|

시장보고서

상품코드

1766314

임상 검사 기능 시험 시장(2025-2034년) : 기회, 성장 촉진요인, 산업 동향 분석, 예측Laboratory Proficiency Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

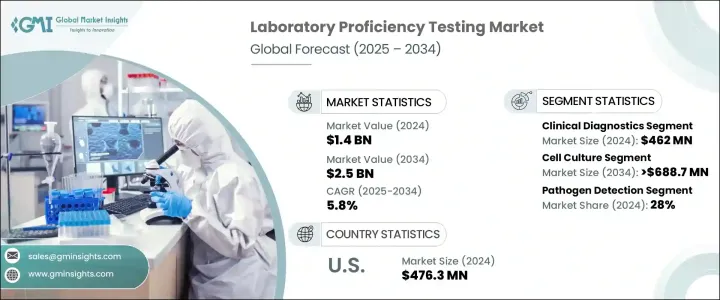

세계의 임상 검사 기능 시험 시장은 2024년에는 14억 달러로 평가되었고 CAGR 5.8%로 성장하여 2034년에는 25억 달러에 이를 것으로 추정됩니다.

시장 확대의 큰 원동력이 되고 있는 것은 검사실 환경에서의 견고한 품질 관리에 대한 수요 증가와 다양한 분야에서의 기능 시험의 이용 확대입니다. 규제 당국의 감시가 강해지고, 인정을 요구하는 검사실이 늘어나고 있기 때문에 시장 진출 기업이 증가하고 있습니다. 임상 진단 검사실의 확장과 만성 질환 및 감염을 관리하기 위한 정밀 검사에 대한 주목 증가는 시장의 기세를 더욱 강화하고 있습니다.

만성적인 건강 문제와 감염이 계속 급증하면서 정확한 진단에 대한 신뢰가 크게 증가하고 있습니다. 국제 기준을 준수하고 오진의 위험을 줄이기 위해 기능 시험 프로그램이 널리 채택되었습니다. 이러한 품질 보증 프로그램은 유전자 검사 및 분자 검사와 같은 고급 진단 기술의 광범위한 응용으로 인해 매우 중요해지고 있습니다. 민관을 불문하고 이해관계자는 이러한 진화하는 기준을 충족하기 위해 검사 시설의 인프라 강화에 투자하고 있습니다. CLIA, ISO, CAP와 같은 조직의 컴플라이언스 요구사항은 현재 인증을 유지하고 세계적인 품질 벤치마크를 충족하기 위해 일상적인 기능 평가를 의무화하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 14억 달러 |

| 예측 금액 | 25억 달러 |

| CAGR | 5.8% |

임상 진단 분야의 시장 규모는 2024년에 4억 6,200만 달러에 이르렀으며, 시장에서 가장 큰 점유율을 차지했습니다. 진단 정밀도에 대한 의존도가 높아지고 따라서 대량의 검사를 실시하는 임상 검사실에서 기능 시험은 필수적인 요소입니다. ISO 15189와 같은 국제 기준과의 무결성도 더욱 중시되고 있습니다. 첨단 진단법이 의료기관 전체에서 채용됨에 따라, 엄격한 숙련도 평가의 필요성은 계속 증가하고, 에러율의 저감과 환자 결과의 개선이 가시화되고 있습니다.

세포 배양 검사 분야는 CAGR 5.3%로 성장하여 2034년에는 6억 8,870만 달러에 달할 전망입니다. 세포 배양은 생물 제제, 백신, 다양한 세포 기반 치료제의 제조에 필수적입니다. 연구실 중에서도 특히 생물학적 제제 및 재생 의학 연구실은 프로세스의 신뢰성과 규제 준수를 보장하기 위해 이러한 평가에 의존하고 있습니다.

미국 임상 검사 기능 시험 시장의 2024년 시장 규모는 4억 7,630만 달러였으며 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 4.9%를 보일 것으로 예측됩니다. 합계 17억 달러의 투자가 검사 능력의 확대에 투입되었으며 연방 정부의 보건 프로그램도 2024년 시점에서 모든 공중 위생 연구실을 거의 커버하는 기능 평가 참가 확대를 추진하고 있어 이 지역 시장 진출 기업의 성장을 크게 뒷받침하고 있습니다.

임상 검사 기능 시험 시장에서 유명한 업계 기업은 Aashvi PT, BIO-RAD, LGC, American Proficiency Institute, COLLEGE of AMERICAN PATHOLOGISTS, QACS LAB, FAPAS, FLUXANA, AOAC INTERNATIONAL, RANDOX, MERCK, Trilogy, WEQAS STANDARDS 등이 있습니다. 이러한 기업들은 분자 생물학, 미생물학, 독물학 등의 전문 검사 분야로의 확대에 의한 서비스 포트폴리오의 강화에도 주력하고 있습니다. 맞춤형 PT 체계가 주요 초점이 되고 있는 한편, 규제 기관과의 파트너십은 이들 기업이 진화하는 세계 품질 기준에 맞추는 데 도움이 되고 있습니다. 또한, 전략적 합병, 진단 연구실과의 제휴, 신흥국으로의 지리적 확대를 통해 경쟁력을 높이고 인정 시험 서비스에 대한 수요의 고조에 대응하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 식품 및 의약품에 대한 엄격한 안전성과 품질 규제

- 수질 검사 수요 증가

- 숙련도 테스트는 연구실 운영 능력 향상에 필수적인 전제 조건입니다

- 의료용 대마의 합법화와 대마 검사 기관 증가

- 업계의 잠재적 위험 및 과제

- 숙련된 전문가의 부족

- 고도의 시험시설에 필요한 거액의 자본 투자

- 시장 기회

- 시험 업계에서의 기술 진보

- 불량식품을 막기 위한 기능 시험의 도입 확대

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 미국

- 유럽

- 기술의 상황

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

- 정책의 정세

- 장래 시장 동향

제4장 경쟁 구도

- 소개

- 기업 매트릭스 분석

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 지역별

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신서비스의 개시

- 확장 계획

제5장 시장 추계 및 예측 : 산업별(2021-2034년)

- 주요 동향

- 임상 진단

- 미생물학

- 의약품

- 식음료

- 생물학적 제형

- 기타 산업

제6장 시장 추계 및 예측 : 기술별(2021-2034년)

- 주요 동향

- 세포 배양

- 면역 측정

- 중합 효소 연쇄 반응

- 분광 분석

- 크로마토그래피

- 기타 기술

제7장 시장 추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 병원체 검출

- 분자감염증 검사

- 혈액화학 검사 및 혈액학 검사

- 무균성 보증

- 엔도톡신 및 발열물질 검사

- 잔류용매 및 오염물질 분석

- 기타 용도

제8장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제9장 기업 프로파일

- Aashvi PT

- ABSOLUTE STANDARDS

- American Proficiency Institute

- AOAC INTERNATIONAL

- BIO-RAD

- COLLEGE of AMERICAN PATHOLOGISTS

- FAPAS

- FLUXANA

- LGC

- MERCK

- QACS LAB

- RANDOX

- Trilogy

- Waters

- WEQAS

The Global Laboratory Proficiency Testing Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 2.5 billion by 2034. A significant driver behind this expansion is the rising demand for robust quality control in laboratory settings, as well as increased usage of proficiency testing across a range of sectors. With growing regulatory scrutiny and more laboratories seeking accreditation, the market is experiencing a boost in participation. The expansion of clinical diagnostics labs and heightened focus on precision testing to manage chronic and infectious diseases are further strengthening market momentum.

As chronic health issues and communicable diseases continue to surge, the reliance on accurate diagnostics has grown substantially. To uphold international standards and reduce the risk of misdiagnosis, proficiency testing programs are being adopted more widely. These quality assurance programs are becoming critical due to the broader application of advanced diagnostic technologies like genetic and molecular testing. Public and private stakeholders alike are investing in strengthening laboratory infrastructure to meet these evolving standards. Compliance requirements from organizations such as CLIA, ISO, and CAP now mandate routine proficiency evaluations to sustain certifications and meet global quality benchmarks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.5 Billion |

| CAGR | 5.8% |

The clinical diagnostics segment reached USD 462 million in 2024, accounting for the largest share in the market. This dominance stems from the critical role accurate diagnostic testing plays in managing patient health outcomes. With the growing burden of chronic illness, there is a higher dependency on diagnostic accuracy, which makes proficiency testing non-negotiable for high-volume labs. Facilities conducting extensive panels in microbiology, molecular testing, and hematology are placing an even greater emphasis on alignment with international frameworks like ISO 15189. As advanced diagnostics see greater adoption across medical institutions, the need for rigorous proficiency assessment continues to rise, ensuring reduced error rates and improved patient outcomes.

The cell culture testing segment is set to grow at a CAGR of 5.3%, reaching USD 688.7 million by 2034. Cell culture is foundational to the production of biologics, vaccines, and various cell-based therapeutics. To maintain consistency and prevent contamination, laboratories must regularly assess their techniques and materials through proficiency testing. Labs operating under GMP guidelines, particularly those in biologics and regenerative medicine, depend on these evaluations to ensure process reliability and regulatory compliance. Furthermore, as new therapies like stem cell treatments and tissue engineering gain momentum, demand for standardized lab practices and reliable results through proficiency testing is expected to escalate.

United States Laboratory Proficiency Testing Market was valued at USD 476.3 million in 2024 and is forecast to grow at a CAGR of 4.9% from 2025 to 2034. The country leads the global market due to its strong regulatory foundation and robust diagnostics infrastructure. Strategic funding initiatives have further fueled progress in lab accuracy. Investments totaling USD 1.7 billion were dedicated to expanding testing capacity, particularly in the areas of infectious disease detection and molecular diagnostics. Federal health programs are also pushing for higher participation in proficiency evaluations, with nearly full coverage of public health labs as of 2024, which significantly supports market growth in the region.

Prominent industry players in the Laboratory Proficiency Testing Market include Aashvi PT, BIO-RAD, LGC, American Proficiency Institute, COLLEGE of AMERICAN PATHOLOGISTS, QACS LAB, FAPAS, FLUXANA, AOAC INTERNATIONAL, RANDOX, MERCK, Trilogy, WEQAS, Waters, and ABSOLUTE STANDARDS. This include strengthening their service portfolios through expansion into specialized testing areas such as molecular biology, microbiology, and toxicology. Firms are also investing in digital platforms to streamline proficiency test result submissions and automate data analysis. Custom-designed PT schemes tailored to emerging diagnostic technologies have become a central focus, while partnerships with regulatory bodies are helping these companies align with evolving global quality standards. Additionally, strategic mergers, collaborations with diagnostic laboratories, and geographic expansion into emerging economies help increase their competitive footprint and meet the growing demand for accredited testing services.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Industry trends

- 2.2.3 Technology trends

- 2.2.4 Application trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent safety and quality regulations for food and pharmaceuticals products

- 3.2.1.2 Increasing demand for water testing

- 3.2.1.3 Proficiency testing is a necessary pre-requisite for laboratory's operational excellence

- 3.2.1.4 Legalization of medical cannabis and increasing number of cannabis testing laboratories

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Dearth of skilled professionals

- 3.2.2.2 Requirement of high-capital investments for advance testing facilities

- 3.2.3 Market opportunities

- 3.2.3.1 Technological advancements in testing industry

- 3.2.3.2 Increasing adoption of proficiency tests to prevent food adulteration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Policy landscape

- 3.10 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 By Region

- 4.3.1.1 North America

- 4.3.1.2 Europe

- 4.3.1.3 Asia Pacific

- 4.3.1 By Region

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New services launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Industry, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Clinical diagnostics

- 5.3 Microbiology

- 5.4 Pharmaceuticals

- 5.5 Food and beverages

- 5.6 Biologics

- 5.7 Other industries

Chapter 6 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cell culture

- 6.3 Immunoassays

- 6.4 Polymerase chain reaction

- 6.5 Spectrometry

- 6.6 Chromatography

- 6.7 Other technologies

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pathogen detection

- 7.3 Molecular infectious disease testing

- 7.4 Blood chemistry and hematology panels

- 7.5 Sterility assurance

- 7.6 Endotoxin and pyrogen testing

- 7.7 Residual solvent and contaminant analysis

- 7.8 Other applications

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Aashvi PT

- 9.2 ABSOLUTE STANDARDS

- 9.3 American Proficiency Institute

- 9.4 AOAC INTERNATIONAL

- 9.5 BIO-RAD

- 9.6 COLLEGE of AMERICAN PATHOLOGISTS

- 9.7 FAPAS

- 9.8 FLUXANA

- 9.9 LGC

- 9.10 MERCK

- 9.11 QACS LAB

- 9.12 RANDOX

- 9.13 Trilogy

- 9.14 Waters

- 9.15 WEQAS