|

시장보고서

상품코드

1755223

차량 제어 장치 시장 : 기회, 성장 촉진 요인, 산업 동향 분석, 예측(2025-2034년)Vehicle Control Unit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

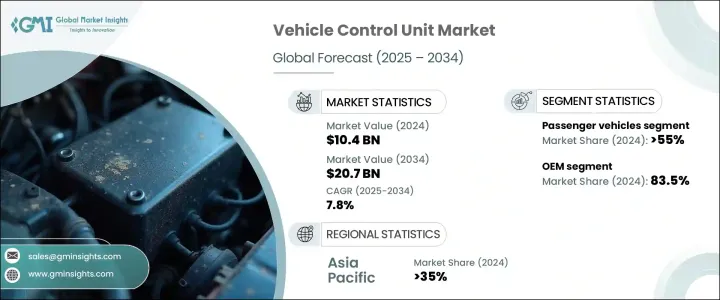

차량 제어 장치 세계 시장 규모는 2024년에 104억 달러로 평가되었고, CAGR 7.8%로 성장하여 2034년에는 207억 달러에 이를 것으로 예측됩니다.

시장 성장의 원동력은 전기자동차(EV)의 보급이 진행되고 있는 것입니다. EV는 배터리 시스템, 전기 모터, 회생 브레이크, 충전 조작 등의 복잡한 기능을 효율적으로 관리하는 VCU를 필요로 합니다. VCU는 에너지 관리, 안전 및 차량 지능을 향상시키는 이 프로세스의 핵심입니다.

또한 소프트웨어 정의 차량 아키텍처로의 마이그레이션을 통해 시장이 확대되고 있습니다. 상용차와 승용차 모두 ADAS와 자율주행 기술에 대한 수요가 증가하고 있어 고성능 VCU의 요구가 더욱 높아지고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 104억 달러 |

| 예측 금액 | 207억 달러 |

| CAGR | 7.8% |

2024년 승용차 부문은 50억 달러를 낳고 특히 미국, 중국, 유럽 등 주요 시장에서 55%의 점유율을 차지합니다. 자동차와 하이브리드 드라이브 트레인으로의 전환을 주도하고 있으며, 여러 디지털 서브시스템을 종합적으로 조정해야 합니다.

2024년에는 OEM 부문이 시장을 선도했으며, 83.5%의 점유율을 획득했습니다. 이어 개발 협력을 통해 VCU는 규제 준수와 통합 효율성을 염두에 두고 집중형 컴퓨팅과 소프트웨어 우선 차량 설계를 선호하는 경향이 강해지고 있으며, OEM은 OTA 기능과 클라우드 기반 서비스, 실시간 시스템 업그레이드 등의 고급 기능을 지원하는 VCU를 도입하고 있으며, 그 시장 규모는 더욱 확대되고 있습니다.

아시아태평양의 차량 제어 장치 시장은 2024년에 35%의 점유율을 차지합니다. 인센티브 프로그램과 국산 VCU 기술의 진보로 중국은 VCU 채용의 최전선에 위치하고 있습니다.

세계 차량 제어 장치 시장의 주요 기업은 ASI Robots, Continental AG, Robert Bosch, Infineon, Denso, ZF Friedrichshafen AG, STMicroelectronics, NXP Semiconductors, Dorleco, Delphi Technologies 등이 있습니다. 이러한 기업은 시장에서 경쟁력을 확보하기 위해 다양한 전략을 구사하고 있습니다. 기업은 AI 주도의 VCU 솔루션, 클라우드 연결, OTA 업데이트 프레임워크에 투자하고 있으며, 진화하는 자동차의 안전 규제와 소프트웨어 규제에 대응하면서, 세계 수요 증가에 대응하기 위해 많은 기업이 아시아와 유럽에서의 제조 능력을 확대하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 비용 구조

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 영향요인

- 성장 촉진요인

- 전기자동차의 성장

- ADAS(선진 운전 지원 시스템)와 자동화의 대두

- 연결성과 인포테인먼트 수요

- 엄격한 배출가스 및 안전규제

- 업계의 잠재적 위험 및 과제

- 개발 및 구현 비용이 높아

- 증가하는 사이버 보안 위험

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTEL 분석

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 가격 동향 s

- 지역별

- 제품별

- 생산 통계

- 생산 거점

- 소비 거점

- 수출과 수입

- 코스트 내역 분석

- 특허 분석

- 지속가능성과 환경 측면

- 지속가능한 관행

- 폐기물 삭감 전략

- 생산에 있어서의 에너지 효율

- 환경 친화적 인 노력

- 카본 풋 프린트의 고려

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카 항공

- 중동 및 아프리카

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장계획과 자금조달

제5장 시장 추정 및 예측 : 추진력별, 2021년-2034년

- 주요 동향

- ICE

- 전기자동차(EV)

- 연료전지 전기자동차(FCEV)

제6장 시장 추정 및 예측 : 차량별, 2021년-2034년

- 주요 동향

- 승용차

- 세단

- SUV

- 해치백

- 상용차

- 소형 상용차

- MCV

- HCV

- 오프로드 차량

제7장 시장 추정 및 예측 : 기능별, 2021년-2034년

- 주요 동향

- 파워트레인 제어

- 배터리 관리 시스템(BMS) 통합

- ADAS(선진 운전 지원 시스템)(ADAS)

- 인포테인먼트와 커넥티비티

- 자율주행 시스템

- 기타

제8장 시장 추정 및 예측 : 용량별, 2021년-2034년

- 주요 동향

- 16비트

- 32비트

- 64비트

제9장 시장 추정 및 예측 : 컴포넌트별, 2021년-2034년

- 주요 동향

- 하드웨어

- 마이크로컨트롤러/마이크로프로세서

- 메모리 유닛

- 입출력 인터페이스

- 전원 관리 컴포넌트

- 기타

- 소프트웨어

- 운영체제

- 제어 알고리즘

- 진단 시스템

- 사용자 인터페이스

- 기타

제10장 시장 추정 및 예측 : 유통 채널별, 2021년-2034년

- 주요 동향

- OEM

- 애프터마켓

제11장 시장 추정 및 예측 : 커뮤니케이션 유형별, 2021년-2034년

- 주요 동향

- CAN(컨트롤러 영역 네트워크)

- LIN(로컬 상호 연결 네트워크)

- FlexRay(플렉서블 데이터 레이트 네트워크)

- 이더넷

제12장 시장 추정 및 예측 : 지역별, 2021년-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 남아프리카

- 사우디아라비아

제13장 기업 프로파일

- ASI Robots

- Continental

- Delphi Technologies

- Denso

- Dorleco

- Embitel

- Hitachi Astemo

- Huawei Technologies

- Infineon

- Nidec Corporation

- NXP Semiconductors

- Pues Corporation

- Renesas Electronics Corporation

- Robert Bosch

- Samino Inc

- STMicroelectronics

- Texas Instruments

- Valeo

- Vitesco Technologies

- ZF Friedrichshafen

The Global Vehicle Control Unit Market was valued at USD 10.4 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 20.7 billion by 2034. The market growth is driven by the rising adoption of electric vehicles (EVs), which require VCUs to efficiently manage complex functions such as battery systems, electric motors, regenerative braking, and charging operations. Unlike traditional internal combustion vehicles, EVs rely on multiple interconnected systems that need real-time coordination. VCUs are central to this process, improving energy management, safety, and vehicle intelligence. As sustainability regulations tighten and incentives increase, automakers are accelerating EV production, which in turn is increasing the need for more advanced and scalable VCU solutions globally.

The market is also expanding due to the shift towards software-defined vehicle architectures. Automakers are integrating VCUs to enable over-the-air (OTA) updates, real-time diagnostics, and centralized vehicle monitoring. These systems allow for modular feature upgrades and adaptive performance management. Additionally, rising demand for ADAS and autonomous technologies in both commercial and passenger vehicles is further boosting the need for high-performance VCUs. By processing input from a wide range of sensors, VCUs facilitate intelligent driving functions such as lane assistance, emergency braking, and adaptive cruise control-making them vital in modern vehicle designs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.4 Billion |

| Forecast Value | $20.7 Billion |

| CAGR | 7.8% |

In 2024, the passenger vehicle segment generated USD 5 billion, claiming 55% share especially in leading markets such as the United States, China, and Europe. As newer vehicles roll off assembly lines with increasingly sophisticated digital features, the demand for integrated VCUs continues to surge. Passenger cars are leading the transition to electric and hybrid drivetrains, which require comprehensive coordination across multiple digital subsystems. VCUs make this integration seamless, ensuring optimal vehicle performance while supporting infotainment, safety, and driver-assist systems.

The OEM segment led the market in 2024, capturing 83.5% share. Vehicle control units are embedded into vehicle systems during the manufacturing process, making OEMs the primary integrators. These units must be customized to suit the architecture of different vehicle platforms and brands. Collaborations between OEMs and Tier 1 suppliers ensure that VCUs are developed with regulatory compliance and integration efficiency in mind. With a growing preference for centralized computing and software-first vehicle design, OEMs are deploying VCUs to support advanced functionalities like OTA capabilities, cloud-based services, and real-time system upgrades, which further expands their market footprint.

Asia Pacific Vehicle Control Unit Market held 35% share in 2024. As one of the top automotive manufacturing hubs globally, China benefits from strong domestic production capabilities, low-cost manufacturing, and proactive government support. Incentive programs for electric and intelligent vehicles, as well as advancements in homegrown VCU technologies, have positioned China at the forefront of VCU adoption. The country's push for smart mobility and energy-efficient vehicles is accelerating the rollout of VCUs across new vehicle platforms.

Key players in the Global Vehicle Control Unit Market include ASI Robots, Continental AG, Robert Bosch, Infineon, Denso, ZF Friedrichshafen AG, STMicroelectronics, NXP Semiconductors, Dorleco, and Delphi Technologies. These companies are leveraging a range of strategies to secure competitive positioning in the market. Core approaches include the development of modular VCU platforms that support vehicle electrification and ADAS, as well as partnerships with automakers for customized integration. Major players are investing in AI-driven VCU solutions, cloud connectivity, and OTA update frameworks. Additionally, many are expanding their manufacturing capabilities in Asia and Europe to meet rising global demand while complying with evolving automotive safety and software regulations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.5 Forecast model

- 1.6 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Propulsion

- 2.2.3 Vehicle

- 2.2.4 Functionality

- 2.2.5 Capacity

- 2.2.6 Component

- 2.2.7 Distribution Channel

- 2.2.8 Communication Type

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth of electric vehicles

- 3.2.1.2 Rise of advanced driver assistance systems and automation

- 3.2.1.3 Connectivity and infotainment demand

- 3.2.1.4 Stringent emission and safety regulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High development and implementation costs

- 3.2.2.2 Growing cybersecurity risks

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 ICE

- 5.3 Electric Vehicles (EVs)

- 5.4 Fuel Cell Electric Vehicles (FCEVs)

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger Vehicles

- 6.2.1 Sedan

- 6.2.2 SUV

- 6.2.3 Hatchback

- 6.3 Commercial Vehicles

- 6.3.1 LCV

- 6.3.2 MCV

- 6.3.3 HCV

- 6.4 Off-highway Vehicles

Chapter 7 Market Estimates & Forecast, By Functionality, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Powertrain control

- 7.3 Battery management system (BMS) integration

- 7.4 Advanced driver assistance systems (ADAS)

- 7.5 Infotainment and connectivity

- 7.6 Autonomous driving systems

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 16-bit

- 8.3 32-bit

- 8.4 64-bit

Chapter 9 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Hardware

- 9.2.1 Microcontrollers/microprocessors

- 9.2.2 Memory units

- 9.2.3 Input/output interfaces

- 9.2.4 Power management components

- 9.2.5 Others

- 9.3 Software

- 9.3.1 Operating systems

- 9.3.2 Control algorithms

- 9.3.3 Diagnostic systems

- 9.3.4 User interfaces

- 9.3.5 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Communication Type, 2021 - 2034 ($Bn)

- 11.1 Key trends

- 11.2 CAN (Controller Area Network)

- 11.3 LIN (Local Interconnect Network)

- 11.4 FlexRay (Flexible Data-Rate Network)

- 11.5 Ethernet

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.3.7 Nordics

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Southeast Asia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 South Africa

- 12.6.3 Saudi Arabia

Chapter 13 Company Profiles

- 13.1 ASI Robots

- 13.2 Continental

- 13.3 Delphi Technologies

- 13.4 Denso

- 13.5 Dorleco

- 13.6 Embitel

- 13.7 Hitachi Astemo

- 13.8 Huawei Technologies

- 13.9 Infineon

- 13.10 Nidec Corporation

- 13.11 NXP Semiconductors

- 13.12 Pues Corporation

- 13.13 Renesas Electronics Corporation

- 13.14 Robert Bosch

- 13.15 Samino Inc

- 13.16 STMicroelectronics

- 13.17 Texas Instruments

- 13.18 Valeo

- 13.19 Vitesco Technologies

- 13.20 ZF Friedrichshafen