|

시장보고서

상품코드

1750447

직접 디지털 제어 시스템 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Direct Digital Control System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

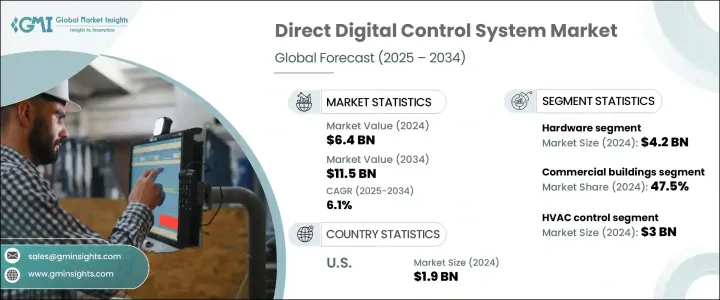

세계의 직접 디지털 제어 시스템 시장 규모는 2024년 64억 달러로 급속한 도시화와 산업화에 따른 스마트 인프라 수요 증가로 CAGR 6.1%로 성장해 2034년에는 115억 달러에 달할 것으로 예측되고 있습니다.

이 시스템은 건물의 HVAC, 조명, 에너지 운영을 관리하고 효율성, 편안함 및 지속가능성을 높이는 데 도움이 됩니다. 특히 인도, 아프리카, 라틴아메리카 등 개발도상지역에서 도시 확대가 계속되고 있는 가운데 지능형 자동 빌딩 관리 시스템 수요가 급증하고 있습니다. DDC 시스템은 에너지 최적화, 자동화 및 수작업 완화에 도움이 되며 대규모 인프라 프로젝트에 필수적입니다.

이 시스템은 난방, 환기, 에어컨(HVAC), 조명 및 기타 중요한 건물 기능을 원활하게 제어하여 전반적인 효율성과 지속가능성을 향상시킵니다. 쾌적성을 확보하면서 에너지 소비를 최적화할 수 있는 것이 상업, 주택, 공업의 각 분야에서 널리 채용되고 있는 주요 요인입니다. 그러나 관세정책에 의한 혼란이 중국, EU, 캐나다 등 주요 제조지역에서 중요한 전자부품, 센서, 컨트롤러의 수입을 방해하는 등의 과제에 시장은 직면하고 있습니다. 이러한 지정학적 요인은 프로젝트 일정을 늦추고 DDC 시스템 제조업체의 비용을 증가시킬 수 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 64억 달러 |

| 예측 금액 | 115억 달러 |

| CAGR | 6.1% |

DDC 시스템 시장은 주로 하드웨어, 소프트웨어, 서비스로 구분되며, 하드웨어가 지배적인 부문입니다. 인프라에 대한 수요가 세계적, 특히 신흥 시장에서 높아짐에 따라 실시간 모니터링, 정확한 자동화, 효율적인 에너지 관리를 가능하게 하는 고급 하드웨어 솔루션에 대한 요구가 높아지고 있습니다.

에너지 사용량이 많고 인프라가 복잡한 상업 빌딩은 2024년 점유율 47.5%를 차지했습니다. DDC 시스템은 운영 자동화에 이상적인 선택이 되어 운영 비용을 절감하고 건물 전체의 성능을 향상시킬 수 있습니다.

미국 직접 디지털 제어 시스템 2024년 시장 규모는 19억 달러로 상업 빌딩, 시설, 산업 빌딩에서 이러한 시스템의 광범위한 채용이 견인하고 있습니다. 또한 DDC 업계의 선도적인 선수들의 존재가 시장의 성장과 기술 혁신을 더욱 뒷받침해 다양한 부문을 위한 고품질의 효율적인 시스템의 안정적인 공급을 보장하고 있습니다.

세계의 직접 디지털 제어 시스템 업계의 주요 기업으로는 Schneider Electric, Azbil Corporation, Honeywell International Inc., Johnson Controls Inc. 등이 있습니다. 이를 통해 스마트 빌딩 솔루션에 대한 수요 증가에 대응하고 있으며, 많은 기업들이 종합적인 설치, 유지보수, 시스템 통합 서비스를 포함한 서비스 제공을 확대하고 있으며, 고객이 DDC 시스템의 가치를 극대화할 수 있도록 하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 트럼프 정권의 관세 분석

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향

- 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향

- 영향을 받는 주요 기업

- 전략적인 업계의 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 영향요인

- 성장 촉진요인

- 스마트 빌딩 기술 도입 증가

- 급속한 도시화와 산업화

- 에너지 효율에 대한 수요 증가

- 노후화된 인프라와 개수 수요

- 자동화 및 제어 시스템의 기술적 진보

- 업계의 잠재적 위험 및 과제

- 초기 설치 비용이 높습니다.

- 통합의 복잡성

- 성장 촉진요인

- 성장 가능성 분석

- 기술과 혁신의 상황

- 주요 뉴스와 대처

- 장래 시장 동향

- Porter's Five Forces 분석

- PESTEL 분석

- 규제 상황

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계 및 예측 : 컴포넌트별, 2021-2034년

- 주요 동향

- 하드웨어

- 컨트롤러

- 센서

- 액추에이터

- 입출력 모듈

- 기타

- 소프트웨어

- 제어 알고리즘

- 인터페이스 및 시각화 도구

- 데이터 분석 소프트웨어

- 기타

- 서비스

- 설치 및 통합

- 유지보수 및 지원

- 컨설팅 및 교육

제6장 시장추계 및 예측 : 용도별, 2021-2034년

- 주요 동향

- HVAC 제어

- 조명 제어

- 산업 자동화

- 에너지 관리 시스템(EMS)

- 기타

제7장 시장 추계 및 예측 : 최종 용도별, 2021-2034년

- 주요 동향

- 주택

- 상업 빌딩

- 사무실 공간

- 소매점

- 접객

- 산업시설

- 제조공장

- 창고

- 공공시설

- 병원

- 학교

- 정부청사

제8장 시장추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제9장 기업 프로파일

- Allison Mechanical, Inc.

- Arvin Air Systems

- Azbil Corporation

- Computrols, Inc.

- DEOS AG

- Honeywell International Inc.

- Innotech

- Johnson Controls Inc.

- KMC Controls

- Lennox International Inc.

- Mason & Barry

- Matrix HG, Inc.

- Mitsubishi Electric Corporation

- Schneider Electric

- Siemens

- Winona Heating & Ventilation

- WODFA Company

The Global Direct Digital Control System Market was valued at USD 6.4 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 11.5 billion by 2034, driven by the increasing demand for smart infrastructure, fueled by rapid urbanization and industrialization. These systems help manage HVAC, lighting, and energy operations within buildings, enhancing efficiency, comfort, and sustainability. As urban expansion continues, particularly in developing regions such as India, Africa, and Latin America, the demand for intelligent, automated building management systems is surging. DDC systems help in energy optimization, automation, and reducing manual labor, making them indispensable for large-scale infrastructure projects.

These systems allow for seamless control of heating, ventilation, air conditioning (HVAC), lighting, and other critical building functions, improving overall efficiency and sustainability. Their ability to optimize energy consumption while ensuring comfort is a key factor behind their widespread adoption in the commercial, residential, and industrial sectors. However, the market faces challenges, such as the disruptions caused by tariff policies, which have hindered the import of critical electronic components, sensors, and controllers from major manufacturing regions like China, the EU, and Canada. These geopolitical factors can delay project timelines and increase costs for DDC system manufacturers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.4 Billion |

| Forecast Value | $11.5 Billion |

| CAGR | 6.1% |

The DDC system market is primarily segmented into hardware, software, and services, with hardware being the dominant segment. In 2024, the hardware segment was valued at USD 4.2 billion. The core components, including controllers, sensors, and actuators, are essential for the effective functioning of DDC systems. As the demand for smart infrastructure grows globally, especially in emerging markets, there is an increasing need for advanced hardware solutions that enable real-time monitoring, precise automation, and efficient energy management. This hardware facilitates high-level control across various building functions, ensuring energy efficiency and occupant comfort.

Commercial buildings, with their high energy usage and complex infrastructure, represented a 47.5% share in 2024. DDC systems are extensively used in office buildings, shopping malls, airports, and hotels, where there is a strong need for efficient energy management and occupant comfort. The complex nature of these buildings makes DDC systems an ideal choice for automating operations, thereby reducing operational costs and enhancing overall building performance. The increasing awareness of sustainability and energy efficiency also makes DDC systems an attractive solution for managing energy resources in commercial facilities.

U.S. Direct Digital Control System Market was valued at USD 1.9 billion in 2024, driven by the widespread adoption of these systems across commercial, institutional, and industrial buildings. Strict energy efficiency regulations and the growing trend of retrofitting older buildings with advanced automation solutions have significantly contributed to the market's expansion in the U.S. Additionally, the presence of major players in the DDC industry further supports the growth and innovation in the market, ensuring a steady supply of high-quality and efficient systems for various sectors.

Key players in the Global Direct Digital Control System Industry include Schneider Electric, Azbil Corporation, Honeywell International Inc., and Johnson Controls Inc. To strengthen their presence in the DDC system market, companies are heavily investing in research and development to enhance the performance and cost-effectiveness of their products. By focusing on improving energy efficiency and scalability, they aim to cater to the growing demand for smart building solutions. Many players are also expanding their service offerings to include comprehensive installation, maintenance, and system integration services, ensuring clients can maximize the value of DDC systems. Strategic partnerships with commercial and industrial players help companies expand their market reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 key companies impacted

- 3.2.4 strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increased adoption of smart building technologies

- 3.3.1.2 Rapid urbanization and industrialization

- 3.3.1.3 Rising demand for energy efficiency

- 3.3.1.4 Aging infrastructure and retrofitting demand

- 3.3.1.5 Technological advancements in automation and control systems

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 High initial installation costs

- 3.3.2.2 Complexity of integration

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Technological & innovation landscape

- 3.6 Key news and initiatives

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Regulatory landscape

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Controllers

- 5.2.2 Sensors

- 5.2.3 Actuators

- 5.2.4 Input/output modules

- 5.2.5 Others

- 5.3 Software

- 5.3.1 Control algorithms

- 5.3.2 Interface & visualization tools

- 5.3.3 Data analytics software

- 5.3.4 Others

- 5.4 Services

- 5.4.1 Installation & integration

- 5.4.2 Maintenance & support

- 5.4.3 consulting & training

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 HVAC control

- 6.3 Lighting control

- 6.4 Industrial automation

- 6.5 Energy management systems (EMS)

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By End use, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Residential buildings

- 7.3 Commercial buildings

- 7.3.1 office spaces

- 7.3.2 retail stores

- 7.3.3 hospitality

- 7.4 Industrial facilities

- 7.4.1 manufacturing plants

- 7.4.2 warehouses

- 7.5 Institutional buildings

- 7.5.1 hospitals

- 7.5.2 schools

- 7.5.3 government buildings

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Allison Mechanical, Inc.

- 9.2 Arvin Air Systems

- 9.3 Azbil Corporation

- 9.4 Computrols, Inc.

- 9.5 DEOS AG

- 9.6 Honeywell International Inc.

- 9.7 Innotech

- 9.8 Johnson Controls Inc.

- 9.9 KMC Controls

- 9.10 Lennox International Inc.

- 9.11 Mason & Barry

- 9.12 Matrix HG, Inc.

- 9.13 Mitsubishi Electric Corporation

- 9.14 Schneider Electric

- 9.15 Siemens

- 9.16 Winona Heating & Ventilating

- 9.17 WODFA Company