|

시장보고서

상품코드

1773270

홀터 심전도 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Holter ECG Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

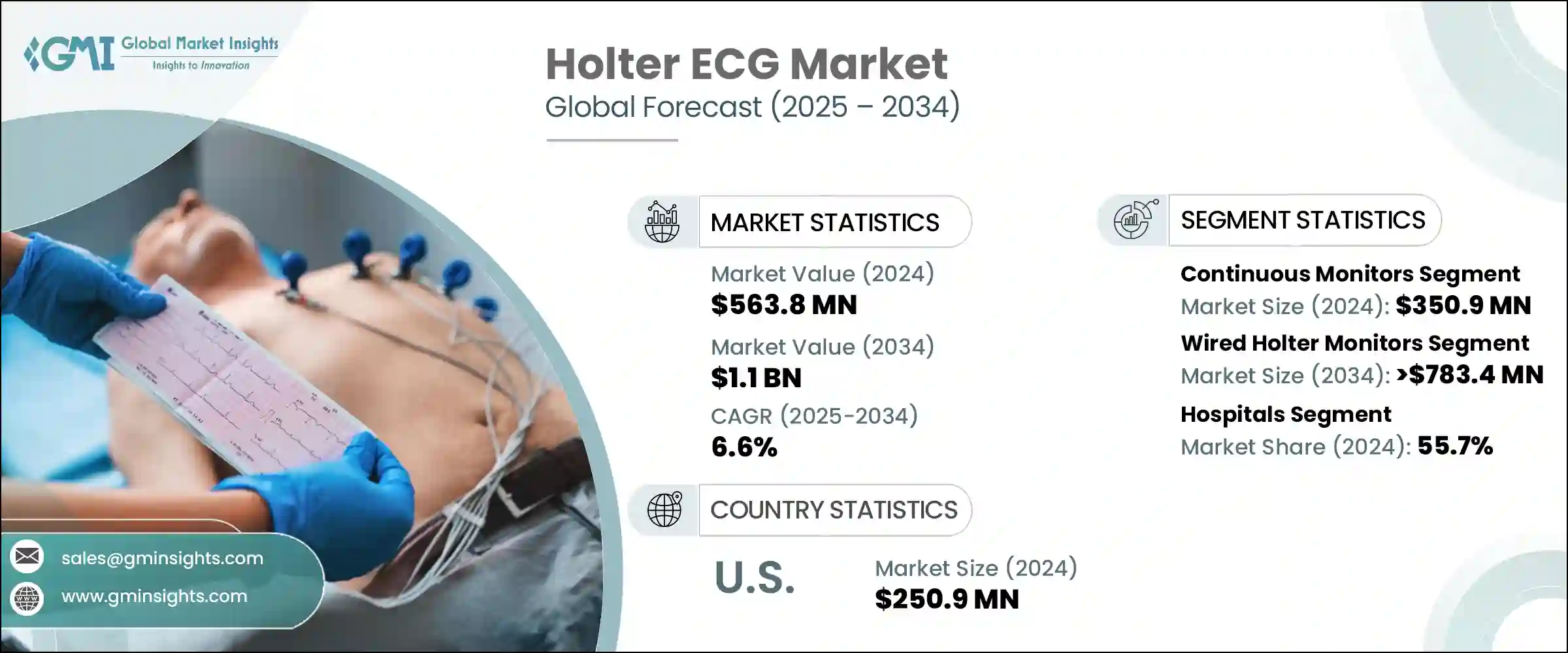

세계의 홀터 심전도 시장은 2024년에 5억 6,380만 달러로 평가되었고, CAGR 6.6%로 성장하여 2034년에는 11억 달러에 이를 것으로 예측됩니다.

이러한 성장은 심장 관련 질환의 유병률 증가, 덜 침습적인 모니터링 기술의 수용 확대, 원격 심장 진단에 대한 수요 증가가 주요 요인으로 작용하고 있습니다. 전 세계적으로 심혈관 질환으로 진단받는 환자 수가 급증하면서 첨단 진단 솔루션에 대한 수요가 지속적으로 증가하고 있습니다. 심장 질환은 전 세계 사망률에 큰 기여를 하고 있어 조기 진단과 정확한 진단이 의료의 중요한 우선순위가 되고 있습니다.

홀터 심전도는 병원과 가정 모두에서 심장 부정맥을 식별하는 데 도움이 되기 때문에 수요가 꾸준히 증가하고 있습니다. 기술의 발전으로 배터리 수명과 무선 기능이 개선된 작고 사용하기 쉬운 기기가 등장하여 의료진과 환자 모두에게 더 나은 사용 편의성을 제공합니다. 이러한 기술 발전으로 간헐적 부정맥을 쉽게 감지할 수 있게 되어 보급이 확대되고 있습니다. 원격 환자 모니터링과 웨어러블 진단 기기 증가로 인해 능동적 건강 관리의 새로운 문이 열리고 있습니다. 이러한 요인들은 광범위한 인식과 의료비 지출과 함께 전 세계 시장에서 홀터 심전도 기기에 대한 수요를 계속 가속화하고 있습니다.

| 시장 범위 | |

|---|---|

| 개시 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 개시 금액 | 5억 6,380만 달러 |

| 예측 금액 | 11억 달러 |

| CAGR | 6.6% |

홀터 심전도는 심장의 리듬을 일정 기간 동안 추적하는 소형 착용형 시스템입니다. 전극은 가슴과 복부의 특정 부위에 부착되어 심장의 전기적 활동을 지속적으로 포착하는 휴대용 모니터에 연결됩니다. 새로운 기술이 의료 서비스 제공 방식을 바꾸고 있는 가운데, 이러한 기기는 병원뿐만 아니라 가정에서도 심장 모니터링 시스템을 구축할 수 있도록 빠르게 확산되고 있습니다. 센서 설계와 마이크로 일렉트로닉스의 발전으로 옷 속에 숨겨져 눈에 띄지 않고 장시간 착용할 수 있는 모니터가 개발되고 있습니다. 이러한 특징은 효과적인 심박수 평가에 필수적인 환자의 편안함과 순응도를 크게 향상시킵니다. 이러한 혁신은 의사가 포착하기 어려운 부정맥을 감지하고 보다 효과적으로 치료를 관리할 수 있도록 돕습니다. 장시간 사용 기기의 매력은 사용 편의성을 향상시키면서도 높은 데이터 품질을 유지할 수 있다는 점에서 현대 심장 치료에 필수적인 도구로 자리매김하고 있습니다.

2024년, 연속 모니터 부문은 3억 5,090만 달러로 시장을 지배했습니다. 연속 홀터 심전도 장치는 24-48시간 또는 그 이상의 기간 동안 중단 없는 데이터를 제공하여 의사가 심장 기능을 관찰할 수 있는 보다 상세한 정보를 제공합니다. 장기간의 기록은 단기간의 평가에서는 종종 발견되지 않는 산발적인 리듬 장애를 발견할 가능성을 높입니다. 그 결과, 많은 의료 전문가들이 철저한 외래 심장 평가를 위해 이 장치를 선호하고 있습니다. 불규칙한 심장 박동의 초기 평가에 있어 이 장치가 첫 번째 선택이 되는 경우가 많습니다. 심장 전문 의료와 일반 의료 모두에서 일관되게 사용되면서 연속형 모니터는 업계 표준이 되어 시장 개척에 크게 기여하고 있습니다.

유선 홀터 모니터는 2034년까지 6%의 연평균 복합 성장률(CAGR)로 7억 8,340만 달러 시장 규모를 형성할 것으로 예측됩니다. 이러한 시스템은 강력한 성능과 일관된 데이터 정확도로 인해 오랫동안 심장학 분야에서 신뢰를 받아왔습니다. 유지보수 필요성이 낮고 병원의 디지털 인프라와의 호환성이 뛰어나 많은 의료 현장에서 필수품으로 자리 잡았습니다. 이 장비는 ECG 소프트웨어, PACS, 아카이브 네트워크와 같은 환자 데이터 시스템과 원활하게 통합되어 진단 워크플로우를 간소화합니다. 의사들은 데이터 갭의 가능성을 최소화하고 심장 박동 리듬 문제를 보다 명확하게 진단할 수 있는 입증된 신뢰성을 신뢰하고 있습니다. 새로운 무선 옵션이 등장하고 있지만, 유선 솔루션은 안정적인 출력과 현재 병원 IT 환경에 쉽게 통합할 수 있는 장점으로 인해 여전히 강력한 시장 수요를 유지하고 있습니다.

미국 홀터 심전도 시장은 2024년 2억 5,090만 달러 규모에 달했으며, 2025-2034년 연평균 5.5% 성장할 것으로 예측됩니다. 특히 고령층과 만성 심장질환 환자들의 도입이 증가하고 있습니다. 클라우드 기반 플랫폼과 AI로 강화된 데이터 분석 도구는 심장 질환의 원격 모니터링 방식에 혁명을 일으켰습니다. 이러한 디지털 강화는 환자 데이터를 더 잘 관리하고 임상 결과를 개선할 수 있게 해줍니다. 또한, 유리한 상환 체계와 현지 기업의 지속적인 혁신적 제품 출시가 홀터 심전도의 성장에 기여하고 있습니다. 특히 심혈관 건강에 초점을 맞춘 예방의학에 대한 노력은 시장에서의 입지를 더욱 강화하고 있습니다.

홀터 심전도 시장에서 경쟁하는 주요 기업으로는 GE HealthCare, SPACELABS HEALTHCARE, SPACELABS HEALTHCARE, ScottCare, VIVALINK, PHILIPS, SCHILLER, iRHYTHM, FUKUDA, Bittium, Baxter 등이 있습니다. 홀터 심전도 업계에서 입지를 강화하기 위해 주요 기업들은 광범위한 제품 혁신, 표적화 된 인수, 기술 통합 등의 전략을 시행하고 있습니다. 진단 정확도를 높이고 원격 분석을 지원하기 위해 많은 기업들이 AI가 탑재된 심전도 해석 도구에 투자하고 있습니다. 또한, 의료 서비스 제공업체와의 전략적 파트너십 및 제휴를 통해 지리적 범위를 확장하고 있습니다. 제품 포트폴리오도 다양화되어 장시간 착용 및 무선 웨어러블 모니터 등 편안함과 사용 편의성에 대한 소비자의 기대치가 높아짐에 따라 제품 포트폴리오를 조정하고 있습니다. 또한 제조업체들은 병원의 IT 생태계와의 호환성을 간소화하고 원활한 데이터 공유 및 해석을 위해 노력하고 있습니다. 이러한 접근 방식은 각 브랜드가 경쟁력을 유지하고 빠르게 진화하는 시장에서 더 큰 시장 점유율을 확보하는 데 도움이 되고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 대한 영향요인

- 성장 촉진요인

- 업계의 잠재적 리스크와 과제

- 시장 기회

- 성장 가능성 분석

- 규제 상황

- 기술 및 혁신 상황

- 현재 기술 동향

- 신기술

- 가격 분석

- 갭 분석

- Porter's Five Forces 분석

- 상환 시나리오

- PESTEL 분석

- 밸류체인 분석

제4장 경쟁 구도

- 서론

- 기업 매트릭스 분석

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 지역별

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 인수합병(M&A)

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추산·예측 : 제품 유형별, 2021-2034년

- 주요 동향

- 연속 모니터

- 간헐 모니터

제6장 시장 추산·예측 : 모달리티별, 2021-2034년

- 주요 동향

- 유선 홀터 심전도 모니터

- 3 lead 홀터 심전도 모니터

- 12 lead 홀터 심전도 모니터

- 기타

- 무선 홀터 모니터

제7장 시장 추산·예측 : 최종 용도별, 2021-2034년

- 주요 동향

- 병원

- 외래수술센터(ASC)

- 기타

제8장 시장 추산·예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카공화국

- 사우디아라비아

- 아랍에미리트(UAE)

제9장 기업 개요

- Baxter

- Bittium

- FUKUDA

- GE HealthCare

- iRHYTHM

- PHILIPS

- SCHILLER

- ScottCare

- SPACELABS HEALTHCARE

- VIVALINK

The Global Holter ECG Market was valued at USD 563.8 million in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 1.1 billion by 2034. This growth is largely fueled by the rising incidence of heart-related conditions, the increasing acceptance of less invasive monitoring technologies, and the growing demand for remote cardiac diagnostics. The surging number of individuals diagnosed with cardiovascular diseases worldwide continues to drive the need for sophisticated diagnostic solutions. With heart ailments contributing significantly to global mortality rates, early and accurate diagnosis has become a critical medical priority.

Demand for Holter ECGs is rising steadily as these devices help identify cardiac irregularities in both hospital and at-home settings. Technological progress has led to smaller, user-friendly devices with improved battery life and wireless features, enhancing usability for both healthcare providers and patients. These technological upgrades have made it easier to detect intermittent arrhythmia, increasing adoption. Remote patient monitoring trends and the availability of more wearable diagnostic devices have opened new doors for proactive health management. Combined with broader awareness and healthcare spending, these factors continue to accelerate the demand for Holter ECG devices across global markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $563.8 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 6.6% |

Holter ECGs are compact wearable systems that track heart rhythms for a defined duration. Electrodes are attached to specific parts of the chest and abdomen, linked to a portable monitor that continuously captures the heart's electrical activity. As newer technologies reshape healthcare delivery, these devices are seeing faster adoption not just in clinics but also in home-based cardiac monitoring setups. Advances in sensor design and microelectronics have led to discreet, long-wear monitors that remain hidden under clothing. These features significantly increase patient comfort and compliance, which are essential for effective cardiac rhythm assessment. These innovations also support physicians in detecting hard-to-catch arrhythmias and managing treatment more effectively. The appeal of extended-use devices lies in their ability to maintain high data quality while improving ease of use, making them an essential tool in modern cardiac care.

In 2024, the continuous monitoring segment brought in USD 350.9 million, dominating the Holter ECG landscape. Continuous Holter ECG devices deliver uninterrupted data for 24 to 48 hours or even longer, giving doctors an enhanced window to observe heart function. Their extended recording duration increases the likelihood of identifying sporadic rhythm disorders that would often go unnoticed in shorter evaluations. As a result, healthcare professionals often prefer them for thorough ambulatory cardiac assessment. These devices are often considered the primary option for initial evaluations of irregular heartbeat conditions. Due to their consistent use across both specialized cardiac practices and general medicine, continuous monitors have become an industry standard, contributing substantially to overall market development.

The wired Holter monitors segment is anticipated to witness a CAGR of 6% through 2034, reaching a market valuation of USD 783.4 million. These systems have long been trusted in cardiology for their robust performance and consistent data accuracy. Their low maintenance requirements and compatibility with digital hospital infrastructure make them a staple in many healthcare settings. These devices seamlessly integrate with patient data systems like ECG software, PACS, and archiving networks, which streamlines diagnostic workflows. Physicians rely on their proven reliability, which minimizes the chance of data gaps and ensures a clearer diagnosis of heart rhythm issues. While newer wireless options are emerging, wired solutions still retain strong market demand due to their dependable output and ease of integration into current hospital IT environments.

United States Holter ECG Market was worth USD 250.9 million in 2024 and is set to grow at a CAGR of 5.5% from 2025 to 2034. Adoption is especially robust among elderly populations and individuals living with chronic heart disease. Cloud-based platforms and AI-enhanced data interpretation tools have revolutionized the way cardiac conditions are monitored remotely. These digital enhancements allow for better management of patient data and improved clinical outcomes. Additionally, favorable reimbursement structures and the continuous launch of innovative products by local companies are contributing to the growth of Holter ECGs in the country. Preventive care initiatives, particularly those focusing on cardiovascular wellness, are further strengthening the market's position.

Major companies competing in the Holter ECG Market include GE HealthCare, SPACELABS HEALTHCARE, ScottCare, VIVALINK, PHILIPS, SCHILLER, iRHYTHM, FUKUDA, Bittium, and Baxter. To reinforce their position in the Holter ECG industry, key players are implementing strategies such as extensive product innovation, targeted acquisitions, and technology integration. Many are investing in AI-powered ECG interpretation tools to enhance diagnostic accuracy and support remote analysis. Companies are also expanding their geographic reach through strategic partnerships and collaborations with healthcare providers. Product portfolios are being diversified to include long-duration and wireless wearable monitors, tailored to meet rising consumer expectations for comfort and usability. Additionally, manufacturers are working to streamline compatibility with hospital IT ecosystems, ensuring seamless data sharing and interpretation. These approaches are helping brands to stay competitive and capture a larger share of this rapidly evolving market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Modality

- 2.2.4 End use

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of cardiac diseases

- 3.2.1.2 Technological advancements

- 3.2.1.3 Growing adoption of minimally invasive devices

- 3.2.1.4 Surging preference for remote patient cardiac monitoring

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory policies

- 3.2.2.2 High cost of the Holter ECG

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of remote patient monitoring (RPM) and telecardiology

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 Reimbursement scenario

- 3.10 PESTEL analysis

- 3.11 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 By region

- 4.3.1.1 North America

- 4.3.1.2 Europe

- 4.3.1.3 Asia Pacific

- 4.3.1 By region

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Continuous monitors

- 5.3 Intermittent monitors

Chapter 6 Market Estimates and Forecast, By Modality, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Wired Holter monitors

- 6.2.1 3 lead Holter monitors

- 6.2.2 12 lead Holter monitors

- 6.2.3 Other wired Holter monitors

- 6.3 Wireless Holter monitors

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Baxter

- 9.2 Bittium

- 9.3 FUKUDA

- 9.4 GE HealthCare

- 9.5 iRHYTHM

- 9.6 PHILIPS

- 9.7 SCHILLER

- 9.8 ScottCare

- 9.9 SPACELABS HEALTHCARE

- 9.10 VIVALINK