|

시장보고서

상품코드

1773245

동물 진단약 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Animal Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

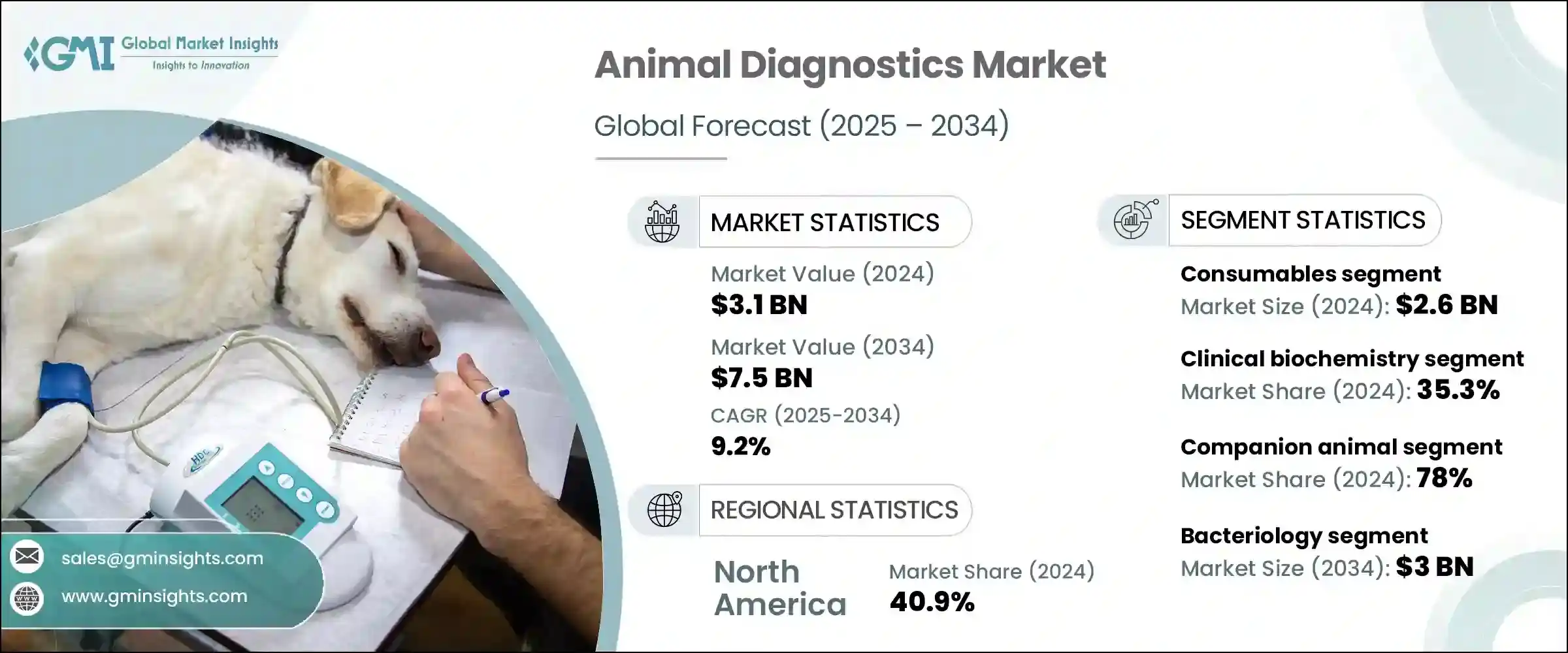

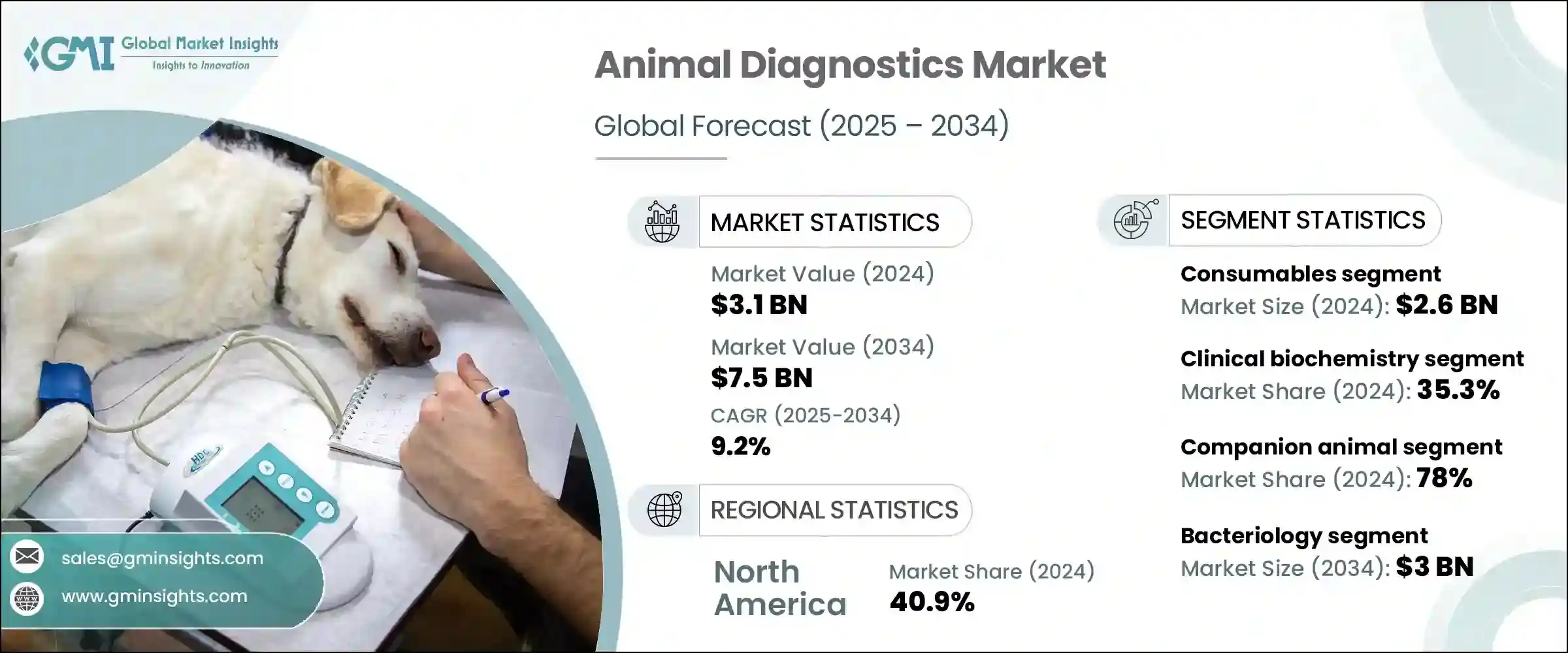

세계의 동물 진단약 시장은 2024년에는 31억 달러로 평가되며, CAGR 9.2%로 성장하며, 2034년에는 75억 달러에 달할 것으로 추정되고 있습니다.

이러한 성장은 주로 반려동물과 가축의 감염성 및 만성질환의 유병률 증가에 기인합니다. 동물의 건강이 개인 소유주와 농업 부문 모두에게 점점 더 큰 관심사가 됨에 따라 신뢰할 수 있는 진단 솔루션에 대한 수요는 계속 증가하고 있습니다.

동물 위생 인프라에 대한 공공 및 민간 투자는 질병 예방 및 관리를 목표로 하는 정부 지원 정책과 함께 수의학 분야 전반에 걸쳐 진단약에 대한 인식과 채택을 촉진하고 있습니다. 동물병원과 진단검사실 간의 협력관계와 주요 기업의 소외된 지역에 대한 아웃리치 확대는 개발도상국의 검사 서비스 접근성을 크게 향상시키고 있습니다. 또한 반려동물 보험의 보급은 보호자의 잦은 진단에 대한 경제적 부담을 줄여 정기적인 검사와 질병의 조기 발견을 장려하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작연도 | 2024년 |

| 예측연도 | 2025-2034년 |

| 시작 금액 | 31억 달러 |

| 예측 금액 | 75억 달러 |

| CAGR | 9.2% |

동물 진단약에는 동물의 질병 및 기타 건강 상태를 감지하고 모니터링하는 데 사용되는 다양한 검사 방법이 포함됩니다. 이러한 방법에는 분자진단학, 혈청학적 검사, 소변 검사, 임상 생화학 등이 포함됩니다. 제품 유형에 따라 시장은 기기와 소모품으로 구분됩니다. 이 중 소모품 부문은 2024년 시장 규모가 26억 달러로 가장 큰 비중을 차지할 것으로 예측됩니다. 이 부문의 우위는 진단 키트, 시약, 슬라이드, 채혈관과 같은 품목의 사용 빈도가 높고 반복적으로 필요하므로 이 부문의 우위에 기인합니다. 이러한 제품들은 동물병원과 연구소의 일상 업무에 필수적이며, 안정적인 수요와 전체 시장의 리더십에 기여하고 있습니다.

기술별로는 임상 생화학 분야가 35.3%의 점유율로 2024년 세계 시장 세분화를 주도했습니다. 이 분야는 혈액, 소변 및 기타 체액을 통해 중요한 생리적 마커를 평가할 수 있으며, 동물의 간 및 신장질환, 대사성 질환, 호르몬 불균형과 같은 상태를 조기에 발견할 수 있는 능력으로 인해 지속적인 지지를 받고 있습니다. 반려동물의 예방의학에 대한 인식이 높아지면서 생화학 패널을 포함한 정기적인 건강검진에 대한 수요가 급증하고 있습니다. 반려동물의 만성질환 사례가 증가하고 있는 것도 수의학 현장에서 임상화학 툴의 사용을 촉진하는 데 중요한 역할을 하고 있습니다.

용도별로 시장은 세균학, 병리학, 기생충학, 기타 진단 용도로 구분됩니다. 세균학 분야는 시장의 대부분을 차지하며 2034년까지 30억 달러에 달할 것으로 예측됩니다. 이 분야는 광범위한 동물 질병을 유발하는 세균성 병원체를 식별하는 데 있으며, 여전히 매우 중요한 분야입니다. 세균학적 검사를 통해 수의사는 감염병을 정확하게 진단하고 적시에 치료 프로토콜을 시행할 수 있습니다. 검사 방법의 혁신과 인수공통전염병의 억제 및 식품 안전 기준의 향상에 대한 중요성이 강조되면서 이 분야가 우위를 점하고 있습니다.

동물 유형별로 분류하면, 반려동물 카테고리가 2024년 78%의 점유율을 차지하며 시장을 주도했습니다. 여기에는 개, 고양이, 말, 기타 반려동물용 진단약이 포함됩니다. 특히 도시 지역에서 반려동물 사육이 급증하면서 진단을 포함한 수의학 서비스에 대한 수요가 증가하고 있습니다. 또한 반려동물의 건강에 대한 인식이 높아지고, 암이나 당뇨병과 같은 동물의 질병 발생률이 증가함에 따라 반려동물 보호자들이 정기적인 건강검진 및 진단 지원을 받으려는 경향이 증가하고 있습니다.

최종 용도별로는 진단 실험실이 2024년 주요 부문으로 부상하여 2025-2034년 연평균 복합 성장률(CAGR) 9.3%를 보일 것으로 예측됩니다. 이러한 실험실은 대량의 샘플을 정확하게 처리할 수 있는 정교한 장비와 숙련된 기술자의 지원을 받아 종합적인 검사 서비스를 제공합니다. 실시간 PCR 및 유전자 염기서열 분석과 같은 고급 검사를 수행할 수 있는 능력으로 정확한 결과를 원하는 수의사들에게 선택받고 있습니다. 중앙 집중식 고처리량 검사에 대한 수요가 증가함에 따라 이 시설들은 시장의 최전선에 자리 잡고 있습니다.

지역별로는 북미가 2024년에도 가장 큰 시장으로 남아 세계 점유율의 40.9%를 차지하고 있습니다. 이 지역은 반려동물 사육의 대중화, 높은 수준의 수의학 의료 인프라, 동물 예방 의료에 대한 인식 증가 등의 혜택을 누리고 있습니다. 미국 동물 진단 의약품 시장만 해도 2024년 11억 4,000만 달러에 달할 것으로 예상되며, 전년 대비 꾸준한 성장세를 보이고 있습니다. 반려동물 보험의 보급과 동물 건강에 대한 지출 증가가 이 지역의 주도권을 지원하는 요인 중 하나입니다.

세계 시장 상황경쟁 구도는 업계의 약 65%에서 70%를 지배하는 주요 기업에 의해 지배되고 있습니다. 이들 기업은 광범위한 제품 포트폴리오와 국제적인 입지를 활용하여 강력한 발판을 유지하고 있습니다. 인수, 신제품 출시, 시설 확장과 같은 전략적 구상은 빠르게 진화하는 이 시장에서 성장을 가속하고 기술 역량을 강화하기 위해 사용되는 일반적인 전술입니다.

목차

제1장 조사 방법과 범위

제2장 개요

제3장 업계 인사이트

- 에코시스템 분석

- 공급업체의 상황

- 각 단계에서의 부가가치

- 밸류체인에 영향을 미치는 요인

- 업계에 대한 영향요인

- 촉진요인

- 애완동물 동물을 기르는 경향이 증가

- 식중독 및 인수 공통 감염증의 만연

- 정부의 양호한 구상

- 동반진단의 진보

- 애완동물 보험의 도입 증가

- 업계의 잠재적 리스크 & 과제

- 동물 실험에 수반하는 불합리한 비용

- 수의 치료에 드는 자기 부담액이 낮다.

- 시장 기회

- 기술의 진보와 POC(Point of Care) 분자 툴

- 확대하는 축산업과 식품 안전에 대한 수요

- 촉진요인

- 성장 가능성 분석

- 가격 분석

- 규제 상황

- 테크놀러지의 상황

- 향후 시장 동향

- 갭 분석

- Porter의 산업 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십과 협업

- 신제품 발매

- 확장 계획

제5장 시장 추산·예측 : 제품별, 2021-2034년

- 주요 동향

- 소모품

- 기기

제6장 시장 추산·예측 : 기술별, 2021-2034년

- 주요 동향

- 임상 생화학

- 혈당 모니터링

- 혈액가스 및 전해질 분석

- 기타 임상 생화학 검사

- 면역진단

- 측방유동 어세이

- ELISA

- 면역측정 분석기

- 기타 면역진단 검사

- 분자진단

- PCR

- 마이크로어레이

- 기타 분자진단 검사

- 혈액학

- 요검사

- 기타 기술

제7장 시장 추산·예측 : 용도별, 2021-2034년

- 주요 동향

- 세균학

- 병리학

- 기생충학

- 기타 용도

제8장 시장 추산·예측 : 동물 유형별, 2021-2034년

- 주요 동향

- 반려동물

- 개

- 고양이

- 말

- 기타 애완동물

- 농장 동물

- 소

- 돼지

- 가금

- 기타 가축

제9장 시장 추산·예측 : 최종 용도별, 2021-2034년

- 주요 동향

- 동물병원 및 진료소

- 진단 실험실

- 홈케어 환경

- 기타 용도

제10장 시장 추산·예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 폴란드

- 네덜란드

- 스웨덴

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 필리핀

- 태국

- 인도네시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 콜롬비아

- 페루

- 칠레

- 중동 및 아프리카

- 남아프리카공화국

- 사우디아라비아

- 아랍에미리트

- 튀르키예

- 이집트

- 이스라엘

제11장 기업 개요

- bioMerieux

- BioNote

- Bio-Rad Laboratories

- Boehringer Ingelheim International

- Heska Corporation

- Idexx laboratories

- KogeneBiotech

- Median Diagnostics

- Neogen Corporation

- Randox

- Thermo Fischer Scientific

- Virbac

- VetAll Laboratories

- Qiagen

- Zoetis

The Global Animal Diagnostics Market was valued at USD 3.1 billion in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 7.5 billion by 2034. This growth is primarily driven by the rising prevalence of both infectious and chronic diseases in companion and farm animals. As animal health becomes a growing concern for both individual owners and the agricultural sector, the demand for reliable diagnostic solutions continues to increase.

Public and private investments in animal health infrastructure, coupled with supportive government policies targeting disease prevention and management, are fostering greater awareness and adoption of diagnostics across the veterinary landscape. Collaborations between veterinary clinics and diagnostic labs, as well as expanded outreach by major players in underserved regions, are significantly improving access to testing services in developing countries. Moreover, the growing popularity of pet insurance is easing the financial burden of frequent diagnostics for pet owners, thereby encouraging regular testing and early disease detection.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $7.5 Billion |

| CAGR | 9.2% |

Animal diagnostics involves a range of testing methods used to detect and monitor diseases or other health conditions in animals. These techniques include molecular diagnostics, serological testing, urinalysis, and clinical biochemistry, among others. Based on product type, the market is divided into instruments and consumables. Among these, the consumables segment held the largest share, valued at USD 2.6 billion in 2024. The dominance of this segment is due to the high usage frequency and recurring need for items such as diagnostic kits, reagents, slides, and collection tubes. These products are integral to daily operations in veterinary clinics and labs, contributing to their consistent demand and overall market leadership.

By technology, the clinical biochemistry segment led the global animal diagnostics market in 2024 with a 35.3% share. This segment continues to gain traction due to its ability to assess vital physiological markers through blood, urine, and other bodily fluids, allowing for the early detection of conditions such as liver and kidney disorders, metabolic diseases, and hormonal imbalances in animals. As awareness about preventive care in pets grows, the demand for routine health screenings, which often include biochemistry panels, has surged. The increasing cases of chronic conditions in pets have also played a key role in boosting the use of clinical chemistry tools in veterinary settings.

In terms of application, the market is segmented into bacteriology, pathology, parasitology, and other diagnostic applications. The bacteriology segment accounted for a significant portion of the market and is projected to reach USD 3 billion by 2034. This segment remains crucial for identifying bacterial pathogens that are responsible for a wide range of animal diseases. Bacteriological testing enables veterinarians to diagnose infections accurately and implement timely treatment protocols. Innovations in testing methodologies and the growing emphasis on controlling zoonotic diseases and improving food safety standards are contributing to the segment's continued dominance.

When segmented by animal type, the companion animals category led the market with a substantial 78% share in 2024. This includes diagnostics for dogs, cats, horses, and other household animals. The surge in pet ownership, especially in urban areas, has led to higher demand for veterinary services, including diagnostics. Furthermore, rising awareness about pet health and the increasing incidence of diseases like cancer and diabetes in animals are pushing pet owners to seek regular health checkups and diagnostic support.

By end use, diagnostic laboratories emerged as the leading segment in 2024 and are projected to grow at a CAGR of 9.3% from 2025 to 2034. These labs offer comprehensive testing services, supported by sophisticated equipment and skilled technicians capable of processing large sample volumes with precision. Their ability to perform advanced testing, such as real-time PCR and genetic sequencing, has made them the preferred choice for veterinarians seeking accurate results. Growing demand for centralized, high-throughput testing continues to position these facilities at the forefront of the market.

Regionally, North America maintained its position as the largest market in 2024, commanding 40.9% of the global share. The region benefits from widespread pet ownership, advanced veterinary healthcare infrastructure, and growing awareness of preventive animal care. The animal diagnostics market in the United States alone reached USD 1.14 billion in 2024, showing consistent year-over-year growth. Increased adoption of pet insurance and high spending on animal health are among the factors supporting this regional leadership.

The competitive landscape of the global animal diagnostics market is dominated by key players that control around 65% to 70% of the industry. These companies leverage their expansive product portfolios and international presence to maintain a strong foothold. Strategic initiatives, including acquisitions, new product launches, and facility expansions, are common tactics used to drive growth and enhance technological capabilities in this rapidly evolving market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Technology

- 2.2.4 Application

- 2.2.5 Animal type

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing trend of adopting pet animals

- 3.2.1.2 Rising prevalence of foodborne and zoonotic diseases

- 3.2.1.3 Favorable government initiatives

- 3.2.1.4 Advancements in companion diagnostics

- 3.2.1.5 Increasing adoption of pet insurance

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Prohibitive cost associated with animal tests

- 3.2.2.2 Low out of pocket expenditure on veterinary care

- 3.2.3 Market opportunities

- 3.2.3.1 Technological advancements and point-of-care molecular tools

- 3.2.3.2 Expanding livestock industry and demand for food safety

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pricing analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Consumables

- 5.3 Instruments

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Clinical biochemistry

- 6.2.1 Glucose monitoring

- 6.2.2 Blood gas and electrolyte analysis

- 6.2.3 Other clinical biochemistry tests

- 6.3 Immunodiagnostics

- 6.3.1 Lateral flow assays

- 6.3.2 ELISA

- 6.3.3 Immunoassay analyzers

- 6.3.4 Other immunodiagnostic tests

- 6.4 Molecular diagnostics

- 6.4.1 PCR

- 6.4.2 Microarrays

- 6.4.3 Other molecular diagnostic tests

- 6.5 Hematology

- 6.6 Urinalysis

- 6.7 Other technologies

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Bacteriology

- 7.3 Pathology

- 7.4 Parasitology

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Companion animals

- 8.2.1 Dogs

- 8.2.2 Cats

- 8.2.3 Horses

- 8.2.4 Other companion animals

- 8.3 Farm animals

- 8.3.1 Cattle

- 8.3.2 Swine

- 8.3.3 Poultry

- 8.3.4 Other farm animals

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Veterinary hospitals and clinics

- 9.3 Diagnostic labs

- 9.4 Home care settings

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Poland

- 10.3.7 Netherlands

- 10.3.8 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Columbia

- 10.5.5 Peru

- 10.5.6 Chile

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

- 10.6.5 Egypt

- 10.6.6 Israel

Chapter 11 Company Profiles

- 11.1 bioMerieux

- 11.2 BioNote

- 11.3 Bio-Rad Laboratories

- 11.4 Boehringer Ingelheim International

- 11.5 Heska Corporation

- 11.6 Idexx laboratories

- 11.7 KogeneBiotech

- 11.8 Median Diagnostics

- 11.9 Neogen Corporation

- 11.10 Randox

- 11.11 Thermo Fischer Scientific

- 11.12 Virbac

- 11.13 VetAll Laboratories

- 11.14 Qiagen

- 11.15 Zoetis