|

시장보고서

상품코드

1766322

동물 인공수정 시장(2025-2034년) : 기회, 성장 촉진요인, 산업 동향 분석, 예측Animal Artificial Insemination Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

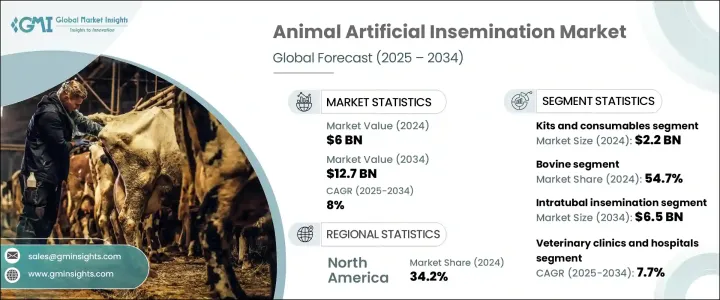

세계의 동물 인공수정 시장은 2024년에는 60억 달러로 평가되었고 CAGR 8%로 성장하여 2034년에는 127억 달러에 이를 것으로 추정됩니다.

성장의 원동력이 되고 있는 것은 유전적 개량에 대한 주목의 고조, 보다 고품질의 가축에 대한 수요 상승, 개발도상지역에서의 고도의 번식 솔루션의 보급입니다. 세계 인구가 증가하면서 육류나 유제품 수요 증가에 대응하기 위해서는 효율적인 가축 생산이 필요합니다. 인공수정(AI)은 생식보조법의 하나이며, 가축의 번식 능력과 생산성을 향상시킴으로써 이러한 요구에 부응하는 데 점점 중요해지고 있습니다.

세계의 많은 지역에서 축산가들은 암소 그룹의 질을 향상시킬뿐만 아니라 번식 관련 비용을 줄이고 생산성을 높이기 위해 AI에 주목하고 있습니다. 선택적 육종을 가능하게 함으로써, AI는 내병성, 유량, 육질 등 바람직한 유전 형질을 높이는 데 도움이 되고 현대의 가축 관리에 필수적인 요소가 되고 있습니다. 시장 확대는 수의학 건강 관리 산업에 대한 투자 증가와 육종 관리 기술의 장기적인 이점에 대한 농부의 의식 증가에 의해 더욱 영향을 받고 있습니다. 또한 인공수정과 수의학 서비스의 통합은 정밀 육종 도구의 지속적인 개발과 함께 인공수정 절차의 효능과 신뢰성을 높이고 종과 지역에 관계없이 보급을 촉진하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 60억 달러 |

| 예측 금액 | 127억 달러 |

| CAGR | 8% |

제품 유형별로는 2024년에 키트 및 소모품 분야가 22억 달러의 평가액으로 시장을 주도했습니다. 자본 집약적인 장비와는 달리, 이러한 제품은 지속적으로 보충되어야 하므로 시장 전체의 수익에 크게 기여하고 있습니다.

동물 유형별로 소 부문은 2024년 총 시장 점유율의 54.7%를 차지했으며, 최고 점유율로 부상했습니다. 우유의 유전자를 개선하고 유량과 내병성 등의 형질을 향상시키는 데 일관되게 중점을 두고 있기 때문에 인공수정은 이 분야에서 선호되는 기술입니다.

기술별로는 난관내 인공수정 분야가 강력한 성장을 이루고 있으며 2034년까지 65억 달러에 달할 것으로 예측되고 있습니다.

최종 용도별로 분석하면 2024년에는 동물병원 및 클리닉이 최대 점유율을 차지하였으며 2034년까지 연평균 복합 성장률(CAGR) 7.7%를 보일 것으로 예측됩니다. 이러한 시설은 생식에 특화된 서비스를 제공하고 있으며, 최신 의료기기와 숙련된 수의사 인력을 도와 복잡한 처치에도 대응할 수 있기 때문에 AI 에코시스템의 중요한 일부로 자리잡고 있습니다.

지역별로는 북미가 2024년 세계 시장을 34.2%의 점유율로 이끌고 있습니다. 미국은 2023년 17억 9,000만 달러에서 2024년 18억 7,000만 달러로 성장했습니다. 이러한 성장은 미국의 고급 수의학 인프라와 높은 가축 생산성을 지원하는 현대 육종 기술의 강력한 도입을 반영합니다.

경쟁 구도는 확립된 세계 기업과 소규모 지역 기업이 혼재하는 것을 특징으로 합니다. IMV Technologies,Genus Plc, URUS Group, CRV Holdings B.V.의 주요 4개 회사는 2024년 시점에서 세계 시장의 약 48%를 차지하였습니다. 이들 기업은 경쟁력을 유지하기 위해 제품 혁신, 기술 업그레이드, 전략적 제휴에 많은 투자를 실시하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 업계에 미치는 영향요인

- 성장 촉진요인

- 자연 교배에 비해 높은 번식 효율을 요구하는 목소리 고조

- 가축과 반려동물 모두에서 유전자 강화 수요 증가

- 정액 채취 및 보존 기술의 기술적 진보

- 동물에서 성 감염의 만연

- 업계의 잠재적 위험 및 과제

- 수술 실패나 합병증의 위험

- 숙련 기술자의 부족

- 규제와 윤리 우려

- 높은 설치 및 설비 비용

- 시장 기회

- 가축의 유전적 개선에 대한 수요 증가

- 신흥 국가의 인공지능 도입 확대

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술의 상황

- 현재의 기술 동향

- 신흥 기술

- 장래 시장 동향

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계 및 예측 : 제품 유형별(2021-2034년)

- 주요 동향

- 서비스

- 정액

- 정상적인 정액

- 성별 판정 정액

- 기기

- 키트와 소모품

제6장 시장 추계 및 예측 : 동물 유형별(2021-2034년)

- 주요 동향

- 소

- 돼지

- 양

- 염소

- 말

- 기타 동물의 유형

제7장 시장 추계 및 예측 : 기술별(2021-2034년)

- 주요 동향

- 난관 내 인공수정

- 자궁내 인공수정

- 자궁 경관 내 수정

- 자궁내 난관 복막 수정

제8장 시장 추계 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 수의사 클리닉과 병원

- 동물 사육 센터

- 연구 기관 및 대학

- 기타 용도

제9장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- Bovine Elite

- CRV Holdings

- Geno SA

- Genus Plc

- IMV Technologies

- Minitube Group

- SEMEX

- Select Sires

- Swine Genetics International

- Shipley Swine Genetics

- Stallion AI Services

- STgenetics

- URUS Group

- VikingGenetics

The Global Animal Artificial Insemination Market was valued at USD 6 billion in 2024 and is estimated to grow at a CAGR of 8% to reach USD 12.7 billion by 2034. This growth is being driven by a rising focus on genetic improvement, increased demand for higher quality livestock, and the widespread adoption of advanced reproductive solutions across developing regions. As the global population continues to grow, so does the need for efficient livestock production to meet escalating demands for meat and dairy products. Artificial insemination (AI), as a method of assisted reproduction, is becoming increasingly important in meeting these needs by enhancing the reproductive performance and productivity of animals.

In many parts of the world, livestock breeders are turning to AI not only to improve herd quality but also to reduce breeding-related costs and boost productivity. By enabling selective breeding, AI helps increase desirable genetic traits such as disease resistance, milk yield, and meat quality, which makes it a vital component of modern livestock management practices. Market expansion is further influenced by the rising investments in the veterinary healthcare industry and the growing awareness among farmers about the long-term benefits of controlled breeding techniques. Additionally, the integration of AI with veterinary services, along with the continuous development of precision breeding tools, is enhancing the effectiveness and reliability of artificial insemination procedures, encouraging its widespread use across species and regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6 Billion |

| Forecast Value | $12.7 Billion |

| CAGR | 8% |

In terms of product type, in 2024, the kits and consumables segment led the market with a valuation of USD 2.2 billion. The frequent use of consumables like insemination pipettes, straws, gloves, and catheters makes them essential components in every AI cycle, driving strong demand. Unlike capital-intensive equipment, these products require consistent replenishment, thereby contributing significantly to overall market revenue. Their high turnover rate and necessity in both clinical and farm settings further reinforce their dominant position in the market.

By animal type, the bovine segment emerged as the top contributor, accounting for 54.7% of the total market share in 2024. This segment benefits from the substantial global demand for dairy and beef products, which has led to the large-scale adoption of artificial insemination techniques in cattle breeding. The consistent emphasis on improving herd genetics and enhancing traits like milk production and disease resistance has made AI a preferred method in this segment. Large cattle populations and organized dairy operations further contribute to the segment's leading share.

Based on technique, the intratubal insemination segment is projected to witness strong growth, reaching USD 6.5 billion by 2034. This technique involves placing semen directly into the fallopian tubes, allowing for improved fertilization success, especially in cases where conventional approaches may not be as effective. Advances in catheter design and insemination tools are enhancing the accessibility and precision of this method, increasing its adoption among breeders aiming for high reproductive efficiency.

When analyzed by end use, in 2024, veterinary clinics and hospitals held the largest share and are expected to grow at a 7.7% CAGR through 2034. These facilities provide specialized reproductive services, and their ability to handle complex procedures, aided by modern medical equipment and skilled veterinary staff, makes them an essential part of the AI ecosystem. Increased awareness of fertility management and the rising preference for professional care also contribute to their strong market presence.

Regionally, North America led the global market in 2024 with a 34.2% share. The United States alone accounted for USD 1.87 billion in 2024, growing from USD 1.79 billion in 2023. This growth reflects the country's advanced veterinary infrastructure and its strong adoption of modern breeding technologies, which support high livestock productivity.

The competitive landscape of the animal artificial insemination market is characterized by the presence of a mix of established global companies and smaller regional firms. Four leading players- IMV Technologies,Genus Plc, URUS Group, and CRV Holdings B.V.-collectively held around 48% of the global market in 2024. These companies are heavily investing in product innovation, technological upgrades, and strategic collaborations to maintain their competitive edge. Meanwhile, local manufacturers continue to intensify competition by offering cost-effective solutions and expanding their geographic presence through mergers and product launches.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Animal type

- 2.2.4 Technique

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for higher reproductive efficiency compared to natural mating

- 3.2.1.2 Increasing demand for enhanced genetics in both livestock and companion animals

- 3.2.1.3 Technological advancements in semen collection and preservation techniques

- 3.2.1.4 Rising prevalence of sexually transmitted diseases among animals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk of procedural failures and complications

- 3.2.2.2 Lack of skilled technicians

- 3.2.2.3 Regulatory and ethical concerns

- 3.2.2.4 High set-up and equipment cost

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for genetic improvement in livestock

- 3.2.3.2 Growing adoption of artificial intelligence in developing countries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Services

- 5.3 Semen

- 5.3.1 Normal semen

- 5.3.2 Sexed semen

- 5.4 Instruments

- 5.5 Kits and consumables

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Bovine

- 6.3 Swine

- 6.4 Ovine

- 6.5 Caprine

- 6.6 Equine

- 6.7 Other animal types

Chapter 7 Market Estimates and Forecast, By Technique, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Intratubal insemination

- 7.3 Intrauterine insemination

- 7.4 Intracervical insemination

- 7.5 Intrauterine tuboperitoneal insemination

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary clinics and hospitals

- 8.3 Animal breeding centers

- 8.4 Research institutes and universities

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Bovine Elite

- 10.2 CRV Holdings

- 10.3 Geno SA

- 10.4 Genus Plc

- 10.5 IMV Technologies

- 10.6 Minitube Group

- 10.7 SEMEX

- 10.8 Select Sires

- 10.9 Swine Genetics International

- 10.10 Shipley Swine Genetics

- 10.11 Stallion AI Services

- 10.12 STgenetics

- 10.13 URUS Group

- 10.14 VikingGenetics