Market generated USD 272.9 million in 2024, supported by rising pet bird ownership, improved access to veterinary care, and increasing consumer focus on preventative wellness. With more owners seeking insurance for pet birds, routine checkups and diagnostics are becoming standard. The availability of bird health products through online retail channels expands consumer reach.

Companies like Vetnil, IDEXX, Vetafarm, Virbac, Merck & Co., INDICAL BIOSCIENCE, AdvaCare Pharma, Wildlife Computers, VioVet, CJ Wildlife, Thermo Fisher Scientific, HomeoPet, and Pranidhi Veterinary Diagnostics are strengthening their foothold by developing species-specific solutions, launching e-commerce platforms, and expanding veterinary education programs. Many invest in avian R&D to produce more effective treatments while collaborating with veterinary professionals to refine product delivery and improve animal outcomes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising awareness of avian health and welfare

- 3.2.1.2 Increase in bird adoption and exotic pet trends

- 3.2.1.3 Advances in avian diagnostics and therapeutics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited availability of species-specific veterinary drugs

- 3.2.2.2 High treatment costs and low insurance penetration for birds

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Products and Services, 2021-2034 ($ Mn)

- 5.1 Key trends

- 5.2 Pharmaceuticals

- 5.2.1 Drugs

- 5.2.2 Vaccines

- 5.2.3 Nutritional supplements

- 5.3 Diagnostics and monitoring

- 5.3.1 Diagnostic equipment

- 5.3.2 Monitoring devices

- 5.3.3 Consumables

- 5.4 Services

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 ($ Mn)

- 6.1 Key trends

- 6.2 Parasitic infestations

- 6.3 Bacterial infections

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 ($ Mn)

- 7.1 Key trends

- 7.2 Veterinary hospitals and clinics

- 7.3 Pet bird owners (home care)

- 7.4 Aviaries and bird sanctuaries

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AdvaCare Pharma

- 9.2 Bimeda

- 9.3 CJ Wildlife

- 9.4 Hidrolab

- 9.5 HomeoPet

- 9.6 IDEXX

- 9.7 INDICAL BIOSCIENCE

- 9.8 Meadow's Animal Healthcare

- 9.9 Merck & Co.

- 9.10 Pranidhi Veterinary Diagnostics

- 9.11 Thermo Fisher Scientific

- 9.12 Vetafarm

- 9.13 vetagenix

- 9.14 Vetnil

- 9.15 VioVet

- 9.16 Virbac

- 9.17 Wildlife Computers

- 9.18 Zhejiang Pushkang Biotechnology