|

시장보고서

상품코드

1773332

수성 접착제 어플리케이터 시장(2025-2034년) : 기회, 성장 촉진요인, 산업 동향 분석, 예측Water-based Adhesive Applicators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

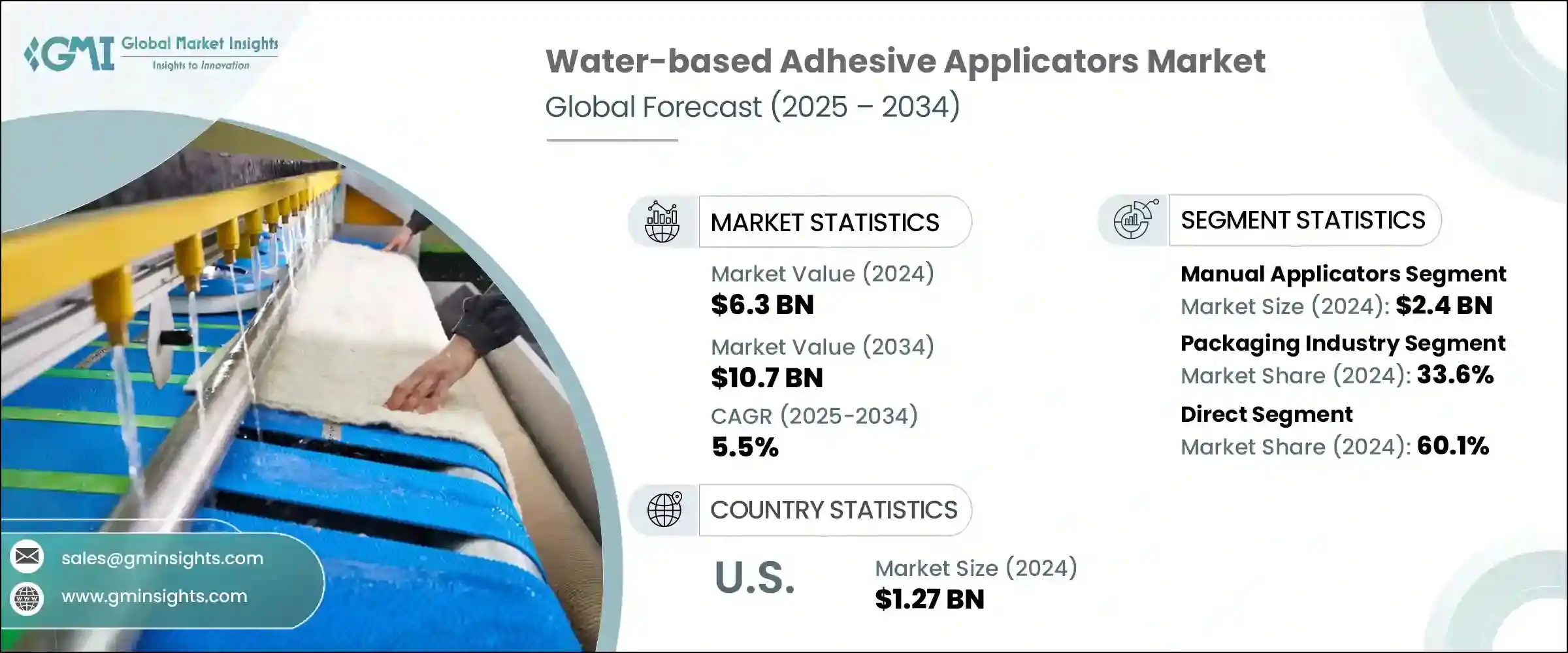

세계의 수성 접착제 어플리케이터 시장은 2024년에 63억 달러로 평가되었고 CAGR 5.5%로 성장하여 2034년까지는 107억 달러에 이를 것으로 추정되고 있습니다. 환경친화적인 포장에 대한 선호도가 높아짐에 따라 이러한 어플리케이터는 재활용 가능한 재료와의 호환성으로 라벨링, 밀봉 및 유연한 포장에 널리 사용됩니다.

또한 가구와 목공 분야에서도 수요가 높아지고 있어 목재, 라미네이트, 단판과 같은 다공질 재료의 접착에 중요한 역할을 하고 있습니다. 반자동 및 자동 어플리케이터 시스템의 채용이 증가하고 있는 것도 특히 건설이나 소비재와 같은 섹터에서 시장 전망을 재구축하고 있습니다. 이 기술은 작업 효율을 향상시키며, 재료의 낭비를 줄이고, 일관된 접착제 도포기능을 제공하며 이는 세계의 제조 환경 자동화 동향과 일치하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작연도 | 2024년 |

| 예측연도 | 2025-2034년 |

| 시작금액 | 63억 달러 |

| 예측금액 | 107억 달러 |

| CAGR | 5.5% |

2024년 수동 어플리케이터 분야는 24억 달러를 창출하였고 2034년까지 연평균 복합 성장률(CAGR) 4.4%를 보일 것으로 예측됩니다. 섬유 분야에서는 자동화가 필수적이지 않거나 비용이 합리적이지 않은 경우 수동 어플리케이터를 계속 사용하고 있으며, 이러한 장치는 고르지 않은 표면과 복잡한 표면에서보다 우수한 접착제 제어성을 제공하므로 다양한 산업 환경에서 미세한 접착작업에 인기가 있습니다.

직접판매 채널 부문은 2024년에 60.1%의 점유율을 차지하였으며, 2025년부터 2034년에 걸쳐 CAGR 5.8%를 보일 것으로 예측되고 있습니다. 커스텀메이드 접착 시스템이 요구되는 경우가 많으며, 통합, 트레이닝, 애프터서비스 등 제조업체의 밀접한 관여가 중시됩니다.

북미의 수성 접착제 어플리케이터 시장은 2024년에 12억 7,000만 달러로 평가되었고 2034년까지 연평균 복합 성장률(CAGR)5%를 보일 것으로 예측됩니다. 배출가스에 대한 우려가 높아지는 가운데 수성 접착제는 낮은 VOC와 규제 준수의 관점에서 선호되고 있습니다.

수성 접착제 어플리케이터 시장의 주요 기업은 Buhnen GmbH & Co.KG, Nordson Corporation, Robatech AG, ITW Dynatec, HB Fuller Company, 3M Company, Franklin International, Graco Inc., Sika AG, Henkel AG & Co.KGaA, Valco Melton, GluePC Corporation, Ad Tech(FPC Corporation) 등이 있습니다. 수성 접착제 어플리케이터 시장에서 경쟁하는 기업은 시장에서의 지위를 높이기 위해서 기술 혁신, 자동화, 커스터마이즈를 우선하고 있습니다. 또한 실시간 모니터링과 성능 데이터를 제공하는 스마트한 IoT 대응 어플리케이터로 제품 라인을 확대하고 있습니다.

목차

제1장 조사방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 업계 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 업계에 미치는 영향요인

- 성장 촉진요인

- 자동 어플리케이터 도입 증가

- 포장 부문에서의 수요 급증

- 스마트 제어 시스템 통합

- 접착제 배합 기술의 진보

- 업계의 잠재적 리스크 및 과제

- 수성 접착제의 성능 한계

- 자동 어플리케이터에 대한 초기 투자 비용 증가

- 기회

- 의료 및 위생 분야로의 도입

- 경량 차량 수요 증가

- 스마트 제조(Industry 4.0)와의 통합

- VOC프리 접착제 솔루션 수요

- 성장 촉진요인

- 성장 가능성 분석

- 장래 시장 동향

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 가격 동향

- 지역별

- 유형별

- 규제 상황

- 표준 및 컴플라이언스 요건

- 지역 규제 프레임워크

- 인증기준

- 무역 통계

- 주요 수입국

- 주요 수출국

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁구도

- 소개

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 지역별

- 기업 매트릭스 분석

- 주요 시장기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계 및 예측 : 자동화별(2021-2034년)

- 주요 동향

- 수동 어플리케이터

- 반자동 어플리케이터

- 자동 어플리케이터

제6장 시장 추계 및 예측 : 최종 이용 산업별(2021-2034년)

- 주요 동향

- 포장업계

- 가구 및 목공

- 건설자재

- 자동차 및 항공우주

- 섬유 및 의류

- 금속

- 유리

- 기타(폼, 섬유 및 직물, 피혁)

제7장 시장 추계 및 예측 : 유통 채널별(2021-2034년)

- 주요 동향

- 직접

- 간접

제8장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 인도네시아

- 말레이시아

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

제9장 기업 프로파일

- 3M Company

- Ad Tech(FPC Corporation)

- Buhnen GmbH &Co. KG

- Dymax Corporation

- Franklin International

- Glue Machinery Corporation

- Graco Inc.

- HB Fuller Company

- Henkel AG &Co. KGaA

- ITW Dynatec

- Nordson Corporation

- Robatech AG

- Sika AG

- Surebonder(FPC Corporation)

- Valco Melton

The Global Water-based Adhesive Applicators Market was valued at USD 6.3 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 10.7 billion by 2034. The industry is witnessing steady growth driven by expansion in the packaging sector, fueled by the boom in e-commerce, fast-moving consumer goods, and food and beverage industries. With a growing preference for eco-conscious packaging, these applicators are widely used for labeling, sealing, and flexible packaging due to their compatibility with recyclable materials. In addition to offering clean and efficient bonding, they support sustainability efforts and function well in high-speed production.

Simultaneously, demand is rising in the furniture and woodworking segments, where these applicators play a vital role in bonding porous materials like wood, laminates, and veneers. Trends such as DIY home improvement and modular furniture have further fueled this uptake. The growing adoption of semi-automatic and automatic applicator systems is also reshaping the market landscape, particularly in sectors like construction and consumer goods. These technologies improve operational efficiency, lower material waste, and offer consistent adhesive application, aligning with automation trends across global manufacturing environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.3 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 5.5% |

In 2024, the manual applicators segment generated USD 2.4 billion and is projected to grow at a CAGR of 4.4% through 2034. Their appeal lies in cost-efficiency and flexibility, making them ideal for low-volume or precision-focused operations. Small and mid-sized manufacturers, especially in packaging, furniture, and textiles, continue to use manual applicators where automation is not essential or cost-justified. These devices also deliver better adhesive control on non-uniform or complex surfaces, which makes them popular for detailed bonding tasks in varied industrial settings.

The direct distribution channels segment held a 60.1% share in 2024 and is expected to grow at a CAGR of 5.8% from 2025 to 2034. Direct sales are gaining traction as they allow manufacturers to tailor their solutions and respond rapidly to customer needs. Industries such as construction, automotive, and packaging often require custom adhesive systems and value close manufacturer involvement for integration, training, and after-sales services. Businesses using semi-automatic and smart applicators rely heavily on this channel for consistent performance, technical assistance, and streamlined procurement.

North America Water-based Adhesive Applicators Market generated USD 1.27 billion in 2024, projected to grow at a CAGR of 5% through 2034. Growth in the U.S. market is largely fueled by the country's industrial strength in sectors like packaging, automotive, woodworking, and construction. With rising concerns around emissions, water-based adhesives are preferred for their low VOCs and regulatory compliance. Additionally, advanced manufacturing and automation trends across U.S. industries continue to drive the demand for high-performance applicator systems that improve speed, safety, and precision.

Key players in the Water-based Adhesive Applicators Market include Buhnen GmbH & Co. KG, Nordson Corporation, Robatech AG, ITW Dynatec, H.B. Fuller Company, 3M Company, Franklin International, Graco Inc., Sika AG, Henkel AG & Co. KGaA, Valco Melton, Glue Machinery Corporation, Surebonder (FPC Corporation), Dymax Corporation, and Ad Tech (FPC Corporation). Companies competing in the water-based adhesive applicators market are prioritizing innovation, automation, and customization to enhance their market position. Many are heavily investing in R&D to develop eco-friendly, energy-efficient systems that meet evolving industrial and environmental standards. To stay competitive, leading firms are expanding their product lines with smart, IoT-enabled applicators that provide real-time monitoring and performance data. Strategic partnerships with end-use industries and OEMs also help boost integration across diverse manufacturing platforms. Firms are optimizing direct sales networks to ensure faster delivery, improved technical support, and better customer retention.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Automation

- 2.2.3 End use

- 2.2.4 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in automated applicator adoption

- 3.2.1.2 Surge in demand from the packaging sector

- 3.2.1.3 Integration of smart control systems

- 3.2.1.4 Advancements in adhesive formulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Performance limitations of water-based adhesives

- 3.2.2.2 High initial investment for automated applicators

- 3.2.3 Opportunities

- 3.2.3.1 Adoption in medical and hygiene applications

- 3.2.3.2 Increasing demand for lightweight vehicles

- 3.2.3.3 Integration with smart manufacturing (Industry 4.0)

- 3.2.3.4 Demand for VOC-free adhesive solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation Landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Automation, 2021 - 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Manual applicator

- 5.3 Semi-automatic applicators

- 5.4 Automatic applicators

Chapter 6 Market Estimates & Forecast, By End Use Industry, 2021 - 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Packaging industry

- 6.3 Furniture & woodworking

- 6.4 Construction & building materials

- 6.5 Automotive & aerospace

- 6.6 Textile & apparel

- 6.7 Metals

- 6.8 Glass

- 6.9 Others (Foam, textiles/fabrics, leather)

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Direct

- 7.3 Indirect

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Indonesia

- 8.4.7 Malaysia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 Saudi Arabia

- 8.6.2 UAE

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 3M Company

- 9.2 Ad Tech (FPC Corporation)

- 9.3 Buhnen GmbH & Co. KG

- 9.4 Dymax Corporation

- 9.5 Franklin International

- 9.6 Glue Machinery Corporation

- 9.7 Graco Inc.

- 9.8 H.B. Fuller Company

- 9.9 Henkel AG & Co. KGaA

- 9.10 ITW Dynatec

- 9.11 Nordson Corporation

- 9.12 Robatech AG

- 9.13 Sika AG

- 9.14 Surebonder (FPC Corporation)

- 9.15 Valco Melton