|

시장보고서

상품코드

1750563

에탄올 e-연료 시장 : 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Ethanol E-Fuel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

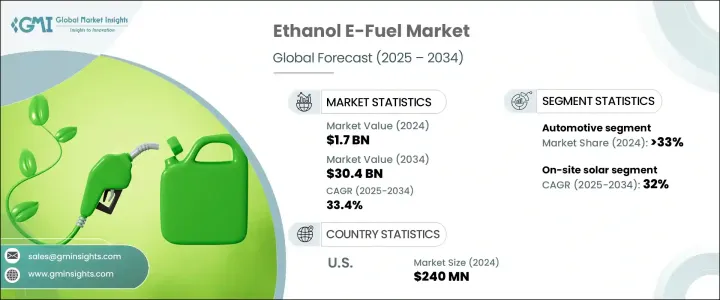

세계의 에탄올 e-연료(전자 연료) 시장은 2024년에는 17억 달러로 평가되었고 효율성과 확장성을 크게 향상시킨 에탄올 생산 기술의 진보로 2034년에는 304억 달러에 이를 것으로 추정되며, CAGR 33.4%로 성장할 전망입니다.

인도 같은 신흥 경제국은 옥수수 등 작물을 에탄올 생산에 활용하고 비식품 원료를 활용한 기술 개발을 촉진하는 데 핵심적인 역할을 해왔습니다. 또한 에탄올 생산 및 유통 인프라 개선은 안정적인 공급을 확보하기 위해 필수적이며, 전 세계 정부는 생산 능력 확대와 물류 개선을 위해 대규모 투자를 진행 중입니다. 이러한 노력은 에탄올의 생산 비용을 낮추고 전통적 연료 대비 경쟁력을 강화하는 것을 목표로 합니다.

탈탄소화와 지속 가능성으로의 전환이 가속화되면서 전 세계적으로 재생 가능 연료, 특히 에탄올에 대한 수요가 증가하고 있습니다. 국가들이 기후 목표 달성을 위해 노력함에 따라 에탄올 e-연료와 같은 지속 가능한 에너지 원천에 대한 수요가 증가하고 있습니다. 시장에는 연료 가격, 농업 정책, 국제 원자재 시장 등 경제적 요인도 영향을 미치고 있습니다. 사탕수수 주스 및 꿀과 같은 다양한 원료 사용을 장려하는 정책은 에탄올 생산 기반을 다각화하여 단일 작물에 대한 의존도를 줄였습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 17억 달러 |

| 예측 금액 | 304억 달러 |

| CAGR | 33.4% |

시장은 다양한 재생 가능 에너지 원천으로 세분화되며, 현장 태양광 발전이 주요 기여 요인으로 부상하고 있습니다. 이 부문은 2034년까지 연간 32%의 인상적인 성장률을 기록할 것으로 예상됩니다. 태양광 발전은 전통적인 화석 연료에 대한 의존도를 줄이고 에탄올 제조와 관련된 탄소 배출량을 크게 감소시켜 에탄올 생산 환경을 혁신하고 있습니다. 태양광 발전으로의 전환은 프로세스를 더 친환경적으로 만들 뿐만 아니라 에너지 비용을 절감해 장기적으로 에탄올 생산의 경제적 타당성과 지속 가능성을 높입니다.

자동차 산업은 에탄올 e-연료 시장 확대의 주요 동력으로 부상했으며, 2024년 기준 33%의 상당한 시장 점유율을 차지했습니다. 산업의 지속적인 변혁과 소비자의 연료 효율성과 환경 친화적 차량에 대한 수요 증가가 에탄올 e-연료 시장 성장을 직접적으로 촉진하고 있습니다. 소비자들은 전통적인 가솔린이나 디젤 대신 에탄올 e-연료와 같은 대체 연료를 사용하는 환경 친화적 자동차에 대한 선호도를 점점 더 높이고 있습니다. 이처럼 친환경 기술로의 전환은 더 깨끗하고 효율적인 대안을 제공하는 에탄올 e-연료의 채택을 가속화하고 있습니다.

미국의 에탄올 e-연료 2024년 시장 규모는 2억 4,000만 달러로 평가되었습니다. 세계 최대의 에탄올 생산국이자 소비국인 미국은 에탄올 생산 기술과 재생 가능 연료 지원을 위한 정책 시행에서 선도적인 역할을 계속하고 있습니다. 정부 인센티브와 환경 문제에 대한 대중의 인식 향상은 미국 내 다양한 산업 분야에서 에탄올 e-연료 수요를 촉진하고 있습니다. 이 역동적인 시장 환경은 에탄올 e-연료 산업의 혁신과 성장에 중요한 기회를 제공하며, 해당 산업이 글로벌 리더로서의 위치를 공고히 하고 있습니다.

세계의 에탄올 e-연료 업계의 주요 기업으로는 Green Plains Inc., Cargill, POET, Valero Energy, Raizen, ADM, Marquis Energy, Flint Hills Resources, GranBio 등이 있습니다. 에탄올 e-연료 분야 기업들은 시장 지위를 강화하기 위해 다양한 전략을 채택하고 있습니다. 많은 기업은 운영 비용을 절감하고 생산 효율성을 높이기 위해 고급 생산 기술 개발에 대규모 투자를 진행하고 있습니다. 재생 에너지 공급업체, 특히 태양광과 풍력 에너지 분야와의 파트너십과 협력이 증가하고 있으며, 이는 탄소 배출량을 줄이고 지속 가능성을 강화하기 위한 노력의 일환입니다. 또한 기업들은 공급망 탄력성을 확보하고 특정 농산물에 대한 의존도를 줄이기 위해 원료 공급원을 다각화하고 있으며, 비식용 작물의 활용을 확대하는 방향으로 나아가고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 트럼프 정권의 관세 분석

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원자재)

- 주요 원자재의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원자재)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 규제 상황

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 전략적 대시보드

- 전략적 노력

- 기업의 시장 점유율

- 경쟁 벤치마킹

- 혁신과 지속가능성의 정세

제5장 시장 규모와 예측 : 재생 에너지원별(2021-2034년)

- 주요 동향

- 현장 태양광

- 풍력

제6장 시장 규모와 예측 : 기술별(2021-2034년)

- 주요 동향

- 피셔트롭슈

- eRWGS

- 기타

제7장 시장 규모와 예측 : 용도별(2021-2034년)

- 주요 동향

- 자동차

- 해양

- 항공

- 산업

- 기타

제8장 시장 규모와 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 네덜란드

- 스페인

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

- 라틴아메리카

- 브라질

- 아르헨티나

제9장 기업 프로파일

- Abengoa Bioenergy

- ADM

- Cargill

- COFCO

- Energix Renewable Fuels

- Flint Hills Resources

- Glacial Lakes Energy

- GranBio

- Green Plains Inc.

- KAAPA Ethanol

- Marquis Energy

- Pacific Ethanol

- POET

- Raizen

- The Andersons

- Valero Energy

- Vivergo Fuels

The Global Ethanol E-Fuel Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 33.4% to reach USD 30.4 billion by 2034, driven by advancements in ethanol production technologies, which have significantly enhanced efficiency and scalability. Emerging economies like India have played a key role in encouraging the use of crops such as maize for ethanol production and developing technologies for using non-food feedstocks. Furthermore, developing infrastructure to improve ethanol production and distribution has become critical in ensuring a steady supply, with governments worldwide making substantial investments to expand production capacities and logistics. These efforts aim to lower production costs and increase the competitiveness of ethanol as a cleaner alternative to conventional fuels.

The increasing shift toward decarbonization and sustainability fuels the global demand for renewable fuels, particularly ethanol. As countries work toward achieving their climate goals, the need for sustainable energy sources like ethanol e-fuel is growing. The market is also influenced by economic factors such as fuel prices, agricultural policies, and international commodity markets. Policies encouraging diverse feedstocks, including sugarcane juice and molasses, have diversified the ethanol production base, reducing dependence on a single crop.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $30.4 Billion |

| CAGR | 33.4% |

The market is further divided into various renewable energy sources, with on-site solar power emerging as a major contributor. The segment is expected to experience an impressive growth rate of 32% annually until 2034. Solar power is revolutionizing the ethanol production landscape by reducing dependence on traditional fossil fuels and significantly lowering the carbon emissions associated with ethanol manufacturing. This transition to solar-powered production not only makes the process more eco-friendly but also drives down energy costs, making ethanol production more financially viable and sustainable in the long term.

The automotive sector has proven to be the driving force behind the expansion of the ethanol e-fuel market, holding a substantial share of 33% in 2024. The automotive industry's ongoing transformation, with increasing consumer demand for fuel-efficient and environmentally friendly vehicles, is directly boosting the market for ethanol e-fuel. Consumers are showing a growing preference for eco-conscious automotives that run on alternative fuels, such as ethanol e-fuels, as opposed to conventional gasoline or diesel. This shift toward greener technologies is accelerating the adoption of ethanol e-fuels, which offer a cleaner and more efficient alternative.

U.S. Ethanol E-Fuel Market was valued at USD 240 million in 2024. As one of the largest producers and consumers of ethanol in the world, the U.S. continues to lead in both ethanol production technologies and the implementation of policies supporting renewable fuels. Government incentives, alongside growing public awareness of environmental concerns, are driving the demand for ethanol e-fuels across multiple sectors in the U.S. This dynamic market environment creates significant opportunities for innovation and growth in the ethanol e-fuel industry, solidifying its role as a global leader in the sector.

Leading companies in the Global Ethanol E-Fuel Industry include Green Plains Inc., Cargill, POET, Valero Energy, Raizen, ADM, Marquis Energy, Flint Hills Resources, and GranBio. To strengthen their market positions, companies in the ethanol e-fuel sector are adopting a range of strategies. Many invest heavily in developing advanced production technologies that reduce operational costs and increase yield efficiency. Partnerships and collaborations with renewable energy providers, especially in solar and wind power, are becoming common as companies aim to lower their carbon footprints and enhance sustainability. Additionally, companies are diversifying their feedstock sources, including expanding the use of non-food crops, to ensure supply chain resilience and reduce reliance on specific agricultural products.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiative

- 4.4 Company market share

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Renewable Source, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 On-Site Solar

- 5.3 Wind

Chapter 6 Market Size and Forecast, By Technology, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.1.1 Fischer-tropsch

- 6.1.2 eRWGS

- 6.1.3 Others

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.1.1 Automotive

- 7.1.2 Marine

- 7.1.3 Aviation

- 7.1.4 Industrial

- 7.1.5 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Netherlands

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 Abengoa Bioenergy

- 9.2 ADM

- 9.3 Cargill

- 9.4 COFCO

- 9.5 Energix Renewable Fuels

- 9.6 Flint Hills Resources

- 9.7 Glacial Lakes Energy

- 9.8 GranBio

- 9.9 Green Plains Inc.

- 9.10 KAAPA Ethanol

- 9.11 Marquis Energy

- 9.12 Pacific Ethanol

- 9.13 POET

- 9.14 Raizen

- 9.15 The Andersons

- 9.16 Valero Energy

- 9.17 Vivergo Fuels