|

시장보고서

상품코드

1750499

임상 검사 시장 : 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Clinical Laboratory Tests Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

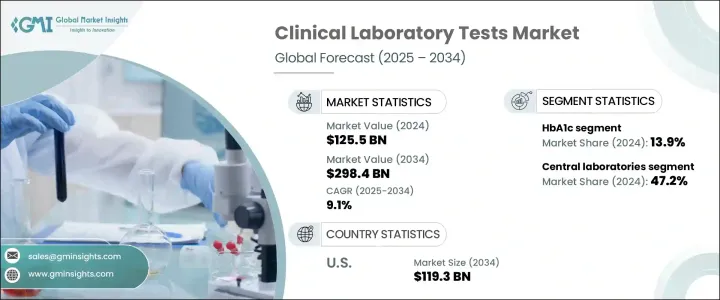

세계의 임상 검사 시장은 2024년 1,255억 달러로 평가되었고, 만성 질환 증가, 세계 인구 고령화, 조기 발견 및 치료 모니터링을 위한 진단 검사 의존도 고조에 따라 CAGR 9.1%로 성장할 전망이며, 2034년에는 2,984억 달러에 달할 것으로 예측됩니다.

임상검사는 의료상의 의사결정에 도움이 되며 대부분의 진단 워크플로우는 시약, 분석 장치, 검체채취 시스템 등의 툴에 의존하고 있습니다. 특히 선진지역의 고령화 사회는 심장병, 암, 당뇨병 등 만성질환에 쉽게 이환되기 때문에 검사 수요에 크게 기여하고 있습니다.

AI와 자동화의 도입으로 검사의 소요 시간과 정밀도가 향상되었습니다. 최신 검사실은 현재 머신러닝과 로봇 공학을 워크플로에 통합하여 수작업에 의한 실수를 줄이고 업무 효율을 높이고 증가하는 샘플량을 관리하고 있습니다. 개별화 의료로의 움직임은 정밀한 진단 및 다항목 검사의 수요를 끌어올리고 있습니다. 임상 검사는 세계적으로 예방 의료 전략의 정기적인 일부가 되고 있으며, 신흥국에서도 정기적인 건강 진단이 점점 일반화되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 1,255억 달러 |

| 예측 금액 | 2,984억 달러 |

| CAGR | 9.1% |

2024년에는 HbA1c 검사가 최대 시장 점유율을 차지하며 총 매출액의 13.9%를 차지했습니다. 이러한 검사는 특히 당뇨병 환자의 장기적인 혈당 조절 모니터링에 필수적입니다. 포터블 분석 장치나 자동화 시스템 등의 기술 개량에 의해 HbA1c 검사는 보다 친근하고 효율적인 것이 되었습니다. 또한, 조기 진단이나 질병 관리에 대한 사회적 의식의 고조도 HbA1c 검사의 빈도를 높이고 있습니다. 당뇨병 환자가 전 세계적으로 증가하는 가운데 정기적인 모니터링에 대한 수요는 계속 급증하고 있어 이 분야의 지속적인 성장을 견인하고 있습니다.

2024년에는 중앙 검사실 부문이 472억 달러를 차지했으며, 최대 점유율을 차지했습니다. 이는 고 처리량 진단 능력, 확립된 인프라, 병원 및 연구기관과의 강력한 통합에 의해 뒷받침되고 있습니다. 이러한 검사 시설은 유전자 진단과 분자 진단을 포함한 복잡한 검사에 대응할 수 있는 설비를 갖추고 폭넓은 지리적 네트워크로 결과의 일관성을 유지하고 있습니다. 비용 대비 효과가 높은 솔루션과 신뢰성으로 인해 대규모 검사 요구에 적합한 선택지가 되고 있습니다.

미국의 임상 검사 2024년 시장 규모는 508억 달러로 평가되었고, 2034년에는 1,193억 달러에 달할 것으로 예측되고 있습니다. 1인당 헬스케어 지출이 높기 때문에 병원, 진료소, 연구소에 최첨단 진단기술이 널리 도입되고 있습니다. 만성질환, 감염병, 노화에 따른 건강상태의 증가는 시기적절하고 정확한 실험실 검사의 필요성을 더욱 높이고 있습니다. 분자 진단, 개별화 의료, 조기 질환 검출 도구에 대한 의존의 고조는 전국의 임상 워크플로우를 재구축하고 있습니다.

이 분야의 주요 기업으로는 Siemens Healthineers, bioMerieux, Agilent Technologies, Illumina, Thermo Fisher Scientific, Abbott Laboratories, Hologic, Bio-Rad Laboratories, QIAGEN, Danaher, 및 PerkinElmer 등이 있습니다. 시장에서의 존재감을 높이기 위해, 각사는 헬스케어 프로바이더와의 제휴, 검사 자동화의 확대, AI 기반의 플랫폼에 대한 투자에 주력하고 있습니다. 또한 검사 메뉴의 다양화, 소규모 진단 기업의 인수, 세계적인 판매망의 확대도 목표로 하고 있습니다. 규제 준수, 제품 혁신, 비용 효율이 높은 솔루션은 진화하는 진단 상황에서 경쟁력을 유지하기 위해 계속해서 필수적입니다.

목차

제1장 조사 방법 및 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 만성 질환 및 감염증의 만연

- 진단 기술의 진보

- 고령화 인구 증가

- 업계의 잠재적 위험 및 과제

- 숙련된 연구실 스탭의 부족

- 엄격한 규제 시나리오

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 국가별 대응

- 업계에 미치는 영향

- 공급측의 영향(제조 비용)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(소비자에 대한 비용)

- 최종 시장에 대한 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(제조 비용)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망 및 향후 검토 사항

- 무역에 미치는 영향

- 기술적 상황

- 장래 시장 동향

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서문

- 기업의 시장 점유율 분석

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계 및 예측 : 테스트 유형별(2021-2034년)

- 주요 동향

- 전혈구 수

- HbA1c

- 대사 패널

- 간 패널

- 신장 패널

- 지질 패널

- 심장혈관 패널

- 기타 검사 유형

제6장 시장 추계 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 중앙연구소

- 1차 클리닉

- 병원

- 기타 용도

제7장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

제8장 기업 프로파일

- Abbott Laboratories

- Agilent Technologies

- Beckman Coulter

- Becton, Dickinson and Company

- bioMerieux

- Bio-Rad Laboratories

- F. Hoffmann-La Roche

- Grifols

- Hologic

- Illumina

- PerkinElmer

- QIAGEN

- QuidelOrtho

- Siemens Healthineers

- Thermo Fisher Scientific

The Global Clinical Laboratory Tests Market was valued at USD 125.5 billion in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 298.4 billion by 2034, fueled by rising chronic disease cases, the aging global population, and the increasing reliance on diagnostic testing for early detection and treatment monitoring. Laboratory testing helps in medical decision-making, with most diagnostic workflows depending on tools like reagents, analyzers, and specimen collection systems. Aging populations, especially in developed regions, contribute significantly to testing demand due to their susceptibility to chronic illnesses such as heart disease, cancer, and diabetes.

Adoption of AI and automation has improved test turnaround time and accuracy. Modern laboratories now integrate machine learning and robotics into workflows to reduce manual errors, boost operational efficiency, and manage rising sample volumes. The move toward personalized medicine pushes demand for precise diagnostics and multi-analyte tests. Clinical testing has become a regular part of preventive healthcare strategies worldwide, and regular health screenings are becoming increasingly common, even in emerging economies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $125.5 Billion |

| Forecast Value | $298.4 Billion |

| CAGR | 9.1% |

In 2024, HbA1c tests accounted for the largest market share, contributing 13.9% of total revenue. These tests are essential for monitoring long-term blood glucose control, particularly in patients with diabetes. Technological improvements such as portable analyzers and automated systems have made HbA1c testing more accessible and efficient. Growing public awareness around early diagnosis and disease management has also pushed the frequency of these tests. With diabetes cases rising globally, demand for regular monitoring continues to surge, driving sustained growth for this segment.

The central laboratories segment held the largest share in 2024, accounting for USD 47.2 billion, supported by high-throughput diagnostic capabilities, well-established infrastructure, and strong integration with hospitals and research institutions. These labs are equipped to handle complex tests, including genetic and molecular diagnostics, and maintain consistency in results across wide geographical networks. Their cost-effective solutions and reliability make them the preferred option for large-scale testing needs.

U.S. Clinical Laboratory Tests Market was valued at USD 50.8 billion in 2024 and is projected to reach USD 119.3 billion by 2034, driven by multiple structural and technological factors. High per capita healthcare spending enables widespread integration of cutting-edge diagnostic technologies across hospitals, clinics, and research labs. The rising incidence of chronic illnesses, infectious diseases, and age-related health conditions further amplifies the need for timely and accurate laboratory testing. Increasing reliance on molecular diagnostics, personalized medicine, and early disease detection tools is reshaping clinical workflows nationwide.

Key players in this space include Siemens Healthineers, bioMerieux, Agilent Technologies, Illumina, Thermo Fisher Scientific, Abbott Laboratories, Hologic, Bio-Rad Laboratories, QIAGEN, Danaher, and PerkinElmer. To strengthen market presence, companies are focusing on partnerships with healthcare providers, expanding laboratory automation, and investing in AI-based platforms. They also aim to diversify test menus, acquire smaller diagnostic firms, and increase their global distribution networks. Regulatory compliance, product innovation, and cost-effective solutions remain critical to staying competitive in the evolving diagnostic landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic and infectious diseases

- 3.2.1.2 Advancements in diagnostic technologies

- 3.2.1.3 Growing geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Shortage of skilled laboratory personnel

- 3.2.2.2 Stringent regulatory scenario

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Test Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Complete blood count

- 5.3 HbA1c

- 5.4 Metabolic panel

- 5.5 Liver panel

- 5.6 Renal panel

- 5.7 Lipid panel

- 5.8 Cardiovascular panel

- 5.9 Other test types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Central laboratories

- 6.3 Primary clinics

- 6.4 Hospitals

- 6.5 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Abbott Laboratories

- 8.2 Agilent Technologies

- 8.3 Beckman Coulter

- 8.4 Becton, Dickinson and Company

- 8.5 bioMerieux

- 8.6 Bio-Rad Laboratories

- 8.7 F. Hoffmann-La Roche

- 8.8 Grifols

- 8.9 Hologic

- 8.10 Illumina

- 8.11 PerkinElmer

- 8.12 QIAGEN

- 8.13 QuidelOrtho

- 8.14 Siemens Healthineers

- 8.15 Thermo Fisher Scientific