|

시장보고서

상품코드

1773268

중전력 전기자동차용 부스바 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Medium Power Electric Vehicle Busbar Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

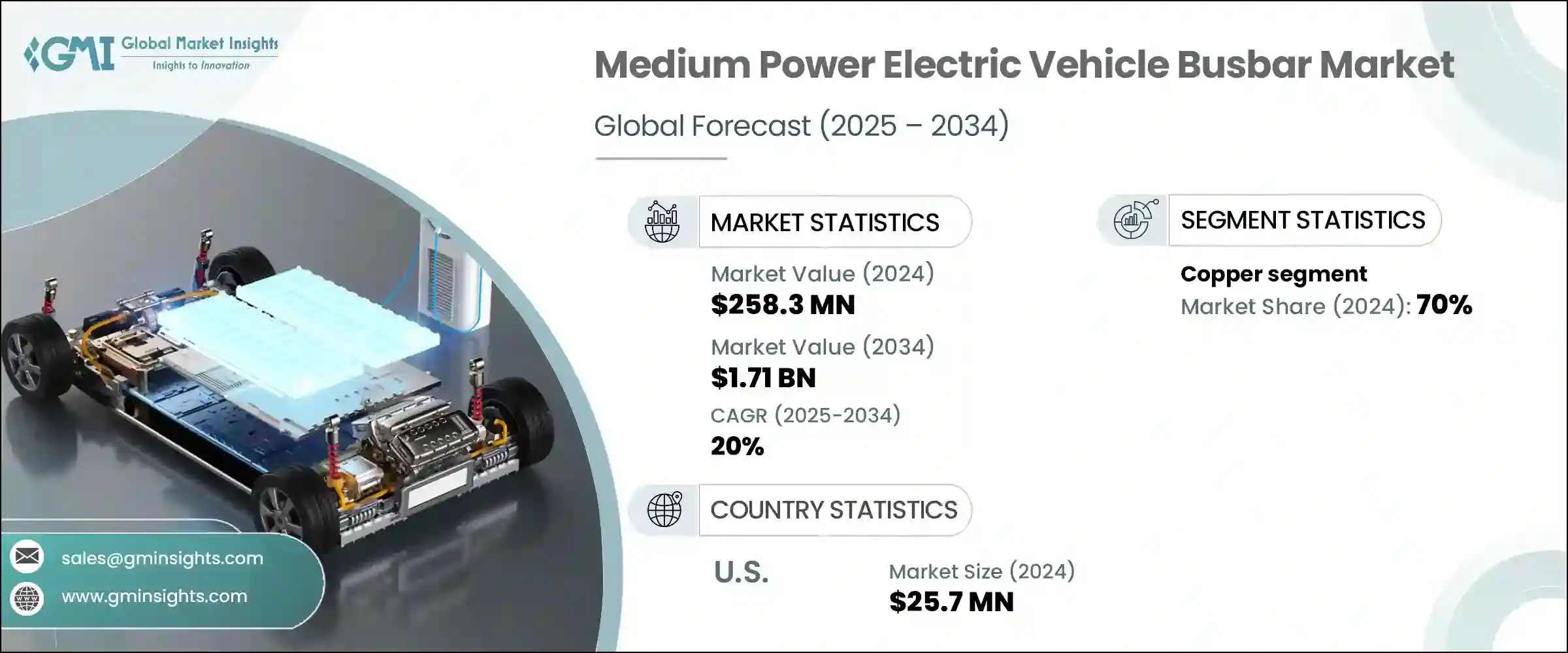

세계의 중전력 전기자동차용 부스바 시장 규모는 2024년에 2억 5,830만 달러로 평가되었고, CAGR 20%로 성장하여 2034년에는 17억 1,000만 달러에 이를 것으로 예측됩니다.

이 놀라운 성장 궤적은 전기 모빌리티에 대한 투자 증가, 유리한 규제 환경, 배전 기술 발전으로 인해 더욱 가속화되고 있습니다. 전기자동차가 계속해서 주류가 되면서 전략적 제휴, 재료 과학의 혁신, 진화하는 생산 기술로 인해 자동차의 에너지 경로가 재구성되고 있습니다. 시장의 모멘텀은 자동차의 주행거리와 성능을 최적화하기 위해 조정된 경량화 및 고효율 시스템으로의 전환과 점점 더 밀접하게 연관되어 있습니다.

재료의 진화는 시장 성장 촉진요인 중 하나입니다. 구리는 탁월한 전기 전도성으로 인해 여전히 주류이지만, 무게가 많이 나가기 때문에 제조업체들은 대체 소재를 찾게 되었습니다. 비용을 낮추고 에너지 효율을 높이기 위해 알루미늄과 같은 가벼운 소재가 사용되기 시작했습니다. 첨단 복합재료를 사용한 맞춤형 솔루션은 뛰어난 열 제어와 기계적 내구성으로 인기를 얻고 있으며, 다양한 EV 용도의 성능을 향상시키고 있습니다. 또한, 맞춤형 버스바 시스템은 제조업체가 재료 낭비를 최소화하고 차량 아키텍처를 최적화하는 데 도움을 주고 있습니다. 스마트한 기술 통합, 차세대 생산 라인, 진화하는 OEM 사양의 융합은 밸류체인 전반에 걸쳐 시장 확대와 혁신의 새로운 문을 열고 있습니다.

| 시장 범위 | |

|---|---|

| 개시 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 개시 금액 | 2억 5,830만 달러 |

| 예측 금액 | 17억 1,000만 달러 |

| CAGR | 20% |

2024년 현재, 중전 력 전기자동차 버스바 시장의 구리 부문은 우수한 전기 전도성과 열 관리로 인해 70%의 점유율을 차지할 것으로 예측됩니다. 에너지 손실을 최소화하는 구리의 특성은 전기자동차 배터리의 성능을 향상시키고, 주행거리를 늘리며, 시스템의 무결성을 유지하는 데 필수적입니다. 이러한 특성은 자동차의 효율성, 안전성, 전력 공급의 균형을 맞추려는 자동차 제조업체에게 지속적으로 중요할 것입니다.

2024년 미국 시장 규모는 2,570만 달러에 달할 것으로 예상되며, 전기차 보급을 가속화하는 연방 및 주정부 주도의 정책과 첨단 그리드 인프라에 대한 수요 증가로 인해 제조업체의 사업 확장을 촉진하고 있습니다. 중전력 버스바는 EV 배전 네트워크의 최적화에 필수적인 요소로, 충전 효율과 부하 분산을 보장하며, EV 생산 규모가 확대됨에 따라 신뢰성이 높고 컴팩트하며 열효율이 높은 버스바 시스템에 대한 수요가 빠르게 증가하고 있습니다.

중전력 전기자동차용 버스바 세계 시장 주요 기업으로는 Amphenol Corporation,Infineon Technologies AG,Blar Elettromeccanica SpA,Littelfuse, Inc. EMS Group, Legrand, Rogers Corporation, Mitsubishi Electric Corporation, TE Connectivity, Schneider Electric, EAE Group, EG Electronics, Weidmuller Interface GmbH Weidmuller Interface GmbH &Co.KG입니다. 이 분야의 주요 기업들은 재료 혁신, 설계 최적화, 세계 제조 확장을 결합하여 시장 확대를 추진하고 있습니다. 이들 중 상당수는 차세대 EV의 진화하는 효율성 기준을 충족시키기 위해 경량화 및 고성능 합금과 복합소재 개발에 우선순위를 두고 있습니다. 자동차 및 배터리 제조업체와의 전략적 합작투자는 장기 공급 계약을 확보하는 데 도움이 되고 있습니다. 또한, 복잡한 차량별 버스바 어셈블리를 확장 가능하고 비용 효율적으로 생산할 수 있도록 자동화 및 정밀 툴에 대한 투자를 강화하고 있습니다. 이와 함께 방열, 스마트 진단, 시스템 통합에 중점을 둔 R&D 활동을 확대하여 OEM의 요구사항에 맞는 고부가가치 솔루션을 제공합니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 규제 상황

- 업계에 대한 영향요인

- 성장 촉진요인

- 업계의 잠재적 리스크와 과제

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 전략적 대시보드

- 전략적 이니셔티브

- 경쟁 벤치마킹

- 기술 및 혁신 상황

제5장 시장 규모와 예측 : 재료별, 2021-2034년

- 주요 동향

- 구리

- 알루미늄

제6장 시장 규모와 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 노르웨이

- 독일

- 프랑스

- 네덜란드

- 영국

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카공화국

- 라틴아메리카

- 브라질

- 아르헨티나

제7장 기업 개요

- Amphenol Corporation

- Brar Elettromeccanica SpA

- EAE Group

- EG Electronics

- EMS Group

- Infineon Technologies AG

- Legrand

- Littelfuse, Inc.

- Mersen SA

- Mitsubishi Electric Corporation

- Rogers Corporation

- Schneider Electric

- Siemens

- TE Connectivity

- Weidmuller Interface GmbH &Co. KG

The Global Medium Power Electric Vehicle Busbar Market was valued at USD 258.3 million in 2024 and is estimated to grow at a CAGR of 20% to reach USD 1.71 billion by 2034. This impressive growth trajectory is being fueled by rising investments in electric mobility, favorable regulatory landscapes, and significant advancements in power distribution technologies. As electric vehicles continue gaining mainstream traction, strategic collaborations, innovations in material sciences, and evolving production technologies are reshaping how energy is routed within these vehicles. Market momentum is increasingly tied to the shift toward lightweight, high-efficiency systems tailored to optimize vehicle range and performance.

Material evolution is a key market driver. While copper remains dominant due to its unmatched electrical conductivity, it adds considerable weight-leading manufacturers to explore alternative materials. Lighter options like aluminum are now being integrated to reduce cost and improve energy efficiency. Custom-engineered solutions using advanced composites are gaining popularity for their superior thermal control and mechanical durability, offering a performance boost across various EV applications. Additionally, tailored busbar systems are helping manufacturers minimize material waste and optimize vehicle architecture. The convergence of smart technology integration, next-gen production lines, and evolving OEM specifications is opening new doors for market expansion and innovation across the value chain.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $258.3 Million |

| Forecast Value | $1.71 Billion |

| CAGR | 20% |

As of 2024, the copper segment in the medium-power electric vehicle busbar market held a 70% share due to its superior conductivity and thermal management. Its ability to minimize energy loss makes it vital for enhancing EV battery performance, ensuring better range, and maintaining system integrity. These characteristics remain critical for automakers striving to balance vehicle efficiency, safety, and power delivery.

United States Medium Power Electric Vehicle Busbar Market USD 25.7 million in 2024. Federal and state-led policies to accelerate EV adoption, coupled with rising demand for advanced grid infrastructure, are pushing manufacturers to scale up. Medium power busbars are essential in optimizing EV power distribution networks, ensuring both charging efficiency and load balancing. As EV production scales, the demand for reliable, compact, and heat-efficient busbar systems is increasing rapidly.

Key companies in the Global Medium Power Electric Vehicle Busbar Market include Amphenol Corporation, Infineon Technologies AG, Brar Elettromeccanica SpA, Littelfuse, Inc., Mersen SA, Siemens, EMS Group, Legrand, Rogers Corporation, Mitsubishi Electric Corporation, TE Connectivity, Schneider Electric, EAE Group, EG Electronics, and Weidmuller Interface GmbH & Co. KG. Leading players in this space are advancing their market footprint through a combination of material innovation, design optimization, and global manufacturing expansion. Many are prioritizing the development of lightweight, high-performance alloys and composites to meet the evolving efficiency standards of next-generation EVs. Strategic joint ventures with automakers and battery manufacturers are helping secure long-term supply agreements. Companies are also boosting investments in automation and precision tooling to enable scalable, cost-effective production of complex, vehicle-specific busbar assemblies. In parallel, they are expanding R&D efforts focused on heat dissipation, smart diagnostics, and system integration to deliver value-added solutions tailored to OEM requirements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Material, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Copper

- 5.3 Aluminum

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 Norway

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Netherlands

- 6.3.5 UK

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 South Korea

- 6.4.5 Australia

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 South Africa

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 Amphenol Corporation

- 7.2 Brar Elettromeccanica SpA

- 7.3 EAE Group

- 7.4 EG Electronics

- 7.5 EMS Group

- 7.6 Infineon Technologies AG

- 7.7 Legrand

- 7.8 Littelfuse, Inc.

- 7.9 Mersen SA

- 7.10 Mitsubishi Electric Corporation

- 7.11 Rogers Corporation

- 7.12 Schneider Electric

- 7.13 Siemens

- 7.14 TE Connectivity

- 7.15 Weidmuller Interface GmbH & Co. KG