|

시장보고서

상품코드

1773323

타이어 밸런스 웨이트 시장(2025-2034년) : 기회, 성장 촉진요인, 산업 동향 분석, 예측Tire Balance Weight Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

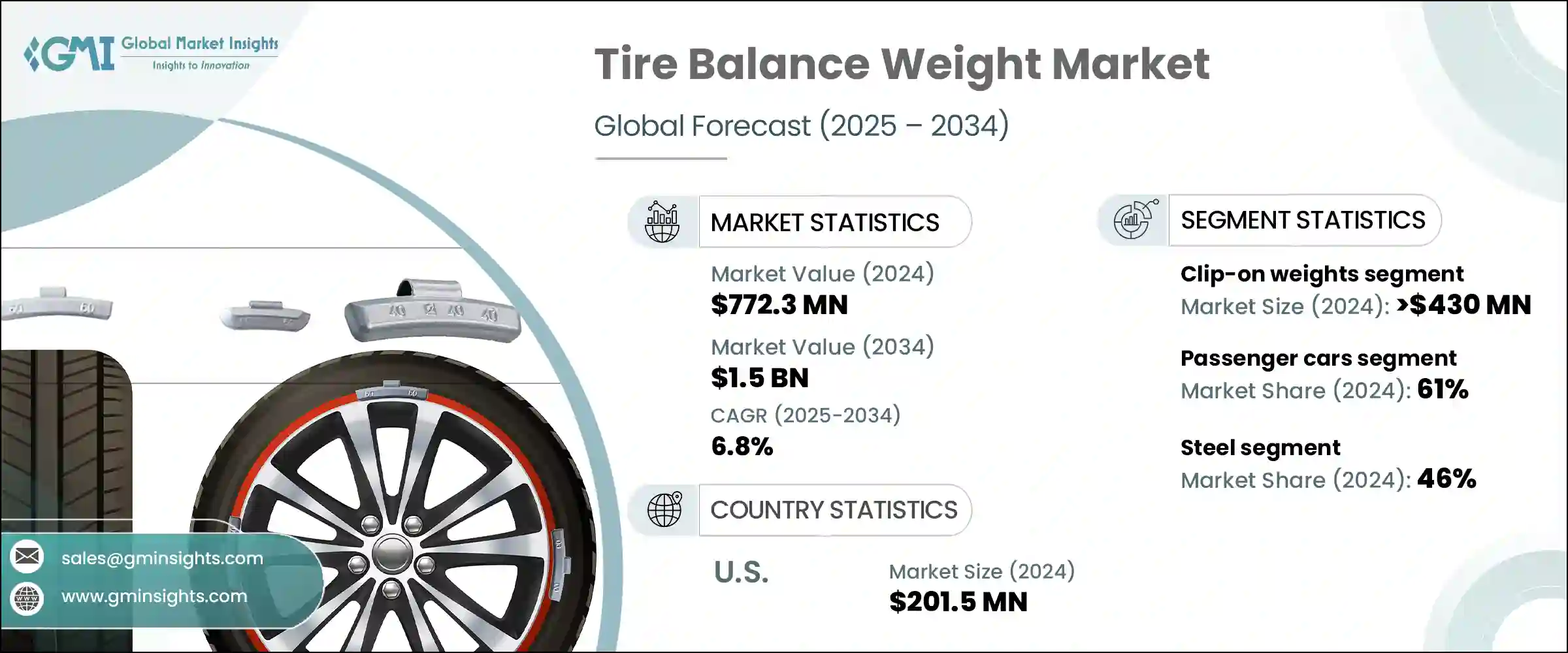

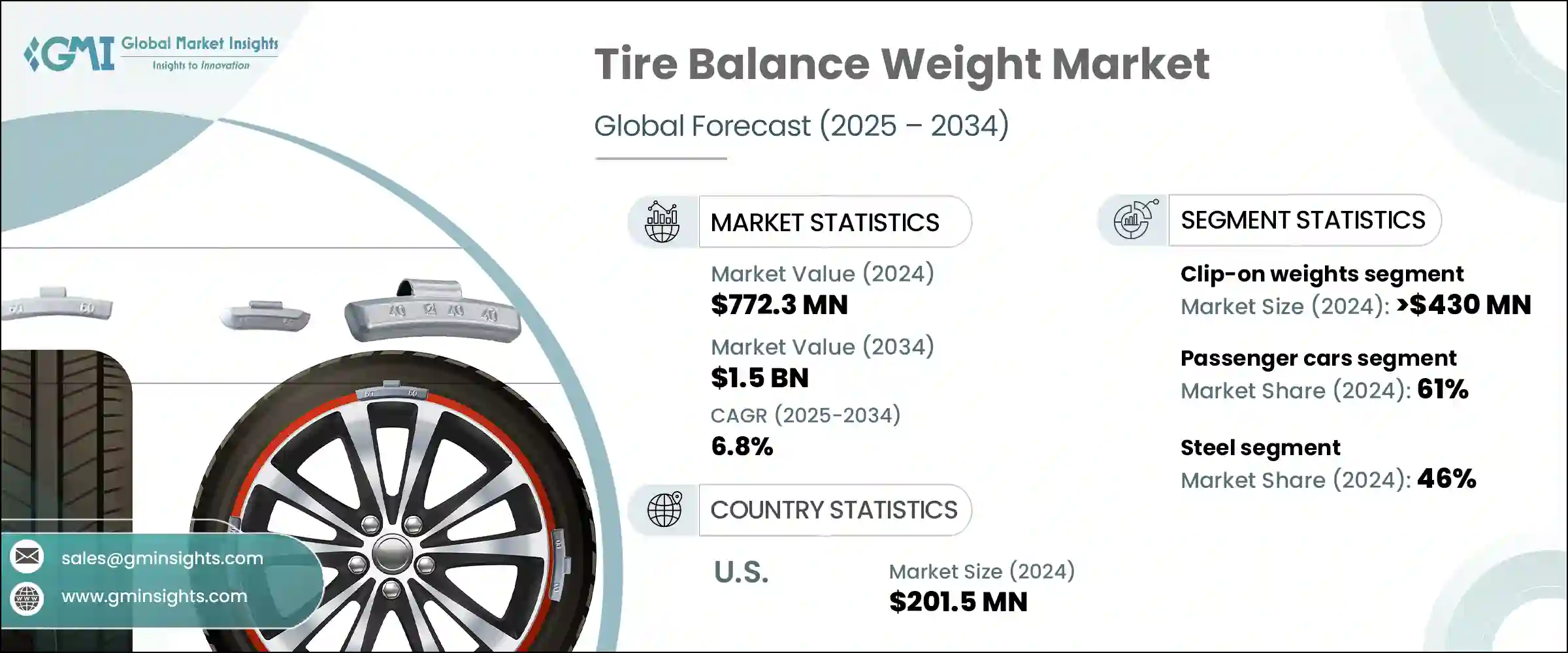

세계의 타이어 밸런스 웨이트 시장은 2024년에는 7억 7,230만 달러에 달하였고, CAGR 6.8%로 성장하여 2034년까지는 15억 달러에 이를 것으로 예측되고 있습니다.

이 성장의 주요 요인은 신흥시장을 중심으로 한 세계적인 자동차 생산량 급증입니다. 물류, 여객수송, 전자상거래 부문에 의한 수송 수요의 상승이 차량 정비 활동을 활성화시켜 타이어 밸런스 웨이트에 대한 왕성한 요구를 창출하고 있습니다.

각 지역의 정부와 규제기관은 안전기준과 도로준수기준을 강화하고 있으며, 이러한 점도 시장을 견인하고 있습니다., 아시아에서는 이러한 규제의 준수가 강화되어 자동차 사업자는 정기적인 타이어 유지보수를 실시하여야만 하고 따라서 수요가 높아지고 있습니다.

| 시장 범위 | |

|---|---|

| 시작연도 | 2024년 |

| 예측연도 | 2025-2034년 |

| 시작금액 | 7억 7,230만 달러 |

| 예측금액 | 15억 달러 |

| CAGR | 6.8% |

2024년 클립온 웨이트 부문은 4억 3,000만 달러를 창출하며 시장에서 지배적 지위를 유지하였습니다. 상업용 차량군과 저비용 차량에 크게 의존하고 있는 신흥 경제국가 가운데 특히 남미, 동유럽, 아시아의 일부와 같이 합금 휠이 일반적이지 않은 지역에서는 여전히 클립온 웨이트가 주로 사용되고 있습니다.

승용차 부문은 2024년에 61%의 점유율을 차지하며 예측기간 동안 상당한 성장이 예상됩니다. 이 동향은 소비자가 성능과 미관 모두를 선호하는 도시 지역과 고급 차량 부문에서 특히 두드러집니다.

북미의 타이어 밸런스 웨이트 시장은 2024년에 30%의 점유율을 차지하였고 미국이 2억 150만 달러를 기여하였습니다. 북미 시장은 자동화의 진보로 인해 성장하고 있습니다. 이 기술 혁신은 서비스의 정밀도와 효율을 향상시킬 뿐만 아니라, 타이어 공기압 모니터링 시스템과의 통합을 가능하게 하여 차량 전체의 안전성과 성능을 향상시킵니다. Hunter Engineering 및 CEMB와 같은 업계 리더는 시장의 디지털 변혁의 최전선에 있으며, 북미를 보다 스마트하고 정밀한 밸런싱 기술로 밀어올리고 있습니다.

세계의 타이어 밸런스 웨이트 시장을 독점하는 주요 기업으로는 Baolong Automotive Corp., 3M Company, Hunter Engineering Company, Hennessy Industries(현 Coats Company), TOHO KOGYO Co., Plombco, WEGMANN Automotive 등이 있습니다.

타이어 밸런스 웨이트 분야의 주요 기업은 시장에서의 존재감을 강화하고 발판을 넓히기 위해 몇 가지 전략적 접근법을 채용하고 있습니다. 각사는 투자를 통해 보다 진화하는 환경 규제를 충족함과 동시에 보다 높은 성능을 요구하는 고객 수요에도 대응할 수 있습니다. 또한, 기업은 생산설비와 서비스설비에 자동화와 디지털기술의 통합을 채용하여 정밀도를 높이고 턴어라운드 시간을 단축함으로써 OEM과 플릿 오퍼레이터의 주목을 받고 있습니다.

목차

제1장 조사방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 업계 생태계 분석

- 공급자의 상황

- 이익률

- 비용구조

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 애프터서비스와 타이어 교환 증가

- 차량 안전에 관한 규제 강화

- 납에서 비독성 물질로의 환경적인 전환

- 타이어와 휠의 설계에서의 기술적 진보

- 업계의 잠재적 리스크 및 과제

- 개발도상지역에서의 의식의 부족

- 선진국 시장 포화

- 시장 기회

- 무연 및 환경친화적인 재료 수요 증가

- EV와 하이브리드차의 보급률 증가

- 자동차 애프터마켓 서비스의 급속한 확대의 새로운 동향

- 스마트 워크숍 기술의 통합

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTEL 분석

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 가격 동향

- 지역별

- 제품별

- 생산통계

- 생산거점

- 소비거점

- 수출과 수입

- 코스트 내역 분석

- 특허 분석

- 지속 가능성과 환경 측면

- 지속 가능한 관행

- 폐기물 감축 전략

- 생산에서의 에너지 효율

- 환경친화적인 노력

- 탄소발자국의 고려

제4장 경쟁구도

- 소개

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 주요 시장기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장계획과 자금조달

제5장 시장 추계 및 예측 : 제품별(2021-2034년)

- 주요 동향

- 클립온 웨이트

- 점착식 웨이트

제6장 시장 추계 및 예측 : 재료별(2021-2034년)

- 주요 동향

- 강철

- 아연

- 납

- 기타

제7장 시장 추계 및 예측 : 차량별(2021-2034년)

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV(스포츠용 다목적차)

- 상용차

- 소형상용차(LCV)

- 중형상용차(MCV)

- 대형상용차(HCV)

- 이륜차

- 오프로드 자동차

제8장 시장 추계 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 자동차공장

- 타이어샵

- 자동차 제조업체

- 플릿 오퍼레이터

제9장 시장 추계 및 예측 : 판매채널별(2021-2034년)

- 주요 동향

- OEM

- 애프터마켓

제10장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 말레이시아

- 싱가포르

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

제11장 기업 프로파일

- 3M Company

- Alpha Autoparts

- Baolong Automotive Corp.

- Bharat Balancing Weights Pvt.

- Cangzhou Yaqiya Auto Parts(Yaqiya)

- Hatco/HARTEC sal

- HEBEI FANYA

- HEBEI XST

- Hennessy Industries(now Coats Company)

- Holman

- Hunter Engineering Company

- John Bean Technologies Corp.

- Micro-Poise Measurement Systems(AMETEK)

- Plombco Inc.

- Shengshi Weiye(Cangzhou Shengshiweiye)

- Snap-on Incorporated

- TOHO KOGYO Co.

- Trax JH

- WEGMANN Automotive

- Wurth USA

The Global Tire Balance Weight Market was valued at USD 772.3 million in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 1.5 billion by 2034. This growth is largely fueled by the rapid increase in automobile production worldwide, particularly in emerging markets. As car ownership rises and commercial vehicle fleets expand, the demand for regular tire maintenance, including wheel balancing, has surged, especially in bustling urban centers with high mobility needs. Furthermore, growing investments by public sectors in infrastructure and the rising transportation demands driven by logistics, passenger transit, and e-commerce sectors have intensified fleet servicing activities, creating a robust need for tire balance weights. Since these components play a critical role in ensuring vehicle safety and ride comfort, their demand naturally scales alongside the global vehicle population.

Governments and regulatory bodies across various regions are tightening safety and road compliance standards, which also drives the market. Proper wheel balancing-made possible through tire balance weights-eliminates unwanted vibrations, extends tire lifespan, improves driving safety at high speeds, and reduces overall maintenance costs. Enhanced adherence to these regulations, especially in North America, Europe, and Asia, is compelling vehicle operators to adopt routine tire maintenance, thereby bolstering demand. Moreover, the combination of regulatory compliance and rising consumer and fleet operator awareness about vehicle performance and safety continues to be a fundamental driver behind the market's steady expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $772.3 Million |

| Forecast Value | $1.5 Billion |

| CAGR | 6.8% |

In 2024, the clip-on weights segment generated USD 430 million in 2024, maintaining a dominant position in the market. Traditionally manufactured from lead, many regions have shifted toward zinc or steel alternatives due to regulatory restrictions, which have increased production costs related to redesigning manufacturing processes and sourcing new materials. Developing economies, which rely heavily on commercial fleets and budget vehicles, still predominantly use clip-on weights, especially where alloy wheels are less common, such as in South America, Eastern Europe, and parts of Asia. To meet these demands, manufacturers are focusing on developing new materials including advanced alloys, polymer-coated steel, and zinc-coated steel.

The passenger car segment held a 61% share in 2024 and is expected to experience considerable growth over the forecast period. The rising popularity of alloy wheels in passenger vehicles has led to increased demand for innovative balancing techniques such as stick-on weights, which prevent damage to the wheel surface and enhance vehicle appearance. This trend is strong in urban areas and higher-end vehicle segments, where consumers prioritize both performance and aesthetics. As passenger cars age, their resale and maintenance values encourage sustained aftermarket demand for balancing services.

North America Tire Balance Weight Market held a 30% share in 2024, with the United States contributing USD 201.5 million. The region benefits from advancements in automated balancing machinery that incorporate laser measurement, two-point optimization, and digital diagnostics. These innovations not only improve service accuracy and efficiency but also enable integration with tire pressure monitoring systems, enhancing overall vehicle safety and performance. Industry leaders like Hunter Engineering and CEMB are at the forefront of digital transformation in the market, pushing North America toward smarter, more precise balancing technologies. Additionally, strict environmental regulations have led to a complete phase-out of lead-based weights in the region, accelerating the adoption of safer, eco-friendly alternatives.

Key players dominating the Global Tire Balance Weight Market include Baolong Automotive Corp., 3M Company, Hunter Engineering Company, Hennessy Industries (now Coats Company), TOHO KOGYO Co., Plombco, and WEGMANN Automotive.

Leading companies in the tire balance weight sector employ several strategic approaches to strengthen their market presence and expand their foothold. Innovation in materials and manufacturing processes is a primary focus, with firms investing heavily in developing eco-friendly, lightweight, and durable alternatives to traditional lead weights. This enables compliance with evolving environmental regulations while meeting customer demand for higher performance. Additionally, companies are embracing automation and digital technology integration in production and service equipment, which enhances precision and reduces turnaround times, appealing to OEMs and fleet operators alike.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Material

- 2.2.4 Vehicle

- 2.2.5 End use

- 2.2.6 Sales channel

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in aftermarket services & tire replacement

- 3.2.1.2 Stricter regulations for vehicle safety

- 3.2.1.3 Environmental shift from lead to non-toxic materials

- 3.2.1.4 Technological advancements in tire & wheel design

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of awareness in developing regions

- 3.2.2.2 Market saturation in developed economies

- 3.2.3 Market opportunities

- 3.2.3.1 Surging demand for lead-free and eco-friendly materials

- 3.2.3.2 Rising EV and hybrid vehicle adoption

- 3.2.3.3 Emerging trends of rapid expansion in automotive aftermarket services

- 3.2.3.4 Integration of smart workshop technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 (USD Million, Units)

- 5.1 Key trends

- 5.2 Clip-on weights

- 5.3 Adhesive/Stick-on weights

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 (USD Million, Units)

- 6.1 Key trends

- 6.2 Steel

- 6.3 Zinc

- 6.4 Lead

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Million, Units)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Hatchbacks

- 7.2.2 Sedans

- 7.2.3 SUVs (Sport utility vehicles)

- 7.3 Commercial vehicles

- 7.3.1 Light commercial vehicles (LCVs)

- 7.3.2 Medium commercial vehicles (MCVs)

- 7.3.3 Heavy commercial vehicles (HCVs)

- 7.4 Two-wheelers

- 7.5 Off-road vehicles

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Million, Units)

- 8.1 Key trends

- 8.2 Automotive workshops

- 8.3 Tire shops

- 8.4 Vehicle manufacturers

- 8.5 Fleet operators

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 (USD Million, Units)

- 9.1 Key trends

- 9.2 OEMs

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Singapore

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 3M Company

- 11.2 Alpha Autoparts

- 11.3 Baolong Automotive Corp.

- 11.4 Bharat Balancing Weights Pvt.

- 11.5 Cangzhou Yaqiya Auto Parts (Yaqiya)

- 11.6 Hatco / HARTEC s.a.l.

- 11.7 HEBEI FANYA

- 11.8 HEBEI XST

- 11.9 Hennessy Industries (now Coats Company)

- 11.10 Holman

- 11.11 Hunter Engineering Company

- 11.12 John Bean Technologies Corp.

- 11.13 Micro-Poise Measurement Systems (AMETEK)

- 11.14 Plombco Inc.

- 11.15 Shengshi Weiye (Cangzhou Shengshiweiye)

- 11.16 Snap-on Incorporated

- 11.17 TOHO KOGYO Co.

- 11.18 Trax JH

- 11.19 WEGMANN Automotive

- 11.20 Wurth USA