|

시장보고서

상품코드

1766212

프로바이오틱스 식품 시장 : 기회, 성장 촉진 요인, 산업 동향 분석, 예측(2025-2034년)Probiotic Food Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

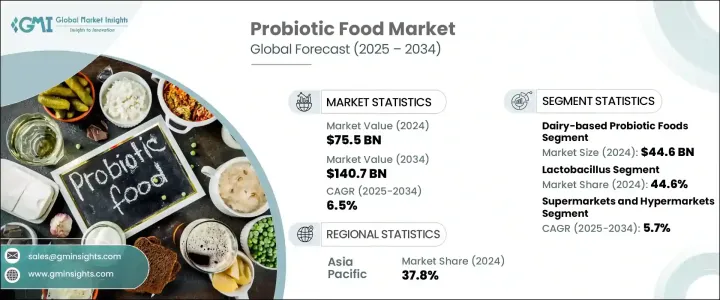

세계 프로바이오틱스 식품 시장은 2024년 755억 달러로 평가되었으며, CAGR 6.5%로 성장하여 2034년에는 1,407억 달러에 이를 것으로 예측됩니다. 정신 건강, 면역 체계 지원에 대한 소비자의 의식 증가가 프로바이오틱스를 풍부하게 포함하는 식품의 일상적인 소비에 박차를 가하고 있습니다. 소비자는 현대의 라이프 스타일이나 건강의 가치관 에 따라 기능적 선택을 점점 더 추구하고 있습니다. 식물성 및 무유당 제형은 비건 및 유당 무관용 인구 통계에서 주목받고 있으며, 선반에 안정적인 캡슐과 프로바이오틱스가 주입된 스낵바와 같은 혁신으로 접근성이 향상되고 있습니다.

과학 연구의 개척과 유리한 규제 당국의 지원에 의해 프로바이오틱스 식품 시장 전체에 걸쳐 새로운 기회가 계속 열리고, 혁신이 촉진되어 제품 개발이 가속하고 있습니다. 연구는 특정 프로바이오틱스 균주가 장 건강뿐만 아니라 면역력, 심장 건강, 피부 건강 및 신진 대사 기능에 어떤 영향을 미치는지에 대한 이해를 넓히고 있습니다. 제조업체 각 사는 새로운 용도를 모색해, 목표로 하는 건강상의 성과에 맞추어 제제를 조정하게 되어, 다양한 연령층이나 라이프 스타일의 요구에 특화한 제품 카테고리가 열리면서 여러 지역의 규제기관도 보다 명확한 가이드라인, 품질기준, 안전 프로토콜을 확립하는 데 중요한 역할을 하고 있으며, 소비자의 신뢰를 높이고 신제품 시장 진입을 합리화하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 755억 달러 |

| 예측 금액 | 1,407억 달러 |

| CAGR | 6.5% |

균주의 세분화에서는 유산균 부문이 2024년에 44.6%의 점유율을 차지하고, 2025-2034년 CAGR은 5.3%를 나타낼 전망입니다. 이 균주의 매력은 다양한 제품 유형에 걸쳐 높은 적응력과 수많은 식품 가공 단계에서 살아남을 수 있다는 점에 있습니다. 양쪽 모두에 관련성이 있기 때문에 일관되게 사용되고 있습니다. 스트렙토코쿠스 써모필루스(Streptococcus thermophilus)는 특히 유제품의 발효에 있어서 풍미를 향상시키는 특성을 가지기 때문에 프로바이오틱스의 생산에 있어 중요한 역할을 하고 있습니다. 한편, 우수한 유통기한과 극한 조건을 견딜 수 있는 능력 덕분에 건식 바실러스 종의 사용이 증가하고 있습니다.

액체 부문은 53.8%의 점유율을 획득했으며, 2024년에는 407억 달러를 창출했습니다. 소비자들은 특히 활동적인 라이프스타일과 건강 인식이 높아진 사람들을 위해 빠른 흡수력, 휴대성, 일상 생활에 쉽게 통합될 수 있기 때문에 이러한 옵션에 매력을 느끼고 있습니다.

아시아태평양 프로바이오틱스 식품 2024년 시장 점유율은 37.8% 점유율을 기록했습니다. 시장 역학은 지역에 따라 다르며, 식생활, 헬스케어 제도, 소비자 의식의 차이에 영향을 받습니다. 일본, 중국, 인도와 같은 국가에서 중산층 인구가 계속 증가함에 따라 건강 의식이 눈에 띄게 증가하여 이들 국가를 주요 신흥 시장으로 자리매김하고 있습니다.

세계의 프로바이오틱스 식품 시장에서 경쟁하는 기업은 시장에서의 존재감을 높이기 위한 다면적인 전략을 채택하고 있습니다. Probi AB, General Mills, Inc., Nestle S.A., Danone S.A., 주식회사 야쿠르트 본사 등의 대기업은 제품의 혁신에 상당한 투자를 실시해, 소비자의 라이프 스타일의 변화에 맞추어 다양한 포맷을 도입하고 있습니다. 또, 전략적 파트너십, 합병, 인수를 통해, 세계적인 리치를 확대하고 있습니다. 또한, 클린 라벨 처방과 천연 발효 원료에 주력하고 있습니다. 또한, 연구 개발 투자에 의해 새로운 균주나 용도가 개척되어, 프로바이오틱스는 식품 뿐만이 아니라, 퍼스널케어나 서플리먼트로까지 확대하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 시장 기회

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTEL 분석

- 가격 동향

- 지역별

- 제품별

- 장래 시장 동향

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 특허 상황

- 무역 통계(HS코드)(참고 : 무역 통계는 주요 국가에서만 제공됨)

- 주요 수입국

- 주요 수출국

- 지속가능성과 환경 측면

- 지속가능한 관행

- 폐기물 삭감 전략

- 생산에 있어서의 에너지 효율

- 환경 친화적 인 노력

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카 항공

- 중동 및 아프리카

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추정 및 예측 : 제품 유형별, 2021 –2034

- 주요 동향

- 유제품 베이스 프로바이오틱스 식품

- 요구르트

- 케피아

- 치즈

- 버터 밀크

- 기타

- 유제품 이외의 프로바이오틱스 식품

- 식물 유래의 요구르트 대체품

- 콩베이스

- 아몬드 베이스

- 코코넛 베이스

- 귀리 베이스

- 기타 식물 유래의 대체품

- 발효 야채

- 김치

- 더워크라우트

- 절임

- 기타 발효 야채

- 발효 대두 제품

- 템페

- 된장

- 낫토

- 콤부처

- 기타 유제품 이외의 제품

- 식물 유래의 요구르트 대체품

- 프로바이오틱스 강화 식품

- 시리얼 및 스낵

- 베이커리

- 과자류

- 영양 바

- 기타

제6장 시장 추정 및 예측 : 프로바이오틱스 균주별, 2021 –2034

- 주요 동향

- 유산균

- L. acidophilus

- L. rhamnosus

- L. casei

- L. plantarum

- 기타

- 비피더스균

- B. bifidum

- B. longum

- B. lactis

- B. breve

- 기타

- 연쇄상 구균

- S. thermophilus

- 기타

- 바실러스

- B. coagulans

- B. subtilis

- 기타

- Saccharomyces

- S. boulardii

- 기타

- 다균주 제형

- 기타 프로바이오틱스주

제7장 시장추정 및 예측 : 형태별, 2021 –2034

- 주요 동향

- 액체

- 고체

- 반고체

제8장 시장추정 및 예측 : 유통채널별, 2021 –2034

- 주요 동향

- 슈퍼마켓 및 하이퍼마켓

- 편의점

- 전문점

- 온라인 소매

- 기타

제9장 시장추정 및 예측 : 지역별, 2021 –2034

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

제10장 기업 프로파일

- Danone SA

- Yakult Honsha Co., Ltd.

- Nestle SA

- General Mills, Inc.

- Probi AB

- Lifeway Foods, Inc.

- BioGaia AB

- Chr. Hansen Holding A/S

- Lallemand Inc.

- Arla Foods amba

- Chobani, LLC

- Fonterra Co-operative Group Limited

- Kerry Group plc

- Kellogg Company

- PepsiCo, Inc.

The Global Probiotic Food Market was valued at USD 75.5 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 140.7 billion by 2034. This robust growth reflects a broader shift among consumers toward preventive healthcare and functional nutrition. Growing public awareness around digestive health, mental well-being, and immune system support is fueling daily consumption of probiotic-rich food products. Consumers are increasingly seeking functional options that align with modern lifestyles and health values. Plant-based and dairy-free formulations are attracting attention from vegan and lactose-intolerant demographics, while innovations such as shelf-stable capsules and probiotic-infused snack bars are enhancing accessibility. Probiotics are also branching out beyond food into skincare and beauty, expanding the health and wellness movement.

Advancements in scientific research and favorable regulatory support continue to unlock new opportunities across the probiotic food market, fostering innovation and accelerating product development. Ongoing clinical studies are expanding the understanding of how specific probiotic strains impact not only gut health but also immunity, mental wellness, skin health, and metabolic function. This growing body of evidence is encouraging manufacturers to explore new applications and tailor formulations for targeted health outcomes, opening specialized product categories for different age groups and lifestyle needs. Regulatory bodies across various regions are also playing a critical role by establishing clearer guidelines, quality standards, and safety protocols, which are boosting consumer trust and streamlining market entry for new products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $75.5 Billion |

| Forecast Value | $140.7 Billion |

| CAGR | 6.5% |

In terms of strain segmentation, the lactobacillus segment held a 44.6% share in 2024 and is forecasted to grow at a CAGR of 5.3% during 2025-2034. This strain's appeal lies in its high adaptability across various product types and its ability to survive numerous food processing stages. Bifidobacterium continues to see consistent use due to its benefits for colon health and its relevance in both pediatric and elderly nutrition. Streptococcus thermophilus also plays a vital role in probiotic production, particularly for its flavor-enhancing attributes in dairy fermentation. Meanwhile, the use of dry-form Bacillus species is rising due to their superior shelf life and ability to withstand extreme conditions.

The liquid segment captured a 53.8% share and generated USD 40.7 billion in 2024. This dominance is largely attributed to the growing popularity of functional beverages, which offer a convenient and efficient method of probiotic intake. Consumers are gravitating toward these options due to their quick absorption, portability, and ease of integration into daily routines, especially for those with active lifestyles and heightened health awareness. The rise of on-the-go nutrition has further propelled the demand for ready-to-drink probiotic products, aligning with the preferences of younger, urban populations seeking instant wellness solutions.

Asia Pacific Probiotic Food Market held a 37.8% share in 2024. Market dynamics vary by region, influenced by differences in dietary habits, healthcare systems, and consumer awareness. The Asia-Pacific region is witnessing the fastest expansion, driven by growing urbanization, rising disposable incomes, and a long-standing cultural familiarity with fermented probiotic foods. As the middle-class population continues to grow across countries like Japan, China, and India, there is a noticeable increase in health consciousness, positioning these nations as key emerging markets. In contrast, while Latin America faces affordability challenges, improvements in healthcare access and retail infrastructure are creating favorable conditions for market development.

Companies competing in the Global Probiotic Food Market are adopting multi-faceted strategies to strengthen their market presence. Leading firms such as Probi AB, General Mills, Inc., Nestle S.A., Danone S.A., and Yakult Honsha Co., Ltd. are investing significantly in product innovation, introducing diverse formats to suit changing consumer lifestyles. They are also expanding their global reach through strategic partnerships, mergers, and acquisitions. Many are focused on clean-label formulations and naturally fermented ingredients to align with the rising demand for transparency and minimal processing. Further, R&D investments are helping to unlock new strains and applications, extending probiotics beyond food into personal care and supplements. Global players are also tailoring their marketing and distribution approaches to tap into high-growth regional markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Dairy-based probiotic foods

- 5.2.1 Yogurt

- 5.2.2 Kefir

- 5.2.3 Cheese

- 5.2.4 Buttermilk

- 5.2.5 Others

- 5.3 Non-dairy probiotic foods

- 5.3.1 Plant-based yogurt alternatives

- 5.3.1.1 Soy-based

- 5.3.1.2 Almond-based

- 5.3.1.3 Coconut-based

- 5.3.1.4 Oat-based

- 5.3.1.5 Other plant-based alternatives

- 5.3.2 Fermented vegetables

- 5.3.2.1 Kimchi

- 5.3.2.2 Sauerkraut

- 5.3.2.3 Pickles

- 5.3.2.4 Other fermented vegetables

- 5.3.3 Fermented soy products

- 5.3.3.1 Tempeh

- 5.3.3.2 Miso

- 5.3.3.3 Natto

- 5.3.4 Kombucha

- 5.3.5 Other non-dairy products

- 5.3.1 Plant-based yogurt alternatives

- 5.4 Probiotic-fortified foods

- 5.4.1 Cereals & snacks

- 5.4.2 Bakery

- 5.4.3 Confectionery

- 5.4.4 Nutrition bars

- 5.4.5 Others

Chapter 6 Market Estimates and Forecast, By Probiotic Strain, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.1.1 Lactobacillus

- 6.1.2 L. acidophilus

- 6.1.3 L. rhamnosus

- 6.1.4 L. casei

- 6.1.5 L. plantarum

- 6.1.6 Others

- 6.2 Bifidobacterium

- 6.2.1 B. bifidum

- 6.2.2 B. longum

- 6.2.3 B. lactis

- 6.2.4 B. breve

- 6.2.5 Others

- 6.3 Streptococcus

- 6.3.1 S. thermophilus

- 6.3.2 Others

- 6.4 Bacillus

- 6.4.1 B. coagulans

- 6.4.2 B. subtilis

- 6.4.3 Others

- 6.5 Saccharomyces

- 6.5.1 S. boulardii

- 6.5.2 Others

- 6.6 Multi-strain formulations

- 6.7 Other probiotic strains

Chapter 7 Market Estimates and Forecast, By Form, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Liquid

- 7.3 Solid

- 7.4 Semi-solid

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Supermarkets & Hypermarkets

- 8.3 Convenience stores

- 8.4 Specialty stores

- 8.5 Online retail

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Danone S.A.

- 10.2 Yakult Honsha Co., Ltd.

- 10.3 Nestle S.A.

- 10.4 General Mills, Inc.

- 10.5 Probi AB

- 10.6 Lifeway Foods, Inc.

- 10.7 BioGaia AB

- 10.8 Chr. Hansen Holding A/S

- 10.9 Lallemand Inc.

- 10.10 Arla Foods amba

- 10.11 Chobani, LLC

- 10.12 Fonterra Co-operative Group Limited

- 10.13 Kerry Group plc

- 10.14 Kellogg Company

- 10.15 PepsiCo, Inc.