|

시장보고서

상품코드

1766354

흡착 장비 시장 : 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Adsorption Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

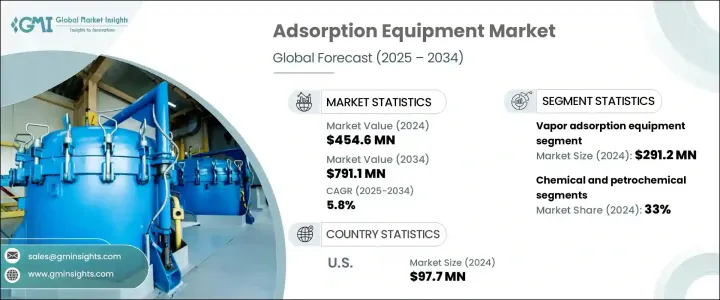

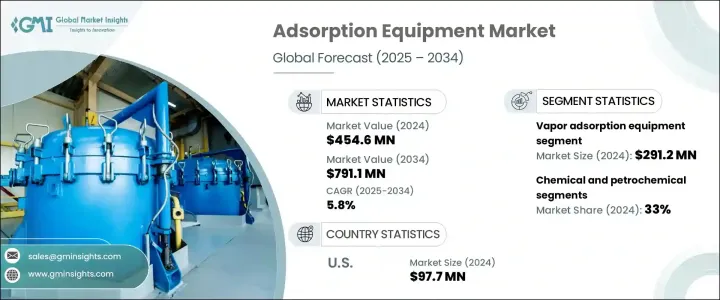

세계의 흡착 장비 시장은 2024년 4억 5,460만 달러로 평가되었고, 2034년에는 7억 9,110만 달러에 이를 것으로 예상되며, CAGR 5.8%로 성장할 전망입니다. 이 시장의 급속한 성장은 환경 규제의 강화와 깨끗한 물과 공기에 대한 수요의 증가에 기인할 수 있습니다. 수처리에 일반적으로 사용되는 활성탄 시스템은 독소, 유기 화합물 및 중금속을 제거하는 데 필수적입니다. 이러한 시스템은 특히 도시 수처리 및 식음료 생산을 포함한 다양한 산업 분야에서 중요합니다. 제약 및 식품 가공과 같은 산업에서 고품질 물과 원자재에 대한 수요가 흡착 장비 시장을 더욱 촉진하고 있습니다. 기술 발전도 이러한 성장에 중요한 역할을 하고 있습니다. 금속-유기 프레임워크(MOF) 및 고급 활성탄과 같은 혁신은 흡착 공정을 보다 효율적이고 비용 효율적으로 만들고 있습니다.

특히 공기 및 수질이 중요한 산업에서 환경 보호에 대한 강조가 높아짐에 따라 고급 흡착 재료의 사용이 널리 확산되고 있습니다. 이러한 재료는 우수한 성능을 제공할 뿐만 아니라 운영 효율성을 높이고 비용을 절감합니다. 오염 통제 규제가 강화됨에 따라 산업은 준수 기준을 충족하기 위해 더 효과적인 해결책을 모색하고 있습니다. 지속 가능한 실천으로의 전환은 제조업체가 에너지 소비와 폐기물 발생을 줄이면서 최적의 결과를 제공하는 흡착제를 채택하도록 촉진하고 있습니다. 또한 흡착 기술의 발전은 산업이 자원 회수율을 개선하고 배출량을 최소화할 수 있도록 지원하여 이러한 고성능 재료에 대한 수요를 더욱 촉진하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 4억 5,460만 달러 |

| 예측 금액 | 7억 9,110만 달러 |

| CAGR | 5.8% |

증기 흡착 장비 부문은 2024년에 2억 9,120만 달러의 매출을 올렸으며, 향후 10년간 5.9%의 성장률을 보일 것으로 예상됩니다. 이 장비는 산업용 공기 및 배기 시스템에서 휘발성 화합물과 가스를 제거하는 데 필수적이며, 공기 정화 및 VOC 제거에 사용됩니다. 특히 오염이 심한 도시 지역에서 깨끗한 공기에 대한 요구가 증가하면서 증기 흡착 시스템에 대한 수요가 증가하고 있습니다. 자동차, 제약 및 제조와 같은 산업은 이러한 기술에 대한 의존도를 높이고 있습니다.

화학 및 석유 화학 부문은 2024년에 33%의 점유율을 차지했으며, 2025년부터 2034년까지 연평균 6.2%의 성장률을 보일 것으로 예상됩니다. 흡착은 가스 분리, 유용 물질 회수, 배출량 감소 등에 중요한 역할을 합니다. 압력 변동 흡착(PSA)과 진공 변동 흡착(VSA)과 같은 기술은 천연 가스 처리 및 바이오가스 업그레이드 분야에서 가스 분리 효율성을 향상시키며 인기를 얻고 있습니다.

미국의 흡착 장비 시장은 2024년에 9,770만 달러로 평가되었고, 2025년부터 2034년까지 5.7%의 성장률이 예상됩니다. 시장의 확장은 EPA와 같은 기관의 엄격한 환경 규제로 촉진되고 있으며, 이러한 규제는 산업계에 공기 및 수질 기준을 준수하기 위해 흡착 기반 시스템을 채택하도록 장려하고 있습니다. 또한 공정 최적화, 효율성 향상, 비용 절감에 대한 수요 증가가 이러한 시스템의 수요를 더욱 촉진하고 있습니다. 화학 및 석유화학 산업, 특히 천연가스 처리 및 용제 회수 분야가 시장 성장의 주요 기여 요인입니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 산업 고찰

- 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 산업에 미치는 영향요인

- 성장 촉진요인

- 산업의 잠재적 리스크 및 과제

- 기회

- 성장 가능성 분석

- 장래 시장 동향

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 가격 동향

- 지역별

- 제품 유형별

- 규제 프레임워크

- 규격과 인증

- 환경규제

- 수출입 규제

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확대 계획

제5장 시장 추정 및 예측 : 제품 유형별(2021-2034년)

- 주요 동향

- 증기 흡착 장비

- 액체 흡착 장비

제6장 시장 추정 및 예측 : 유량별(2021-2034년)

- 주요 동향

- 최대 1만 CFM

- 1만-2만 CFM

- 2만 CFM 이상

제7장 시장 추정 및 예측 : 최종 이용 산업별(2021-2034년)

- 주요 동향

- 의약품

- 폐기물 및 폐수 처리

- 화학 및 석유 화학

- 자동차

- 인쇄

- 기타(농약, 코팅 등)

제8장 시장 추정 및 예측 : 유통 채널별(2021-2034년)

- 주요 동향

- 직접 판매

- 간접 판매

제9장 시장 추정 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

제10장 기업 프로파일

- Bry-Air

- Calgon Carbon

- Carbtrol

- CECO Environmental

- Durr

- Evoqua

- General Carbon

- GUNT

- KCH

- Microtrac

- Munters

- Process Combustion Corporation

- Suny Group

- Thermax

- TIGG

The Global Adsorption Equipment Market was valued at USD 454.6 million in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 791.1 million by 2034. The rapid growth in this market can be attributed to stricter environmental regulations and the increasing need for clean water and air. Activated carbon systems, commonly used for water treatment, are essential for removing toxins, organic compounds, and heavy metals. These systems are particularly important for municipal water treatment and various industrial applications, including food and beverage production. The demand for high-quality water and raw materials in industries like pharmaceuticals and food processing is further driving the market for adsorption equipment. Technological advancements are also playing a significant role in this growth. Innovations like metal-organic frameworks (MOFs) and advanced activated carbon are making adsorption processes more efficient and cost-effective.

The growing emphasis on environmental protection, particularly in industries where air and water quality are critical, is driving the widespread use of advanced adsorption materials. These materials not only offer superior performance but also enhance operational efficiency while reducing costs. As regulations around pollution control tighten, industries are turning to more effective solutions to meet compliance standards. The shift toward sustainable practices is pushing manufacturers to adopt adsorbents that deliver optimal results with lower energy consumption and reduced waste generation. Furthermore, advancements in adsorption technologies are enabling industries to improve resource recovery and minimize emissions, further boosting the demand for these high-performance materials.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $454.6 Million |

| Forecast Value | $791.1 Million |

| CAGR | 5.8% |

The vapor adsorption equipment segment generated USD 291.2 million in 2024, with an estimated growth rate of 5.9% over the next decade. This equipment is essential for removing volatile compounds and gases from industrial air and exhaust systems, with applications in air purification and VOC removal. The growing need for cleaner air, especially in polluted urban areas, is pushing the demand for vapor adsorption systems. Industries such as automotive, pharmaceuticals, and manufacturing are increasing their reliance on these technologies.

The chemical and petrochemical segment accounted for a 33% share in 2024 and is expected to grow at a CAGR of 6.2% between 2025 and 2034. Adsorption plays a vital role in these industries by helping with the separation of gases, the recovery of useful materials, and the reduction of emissions. Technologies like pressure swing adsorption (PSA) and vacuum swing adsorption (VSA) are becoming increasingly popular in natural gas processing and biogas upgrading, offering improved efficiency in gas separation.

U.S. Adsorption Equipment Market was valued at USD 97.7 million in 2024, with an estimated growth rate of 5.7% from 2025 to 2034. The market's expansion is being driven by stringent environmental regulations from bodies like the EPA, which are encouraging industries to adopt adsorption-based systems to comply with air and water quality standards. Additionally, the increasing demand for process optimization, efficiency, and cost reduction is further fueling the demand for these systems. The chemical and petrochemical sectors, particularly in areas like natural gas processing and solvent recovery, are key contributors to market growth.

Several prominent players are leading the Adsorption Equipment Industry, including Calgon Carbon, Bry-Air, Durr, Evoqua, and CECO Environmental. These companies are focused on driving innovation and expanding their market presence by investing in advanced technologies and offering solutions that meet the growing demands for clean air and water in the industrial and municipal sectors. To enhance their market position, companies in the adsorption equipment industry are implementing various strategies. These include focusing on research and development to introduce more efficient and cost-effective solutions. Additionally, they are expanding their product portfolios to cater to a wider range of industries, from water treatment to air purification. Strategic partnerships and acquisitions are also being pursued to strengthen their capabilities and reach. Companies are investing in state-of-the-art technologies like metal-organic frameworks and advanced adsorption materials to maintain their competitive edge.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Flow rate

- 2.2.4 End use industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Vapor adsorption equipment.

- 5.3 Liquid adsorption equipment

Chapter 6 Market Estimates & Forecast, By Flow Rate, 2021 - 2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Up to 10,000 CFM

- 6.3 10,000 - 20,000 CFM

- 6.4 More than 20,000 CFM

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Pharmaceutical

- 7.3 Waste & wastewater treatment.

- 7.4 Chemical and Petrochemical

- 7.5 Automotive

- 7.6 Printing

- 7.7 Others (pesticide, coating etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Bry-Air

- 10.2 Calgon Carbon

- 10.3 Carbtrol

- 10.4 CECO Environmental

- 10.5 Durr

- 10.6 Evoqua

- 10.7 General Carbon

- 10.8 GUNT

- 10.9 KCH

- 10.10 Microtrac

- 10.11 Munters

- 10.12 Process Combustion Corporation

- 10.13 Suny Group

- 10.14 Thermax

- 10.15 TIGG