|

시장보고서

상품코드

1766245

급성 관상동맥 증후군 치료제 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Acute Coronary Syndrome Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

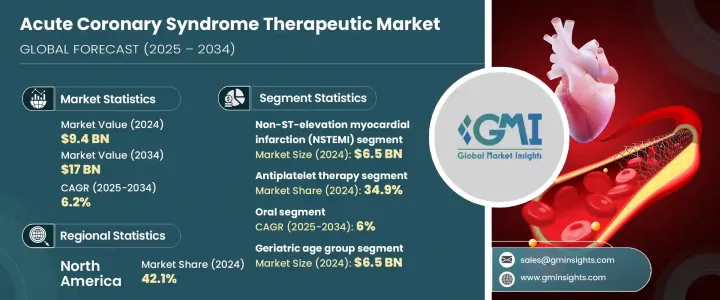

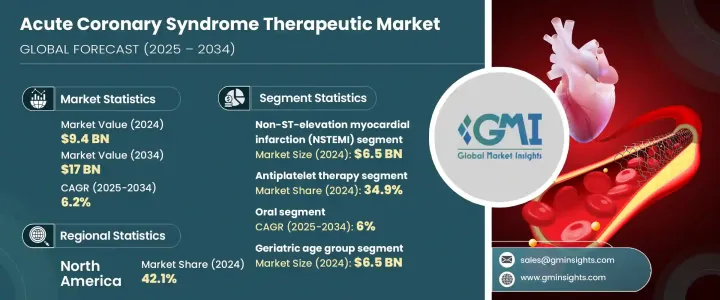

세계의 급성 관상동맥 증후군 치료제 시장 규모는 2024년 94억 달러에 달했고, CAGR 6.2%로 성장해 2034년까지 170억 달러에 이를 것으로 추정됩니다.

시장 확대의 주요 요인은 심혈관 질환, 특히 ST 상승형 심근경색(STEMI), 비ST 상승형 심근경색(NSTEMI), 불안정 협심증 등의 병태를 포함한 급성 관상동맥 증후군의 이환율의 상승입니다. 이 질환은 세계적으로 주요 사인 중 하나이며 수요를 창출하고 있습니다. 약품 전달 시스템의 기술 혁신과 차세대 심혈관계 치료제의 개발로 치료 옵션이 넓어지고 있습니다.

병용 요법과 서방형 제제의 대두는 ACS 치료에 있어서의 안전성과 효능을 모두 향상시키고 있습니다. 항응고제, 베타차단제 등 다양한 약리학적 치료의 통합이 중시되어 보다 효과적인 병태관리에 도움이 되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 94억 달러 |

| 예측 금액 | 170억 달러 |

| CAGR | 6.2% |

2024년 시장 세분화에서는 NSTEMI 분야가 65억 달러의 평가액으로 시장을 리드했습니다. 라이프 스타일과 관련된 위험 인자와 고감도 트로포닌 분석 및 심장 영상 진단과 같은 진단 도구의 진보가 NSTEM의 발견률을 높이고 이 병태에 대한 표적 치료제 수요를 더욱 밀어 올리고 있습니다.

항혈소판 요법 부문은 2024년에 34.9%의 점유율을 차지했습니다. 이러한 약물의 사용은 특히 고위험 환자에 대한 항혈소판 이중 요법을 권장하는 임상 지침에 의해 널리 이루어지고 있습니다.

미국 급성관증후군 치료제 2024년 시장 규모는 36억 달러로 미국에서는 ACS의 유병률이 높아지고 있으며, 고급 치료 옵션에 대한 수요가 높아지고 있습니다. 공중 보건 노력과 의료 인프라 개선이 시장 성장에 기여하고 있습니다.

급성 관상 증후군 치료제 세계 시장에서 주요 기업은 Merck, Pfizer, AstraZeneca, Bristol Myers Squibb, Eli Lilly, Genentech(Roche), Sanofi, Jansen Pharmaceuticals, Boehringer Ingelheim 등이 있습니다. 급성 관상 증후군 치료제 시장의 각 회사는 신약 연구 개발, 특히 신속성 및 안전성 프로파일 개선을 제공하는 신약 연구 개발에 대한 전략적 투자를 통해 그 지위 를 강화하고 있습니다. 많은 제약 회사는 환자 고유의 요구에 대응하기 위해 병용 요법과 맞춤형 치료 옵션으로 포트폴리오를 확대하고 있습니다. 연구소는 또한 제약 기업의 전략의 중요한 부분을 차지하며, 충분한 서비스를 받지 못한 시장에 진입할 수 있도록 합니다. 선진국 시장과 신흥국 시장 모두에서 경쟁 우위를 유지하기 위해서는 지역의 제조 능력을 확대하고 신규 치료제의 약사 승인을 확보하는 것도 주요 전략입니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 업계에 미치는 영향요인

- 성장 촉진요인

- 심혈관 질환의 발생률의 상승

- ACS의 약리학적 치료 진보

- 조기진단과 응급의료의 중요성 증가

- 고령화의 진행과 빈발하는 사건

- 업계의 잠재적 위험 및 과제

- 고액의 치료비와 접근의 문제

- 임상 실천과 준수에 있어서의 편차

- 시장 기회

- 심혈관계에 대한 부담이 큰 신흥 시장

- 관민 헬스케어 제휴

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 미래 시장 동향

- 가격 분석

- 파이프라인 분석

- 소비자 행동 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병인수

- 파트너십 및 협업

- 신제품 발매

제5장 시장 추계 및 예측 : 유형별, 2021-2034년

- 주요 동향

- 비ST 상승형 심근경색(NSTEMI)

- ST 상승형 심근경색(STEMI)

- 불안정 협심증

제6장 시장 추계 및 예측 : 약제 클래스별, 2021-2034년

- 주요 동향

- 항혈소판 요법

- 항응고제

- 베타 차단제

- 질산염

- 혈전 용해제

- 기타 약

제7장 시장 추계 및 예측 : 투여 경로별, 2021-2034년

- 주요 동향

- 경구

- 주사제

제8장 시장 추계 및 예측 : 연령별, 2021-2034년

- 주요 동향

- 성인

- 고령

제9장 시장 추계 및 예측 : 최종 용도별, 2021-2034년

- 주요 동향

- 병원

- 심장병 클리닉

- 외래수술센터(ASC)

- 기타 용도

제10장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제11장 기업 프로파일

- AstraZeneca

- Azurity Pharmaceuticals

- Baxter Healthcare

- Boehringer Ingelheim

- Bristol Myers Squibb

- Cipla

- Eli Lilly

- Genentech(Roche)

- Intas Pharmaceuticals

- Janssen Pharmaceuticals

- Merck

- Novartis

- Pfizer

- Ranbaxy Laboratories

- Sanofi

The Global Acute Coronary Syndrome Therapeutics Market was valued at USD 9.4 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 17 billion by 2034. The market expansion is primarily driven by the rising incidence of cardiovascular diseases, particularly acute coronary syndrome, which encompasses conditions such as ST-elevation myocardial infarction (STEMI), non-ST-elevation myocardial infarction (NSTEMI), and unstable angina. These conditions are among the leading causes of death worldwide, creating significant demand for advanced therapies. Technological innovations in drug delivery systems and the development of next-generation cardiovascular drugs are enhancing treatment options. Additionally, the growing trend of personalized medicine for ACS allows for more targeted treatments tailored to individual patient profiles.

The rise of combination therapies and extended-release formulations is improving both safety and effectiveness in treating ACS. Furthermore, efforts to enhance early detection and rapid diagnosis in emergency settings, along with government support for heart health initiatives, are also contributing to market growth. A strong emphasis on integrating various pharmacological treatments, including antiplatelets, anticoagulants, and beta-blockers, is helping to manage the condition more effectively. Pharmaceutical companies are focusing on expanding their reach through regional production, collaborations, and new drug development to meet the growing demand across both developed and emerging markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.4 Billion |

| Forecast Value | $17 Billion |

| CAGR | 6.2% |

The NSTEMI segment led the market in 2024 with a valuation of USD 6.5 billion, driven by the growing prevalence of this condition globally. NSTEMI, which results from partial blockage of coronary arteries, demands immediate medical intervention and is more common than STEMI, though it causes less damage to the heart. Factors like lifestyle-related risk factors and advancements in diagnostic tools, such as sensitive troponin assays and cardiac imaging, have increased the detection rates of NSTEMI, further driving the demand for targeted therapeutics for the condition.

The antiplatelet therapies segment held a 34.9% share in 2024. These therapies, including drugs like aspirin, clopidogrel, and ticagrelor, are commonly used to prevent platelet aggregation and thrombus formation, which are key causes of artery blockage in ACS. Their use is widespread due to clinical guidelines recommending dual antiplatelet therapy, especially for high-risk patients. The ongoing development of faster-acting and safer antiplatelet medications continues to expand their use across diverse patient populations.

U.S. Acute Coronary Syndrome Therapeutics Market was valued at USD 3.6 billion in 2024. The growing prevalence of ACS in the U.S. is driving demand for advanced treatment options. Public health initiatives addressing risk factors such as hypertension, obesity, and diabetes, as well as improving healthcare infrastructure, are contributing to market growth. Additionally, the widespread adoption of guideline-directed medical therapy is helping improve patient outcomes and reduce healthcare costs related to cardiac care.

Key players in the Global Acute Coronary Syndrome Therapeutics Market include Merck, Pfizer, AstraZeneca, Bristol Myers Squibb, Eli Lilly, Genentech (Roche), Sanofi, Janssen Pharmaceuticals, and Boehringer Ingelheim, among others. Companies in the acute coronary syndrome therapeutics market are strengthening their position through strategic investments in research and development of new drugs, especially those offering faster action and improved safety profiles. Many pharmaceutical firms are expanding their portfolios with combination therapies and personalized treatment options to address the unique needs of patients. Collaborations with healthcare providers and government initiatives are also a significant part of their strategy, enabling them to reach underserved markets. Additionally, companies are leveraging digital health technologies to improve patient monitoring and treatment adherence. Expanding regional manufacturing capabilities and securing regulatory approvals for novel therapies are also key strategies to maintain competitive advantage in both developed and emerging markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Drug class

- 2.2.4 Route of administration

- 2.2.5 Age group

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of cardiovascular diseases

- 3.2.1.2 Advancements in pharmacological treatments for ACS

- 3.2.1.3 Increasing emphasis on early diagnosis and emergency care

- 3.2.1.4 Growing aging population and recurrent events

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment costs and accessibility issues

- 3.2.2.2 Variability in clinical practice and adherence

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging markets with high cardiovascular burden

- 3.2.3.2 Public-private healthcare collaborations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Future market trends

- 3.6 Pricing analysis

- 3.7 Pipeline analysis

- 3.8 Consumer behaviour analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Non-ST-elevation myocardial infarction (NSTEMI)

- 5.3 ST-elevation MI (STEMI)

- 5.4 Unstable angina

Chapter 6 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Antiplatelet therapy

- 6.3 Anticoagulants

- 6.4 Beta blockers

- 6.5 Nitrates

- 6.6 Thrombolytics

- 6.7 Other medications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectables

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Adult

- 8.3 Geriatric

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Cardiology clinics

- 9.4 Ambulatory surgical centers

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AstraZeneca

- 11.2 Azurity Pharmaceuticals

- 11.3 Baxter Healthcare

- 11.4 Boehringer Ingelheim

- 11.5 Bristol Myers Squibb

- 11.6 Cipla

- 11.7 Eli Lilly

- 11.8 Genentech (Roche)

- 11.9 Intas Pharmaceuticals

- 11.10 Janssen Pharmaceuticals

- 11.11 Merck

- 11.12 Novartis

- 11.13 Pfizer

- 11.14 Ranbaxy Laboratories

- 11.15 Sanofi