|

시장보고서

상품코드

1755364

주행차량 중량 계측기 시장 : 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Automotive Weigh in Motion Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

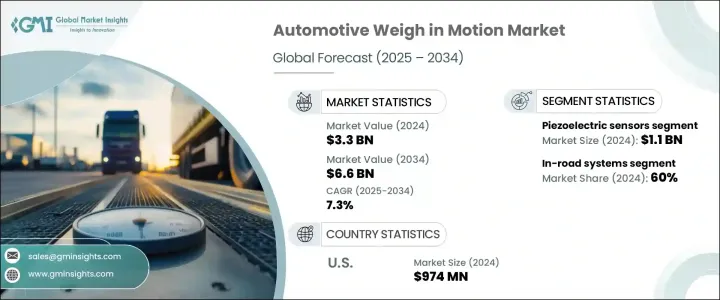

세계의 주행차량 중량 계측기 시장 규모는 2024년에 33억 달러로 평가되었고, 2034년에는 66억 달러에 이를 것으로 예측되며, CAGR 7.3%로 성장할 전망입니다.

이러한 상승 추세는 화물 운송 통로, 통행료 징수소, 고속도로 및 물류 허브에서 지능형 교통 솔루션 및 실시간 차량 중량 추적에 대한 수요가 증가함에 따라 가속화되고 있습니다. 교통 흐름을 중단하지 않고 정확한 동적 차량 중량 측정에 대한 수요가 증가함에 따라 WIM 기술의 광범위한 채택이 진행되고 있습니다. 정부 및 교통 당국은 도로 안전 강화, 도로 수명 연장, 차축 하중 규정 준수 확보를 위해 WIM 시스템 도입을 확대하고 있습니다. 인공지능, 고급 센서, 실시간 데이터 분석 기술의 통합을 통해 WIM 시스템은 전 세계 교통 인프라에서 더욱 신뢰성 있고 효율적이며 지능적인 솔루션으로 발전하고 있습니다.

이 시스템은 클라우드 통합, 내장형 카메라, 고속 데이터 전송, 원격 진단 기능을 포함해 교통 관리를 효율화합니다. IoT 기반 센서, 예측 유지보수 기능, 디지털 트윈 시뮬레이션의 활용은 인프라 계획 수립 방식도 혁신하고 있습니다. 내장형 조작 방지 기능, 사이버 보안 프로토콜, 준수 기능은 안전한 도로 모니터링을 추가로 지원합니다. 이러한 혁신은 당국과 상업 운영자가 비용을 절감하고 운영 효율성을 향상시키며 교통 혼란을 줄이는 동시에 도시 및 장거리 운송 노선 전반에서 환경 지속 가능성을 개선할 수 있도록 지원합니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 33억 달러 |

| 예측 금액 | 66억 달러 |

| CAGR | 7.3% |

압전 센서 부문은 2024년에 11억 달러의 매출을 올리며 전 세계 WIM 시장에서 가장 큰 비중을 차지하는 센서 유형이 되었습니다. 이들의 광범위한 사용은 높은 신호 감도, 컴팩트한 크기, 고속도로 속도에서 무게를 측정할 수 있는 능력에서 비롯됩니다. 교통 당국은 설치 과정이 간단하고 유지보수 비용이 적다는 점에서 이 센서를 선호합니다. 대규모 배포에서 확장 가능하고 비용 효율적인 시스템이 필수적이기 때문에 특히 효과적입니다. 기존 도로 인프라와의 호환성, 교통 데이터, 통행료 운영, 화물 분석 지원을 통해 스마트 모빌리티 프로젝트에서 높은 매력을 보이고 있습니다.

2024년 기준 도로 내 시스템이 60%의 시장 점유율을 차지했습니다. 이 시스템은 도로에 직접 내장되어 교통 지연 없이 연속적이고 정확한 무게 데이터를 제공합니다. 고밀도 교통 구간, 화물 운송 노선, 통행료 수납소 등에 최적화되어 있습니다. 지능형 교통 네트워크와의 원활한 통합을 통해 자동화, 단속 정확도 향상, 운영 효율성 증대를 실현합니다. 당국은 도로 내 WIM 시스템을 통해 고속 차량 분류, 실시간 준수 점검, 동적 차량 평가를 수동 개입 없이 수행합니다. 낮은 가시성과 높은 성능은 도로 인프라 최적화와 규제 집행에 필수적인 도구로 자리매김했습니다.

미국의 주행차량 중량 계측기 시장은 2024년 9억 7,400만 달러를 창출해 2034년까지 연평균 성장률(CAGR) 7.6%로 성장할 전망입니다. 미국은 교통 인프라의 현대화 및 디지털 전환을 강력하게 추진하여 WIM 채택의 선두 주자로 자리매김했습니다. 도로의 품질 유지, 화물량 관리, 차축 하중 규정 준수에 중점을 둔 결과, 전국적으로 첨단 중량 모니터링 시스템이 도입되었습니다. 전 세계에서 가장 광범위한 고속도로 시스템을 갖춘 미국은 도시 및 농촌의 화물 운송 통로를 위해 고정밀 WIM 기술에 지속적으로 투자하고 있습니다. 연방 및 주 차원의 자금 지원, 강력한 ITS 생태계, 데이터 기반의 교통 정책 이니셔티브의 증가에 힘입어 미국 시장은 차세대 WIM 플랫폼의 혁신 및 배포를 위한 핵심 허브로 남아 있습니다.

이 시장 진출기업은 Intercomp, SWARCO AG, Kistler, Q-Free ASA, Kapsch TrafficCom, Siemens Mobility, TE Connectivity, TDC Systems Ltd., Econolite, International Road Dynamics 등이 있습니다. 주행차량 중량 계측 시장에서의 경쟁력을 강화하기 위해 기업들은 AI 기반 중량 분석, 센서 통합, 스마트 인프라 호환성 등 지속적인 혁신에 집중하고 있습니다. 클라우드 연결성, 머신 러닝, 에지 컴퓨팅에 대한 투자는 실시간 진단 및 자동화된 차량 분류를 가능하게 합니다. 기업들은 다양한 도로 조건과 교통 밀도에 대응하기 위해 확장 가능한 모듈형 시스템을 제공하고 있습니다. 교통 당국 및 스마트 시티 계획자들과의 협업은 적용 분야를 확장하는 데 핵심적인 역할을 하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 비용 구조

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 시장 기회

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTEL 분석

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 코스트 내역 분석

- 특허 분석

- 지속가능성과 환경 측면

- 지속가능한 관행

- 폐기물 삭감 전략

- 생산에 있어서의 에너지 효율

- 환경 친화적 인 노력

- 카본 풋 프린트의 고려

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카 항공

- 중동 및 아프리카

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장계획과 자금조달

제5장 시장 추계 및 예측 : 설비별(2021-2034년)

- 주요 동향

- 도로내 시스템

- 계량교 시스템

- 온보드 시스템

제6장 시장 추계 및 예측 : 센서별(2021-2034년)

- 주요 동향

- 압전 센서

- 벤딩 플레이트

- 단일 로드셀

- 기타

제7장 시장 추계 및 예측 : 차축 구성별(2021-2034년)

- 주요 동향

- 단일 축

- 탠덤 축

- 삼중 축

- 사중 축

제8장 시장 추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 중량 제한

- 교통 데이터 수집

- 중량 기반 통행료 징수

- 교량 보호

- 산업용 트럭 계량

제9장 시장 추계 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 정부

- 운송

- 민간 부문

- 기타

제10장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

제11장 기업 프로파일

- Adient

- Applus

- Axis Communications

- Cestel

- Continental

- Econolite

- Efftronics Systems

- Golden River

- IAC Group

- Intercomp

- International Road Dynamics

- Kapsch TrafficCom

- Kasai Kogyo

- Q-Free ASA

- Siemens Mobility

- SWARCO AG

- TDC Systems

- TE Connectivity

- Wavetronix

- WIM Systems

The Global Automotive Weigh in Motion Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 6.6 billion by 2034. This upward trend is fueled by rising demand for intelligent traffic solutions and real-time vehicle weight tracking across freight corridors, toll booths, highways, and logistics hubs. The expanding need for accurate, dynamic vehicle weighing without halting traffic is leading to the widespread adoption of WIM technologies. Governments and transportation authorities are increasingly turning to WIM systems to boost road safety, extend road lifespans, and ensure compliance with axle-load regulations. With the integration of artificial intelligence, advanced sensors, and real-time data analytics, WIM systems are becoming more reliable, efficient, and intelligent across transportation infrastructures worldwide.

These systems now include cloud integration, embedded cameras, high-speed data transfer, and remote diagnostics to streamline traffic management. The use of IoT-powered sensors, predictive maintenance features, and digital twin simulations has also reshaped infrastructure planning. Built-in tamper resistance, cybersecurity protocols, and compliance features further support safe and efficient road monitoring. These innovations empower authorities and commercial operators to cut costs, enhance operational efficiency, and reduce traffic disruptions while improving environmental sustainability across both urban and long-haul transport routes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 billion |

| Forecast Value | $6.6 billion |

| CAGR | 7.3% |

The piezoelectric sensors segment generated USD 1.1 billion in 2024, making it the leading sensor type in the global WIM market. Their widespread use stems from their high signal sensitivity, compact size, and ability to measure weights at highway speeds. These sensors are a preferred choice for transportation authorities due to their straightforward installation process and minimal upkeep needs. They are particularly effective in large-scale deployments, where scalable and cost-efficient systems are essential. Their compatibility with existing road infrastructure, as well as their ability to support traffic data applications, toll operations, and freight analytics, makes them highly attractive in smart mobility projects.

In 2024, in-road systems led the market with a 60% share. These systems are directly embedded into roadways and provide continuous, accurate weight data without causing traffic delays. They are ideally suited for high-traffic corridors, freight transport routes, and toll stations. Their seamless integration into intelligent transportation networks enables automation, improves enforcement accuracy, and increases operational throughput. Authorities rely on in-road WIM systems to carry out high-speed vehicle classification, real-time compliance checks, and dynamic vehicle assessments, all without manual intervention. Their low visibility and high performance make them vital tools in road infrastructure optimization and regulatory enforcement.

U.S. Automotive Weigh in Motion Market generated USD 974 million in 2024 and is estimated to grow at a CAGR of 7.6% through 2034. The country's strong push toward infrastructure modernization and digital transformation in transportation has positioned it as a key leader in WIM adoption. The focus on preserving road quality, managing freight volumes, and adhering to axle-load compliance rules has driven nationwide deployments of advanced weight monitoring systems. With one of the most extensive highway systems globally, the U.S. continues to invest in high-precision WIM technology for both urban and rural freight corridors. Backed by federal and state-level funding, robust ITS ecosystems, and increasing data-driven transport policy initiatives, the U.S. market remains a key hub for innovation and deployment of next-gen weigh-in-motion platforms.

Key industry participants in the Automotive Weigh in Motion Market include Intercomp, SWARCO AG, Kistler, Q-Free ASA, Kapsch TrafficCom, Siemens Mobility, TE Connectivity, TDC Systems Ltd., Econolite, and International Road Dynamics. To enhance their position in the automotive weigh-in-motion market, companies are focusing on continuous innovation, particularly in AI-powered weight analytics, sensor integration, and smart infrastructure compatibility. Investments in cloud connectivity, machine learning, and edge computing help deliver real-time diagnostics and automated vehicle classification. Firms are also offering scalable modular systems to meet varying roadway conditions and traffic densities. Collaborations with transportation authorities and smart city planners have become central to expanding application areas.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Installation

- 2.2.3 Sensor

- 2.2.4 Axle configuration

- 2.2.5 Application

- 2.2.6 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly initiatives

- 3.10.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Installation, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 In-road systems

- 5.3 Weight bridge systems

- 5.4 Onboard systems

Chapter 6 Market Estimates & Forecast, By Sensor, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Piezoelectric sensors

- 6.3 Bending plate

- 6.4 Single load cell

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Axle Configuration, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Single axle

- 7.3 Tandem axle

- 7.4 Triple axle

- 7.5 Quad axle

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Weight enforcement

- 8.3 Traffic data collection

- 8.4 Weight based tolling

- 8.5 Bridge protection

- 8.6 Industrial truck weighing

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 Government

- 9.3 Transportation

- 9.4 Private sector

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Adient

- 11.2 Applus

- 11.3 Axis Communications

- 11.4 Cestel

- 11.5 Continental

- 11.6 Econolite

- 11.7 Efftronics Systems

- 11.8 Golden River

- 11.9 IAC Group

- 11.10 Intercomp

- 11.11 International Road Dynamics

- 11.12 Kapsch TrafficCom

- 11.13 Kasai Kogyo

- 11.14 Q-Free ASA

- 11.15 Siemens Mobility

- 11.16 SWARCO AG

- 11.17 TDC Systems

- 11.18 TE Connectivity

- 11.19 Wavetronix

- 11.20 WIM Systems