|

시장보고서

상품코드

1750539

저전압 회로 차단기 시장 : 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Low Voltage Circuit Breaker Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

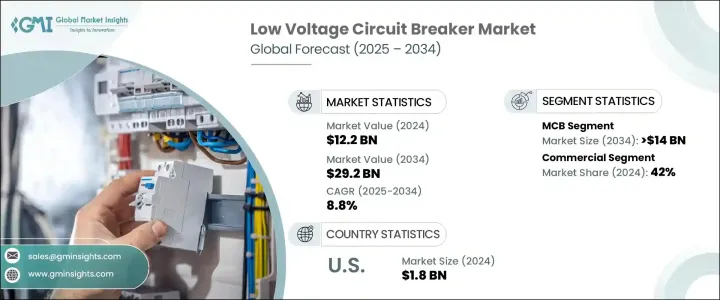

세계의 저전압 회로 차단기 시장은 2024년에는 122억 달러로 평가되었고, CAGR 8.8%로 성장할 전망이며, 2034년에는 292억 달러에 이를 것으로 예측됩니다.

이는 특히 주택 및 상업 건설 부문의 인프라에 대한 대규모 투자가 신뢰성 있는 회로 보호 시스템에 대한 수요를 뒷받침하기 때문입니다. 게다가 근대적인 제조 시설의 디지털화 및 상호 접속이 진행됨에 따라 인텔리전트한 회로 보호 솔루션의 수요가 높아지고 있습니다. 스마트 모니터링, 원격 진단, 실시간 고장 검출을 갖춘 저전압 회로 차단기는 자동화 환경에서 필수적인 컴포넌트가 되고 있습니다.

이러한 고급 기능은 다운타임과 유지보수 비용을 줄일 뿐만 아니라, 예지보전 전략도 지원합니다. 인더스트리 4.0으로의 이행은 특히 자동차, 일렉트로닉스, 중장비 등의 분야에서 보다 견고하고 응답성이 높은 회로 보호 시스템의 필요성을 강화하고 있습니다. 또한 복합 상업 시설, 데이터 센터, 신재생 에너지 설비 등의 인프라 프로젝트에 대한 투자가 증가하고 있어 시장의 성장을 더욱 촉진하고 있습니다. 각국 정부는 보다 엄격한 규제를 실시하고 시대에 뒤떨어진 전기 인프라를 업그레이드하기 위한 인센티브를 제공함으로써 매우 중요한 역할을 하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 122억 달러 |

| 예측 금액 | 292억 달러 |

| CAGR | 8.8% |

소형 회로 차단기(MCB) 분야는 과부하 또는 단락시 회로를 자동으로 차단하여 전기 화재의 위험을 줄이는 기능으로 2034년까지 140억 달러에 이를 것으로 예측되고 있습니다. 이 기능은, 세계의 급속한 도시화 및 인프라 개발에 수반해, 주택, 상업, 공업의 각 분야에서 불가결한 것이 되고 있습니다. 세계 도시 지역의 성장과 전력 수요 증가에 따라 MCB는 전기 설비의 중요한 부품이 되고 있으며, 신축과 개수 공간 모두에서 안전한 배전을 보장하고 있습니다.

상업용 최종 용도 부문은 2024년에 42%의 점유율을 차지했으며, 2034년까지 연평균 복합 성장률(CAGR) 8.5%를 보일 것으로 예측되고 있습니다. 가정에서의 전기 안전성 혁신 및 스마트 홈 기술의 진보가 첨단 회로 보호 시스템의 성장을 가속하고 있습니다. 오피스나 소매업 등의 상업 부문에서는, 에너지 절약 기술과 함께 자동화 도입이 진행되고 있어 기기를 보호해 계속적인 전력 공급을 보증하는 신뢰성 높은 회로 차단기의 필요성이 높아지고 있습니다. 산업 활동의 강화, 새로운 제조 공장, 재생 에너지 자원의 추가는 산업 시장에 현저한 확대를 가져오고 있습니다.

미국의 저전압 회로 차단기 2024년 시장 규모는 18억 달러로 평가되었고, 인구 증가 및 도시화에 따른 주택, 상업, 산업 부문의 전력 수요 증가는 신뢰성 있고 효율적인 전기 시스템의 필요성을 강조하고 저전압 회로 차단기 수요를 촉진하고 있습니다. 미국의 노후화된 전기 인프라를 개선하기 위한 투자는 각 지역이 시스템 안전성과 신뢰성 향상에 주력하고 있기 때문에 시장 확대를 더욱 뒷받침하고 있습니다. 전반적으로 저전압 회로 차단기 시장은 인프라 개발, 안전 기준 강화, 현대화와 자동화에 대한 세계 동향에 따라 크게 성장할 전망입니다.

Texas Instruments, L & T Electrical and Automation, Efacec, Tesco Automation, Hitachi Energy, Locamation, Rockwell Automation, Schneider Electric, CG Power, Siemens, Eaton, General Electric, ABB, Open International사는 저전압 회로 차단기 시장의 혁신과 성장을 견인하는 주요 기업입니다. 저전압 회로 차단기 시장의 주요 제조업체는 혁신, 확대, 디지털 통합 전략을 조합하여 구입하여 시장에서의 지위를 강화하고 있습니다. 많은 기업이 연구 개발에 고액의 투자를 실시해, 예지 보전이나 원격 감시를 서포트하는, 보다 스마트하고 에너지 효율이 높은 회로 차단기를 개발하고 있습니다. 하이테크 기업과의 전략적 제휴는 제품 자동화와 IoT 호환성 강화에 도움이 되고 있습니다. 몇몇 기업은 신흥 시장에 진출하고 지역 수요에 대응하기 위해 현지에 제조 시설과 서비스 시설을 설립함으로써 세계의 발자취를 확대하고 있습니다. 또한 시장 점유율을 강화하고 제품 포트폴리오를 다양화하기 위해 M&A에 주력하고 있는 기업도 있습니다.

목차

제1장 조사 방법 및 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 트럼프 정권의 관세 분석

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에 대한 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망 및 향후 검토 사항

- 무역에 미치는 영향

- 규제 상황

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 경쟁 구도

- 전략적 대시보드

- 기업의 시장 점유율 분석

- 경쟁 벤치마킹

- 혁신 및 기술의 상황

제5장 시장 규모 및 예측 : 제품별(2021-2034년)

- 주요 동향

- ACB

- MCB

- MCCB

- 기타

제6장 시장 규모 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 주택용

- 상업용

- 산업

제7장 시장 규모 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 프랑스

- 이탈리아

- 영국

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 카타르

- 오만

- 남아프리카

- 라틴아메리카

- 브라질

- 칠레

제8장 기업 프로파일

- ABB

- CG Power

- Eaton

- Efacec

- General Electric

- Hitachi Energy

- L & T Electrical and Automation

- Locamation

- Open System International

- Rockwell Automation

- Schneider Electric

- Siemens

- Tesco Automation

- Texas Instruments

The Global Low Voltage Circuit Breaker Market was valued at USD 12.2 billion in 2024 and is estimated to grow at 8.8% CAGR to reach USD 29.2 billion by 2034, driven by substantial investments in infrastructure, especially within the residential and commercial construction sectors, boosting demand for reliable circuit protection systems. Moreover, as modern manufacturing facilities become more digitized and interconnected, the demand for intelligent circuit protection solutions is gaining traction. Low-voltage circuit breakers equipped with smart monitoring, remote diagnostics, and real-time fault detection are becoming essential components in automated environments.

These advanced features not only reduce downtime and maintenance costs but also support predictive maintenance strategies, which are crucial for minimizing operational disruptions. The transition to Industry 4.0 reinforces the need for more robust and responsive circuit protection systems, particularly in sectors such as automotive, electronics, and heavy machinery. In tandem, rising investments in infrastructure projects-including commercial complexes, data centers, and renewable energy installations-are further stimulating market growth. Governments play a pivotal role by implementing stricter regulations and offering incentives for upgrading outdated electrical infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.2 Billion |

| Forecast Value | $29.2 Billion |

| CAGR | 8.8% |

The miniature circuit breaker (MCB) segment is projected to reach USD 14 billion by 2034, fueled by its ability to automatically disconnect circuits during overloads or short circuits, thereby mitigating the risks of electrical fires. This feature has become essential across residential, commercial, and industrial settings, aligning with rapid urbanization and infrastructure development worldwide. As global urban areas grow and electricity demand rises, MCBs are becoming critical components in electrical installations, ensuring safe power distribution in both new constructions and renovated spaces.

The commercial end-use segment held a 42% share in 2024 and is anticipated to grow at a CAGR of 8.5% through 2034. Innovations in electrical safety at home and the advancement in smart home technologies drive the growth of highly advanced circuit protection systems. Commercial sectors, including offices and retail, are adopting automation alongside energy-saving technologies, which increases the need for reliable circuit breakers to protect equipment and ensure a continuous power supply. The enhancement of industrial activities, new manufacturing plants, and the addition of renewable energy resources are creating notable expansion in the industrial market.

U.S. Low Voltage Circuit Breaker Market generated USD 1.8 billion in 2024. Rising electricity demand across residential, commercial, and industrial sectors, alongside population growth and urbanization, underscores the need for reliable and efficient electrical systems, thereby driving demand for low-voltage circuit breakers. Investments in upgrading the U.S. aging electrical infrastructure further support market expansion as regions focus on improving system safety and reliability. Overall, the low-voltage circuit breaker market is set for significant growth, driven by infrastructure development, heightened safety standards, and the global trend toward modernization and automation.

Texas Instruments, L&T Electrical and Automation, Efacec, Tesco Automation, Hitachi Energy, Locamation, Rockwell Automation, Schneider Electric, CG Power, Siemens, Eaton, General Electric, ABB, and Open System International are key players driving innovation and growth in the low voltage circuit breaker market. Leading manufacturers in the low voltage circuit breaker market purchase a blend of innovation, expansion, and digital integration strategies to strengthen their market position. Many companies invest heavily in R&D to develop smarter, more energy-efficient circuit breakers that support predictive maintenance and remote monitoring. Strategic collaborations with tech firms are helping enhance product automation and IoT compatibility. Several players are expanding their global footprint by entering emerging markets and establishing local manufacturing or service facilities to meet regional demand. Others focus on mergers and acquisitions to consolidate their market share and diversify their product portfolios.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Competitive landscape, 2025

- 4.2 Strategic dashboard

- 4.3 Company market share analysis

- 4.4 Competitive benchmarking

- 4.5 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (‘000 Units, USD Million)

- 5.1 Key trends

- 5.2 ACB

- 5.3 MCB

- 5.4 MCCB

- 5.5 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (‘000 Units, USD Million)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial

- 6.4 Industrial

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (‘000 Units, USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 Italy

- 7.3.4 UK

- 7.3.5 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Oman

- 7.5.5 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Chile

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 CG Power

- 8.3 Eaton

- 8.4 Efacec

- 8.5 General Electric

- 8.6 Hitachi Energy

- 8.7 L&T Electrical and Automation

- 8.8 Locamation

- 8.9 Open System International

- 8.10 Rockwell Automation

- 8.11 Schneider Electric

- 8.12 Siemens

- 8.13 Tesco Automation

- 8.14 Texas Instruments