|

시장보고서

상품코드

1773345

자궁근종 치료 기기 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Uterine Fibroid Treatment Device Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

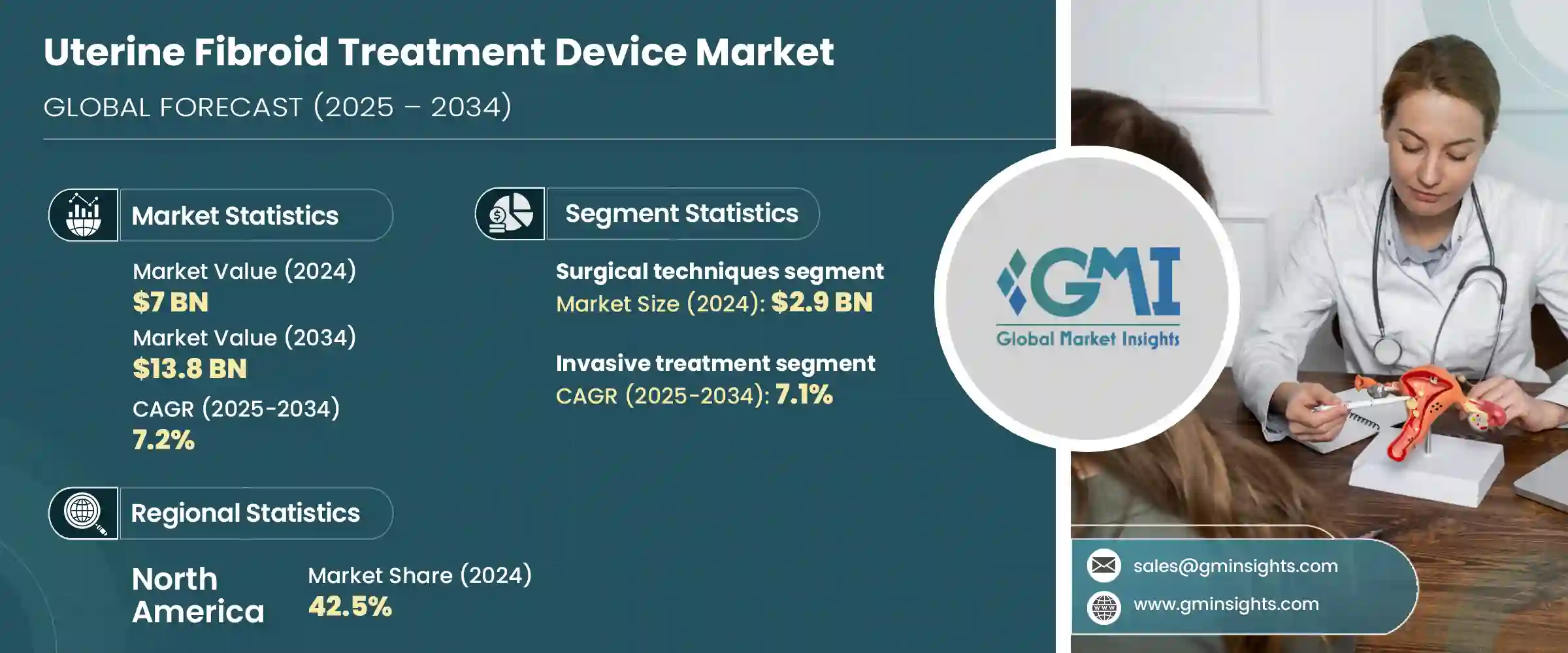

세계의 자궁근종 치료 기기 시장은 2024년에는 70억 달러로 평가되었으며 CAGR 7.2%를 나타내 2034년에는 138억 달러에 이를 것으로 추정됩니다.

출산 적령기 여성에서 자궁근종 환자의 일관된 증가는 신뢰성과 안전성을 결합한 고급 치료 옵션에 대한 수요를 크게 촉진하고 있습니다. 자궁을 보존하는 수술에 대한 의식의 고조가, 헬스케어 시스템 전체에서의 폭넓은 채용을 촉진하고 있습니다. 에너지 기반의 기술은 자궁의 완전성을 유지하면서 자궁근종을 효율적으로 관리하는 능력으로 인기를 얻고 있습니다.

비침습적이고 침습적이지 않은 치료법의 끊임없는 기술 혁신은 특히 전통적인 수술을 대체하는 치료법을 찾는 환자에게 환자의 결과를 향상 시켰습니다. 전반적으로 치료에 대한 접근이 확대되고 있는 것은 시장 성장을 지원하는 중요한 역할을 하고 있습니다. Canyon Medical사, Minerva Surgical사, Medtronic사, Terumo Corporation사, Johnson & Johnson(Ethicon)사 등의 기업이 새로운 치료 기구로 자궁근종 관리를 전진시키고 있는 주요 기업입니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 70억 달러 |

| 예측 금액 | 138억 달러 |

| CAGR | 7.2% |

외과적 치료 부문은 2024년에 29억 달러를 창출했습니다. 이 치료는 자궁근종을 제거하는 데 중점을 둡니다. 자궁 자체를 적출하는 일도 있습니다. 자궁근종이 크거나, 수가 많거나, 증상이 강하거나 하는 경우에는 자궁근종 핵출술이나 자궁 적출술이라고 하는 처치가 종종 선호됩니다. 헬스케어 제공업체와 환자 모두에서 인기가 있는 것은 성공률이 높고 증상의 완화가 장기간 지속되기 때문입니다. 경험이 풍부한 수술 전문가에 대한 액세스의 향상에 의해 지원되고 있습니다.

2024년에는 침습적 치료 분야가 시장을 선도했고 2034년까지 연평균 복합 성장률(CAGR) 7.1%를 나타낼 것으로 예측됩니다. 이 치료는 복잡한 근종과 심각한 근종에 특히 효과적이며 종합적인 증상 완화를 제공합니다. 침습적인 방법에 비해 보다 확실한 결과를 가져오는 것으로, 골반의 불쾌감, 이상 출혈, 불임과 관련된 합병증 등의 지속적인 문제를 해결합니다.

미국의 자궁근종 치료 기기 시장은 2024년에 30억 달러로 평가되었습니다. 기술적 진보와 보다 낮은 침습적인 선택에 대한 폭넓은 인식으로 미국은 계속 시장 전체의 확대에 크게 기여하고 있습니다.

업계 선두로는 올림푸스, 인사이텍, Shenzhen Mindray Bio-Medical Electronics, Conmed, Merit Medical Systems, CooperSurgical, Boston Scientific, Karl Storz, Hologic, Canyon Medical, Medtronic, Minerva Surgical, Terumo Corporation, Nesa Medtech, & Johnson(Ethicon) 등을 들 수 있습니다. 이들 기업은 지속적인 제품 개발과 혁신을 통해 시장의 방향성을 형성하는데 큰 역할을 하고 있습니다. 합병과 전략적 제휴, 인수를 통해 제품 포트폴리오를 확대하는 데 주력하고 있는 기업도 많습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 밸류체인에 영향을 주는 요인

- 업계에 미치는 영향요인

- 성장 촉진요인

- 자궁근종의 이환율 증가

- 자궁 및 복강경 장치의 기술적 진보

- 낮은 침습 수술 수요 증가

- 업계의 잠재적 위험 및 과제

- 고급 치료 장비의 높은 비용

- 농촌나 발전 도상 지역에서는 입수가 한정

- 시장 기회

- 일회용 및 단회 사용 디바이스의 채용 증가

- 생식 능력 온존 치료 옵션 수요 증가

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 가격 분석

- 향후 시장 동향

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계·예측 : 기술별(2021-2034년)

- 주요 동향

- 수술 기술

- 자궁 적제술

- 근종 절제술

- 복강경 수술

- 복강경 근종 절제술

- 근 융해

- 절제 기술

- 마이크로파 절제

- 열수 절제

- 냉동 절제

- 초음파 절제

- 고강도 초점식 초음파(HIFU)

- MRI 유도 집속 초음파(MRGFUS)

- 색전술

제6장 시장 추계·예측 : 치료별(2021-2034년)

- 주요 동향

- 침습적 치료

- 최소 침습 치료

- 비침습적 치료

제7장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제8장 기업 프로파일

- Boston Scientific

- Canyon Medical

- Conmed

- CooperSurgical

- Hologic

- Insightec

- Johnson & Johnson(Ethicon)

- Karl Storz

- Medtronic

- Merit Medical Systems

- Minerva Surgical

- Nesa Medtech

- Olympus

- Shenzhen Mindray Bio-Medical Electronics

- Terumo Corporation

The Global Uterine Fibroid Treatment Device Market was valued at USD 7 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 13.8 billion by 2034. The consistent rise in fibroid cases among women of childbearing age is significantly fueling the demand for advanced treatment options that are both reliable and safe. Greater awareness about minimally invasive and uterus-sparing procedures, along with a noticeable shift towards technologically sophisticated solutions, is driving broader adoption across healthcare systems. Energy-based technologies have gained popularity for their ability to manage fibroids efficiently while maintaining uterine integrity.

Continuous innovation in non-invasive and less aggressive treatment methods is enhancing patient outcomes, particularly for those seeking alternatives to traditional surgery. The availability of skilled practitioners and expanded access to treatment across developed and emerging healthcare infrastructures also play a critical role in supporting market growth. As the prevalence of conditions like menorrhagia and other gynecologic disorders increases, the market for uterine fibroid treatment devices continues to expand. Companies like Canyon Medical, Minerva Surgical, Medtronic, Terumo Corporation, Johnson & Johnson (Ethicon), and others are key players advancing the landscape of fibroid management with novel therapeutic devices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7 Billion |

| Forecast Value | $13.8 Billion |

| CAGR | 7.2% |

The surgical procedures segment generated USD 2.9 billion in 2024. These treatments focus on eliminating fibroids or, in certain situations, removing the uterus itself, depending on the extent and complexity of the condition. Procedures such as myomectomy and hysterectomy are often preferred when fibroids are large, numerous, or highly symptomatic. Their popularity among both healthcare providers and patients stems from high success rates and long-lasting relief from symptoms. The continued dominance of this segment is supported by an expanding healthcare infrastructure, improved insurance options, and better access to experienced surgical professionals. Factors like rising cases of excessive menstrual bleeding and related gynecological issues also contribute to the strong demand for surgical intervention.

In 2024, the invasive procedures segment led the market and is anticipated to grow at a CAGR of 7.1% through 2034. These treatments are especially effective for complicated or severe fibroid conditions, offering comprehensive symptom relief. When medications or non-invasive therapies fail to deliver the expected results, these methods become the preferred option. Open surgical approaches address persistent issues such as pelvic discomfort, abnormal bleeding, and fertility-related complications by providing more definitive outcomes compared to non-invasive techniques. The ability to treat deeply embedded or multiple fibroids also makes this segment a critical part of the uterine fibroid treatment device market.

U.S. Uterine Fibroid Treatment Device Market was valued at USD 3 billion in 2024. A key factor contributing to this growth is the availability of medical experts specializing in women's health and gynecologic procedures. Thousands of energy-based and embolization procedures are carried out annually to treat fibroids effectively. With continual technological advancements in treatment devices and broader awareness of less invasive alternatives, the U.S. continues to be a significant contributor to overall market expansion. Education around newer treatment techniques and improvements in healthcare delivery models are also helping to increase patient uptake and trust in device-based fibroid solutions.

Prominent industry players include Olympus, Insightec, Shenzhen Mindray Bio-Medical Electronics, Conmed, Merit Medical Systems, CooperSurgical, Boston Scientific, Karl Storz, Hologic, Canyon Medical, Medtronic, Minerva Surgical, Terumo Corporation, Nesa Medtech, and Johnson & Johnson (Ethicon). These companies are instrumental in shaping the market's direction through ongoing product development and innovation. To reinforce their position in the uterine fibroid treatment device market, leading companies are actively investing in research and development to introduce minimally invasive technologies with improved safety profiles. Many are focusing on expanding their product portfolios through mergers, strategic partnerships, and acquisitions to access innovative treatment platforms. Several firms are working to enhance patient outcomes by integrating real-time imaging and AI-based navigation systems into their devices. Additionally, key players are increasing their global footprint by entering untapped markets and aligning with regional healthcare providers.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Treatment

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of uterine fibroids

- 3.2.1.2 Technological advancements in uterine & laparoscopic devices

- 3.2.1.3 Rising demand for minimally invasive procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced treatment devices

- 3.2.2.2 Limited availability in rural and developing areas

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing adoption of disposable and single-use devices

- 3.2.3.2 Increased demand for fertility-preserving treatment options

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Surgical techniques

- 5.2.1 Hysterectomy

- 5.2.2 Myomectomy

- 5.3 Laparoscopic techniques

- 5.3.1 Laparoscopic myomectomy

- 5.3.2 Myolysis

- 5.4 Ablation techniques

- 5.4.1 Microwave ablation

- 5.4.2 Hydrothermal ablation

- 5.4.3 Cryoablation

- 5.4.4 Ultrasound ablation

- 5.4.4.1 High intensity focused ultrasound (HIFU)

- 5.4.4.2 MRI-guided focused ultrasound (MRGFUS)

- 5.5 Embolization techniques

Chapter 6 Market Estimates and Forecast, By Treatment, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Invasive treatment

- 6.3 Minimally invasive treatment

- 6.4 Non-invasive treatment

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Boston Scientific

- 8.2 Canyon Medical

- 8.3 Conmed

- 8.4 CooperSurgical

- 8.5 Hologic

- 8.6 Insightec

- 8.7 Johnson & Johnson (Ethicon)

- 8.8 Karl Storz

- 8.9 Medtronic

- 8.10 Merit Medical Systems

- 8.11 Minerva Surgical

- 8.12 Nesa Medtech

- 8.13 Olympus

- 8.14 Shenzhen Mindray Bio-Medical Electronics

- 8.15 Terumo Corporation