|

시장보고서

상품코드

1773224

기능성 소맥분 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Functional Flours Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

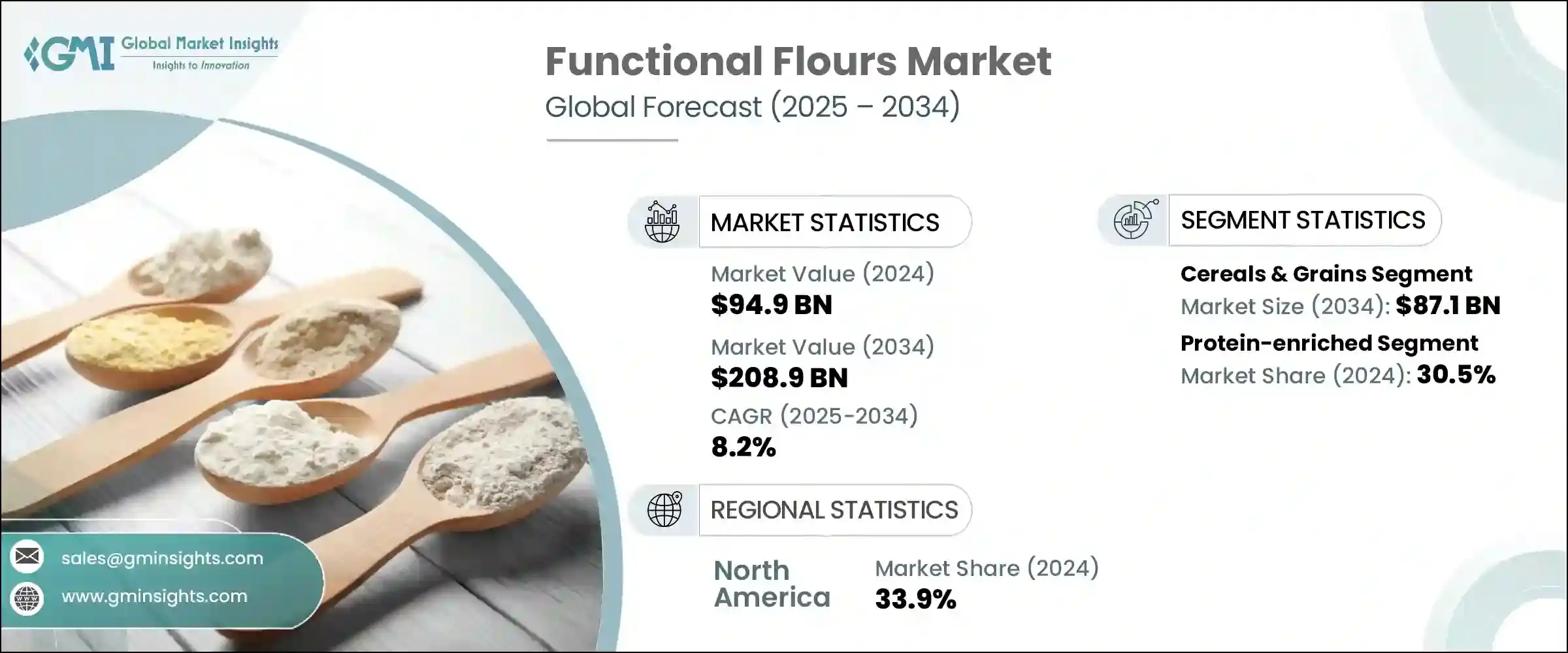

세계의 기능성 소맥분 시장은 2024년에 949억 달러로 평가되었고, CAGR 8.2%로 성장하여 2034년에는 2,089억 달러에 이를 것으로 추정되고 있습니다.

이러한 빠른 성장의 배경에는 강화 밀가루의 건강상의 이점, 특히 비만 및 당뇨병과 같은 생활습관 관련 증상 관리에 있어 강화 밀가루의 역할에 대한 인식이 높아진 것이 한몫하고 있습니다. 소비자들은 점점 더 영양가 높은 대안을 찾고 있으며, 제조업체들은 밀가루에 섬유질, 단백질, 미량 영양소를 강화하기 위해 노력하고 있습니다. 또한 베이커리, 스낵, 간편식, 특히 클린 라벨 및 글루텐 프리 분야에서 수요가 증가함에 따라 시장 모멘텀이 강화되고 있습니다. 제분 및 생산 기술의 발전으로 식감, 영양가, 기능적 성능이 개선된 밀가루를 생산할 수 있게 되어 밀가루의 수준을 높이고 있습니다.

이러한 발전으로 생산자들은 소비자의 다양한 기대에 부응할 수 있게 되었고, 특정 식습관, 건강 요구, 문화 트렌드에 맞추어 고도로 전문화된 밀가루 제품을 개발할 수 있게 되어 시장 확대가 더욱 가속화되고 있습니다. 소비자들이 투명성, 기능성, 클린 라벨의 원료를 점점 더 많이 찾는 가운데, 제조업체들은 이러한 기술 혁신을 활용하여 영양가, 소화율, 보존성을 개선한 밀가루를 생산하고 있습니다. 글루텐 프리, 저탄수화물, 단백질이 풍부한 밀가루, 알레르겐 대응 등 밀가루 배합을 맞춤화할 수 있기 때문에 브랜드는 틈새 시장에 대응하면서 소비자층을 확대할 수 있습니다. 결국, 진화하는 식품 트렌드와의 전략적 정합성이 프리미엄 제품의 포지셔닝과 대중 시장으로의 확장성을 모두 지원하여 세계 기능성 밀가루 산업의 모멘텀을 강화하고 있습니다.

| 시장 범위 | |

|---|---|

| 개시 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 개시 금액 | 949억 달러 |

| 예측 금액 | 2,089억 달러 |

| CAGR | 8.2% |

시리얼 및 곡물 분야는 CAGR 5.4%로 성장하여 2034년에는 871억 달러에 이를 것으로 예측됩니다. 빵, 아침 시리얼, 스낵바, 조리된 식품 등 일상적인 제품에 광범위하게 적용되고 있는 것이 이 시장의 강력한 입지를 뒷받침하고 있습니다. 특히 글루텐 프리, 통곡물, 고섬유질 제제 등 몸에 좋은 식품에 대한 소비자의 선호도가 급증하면서 이 분야의 성장에 박차를 가하고 있습니다. 건강 및 웰빙 트렌드가 전 세계 식습관을 계속 형성하고 있기 때문에 이 분야는 선진국과 신흥국 시장에서 모두 인기 상품으로 자리 잡고 있습니다. 이러한 모멘텀에도 불구하고, 원자재 가격 변동, 운송 비용, 간헐적인 공급망 중단은 지속적인 위험 요소로 작용하고 있습니다. 이러한 문제를 해결하기 위해 생산자들은 식이섬유, 비타민, 미네랄을 첨가하여 시리얼 기반 밀가루의 영양 밀도를 높이고 건강 지향적인 구매층에게 어필하기 위해 노력하고 있습니다.

2024년에는 단백질 강화 분말 부문이 30.5%의 점유율을 차지했습니다. 이 부문은 2034년까지 연평균 복합 성장률(CAGR) 5.2%를 보일 것으로 예측됩니다. 이 부문은 신체 능력 향상, 근육 건강, 포만감, 체중 조절과 관련된 단백질이 풍부한 식단에 대한 수요가 급증하면서 성장 동력이 되고 있습니다. 특히 고령자 및 특정 인구 집단에서 단백질 부족의 부정적인 영향에 대한 소비자의 인식이 높아지면서 단백질이 첨가된 기능성 밀가루에 대한 관심이 높아지고 있습니다. 이에 따라 제조업체들은 채식주의자 및 비건 인구 증가에 대응하고 유제품 및 콩 알레르기가 있는 소비자들을 위해 렌틸콩, 완두콩, 콩 등 식물성 단백질을 사용한 혁신적인 제품을 개발하고 있습니다.

북미 기능성 밀가루 시장은 2024년 33.9%의 점유율을 차지했습니다. 이 지역 시장 점유율이 높은 주요 요인은 식생활 맞춤화에 대한 인식이 높아지면서 글루텐 불내증, 체강 질병 및 기타 라이프 스타일에 따른 식습관에 적합한 밀가루를 적극적으로 찾고 있기 때문입니다. 이러한 수요는 병아리콩, 퀴노아, 현미와 같은 영양이 풍부한 원료에서 추출한 밀가루의 생산과 소비를 촉진하고 있습니다. 기술 혁신과 제품 다양화를 통해 지속적으로 제품 포트폴리오를 확장하고 있는 기존 업계 기업들의 존재감이 강해 시장 성장을 더욱 촉진하고 있습니다.

이 시장의 주요 기업으로는 Roquette Freres, Ingredion Incorporated, Archer Daniels Midland Company(ADM), SunOpta Inc. 기능성 밀가루 분야의 선두 기업들은 다각화, 건강 중심의 혁신, 공급망 견고성에 초점을 맞추었습니다. 이들 기업은 식물성 단백질 밀가루와 대체 곡물 등 제품 범위를 확장하고 있습니다. R&D에 대한 집중적인 투자를 통해 혈당 조절, 장 건강, 고단백 식단을 지원하는 맞춤형 밀가루 블렌드를 개발할 수 있게 되었습니다. 베이커리 및 식품 제조업체와의 전략적 제휴를 통해 제품 보급과 최종 용도 적합성을 향상시키고 있습니다. 이들 기업은 원자재 가격 변동에 대비하기 위해 조달 파트너십과 저장 인프라를 통해 세계 공급망을 강화하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 주요 제조업체

- 유통업체

- 업계 전체 이익률

- 공급망과 유통 분석

- 원재료 조달

- 생산과 제조

- 콜드체인 인프라

- 유통 채널

- 공급망 과제와 최적화

- 지속가능한 관행

- 무역 통계(HS코드)

- 주요 수출국, 2021-2024

- 주요 수출국, 2021-2024

(주 : 상기 무역 통계는 주요 국가 봐에 제공됩니다)

- 영향요인

- 성장 촉진요인

- 건강 의식의 고양

- 무글루텐 제품 수요 증가

- 단백질 섭취량 증가

- 클린 라벨 동향

- 업계의 잠재적 리스크&과제

- 기존 소맥분에 비해 고가

- 보존 기간이 한정되어 있다

- 처리상 과제

- 맛과 먹을 때의 느낌 제한

- 시장 기회

- 아시아태평양 신흥 시장

- 식물 유래 제품 혁신

- 기능성 식품 응용

- E-Commerce 확대

- 성장 촉진요인

- 원재료 상황

- 제조업 동향

- 기술 진화

- 가공 기술

- 요새화 방법

- 품질 테스트 및 분석

- 포장 혁신

- 가격 분석과 비용 구조

- 가격 동향(달러/톤)

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 가격 요인(원재료, 에너지, 노동력)

- 지역에 의한 가격차

- 비용 구조 내역

- 수익성 분석

- 가격 동향(달러/톤)

- 규제 프레임워크와 기준

- FDA 규제(미국)

- EU규제

- 코덱스 식품 규격

- 지역 규제기관

- 라벨 요건

- 품질 기준

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 기업 히트맵 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

- Expansion

- Mergers &acquisition

- Collaborations

- New product launches

- Research &development

- 주요 기업의 최근 동향과 영향 분석

- 기업 분류

- 참가자 개요

- 재무 실적

- 제품 벤치마킹

제5장 시장 추산·예측 : 공급원별, 2021년-2034년

- 주요 동향

- 곡물

- 밀

- 미

- 옥수수

- 귀리

- 보리

- 퀴노아

- 기타 곡물

- 콩(물집)과식물

- 병아리콩

- 렌틸콩

- 완두콩

- 두

- 기타 콩류

- 견과류 및 씨앗자

- 아몬드

- 코코넛

- 해바라기 종

- 아마 종자

- 기타 견과류 유형

- 과일 및 채소

- 바나나

- 고구마

- 카사바

- 기타 과일 및 채소

- 기타 공급원

- 곤충

- 조류(Algae)

- 버섯

제6장 시장 추산·예측 : 기능별, 2021년-2034년

- 주요 동향

- 단백질 강화

- 식이섬유가 풍부

- 무글루텐

- 비타민&미네랄 강화

- 저탄수화물

- 프로바이오틱스

- 항산화물질이 풍부

- 기타 기능

제7장 시장 추산·예측 : 용도별, 2021년-2034년

- 주요 동향

- 베이커리 및 제과

- 빵

- 케이크와 페이스트리

- 쿠키와 비스킷

- 머핀과 컵 케이크

- 기타 베이커리 제품

- 스낵

- 밀어 내 스낵

- 크래커

- 팁스

- 기타 스낵

- 음료

- 프로테인 드링크

- 스무디

- 기능성 음료

- 기타 음료

- 파스타와 면류

- 아침식사용 시리얼

- 수프 및 소스

- 고기 대체품

- 기타

제8장 시장 추산·예측 : 형태별, 2021년-2034년

- 주요 동향

- 분말

- 과립

- 플레이크

- 펠릿

제9장 시장 추산·예측 : 유통 채널별, 2021년-2034년

- 주요 동향

- B2B(기업간 거래)

- 식품제조업체

- 빵가게

- 푸드서비스

- 기타 B2B 채널

- B2C(기업대 소비자)

- 슈퍼마켓 및 하이퍼마켓

- 전문점

- 온라인 소매

- 편의점

- 기타 B2C 채널

제10장 시장 추산·예측 : 지역별, 2021년-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 기타 라틴아메리카

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카공화국

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

제11장 기업 개요

- Cargill, Incorporated

- Archer Daniels Midland Company(ADM)

- Associated British Foods plc

- General Mills, Inc.

- Ingredion Incorporated

- Roquette Freres

- Tate &Lyle PLC

- SunOpta Inc.

- The Scoular Company

- Agrana Beteiligungs-AG

- Limagrain

- Bunge Limited

- The Andersons, Inc.

- Grain Millers, Inc.

- Hodgson Mill, Inc.

- Lifeway Foods, Inc.

- Manildra Group

- Unicorn Grain Specialties

- Bluebird Grain Farms

The Global Functional Flours Market was valued at USD 94.9 billion in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 208.9 billion by 2034. This surge is being driven by growing awareness of the health advantages that fortified flours offer-particularly their roles in managing lifestyle-related conditions like obesity and diabetes. Consumers increasingly seek nutritious alternatives, leading manufacturers to enrich flours with fibers, proteins, and micronutrients. Additionally, rising demand across applications such as bakery, snacks, and convenience foods-especially clean-label and gluten-free segments-has strengthened market momentum. Technological enhancements in milling and production have also raised the bar, enabling the creation of flours with improved texture, nutritional value, and functional performance.

These advancements allow producers to meet diverse consumer expectations, further fueling market expansion by enabling the development of highly specialized flour products tailored to specific dietary preferences, health needs, and cultural trends. As consumers increasingly demand transparency, functionality, and clean-label ingredients, manufacturers are leveraging these innovations to create flours with enhanced nutritional value, better digestibility, and improved shelf life. The ability to customize flour formulations-whether gluten-free, low-carb, protein-rich, or allergen-friendly-empowers brands to cater to niche markets while broadening their overall consumer base. In turn, this strategic alignment with evolving food trends supports both premium product positioning and mass-market scalability, reinforcing the momentum of the global functional flour industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $94.9 Billion |

| Forecast Value | $208.9 Billion |

| CAGR | 8.2% |

The cereals & grains segment is forecasted to reach USD 87.1 billion by 2034, expanding at a CAGR of 5.4%. Its strong market presence is supported by widespread incorporation in everyday products like bread, breakfast cereals, snack bars, and ready-to-eat foods. A surge in consumer preference for better-for-you options-especially gluten-free, whole-grain, and high-fiber formulations-is fueling this segment's growth. As health and wellness trends continue to shape eating habits globally, this segment remains a staple in both developed and emerging markets. Despite this momentum, fluctuating raw material prices, transportation costs, and occasional supply chain interruptions pose ongoing risks. To counteract these challenges, producers are focusing on increasing the nutritional density of cereal-based flours by fortifying them with added fiber, vitamins, and minerals to appeal to health-conscious buyers.

In 2024, protein-enriched flours segment held 30.5% share. This segment is projected to grow at a CAGR of 5.2% through 2034, driven by surging demand for protein-rich diets, which are widely associated with improved physical performance, muscle health, satiety, and weight management. Heightened consumer awareness of the negative impacts of protein deficiency, especially among older adults and specific demographic groups, is intensifying interest in functional flours with added protein. In response, manufacturers are developing innovative offerings using plant-based proteins like lentils, peas, and soy to support growing vegetarian and vegan populations, while also catering to consumers with dairy or soy allergies.

North America Functional Flours Market held a 33.9% share in 2024. The region's leading share is largely attributed to rising awareness around dietary customization, with consumers actively seeking flours suited for gluten intolerance, celiac disease, and other lifestyle-based eating patterns. This demand is driving the production and consumption of flours derived from nutrient-dense sources like chickpeas, quinoa, and brown rice. The strong presence of established industry players, who are consistently expanding their product portfolios through innovation and product diversification, is further supporting market growth.

Major players in the market include Roquette Freres, Ingredion Incorporated, Archer Daniels Midland Company (ADM), SunOpta Inc., and Associated British Foods plc. Top companies in the functional flour space are focusing on diversification, health-driven innovation, and supply chain robustness. They are expanding their product ranges to include plant-based protein flours and alternative grains. Heavy investment in R&D is enabling the development of custom-tailored flour blends that support blood sugar control, gut health, or high-protein diets. Strategic alliances with bakery and food manufacturers are improving product penetration and end-use compatibility. These players are strengthening global supply chains through sourcing partnerships and storage infrastructure to hedge against raw material price fluctuations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Key manufacturers

- 3.1.2 Distributors

- 3.1.3 Profit margins across the industry

- 3.1.4 Supply chain and distribution analysis

- 3.1.4.1 Raw material sourcing

- 3.1.4.2 Production and manufacturing

- 3.1.4.3 Cold chain infrastructure

- 3.1.4.4 Distribution channels

- 3.1.4.5 Supply chain challenges and optimization

- 3.1.4.6 Sustainable practices

- 3.2 Trade statistics (HS code)

- 3.2.1 Major exporting countries, 2021-2024 (Kilo Tons)

- 3.2.2 Major exporting countries, 2021-2024 (Kilo Tons)

( Note: the above trade statistics will be provided for key countries only)

- 3.3 Impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising health consciousness

- 3.3.1.2 Growing demand for gluten-free products

- 3.3.1.3 Increasing protein consumption

- 3.3.1.4 Clean label trends

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 High cost compared to conventional flour

- 3.3.2.2 Limited shelf life

- 3.3.2.3 Processing challenges

- 3.3.2.4 Taste and texture limitations

- 3.3.3 Market opportunity

- 3.3.3.1 Emerging markets in Asia-Pacific

- 3.3.3.2 Innovation in plant-based products

- 3.3.3.3 Functional food applications

- 3.3.3.4 E-commerce expansion

- 3.3.1 Growth drivers

- 3.4 Raw material landscape

- 3.4.1 Manufacturing trends

- 3.4.2 Technology evolution

- 3.4.2.1 Processing technologies

- 3.4.2.2 Fortification methods

- 3.4.2.3 Quality testing & analysis

- 3.4.2.4 Packaging innovations

- 3.5 Pricing analysis and cost structure

- 3.5.1 Pricing trends (USD/Ton)

- 3.5.1.1 North America

- 3.5.1.2 Europe

- 3.5.1.3 Asia Pacific

- 3.5.1.4 Latin America

- 3.5.1.5 Middle East Africa

- 3.5.2 Pricing factors (raw materials, energy, labor)

- 3.5.3 Regional price variations

- 3.5.4 Cost structure breakdown

- 3.5.5 Profitability analysis

- 3.5.1 Pricing trends (USD/Ton)

- 3.6 Regulatory framework and standards

- 3.6.1 FDA regulations (U.S.)

- 3.6.2 EU regulations

- 3.6.3 Codex alimentarius standards

- 3.6.4 Regional regulatory bodies

- 3.6.5 Labeling requirements

- 3.6.6 Quality standards

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Company heat map analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.6.1 Expansion

- 4.6.2 Mergers & acquisition

- 4.6.3 Collaborations

- 4.6.4 New product launches

- 4.6.5 Research & development

- 4.7 Recent developments & impact analysis by key players

- 4.7.1 Company categorization

- 4.7.2 Participant’s overview

- 4.7.3 Financial performance

- 4.8 Product benchmarking

Chapter 5 Market Estimates & Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Cereals & grains

- 5.2.1 Wheat

- 5.2.2 Rice

- 5.2.3 Corn

- 5.2.4 Oats

- 5.2.5 Barley

- 5.2.6 Quinoa

- 5.2.7 Other cereals & grains

- 5.3 Legumes

- 5.3.1 Chickpeas

- 5.3.2 Lentils

- 5.3.3 Peas

- 5.3.4 Beans

- 5.3.5 Other legumes

- 5.4 Nuts & seeds

- 5.4.1 Almonds

- 5.4.2 Coconut

- 5.4.3 Sunflower seeds

- 5.4.4 Flax seeds

- 5.4.5 Other nuts & seeds

- 5.5 Fruits & vegetables

- 5.5.1 Banana

- 5.5.2 Sweet potato

- 5.5.3 Cassava

- 5.5.4 Other fruits & vegetables

- 5.6 Other sources

- 5.6.1 Insects

- 5.6.2 Algae

- 5.6.3 Mushrooms

Chapter 6 Market Estimates & Forecast, By Functionality, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Protein enriched

- 6.3 Fiber enriched

- 6.4 Gluten-free

- 6.5 Vitamin & mineral fortified

- 6.6 Low carbohydrate

- 6.7 Probiotic

- 6.8 Antioxidant rich

- 6.9 Other functionalities

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Bakery & confectionery

- 7.2.1 Bread

- 7.2.2 Cakes & pastries

- 7.2.3 Cookies & biscuits

- 7.2.4 Muffins & cupcakes

- 7.2.5 Other bakery products

- 7.3 Snacks

- 7.3.1 Extruded snacks

- 7.3.2 Crackers

- 7.3.3 Chips

- 7.3.4 Other snacks

- 7.4 Beverages

- 7.4.1 Protein drinks

- 7.4.2 Smoothies

- 7.4.3 Functional beverages

- 7.4.4 Other beverages

- 7.5 Pasta & noodles

- 7.6 Breakfast cereals

- 7.7 Soups & sauces

- 7.8 Meat alternatives

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Powder

- 8.3 Granules

- 8.4 Flakes

- 8.5 Pellets

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 B2b (business-to-business)

- 9.2.1 Food manufacturers

- 9.2.2 Bakeries

- 9.2.3 Foodservice

- 9.2.4 Other b2b channels

- 9.3 B2c (business-to-consumer)

- 9.3.1 Supermarkets & hypermarkets

- 9.3.2 Specialty stores

- 9.3.3 Online retail

- 9.3.4 Convenience stores

- 9.3.5 Other b2c channels

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Cargill, Incorporated

- 11.2 Archer Daniels Midland Company (ADM)

- 11.3 Associated British Foods plc

- 11.4 General Mills, Inc.

- 11.5 Ingredion Incorporated

- 11.6 Roquette Freres

- 11.7 Tate & Lyle PLC

- 11.8 SunOpta Inc.

- 11.9 The Scoular Company

- 11.10 Agrana Beteiligungs-AG

- 11.11 Limagrain

- 11.12 Bunge Limited

- 11.13 The Andersons, Inc.

- 11.14 Grain Millers, Inc.

- 11.15 Hodgson Mill, Inc.

- 11.16 Lifeway Foods, Inc.

- 11.17 Manildra Group

- 11.18 Unicorn Grain Specialties

- 11.19 Bluebird Grain Farms