|

시장보고서

상품코드

1773262

드릴링 머신 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Drilling Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

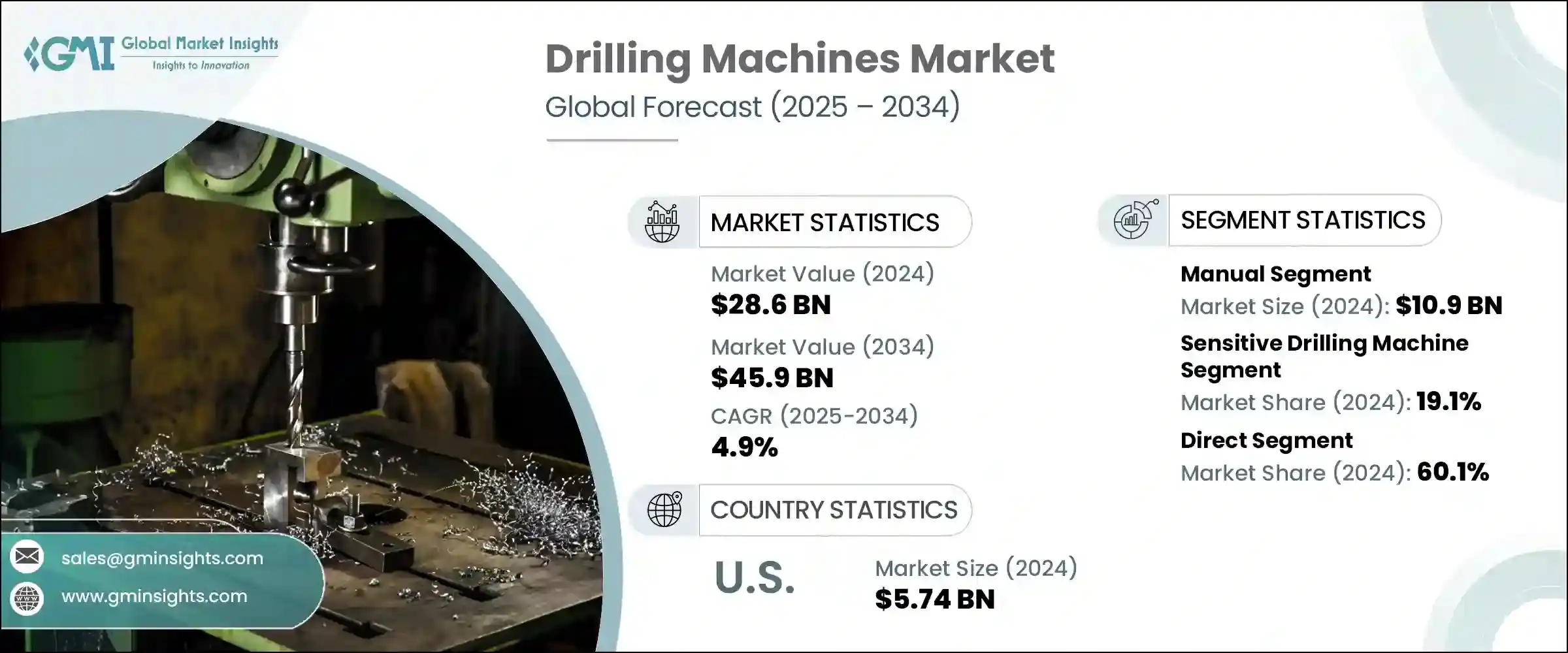

드릴링 머신 세계 시장은 2024년에는 286억 달러로 평가되었고, CAGR 4.9%로 성장하여 2034년에는 459억 달러에 이를 것으로 예측됩니다.

스마트 제조의 발전과 산업 자동화의 급격한 성장이 시장 확대에 박차를 가하고 있습니다. 정밀도와 안정적인 출력으로 유명한 CNC 드릴링 머신은 스마트 팩토리 환경에서 필수적인 구성 요소로 자리 잡고 있습니다. 인더스트리 4.0과 IoT를 활용한 시스템이 제조업 전반에 걸쳐 추진력을 얻고 있는 가운데, 드릴링 머신은 실시간 성능 모니터링, 원격 시스템 진단, 예지보전과 같은 지능형 기능으로 강화되고 있으며, 이 모든 것이 효율성 향상과 다운타임 감소에 기여하고 있습니다.

또한, 특히 신흥 경제 국가들의 인프라 구축과 도시 확장으로 인해 건설이 활발한 지역에서도 수요가 증가하고 있습니다. 이러한 추세는 현지 제조업체들이 신흥 시장 특유의 요구를 충족하는 보다 컴팩트하고 비용 효율적인 기계를 생산하도록 영향을 미치고 있습니다. 산업 성장을 더욱 뒷받침하는 것은 분야 간 응용 분야 확대, 첨단 기술에 대한 접근성 향상, 디지털 제조 생태계에 대한 투자 증가입니다. 이러한 원동력이 결합되어 전 세계 산업 공급망에서 드릴링 머신의 사용 방식을 재구성하여 이 분야의 꾸준한 상승 궤도에 기여하고 있습니다.

| 시장 범위 | |

|---|---|

| 개시 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 개시 금액 | 286억 달러 |

| 예측 금액 | 459억 달러 |

| CAGR | 4.9% |

건설 활동이 활발해짐에 따라 대규모 작업에 대응할 수 있는 대형 굴착 솔루션에 대한 수요가 증가하고 있습니다. 많은 신흥국 시장에서 인프라 업그레이드가 급증하면서 견고하고 효율적인 기계에 대한 수요가 꾸준히 증가하고 있습니다. 이에 따라 제조업체들은 내구성뿐만 아니라 다양한 작업 조건에 적응할 수 있는 장비 생산에 주력하고 있습니다.

2024년 수동 드릴링 머신은 109억 달러의 가치를 창출했으며, 2034년까지 연평균 3.8%의 성장률을 보일 것으로 예측됩니다. 급격한 자동화에도 불구하고, 수동 드릴링 머신은 저렴한 비용, 유연성, 사용 편의성 때문에 많은 산업 분야에서 여전히 필수적인 장비입니다. 이 기계는 에너지 접근성이 제한되어 있거나 숙련된 노동자의 인건비가 낮은 지역에서 자주 사용됩니다. 기본적인 굴착 작업으로 충분하고 고급 시스템이 아직 실현되지 않은 중소기업, 이동식 작업장, 원격지 작업장에서는 종종 첫 번째 선택이 됩니다. 다기능과 기본 작업에 대한 높은 적응성으로 인해 개발이 늦거나 인프라가 잘 갖추어지지 않은 환경에서 일상적인 산업 및 건설 작업에 대한 실용적인 솔루션이되었습니다.

고감도 드릴링 머신은 2024년 19.1%의 점유율을 차지했고, 2034년까지 4.2%의 연평균 복합 성장률(CAGR)을 보일 것으로 예측됩니다. 이 기계는 정확성, 신뢰성, 높은 정밀도를 필요로 하는 경부하 작업에 적합하기 때문에 선호되고 있습니다. 공간이 제한적이고 섬세한 취급이 중요한 작업에서 널리 사용되고 있습니다. 컴팩트한 구조로 유지보수가 용이하여 정밀한 천공과 섬세한 마무리가 필요한 분야에서 널리 사용되고 있습니다. 신흥국에서는 정밀 가공에 대한 투자가 진행되고 있으며, 교육 현장이나 소규모 가공 공장 등 저가의 고성능 공구가 요구되는 분야에서 수요가 증가하고 있습니다.

미국의 2024년 시장 규모는 57억 4,000만 달러로 평가되었고, 2025-2034년 연평균 4.7%의 성장률을 보일 것으로 예측됩니다. 현대적 제조 방식에 대한 지속적인 투자와 인더스트리 4.0 기술 도입으로 인해 자동화 및 지능형 드릴링 머신에 대한 수요가 크게 증가하고 있습니다. 국내 생산 능력의 회복은 재생에너지 확대 및 노후화된 인프라를 업그레이드하려는 노력과 함께 다양한 드릴링 시스템에 대한 안정적인 수요를 촉진하고 있습니다. 미국은 또한 탄탄한 공급망, 강력한 R&D 투자, 신기술의 조기 도입, 제조, 에너지, 산업 분야에서 첨단 및 혁신적 장비의 통합을 뒷받침하는 강력한 공급망의 혜택을 누리고 있습니다.

드릴링 머신 시장에서 경쟁하는 주요 기업으로는 Cheto Corporation SA,Soilmec S.p.A.,Minitool,Hitachi Construction Machinery Ltd,Mitsubishi Heavy Industries Ltd. Ingersoll Rand,Sandvik AB,Epiroc AB,KURAKI Co Ltd,SMTCL,Beretta S.r.l. P,ERLO Group,Bauer Maschinen GmbH,Robert Bosch GmbH,Caterpillar, Liebherr Group,Dezhou Hongxin Machine Tool Co Ltd,Shenyang Machine Tool Co Ltd,Atlas Copco,Boart Longyear 등이 있습니다. 시장 지위를 강화하기 위해 드릴링 머신 업계의 주요 기업들은 AI 통합, IoT 연결, 자동화에 적합한 설계를 특징으로 하는 차세대 기계로 제품 라인을 확장하는 등의 전략을 추구하고 있습니다. 또한, 새로운 지역으로의 접근과 유통 역량을 강화하기 위해 파트너십과 합작투자를 설립하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급업체 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 미치는 요인

- 업계에 대한 영향요인

- 성장 촉진요인

- 업계의 잠재적 리스크와 과제

- 성장 가능성 분석

- 향후 시장 동향

- 기술 및 혁신 상황

- 현재 기술 동향

- 신기술

- 가격 동향

- 지역별

- 유형별

- 규제 상황

- 표준과 컴플라이언스 요건

- 지역 규제 구조

- 인증 기준

- 무역 통계

- 주요 수입국

- 주요 수출국

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 인수합병(M&A)

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추산·예측 : 유형별, 2021-2034년

- 주요 동향

- 고감도 드릴링 머신

- 업라이트 드릴링 머신

- 래디얼 드릴링 머신

- 갱 드릴링 머신

- 딥홀 드릴링 머신

- CNC 드릴링 머신

- 다축 드릴링 머신

- 기타(자기 드릴링 머신)

제6장 시장 추산·예측 : 자동화 레벨별, 2021-2034년

- 주요 동향

- 수동

- 반자동

- 완전 자동

제7장 시장 추산·예측 : 조작별, 2021-2034년

- 주요 동향

- Hole drilling

- Tapping

- Counterboring

- Reaming

- Spot facing

- 기타(Boring, Peck, Core)

제8장 시장 추산·예측 : 구조별, 2021-2034년

- 주요 동향

- 고정식

- 휴대용

제9장 시장 추산·예측 : 전력별, 2021-2034년

- 주요 동향

- 배터리 구동

- 유선

제10장 시장 추산·예측 : 용도별, 2021-2034년

- 주요 동향

- Metal drilling

- Wood drilling

- Fiber & plastic drilling

- Composite material drilling

- Glass and ceramic drilling

- 기타(의료용 임플란트 및 수술 기구, PCB 드릴링(마이크로드릴링) 등)

제11장 시장 추산·예측 : 최종 용도별, 2021-2034년

- 주요 동향

- 항공우주

- 중기

- 자동차

- 에너지 업계

- 군 및 방위

- 기타

제12장 시장 추산·예측 : 유통 채널별, 2021-2034년

- 주요 동향

- 직접

- 간접

제13장 시장 추산·예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 인도네시아

- 말레이시아

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카공화국

제14장 기업 개요

- Atlas Copco

- Bauer Maschinen GmbH

- Beretta S.r.l. P

- Boart Longyear

- Caterpillar

- Cheto Corporation SA

- Dezhou Hongxin Machine Tool Co Ltd

- Epiroc AB

- ERLO Group

- Hitachi Construction Machinery Ltd

- Ingersoll Rand

- KURAKI Co Ltd

- Liebherr Group

- Minitool

- Mitsubishi Heavy Industries ltd.

- Robert Bosch GmbH

- Sandvik AB

- Shenyang Machine Tool Co Ltd

- SMTCL

- Soilmec S.p.A.

The Global Drilling Machines Market was valued at USD 28.6 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 45.9 billion by 2034. The ongoing evolution of smart manufacturing and rapid growth in industrial automation are fueling market expansion. CNC drilling machines, known for their precision and consistent output, are becoming essential components in smart factory environments. As Industry 4.0 and IoT-driven systems gain momentum across manufacturing industries, drilling machines are being enhanced with intelligent features such as real-time performance monitoring, remote system diagnostics, and predictive maintenance, all of which contribute to improved efficiency and reduced downtime.

Demand is also growing in construction-heavy regions, particularly due to robust infrastructure development and urban expansion in industrializing economies. These trends are influencing local manufacturers to produce more compact and cost-efficient machines that meet the unique needs of emerging markets. The industry's growth is further supported by the widening application base across sectors, improved access to advanced technology, and rising investment in digital manufacturing ecosystems. Combined, these dynamics are reshaping how drilling machines are used across global industrial supply chains and contributing to the sector's steady upward trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $28.6 Billion |

| Forecast Value | $45.9 Billion |

| CAGR | 4.9% |

With construction activities gaining momentum, there is a growing need for heavy-duty drilling solutions that can keep up with large-scale operations. Many developing markets are experiencing a surge in infrastructure upgrades, which is creating consistent demand for rugged, efficient machines. In response, manufacturers are focusing on building equipment that is not only durable but also adaptable to varying working conditions.

In 2024, manual drilling machines generated USD 10.9 billion and are expected to grow at a CAGR of 3.8% through 2034. Despite the surge in automation, manual drilling equipment remains essential in many industries due to its lower cost, flexibility, and ease of use. These machines are frequently utilized in regions with limited access to energy or where skilled labor costs remain low. They are often the first choice for smaller businesses, mobile workshops, and remote worksites where basic drilling operations are sufficient and advanced systems are not yet feasible. Their multifunctional nature and adaptability for basic operations make them a practical solution for everyday industrial and construction tasks in less-developed or infrastructure-poor environments.

The sensitive drilling machines segment accounted for a 19.1% share in 2024 and is forecasted to grow at a CAGR of 4.2% through 2034. These machines are favored for their precision, reliability, and suitability for light-duty applications requiring high levels of accuracy. They are extensively used in operations where space is limited and delicate handling is crucial. Because of their compact structure and straightforward maintenance, they are widely adopted in fields requiring meticulous hole placement and fine detailing. Emerging economies are increasingly investing in precision manufacturing, driving the need for these machines in educational workshops, small-scale fabrication units, and other sectors prioritizing affordable, high-performance tools.

United States Drilling Machines Market was valued at USD 5.74 billion in 2024 and is projected to grow at a CAGR of 4.7% between 2025 and 2034. With the country's continued investment in modern manufacturing practices and adoption of Industry 4.0 technologies, the demand for automated and intelligent drilling machines is growing significantly. The resurgence of domestic production capacity, coupled with expanding renewable energy initiatives and efforts to upgrade outdated infrastructure, is spurring consistent demand for a range of drilling systems. The U.S. also benefits from a robust supply chain, strong R&D investment, and early adoption of new technologies, which supports the integration of sophisticated and innovative equipment across manufacturing, energy, and industrial segments.

Major companies competing in the Drilling Machines Market include Cheto Corporation SA, Soilmec S.p.A., Minitool, Hitachi Construction Machinery Ltd, Mitsubishi Heavy Industries Ltd., Ingersoll Rand, Sandvik AB, Epiroc AB, KURAKI Co Ltd, SMTCL, Beretta S.r.l. P, ERLO Group, Bauer Maschinen GmbH, Robert Bosch GmbH, Caterpillar, Liebherr Group, Dezhou Hongxin Machine Tool Co Ltd, Shenyang Machine Tool Co Ltd, Atlas Copco, and Boart Longyear. To strengthen their market position, leading companies in the drilling machines industry are pursuing strategies such as expanding their product lines with next-generation machines featuring AI integration, IoT connectivity, and automation-friendly designs. Partnerships and joint ventures are being formed to access new regions and enhance distribution capabilities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Automation Level

- 2.2.4 Operation

- 2.2.5 Application

- 2.2.6 End use

- 2.2.7 Structure

- 2.2.8 Power Source

- 2.2.9 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Industrial automation and smart manufacturing

- 3.2.1.2 Rising infrastructure and construction projects

- 3.2.1.3 Urbanization and industrialization in emerging economies

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Slow adoption in certain end use industries

- 3.2.2.2 Safety and operational hazards

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation Landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Sensitive drilling machine

- 5.3 Upright drilling machine

- 5.4 Radial drilling machine

- 5.5 Gang drilling machine

- 5.6 Deep hole drilling machine

- 5.7 CNC drilling machine

- 5.8 Multiple spindle drilling machine

- 5.9 Others (magnetic drilling machine)

Chapter 6 Market Estimates & Forecast, By Automation Level, 2021 - 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-Automated

- 6.4 Fully Automated

Chapter 7 Market Estimates & Forecast, By Operation, 2021 - 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Hole drilling

- 7.3 Tapping

- 7.4 Counterboring

- 7.5 Reaming

- 7.6 Spot facing

- 7.7 Others (Boring, Peck, Core)

Chapter 8 Market Estimates & Forecast, By Structure, 2021 - 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Fixed

- 8.3 Portable

Chapter 9 Market Estimates & Forecast, By Power Source, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Battery powered

- 9.3 Corded

Chapter 10 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Metal drilling

- 10.3 Wood drilling

- 10.4 Fiber & plastic drilling

- 10.5 Composite material drilling

- 10.6 Glass and ceramic drilling

- 10.7 Others (Medical implants & Surgical tools, PCB drilling (Micro drilling), etc.)

Chapter 11 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Aerospace

- 11.3 Heavy equipment

- 11.4 Automotive

- 11.5 Energy industry

- 11.6 Military & defense

- 11.7 Others

Chapter 12 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 Direct

- 12.3 Indirect

Chapter 13 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 Germany

- 13.3.2 UK

- 13.3.3 France

- 13.3.4 Italy

- 13.3.5 Spain

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 South Korea

- 13.4.5 Australia

- 13.4.6 Indonesia

- 13.4.7 Malaysia

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.6 MEA

- 13.6.1 Saudi Arabia

- 13.6.2 UAE

- 13.6.3 South Africa

Chapter 14 Company Profiles

- 14.1 Atlas Copco

- 14.2 Bauer Maschinen GmbH

- 14.3 Beretta S.r.l. P

- 14.4 Boart Longyear

- 14.5 Caterpillar

- 14.6 Cheto Corporation SA

- 14.7 Dezhou Hongxin Machine Tool Co Ltd

- 14.8 Epiroc AB

- 14.9 ERLO Group

- 14.10 Hitachi Construction Machinery Ltd

- 14.11 Ingersoll Rand

- 14.12 KURAKI Co Ltd

- 14.13 Liebherr Group

- 14.14 Minitool

- 14.15 Mitsubishi Heavy Industries ltd.

- 14.16 Robert Bosch GmbH

- 14.17 Sandvik AB

- 14.18 Shenyang Machine Tool Co Ltd

- 14.19 SMTCL

- 14.20 Soilmec S.p.A.