|

시장보고서

상품코드

1750561

수의용 CT 이미징 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Veterinary CT Imaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

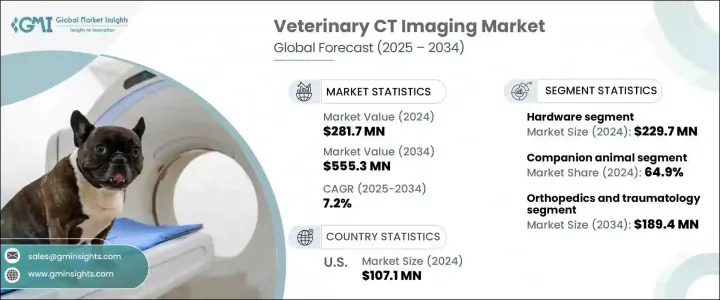

세계의 수의용 CT 이미징 시장은 2024년에는 2억 8,170만 달러로 평가되었고, 2034년에는 CAGR 7.2%를 나타내 5억 5,530만 달러에 달할 것으로 예측되고 있습니다.

이것은 세계 동물 인구 증가, 반려동물 인기 증가, 수의사 서비스에 대한 액세스 향상, 반려동물 케어에 대한 주목도 증가 등의 요인에 의한 것입니다. 포함된 첨단 진단 기술에 대한 수요는 증가의 길을 따라 가고 있습니다.

복잡한 해부학 구조의 고해상도 이미지를 제공하는 능력 외에도 CT 이미징은 특히 긴급 사례에 유익합니다. 병원 및 진료소 증가, 반려동물 보험의 이용 가능성 증가가 시장 확대를 뒷받침하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 2억 8,170만 달러 |

| 예측 금액 | 5억 5,530만 달러 |

| CAGR | 7.2% |

반려동물 부문은 2024년에 64.9%의 최대 점유율을 차지했습니다. 특히 반려동물의 동물 CT 이미징 수요를 계속 견인할 것으로 예측됩니다.

수의용 CT 이미징 시장의 하드웨어 부문은 2024년에 2억 2,970만 달러를 차지했습니다. 하드웨어 솔루션 수요는 꾸준히 성장할 것으로 예측됩니다. 이 구성 요소는 고해상도 이미지를 생성하는 데 필수적이며 수의사가 동물의 다양한 상태를 파악하고 해결할 수 있도록합니다.

2024년 미국의 수의용 CT 이미징 시장 규모는 1억 710만 달러로 평가되었는데, 이 나라의 반려동물 사육률의 높이와 고도의 수의료에 대한 액세스 증가에 의해 견인되고 있습니다. 반려동물의 건강에 대한 관심이 높아짐에 따라 주인은 동물을 위한 최첨단 진단 도구를 추구하는 경향이 커지고 수의용 CT 이미징 시스템의 채용이 확대되고 있습니다. 또한 반려동물 보험 가입이 진행됨에 따라 이러한 고급 진단 서비스를 저렴한 가격으로 받을 수 있으며 시장 성장에 더욱 기여하고 있습니다. 미국은 또한 확립된 인프라와 이미징 기술에서 지속적인 혁신의 혜택을 누리고 있으며, 시장은 호조를 유지하고 지속적인 발전 태세를 갖추고 있습니다.

세계의 수의용 CT 이미징 업계의 기업은 이미징 기술 혁신, 제품 포트폴리오 확대, 파트너십 및 협업을 통한 시장 도달 범위 확대 등의 전략을 채택하고 있습니다. Canon Medical Systems Corporation 및 Siemens Healthineers와 같은 기업은 높은 정밀도 진단에 대한 수요 증가에 대응하기 위해 고해상도 및 고속 이미지 기능을 갖춘 고급 CT 스캐너 개발에 주력하고 있습니다. 또한 GE Healthcare 및 Hallmarq Veterinary Imaging과 같이 제품 라인업 확대 및 신흥 시장에서의 프레즌스 향상에 투자하는 기업도 있습니다. 이러한 기업들은 수의용 이미지 솔루션의 가용성과 합리적인 가격을 개선함으로써 시장에서의 지위를 강화하고 동물 의료에서 고급 진단 도구에 대한 수요 증가에 대응할 것을 목표로 하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 반려동물의 사육과 동물 의료비 증가

- 동물의 병이나 부상의 만연

- 화상 진단법에 있어서 기술적 진보

- 선진국에서 수의사 수 증가

- 업계의 잠재적 리스크 및 과제

- 고액의 CT 스캐너

- 신흥 시장에서의 낮은 동물 건강 의식

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 기술의 상황

- 향후 시장 동향

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계·예측 : 제품별(2021-2034년)

- 주요 동향

- 하드웨어

- 고정식 멀티 슬라이스 CT 스캐너

- 미드엔드

- 하이엔드

- 로우엔드

- 휴대용 CT 스캐너

- 고정식 멀티 슬라이스 CT 스캐너

- 소모품

- 소프트웨어

제6장 시장 추계·예측 : 동물 유형별(2021-2034년)

- 주요 동향

- 반려동물

- 가축

- 기타

제7장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 동향

- 정형외과 및 외상학

- 종양학

- 치과

- 신경학

- 기타

제8장 시장 추계·예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 동물 병원 및 진료소

- 화상 진단센터

- 기타

제9장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- Carestream Health

- Canon Medical Systems Corporation

- Epica International

- GNI ApS

- GE Healthcare

- Hallmarq Veterinary Imaging

- Hitachi

- Isabelle Vets

- Neurologica corporation

- Koninklijke Philips NV

- Siemens Healthineers

- Sound

- Shenzhen Anke High-Tech

- Xoran Technologies

The Global Veterinary CT Imaging Market was valued at USD 281.7 million in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 555.3 million by 2034, driven by factors such as an increasing global animal population, the rising popularity of pets, greater access to veterinary services, and a higher focus on pet care. As more pets and livestock are diagnosed with chronic and complex health conditions, the demand for advanced diagnostic technologies, including veterinary CT imaging, continues to rise. This technology has revolutionized the way veterinarians assess animal health by offering clear, detailed, and three-dimensional images of animal anatomy, allowing for precise diagnostics and timely interventions.

In addition to its ability to provide high-resolution images of complex anatomical structures, CT imaging is particularly beneficial for emergency cases. Innovations like higher resolution scanners and faster imaging techniques have further enhanced its diagnostic capabilities, making it an invaluable tool in the veterinary field. Furthermore, the growth in veterinary hospitals, clinics, and the increasing availability of pet insurance are boosting market expansion. As pets and livestock face a growing number of health issues, such as tumors, orthopedic injuries, and organ abnormalities, the demand for diagnostic imaging tools like CT scanners will continue to increase.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $281.7 Million |

| Forecast Value | $555.3 Million |

| CAGR | 7.2% |

The companion animal segment held the largest share with 64.9% in 2024, driven by the growing adoption of pets such as dogs and cats, which are increasingly prone to diseases that require advanced diagnostic tools. The increasing awareness of animal health and the availability of specialized treatments are expected to continue driving the demand for veterinary CT imaging, particularly for companion animals. The rising disposable income in emerging economies and the launch of more sophisticated diagnostic devices will further propel this market.

The hardware segment within the veterinary CT imaging market accounted for USD 229.7 million in 2024. This segment includes essential components such as CT scanners, gantries, and detectors, all of which are crucial for obtaining the detailed cross-sectional images that enable accurate diagnoses. As veterinary clinics and hospitals increasingly recognize the importance of advanced diagnostic technologies, the demand for these hardware solutions is expected to grow steadily. These components are critical for producing high-resolution images, allowing veterinarians to identify and address a wide range of conditions in animals. The continued investment in sophisticated diagnostic equipment by veterinary facilities will drive further growth in the hardware segment, enhancing the overall capabilities of veterinary medicine.

United States Veterinary CT Imaging Market was valued at USD 107.1 million in 2024, driven by high rates of pet ownership in the country, along with increasing access to advanced veterinary care. With the growing focus on pet health, owners are more inclined to seek out cutting-edge diagnostic tools for their animals, leading to greater adoption of veterinary CT imaging systems. Additionally, the rise in pet insurance coverage has facilitated the affordability of these advanced diagnostic services, further contributing to market growth. The U.S. also benefits from a well-established infrastructure and ongoing innovations in imaging technology, ensuring that the market remains strong and poised for continued development.

Companies in the Global Veterinary CT Imaging Industry employ strategies such as innovation in imaging technology, expanding product portfolios, and increasing market reach through partnerships and collaborations. Companies like Canon Medical Systems Corporation and Siemens Healthineers focus on developing advanced CT scanners with higher resolution and faster imaging capabilities to meet the growing demand for precise diagnostics. Others, like GE Healthcare and Hallmarq Veterinary Imaging, are investing in expanding their product offerings and increasing their presence in emerging markets. By improving the accessibility and affordability of veterinary imaging solutions, these companies aim to strengthen their market position and cater to the increasing demand for advanced diagnostic tools in veterinary medicine.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increased pet ownership and animal health expenditure

- 3.2.1.2 Rising prevalence of animal diseases and injuries

- 3.2.1.3 Technological advancements in imaging modalities

- 3.2.1.4 Rising number of veterinary practitioners in developed economies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of CT scanners

- 3.2.2.2 Low animal health awareness in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Stationary multi-slice CT scanner

- 5.2.1.1 Mid end

- 5.2.1.2 High end

- 5.2.1.3 Low end

- 5.2.2 Portable CT scanner

- 5.2.1 Stationary multi-slice CT scanner

- 5.3 Consumables

- 5.4 Software

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Companion animal

- 6.3 Livestock animal

- 6.4 Other animal types

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Orthopedics and traumatology

- 7.3 Oncology

- 7.4 Dental

- 7.5 Neurology

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospitals and clinics

- 8.3 Diagnostic imaging centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Carestream Health

- 10.2 Canon Medical Systems Corporation

- 10.3 Epica International

- 10.4 GNI ApS

- 10.5 GE Healthcare

- 10.6 Hallmarq Veterinary Imaging

- 10.7 Hitachi

- 10.8 Isabelle Vets

- 10.9 Neurologica corporation

- 10.10 Koninklijke Philips N.V.

- 10.11 Siemens Healthineers

- 10.12 Sound

- 10.13 Shenzhen Anke High-Tech

- 10.14 Xoran Technologies