|

시장보고서

상품코드

1766178

황산암모늄 시장 : 기회, 성장 촉진 요인, 산업 동향 분석, 예측(2025-2034년)Ammonium Sulphate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

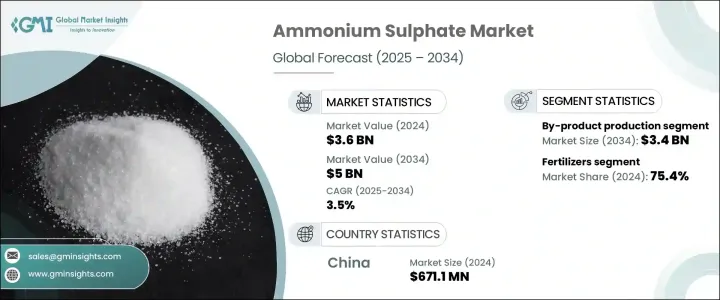

황산암모늄 세계 시장 규모는 2024년 36억 달러에 달했고, CAGR 3.5%로 성장하여 2034년에는 50억 달러에 달할 것으로 예측되고 있습니다. 이러한 성장은 전 세계 식량 생산 지원의 필요성 증가, 농업 운영 확대, 그리고 증가하는 인구를 위한 식량 공급망 확보를 위한 수요 증가에 의해 주도되고 있습니다. 상승을 위한 선호되는 선택이 되고 있습니다. 지속 가능한 농업을 추진하는 정부의 이니셔티브에 지지되어 개발 도상 지역에서 이 화합물의 중요성이 높아지고 있습니다.

세계의 황산암모늄 수요의 75% 이상은 비료 사용에 의한 것입니다. 이 화합물은 수처리, 의약품 제조, 식품 가공과 같은 산업 분야에서도 점점 더 많은 역할을 하고 있습니다. 배기가스 탈황 시스템에서의 적용은 특히 엄격한 대기질 기준을 준수하는 분야에서 중요성을 얻고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 36억 달러 |

| 예측 금액 | 50억 달러 |

| CAGR | 3.5% |

2024년 부산물 생산 방식이 24억 달러의 공헌을 했으며, CAGR 3.5%로 성장하고, 2034년에는 34억 달러에 이를 것으로 예측되고 있습니다. 석탄 배기 가스의 스크러빙 중에 황산암모늄을 회수합니다. 특히, 황산암모늄과 같은 사용 가능한 형태로의 황 회수를 촉진하는 산업 배출 지령과 같은 시책하에서는 이러한 방법에 의해 생산 코스트를 낮추는 것과 동시에, 환경에 대한 우려에도 대응할 수 있습니다.

2024년 시장은 비료부문이 75.4%의 점유율을 차지했습니다. 옥수수, 쌀, 기타 곡물 등의 작물은 그 사용 편의성과 다른 비료와의 궁합에서 혜택을 받고 있습니다.

중국의 황산암모늄 2024년 시장 규모는 6억 7,110만 달러에 달하고, CAGR 3.6%로 성장해 2034년에는 9억 5,390만 달러에 이를 것으로 예측되고 있습니다. 약 25%를 생산하고 있으며, 특히 벼농사에서는 황산암모늄과 같은 토양개량제에 대한 의존도가 높습니다.

세계 황안산업의 주요 기업으로는 BASF SE, UBE Corporation, OCI Nitrogen, Evonik Industries AG, Lanxess AG 등이 있습니다. 황산암모늄 시장의 주요 기업이 채택하는 주요 전략은 전략적 제휴에 의한 생산 능력의 확대, 비용 효율적인 생산 기술의 연구개발 강화, 부가가치가 높은 산업용도의 개척입니다. 사업 및 시설 확대를 통해 아시아태평양과 같은 고성장 지역에서의 사업 거점을 확대하는 것도 주요 우선순위가 되고 있습니다. 또한 주요 기업은 특히 비료 수요가 급증하고 있는 신흥국에서 보다 좋은 서비스 제공과 지역 밀착형 지원을 확보하기 위해 공급망과 유통망을 강화하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 산업 고찰

- 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 산업에 미치는 영향요인

- 성장 촉진요인

- 산업의 잠재적 리스크?과제

- 시장 기회

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTEL 분석

- 가격 동향

- 지역별

- 제품 형태별

- 장래 시장 동향

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 특허 상황

- 무역 통계

(참고: 무역 통계는 주요 국가에서만 제공됩니다.)

- 주요 수입국

- 주요 수출국

- 지속가능성과 환경 측면

- 지속 가능한 실습

- 폐기물 삭감 전략

- 생산에 있어서의 에너지 효율

- 친환경 활동

- 탄소 발자국의 고려

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카 항공

- 중동 및 아프리카

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확대 계획

제5장 시장 추정 및 예측 : 제조 방법별, 2021-2034년

- 주요 동향

- 합성생산

- 제품별 생산

- 카프로락탐 생산

- 코크스로의 조업

- 메틸메타크릴레이트의 생산

- 기타 제품별 소스

제6장 시장 추정 및 예측 : 제품 형태별, 2021-2034년

- 주요 동향

- 고체

- 입상

- 결정질

- 액체

제7장 시장 추정 및 예측 : 순도별, 2021-2034년

- 주요 동향

- 표준 등급(99% 이하)

- 고순도 등급(99% 이상)

제8장 시장 추정 및 예측 : 용도별, 2021-2034년

- 주요 동향

- 비료

- 스트레이트 비료

- 복합 비료

- 특수 비료

- 산업용도

- 섬유산업

- 수처리

- 식품 첨가물

- 난연제

- 화학제조

- 기타

- 의약품

- 기타

제9장 시장 추정 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 기타 라틴아메리카

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

제10장 기업 프로파일

- BASF SE

- AdvanSix Inc.

- CF Industries Holdings, Inc.

- Domo Chemicals GmbH

- Domo Engineering Plastics US

- EuroChem Group AG

- Evonik Industries AG

- Grupa Azoty SA

- Helm AG

- Honeywell International Inc.

- JSC Kuibyshevazot

- Lanxess AG

- Novus International, Inc.

- Nutrien Ltd.

- OCI NV

- Ostchem Holding

- Sinopec

- Sumitomo Chemical Co., Ltd.

- Ube Industries, Ltd.

- Yara International ASA

The Global Ammonium Sulphate Market was valued at USD 3.6 billion in 2024 and is estimated to grow at a CAGR of 3.5% to reach USD 5 billion by 2034. This growth is driven by the increasing need to support global food production, expanding agricultural operations, and the rising demand to secure food supply chains for a growing population. Ammonium sulphate continues to see strong traction primarily due to its critical role as a nitrogen-based fertilizer and its expanding applications across various industrial sectors. Its high solubility and efficiency in alkaline soils make it a preferred choice for enhancing crop yields, especially in rice, maize, and wheat farming. The compound's relevance is rising in developing regions, supported by governmental initiatives promoting sustainable agricultural practices.

More than 75% of global ammonium sulphate demand is attributed to fertilizer usage. In regions like Asia Pacific, especially countries such as China and India, the growing population and increased focus on arable land expansion have resulted in higher fertilizer consumption. The compound also plays a growing role in industrial fields like water treatment, pharmaceutical manufacturing, and food processing. Its application in flue gas desulfurization systems has gained significance, particularly in areas that enforce stringent air quality standards. The push toward cleaner shipping through emission control technologies has also boosted ammonium sulphate usage, as global regulations continue to tighten.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.6 Billion |

| Forecast Value | $5 Billion |

| CAGR | 3.5% |

In 2024, the by-product production method contributed USD 2.4 billion and is forecasted to reach USD 3.4 billion by 2034, maintaining a 3.5% CAGR. By-product production accounts for 68.4% share due to its cost-effectiveness and environmentally favorable use of waste streams. This method recovers ammonium sulphate during the processing of materials like coke oven gas and caprolactam, as well as during coal flue gas scrubbing. These routes lower production costs while addressing environmental concerns, especially under policies like the Industrial Emissions Directive, which promotes sulphur recovery into usable forms such as ammonium sulphate.

The fertilizer segment dominated the market in 2024, holding a 75.4% share. This segment continues to thrive as ammonium sulphate serves as an effective and low-cost nitrogen fertilizer, especially valuable in improving nutrient uptake in alkaline soils. It supports a wide range of agricultural activities at both subsistence and commercial levels. Crops like maize, rice, and other cereals benefit from its ease of use and compatibility with other fertilizers. Developing nations in Asia Pacific and Latin America are leading in its adoption, thanks to increased government subsidies and a greater shift toward modern agricultural strategies like precision farming, which enhances efficiency and minimizes waste.

China Ammonium Sulphate Market generated USD 671.1 million in 2024 and is projected to grow at a 3.6% CAGR, reaching USD 953.9 million by 2034. This market is expanding rapidly, underpinned by the country's robust agricultural output. Despite having under 10% of the world's arable land, China produces around 25% of global grain, reinforcing its heavy reliance on soil enhancers like ammonium sulphate, particularly for rice cultivation. The country also benefits from growing industrial production, and large-scale collaborations aimed at manufacturing significant volumes of compacted ammonium sulphate are boosting the sector's momentum.

Major players in the global ammonium sulfate industry include BASF SE, UBE Corporation, OCI Nitrogen, Evonik Industries AG, and Lanxess AG. Key strategies adopted by leading companies in the ammonium sulphate market focus on expanding capacity through strategic collaborations, boosting R&D for cost-efficient production technologies, and tapping into value-added industrial applications. Companies are investing in cleaner production routes, especially by-product recovery from caprolactam and coke oven processes, which allow cost savings and align with regulatory pressures for environmental sustainability. Expanding footprint in high-growth regions like Asia Pacific through joint ventures and facility expansions also remains a major priority. Additionally, key firms are strengthening their supply chains and distribution networks to ensure better service delivery and localized support, especially in emerging economies where fertilizer demand is booming.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Production Method

- 2.2.3 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product form

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics

( Note: the trade statistics will be provided for key countries only

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.7 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Production Method, 2021 – 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Synthetic production

- 5.3 By-product production

- 5.3.1 Caprolactam production

- 5.3.2 Coke oven operations

- 5.3.3 Methyl methacrylate production

- 5.3.4 Other by-product sources

Chapter 6 Market Estimates and Forecast, By Product Form, 2021 – 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Solid

- 6.2.1 Granular

- 6.2.2 Crystalline

- 6.3 Liquid

Chapter 7 Market Estimates and Forecast, By Purity Grade, 2021 – 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Standard grade (≤99%)

- 7.3 High purity grade (>99%)

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 Fertilizers

- 8.2.1 Straight fertilizers

- 8.2.2 Compound fertilizers

- 8.2.3 Specialty fertilizers

- 8.3 Industrial applications

- 8.3.1 Textile industry

- 8.3.2 Water treatment

- 8.3.3 Food additives

- 8.3.4 Flame retardants

- 8.3.5 Chemical manufacturing

- 8.3.6 Others

- 8.4 Pharmaceutical

- 8.5 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 BASF SE

- 10.2 AdvanSix Inc.

- 10.3 CF Industries Holdings, Inc.

- 10.4 Domo Chemicals GmbH

- 10.5 Domo Engineering Plastics US

- 10.6 EuroChem Group AG

- 10.7 Evonik Industries AG

- 10.8 Grupa Azoty S.A.

- 10.9 Helm AG

- 10.10 Honeywell International Inc.

- 10.11 JSC Kuibyshevazot

- 10.12 Lanxess AG

- 10.13 Novus International, Inc.

- 10.14 Nutrien Ltd.

- 10.15 OCI N.V.

- 10.16 Ostchem Holding

- 10.17 Sinopec

- 10.18 Sumitomo Chemical Co., Ltd.

- 10.19 Ube Industries, Ltd.

- 10.20 Yara International ASA