|

시장보고서

상품코드

1766226

혈관 접근 기기 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Vascular Access Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

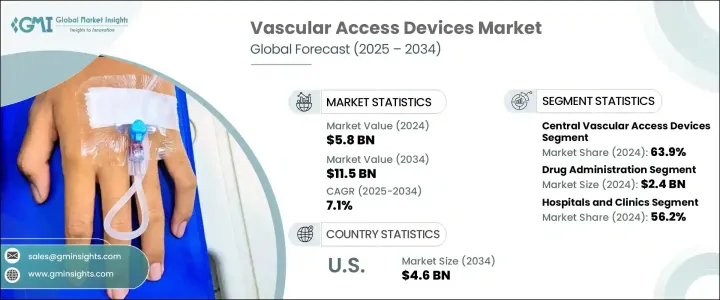

세계의 혈관 접근 기기 시장 규모는 2024년 58억 달러에 달했고, CAGR 7.1%로 성장하여 2034년까지 115억 달러에 이를 것으로 예측됩니다.

이러한 장비 수요는 장기적 또는 반복적인 정맥내 치료를 필요로 하는 만성 건강 상태의 부담 증가에 의해 추진되고 있습니다.

임상 현장에서 혈관 접근 기기는 약물 공급, 혈액 채취, 주입 및 기타 중요한 치료를 수행하는 데 필수적입니다. 신흥 국가에서는 건강 관리 시스템이 확대되고 있으며 기존 시장에서 기술이 업그레이드됨에 따라 급성기와 비급성기에 관계없이 버스 큐러 접근 기기에 대한 요구가 계속 증가하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 58억 달러 |

| 예측 금액 | 115억 달러 |

| CAGR | 7.1% |

이러한 기기는 다양한 치료를 위해 혈류에 직접적으로 효율적으로 접근할 수 있도록 특별히 설계되어 있습니다. 기구의 소재와 디자인에 있어서의 기술 혁신은 감염증이나 혈전등의 합병증을 최소한으로 억제해, 의료 종사자의 사용의 용이성을 향상시키는 등, 안전성의 향상에 공헌하고 있습니다.

이 시장은 말초형과 중추형으로 분류됩니다. 2024년에는 중앙 혈관 접근 기기가 압도적인 지위를 차지해 시장 총 매출의 63.9%를 만들었습니다. 특히 굵은 정맥에 약물을 직접 전달할 수 있기 때문에 특히 장기간 사용하기에 적합합니다.

이 부문에서 최근의 동향은 항균 특성과 항응혈 기능을 개선한 혈관 기구의 개발로 이어지고 있습니다.

응용 분야별로는 약물 투여가 가장 높은 수익을 차지하며 2024년에는 24억 달러에 달했습니다. 점적 접근를 필요로 하기 때문에 혈관 접근 기기가 불가결해지고 있습니다.

시장은 병원 및 진료소, 외래수술센터(ASC), 재택 케어 환경, 기타를 포함한 최종사용자별로 구분됩니다. 이 시설에서는 일상적인 처치에는 말초 정맥로, 보다 복잡한 치료에는 중심 정맥로의 양쪽이 빈번하게 사용됩니다.

지역별로는 북미가 시장을 선도해 2024년에는 26억 달러의 수익을 올렸으며, 향후 10년간 CAGR 7%를 보일 것으로 예측됩니다. 외래 치료 및 재택 치료 프로그램으로의 전환이 시장의 지속적인 확대를 지원하고 있습니다. 보다 안전한 혈관 접근 옵션에 대한 수요는 여전히 높으며, 양질의 치료 결과와 환자 중심의 솔루션을 요구하는 의료 제공자가 그 원동력이 되고 있습니다.

이 시장 경쟁 구도에는 기술 혁신과 제품 성능에 중점을 둔 업계 유력 기업이 포함됩니다. Becton Dickinson and Company, Teleflex, B. Braun, Medtronic, Fresenius Medical Care와 같은 기업은 2024년 세계 시장 점유율의 약 60%를 차지하고 있습니다. 현지 제조업체는 비용 효율성이 뛰어나고 컴플라이언스에 적합한 대체품 공급자로서의 지위를 확립하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 업계 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 만성질환의 유병률 증가

- 낮은 침습 수술에 대한 관심 증가

- 기술적 진보

- 재택 헬스 케어 수요 증가

- 업계의 잠재적 리스크 및 과제

- 카테터 관련 혈류 감염(CRBSI)의 높은 위험

- 고급 혈관 접근 기기의 높은 비용

- 성장 촉진요인

- 성장 가능성 분석

- 기술의 상황

- 가격 분석

- 갭 분석

- 미래 시장 동향

- 규제 상황

- 특허 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계 및 예측 : 제품별, 2021-2034년

- 주요 동향

- 주변기기 혈관 접근 기기

- 중앙 혈관 접근 기기

제6장 시장 추계 및 예측 : 용도별, 2021-2034년

- 주요 동향

- 약제 투여

- 수분 및 영양 투여

- 수혈

- 진단 검사

- 기타 용도

제7장 시장 추계 및 예측 : 최종 용도별, 2021-2034년

- 주요 동향

- 병원 및 진료소

- 외래수술센터(ASC)

- 재택 치료

- 기타 용도

제8장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 아시아태평양

- 일본

- 중국

- 인도

- 호주

- 한국

- 라틴아메리카

- 멕시코

- 브라질

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제9장 기업 프로파일

- Access Vascular

- AngioDynamics

- B Braun

- Becton Dickinson and Company

- ConvaTec

- Cook Medical

- Fresenius Medical Care

- ICU Medical

- Medical Components

- Medtronic

- Nipro

- Penumbra

- Teleflex

- Terumo

- Vygon

The Global Vascular Access Devices Market was valued at USD 5.8 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 11.5 billion by 2034. Demand for these devices is being propelled by the rising burden of chronic health conditions that require long-term or repeated intravenous therapies. Across the healthcare spectrum, patients undergoing treatment for serious ailments often require sustained drug delivery, nutritional support, or fluid management, which calls for dependable vascular access solutions.

In clinical settings, vascular access devices are essential for delivering medications, drawing blood, administering fluids, and performing other critical procedures. Their role becomes even more vital with the growing number of patients needing intensive care, surgical procedures, and specialized treatments. As healthcare systems expand in developing countries and upgrade technologies in established markets, the need for vascular access equipment continues to grow in both acute and non-acute care environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.8 Billion |

| Forecast Value | $11.5 Billion |

| CAGR | 7.1% |

These devices are specifically designed to provide direct and efficient access to the bloodstream for a range of treatments. They are widely used in both short-term scenarios, such as surgical procedures, and for long-duration therapies like dialysis or chemotherapy. As the healthcare landscape shifts toward more outpatient and home-based care models, the use of these devices outside hospital settings is also gaining traction. Innovations in device materials and design have contributed to greater safety, minimizing complications like infections and blood clots, and improving ease of use for medical personnel. Vascular access equipment has thus become integral to modern healthcare delivery, ensuring both patient safety and procedural efficiency.

The market is categorized into peripheral and central vascular access devices. In 2024, central vascular access devices held the dominant position, generating 63.9% of the total market revenue. These devices are frequently preferred in situations requiring consistent or repeated intravenous treatments, especially in complex therapeutic regimens. Their ability to remain in place for extended durations and deliver drugs directly into large veins makes them particularly suitable for long-term applications. Among the various central access options, devices such as peripherally inserted central catheters, tunneled catheters, and implantable ports are widely used due to their lower insertion frequency and enhanced patient comfort.

Recent advancements in this segment have led to the development of vascular devices with improved antimicrobial properties and anti-clotting features. These product upgrades are designed to minimize risks associated with prolonged usage, such as catheter-related bloodstream infections, and enhance device reliability. Additionally, the integration of imaging technologies in insertion techniques has made placements more accurate and safer, contributing to the overall efficiency of treatment protocols.

From an application standpoint, drug administration accounted for the highest revenue, reaching USD 2.4 billion in 2024. This segment continues to thrive due to the growing need for continuous infusion therapies in patients with chronic illnesses. Medications, including antibiotics, biologics, and immunotherapies, often require prolonged intravenous access, which makes vascular access devices indispensable. As medical practices increasingly support home infusion services and outpatient therapy to reduce hospitalization costs, vascular access tools are becoming more common in homecare environments as well.

The market is also segmented by end users, including hospitals and clinics, ambulatory surgical centers, homecare settings, and others. Hospitals and clinics emerged as the leading segment, with a market share of 56.2% in 2024. The consistent rise in surgical volumes, along with a higher patient inflow for both acute and chronic care, sustains a strong demand for vascular devices in these facilities. These settings frequently utilize both peripheral IVs for routine procedures and central lines for more complex treatment needs. Infection prevention and compliance with regulatory standards are critical concerns, prompting hospitals to invest in advanced access devices that incorporate closed-system designs and antimicrobial materials.

Regionally, North America led the market, generating USD 2.6 billion in revenue in 2024 and is forecasted to grow at a CAGR of 7% over the next decade. Within this region, the United States is expected to see its vascular access device market grow from USD 2.3 billion in 2024 to USD 4.6 billion by 2034. The increasing prevalence of long-term health conditions, combined with a shift toward outpatient care and at-home treatment programs, supports continued market expansion. The demand for effective, durable, and safer vascular access options remains high, driven by healthcare providers striving for quality outcomes and patient-centered solutions.

The competitive landscape of the market includes prominent industry players that focus on innovation and product performance. Companies such as Becton Dickinson and Company, Teleflex, B. Braun, Medtronic, and Fresenius Medical Care collectively captured approximately 60% of the global market share in 2024. Market dynamics are heavily influenced by advancements in product technology and cost considerations, particularly in price-sensitive regions. Multinational corporations often face pressure to balance affordability with quality, while local manufacturers position themselves as providers of cost-effective yet compliant alternatives. This balance between innovation and accessibility will remain a defining feature of the vascular access devices market in the years ahead.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases

- 3.2.1.2 Growing preference for minimally invasive procedures

- 3.2.1.3 Technological advancements

- 3.2.1.4 Rising demand for home healthcare

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High risk of catheter-related bloodstream infections (CRBSIs)

- 3.2.2.2 High cost of advanced vascular access devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.5 Pricing analysis

- 3.6 Gap analysis

- 3.7 Future market trends

- 3.8 Regulatory landscape

- 3.9 Patent analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Peripheral vascular access devices

- 5.3 Central vascular access devices

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Drug administration

- 6.3 Fluid and nutrition administration

- 6.4 Blood transfusion

- 6.5 Diagnostic testing

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Ambulatory surgical centers

- 7.4 Homecare settings

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Mexico

- 8.5.2 Brazil

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Access Vascular

- 9.2 AngioDynamics

- 9.3 B Braun

- 9.4 Becton Dickinson and Company

- 9.5 ConvaTec

- 9.6 Cook Medical

- 9.7 Fresenius Medical Care

- 9.8 ICU Medical

- 9.9 Medical Components

- 9.10 Medtronic

- 9.11 Nipro

- 9.12 Penumbra

- 9.13 Teleflex

- 9.14 Terumo

- 9.15 Vygon