|

시장보고서

상품코드

1773358

탈지분유 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Skimmed Milk Powder Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

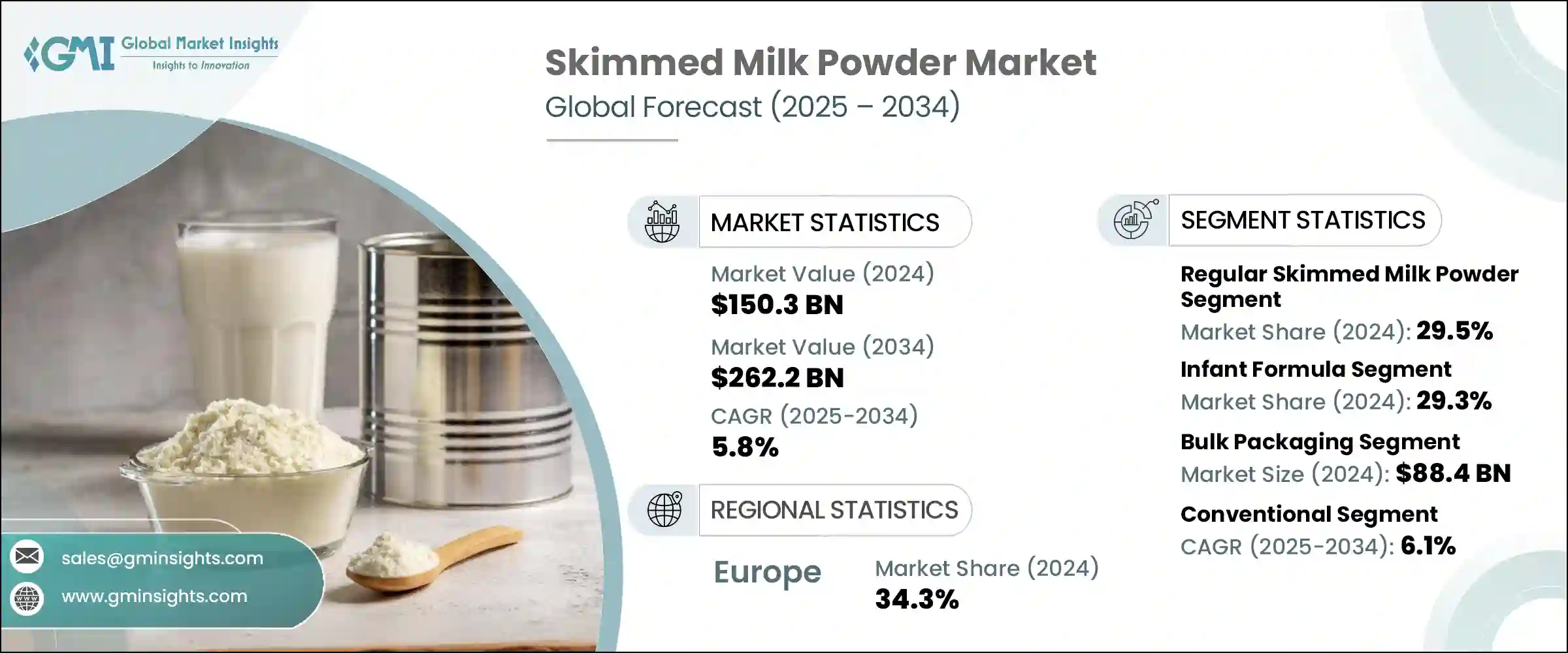

세계의 탈지분유 시장은 2024년에는 1,503억 달러로 평가되었고, CAGR 5.8%를 나타내 2034년에는 2,622억 달러에 달할 것으로 예측되고 있습니다. 보다 건강한 식품을 선택하자는 의식의 고조, 고품질의 유단백질을 요구하는 움직임, 유아 영양, 구운 과자, 과자류 등의 분야에서 수요 증가가 계속 시장 확대의 원동력이 되고 있습니다. 분무 건조 공정의 개선에 의해 제품의 품질과 보존 안정성이 향상해, 국제 무역에 큰 기회가 탄생하고 있습니다. 유제품 가격의 변동, 정책 전환, 무역역학은 가격 전략이나 생산 계획에 영향을 미치고 있습니다만, 장기적인 시장 전망은 계속 견조합니다.

경쟁 구도는 비교적 한정적이며, 신규 참가 제조업체에게는 미개척의 가능성이 많아, 규모 확대를 기대할 수 있습니다.신흥 시장에서는 단백질이 풍부한 식생활이 꾸준히 침투하고 있어 장기적인 성장을 한층 더 밀어주고 있습니다. 환경에 배려한 제조에 의해 시장의 기업도 진화를 이루고 있습니다. 공급면에서의 과제나 가격면에서의 불확실성이 있는 중에서도, 유제품을 베이스로 한 기능성 소재에 대한 세계의 욕구의 높아짐은 유제품 섹터의 진화에 있어서 탈지분유가 계속 중요한 역할을 하는 것을 확실히 하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 1,503억 달러 |

| 예측 금액 | 2,622억 달러 |

| CAGR | 5.8% |

일반 탈지분유 분야는 2024년에는 29.5%의 점유율을 차지했으며, 시장 규모는 444억 달러에 이르렀습니다. 고용 유형과 중온 유형은 그 가공 내성의 높이로부터 공업용 식품 분야에 적합하고, 저열 유형은 보다 자연스러운 품질로 가공도가 낮은 선택지를 요구하는 소비자를 매료하고 있습니다.

벌크 포장 부문은 2024년에 58.8% 점유율을 나타냈고, 884억 달러로 시장을 독점했습니다. 소비자의 편리성을 중시해, 리시러빌리티나 브랜드화된 포맷이라고 하는 기능을 제공하는 것으로, 선반에의 어필을 높이고 있습니다. 양부문 모두, 환경에 대한 우려나 규제의 압력이 높아지는 가운데, 환경 배려형의 포장 디자인을 채용하는 브랜드가 늘고 있습니다.

유럽의 탈지분유 시장은 2024년에 34.3%의 점유율을 차지했습니다. 이 지역은 또한 베이커리, 유아용 조제 분유, 과자류 등 폭넓은 용도로 왕성한 수요를 나타내고 있으며, 국내 소비를 더욱 촉진하고 있습니다.

주요 업계 리더로는 Friesland Campina, Danone SA, Arla Foods amba, Nestle SA, Fonterra Co-operative Group Limited 등이 있습니다. 탈지분유 업계 주요 기업은 세계 유통망의 확대, 지역 특유의 식생활동향의 활용, 공급 체인 효율 향상을 위한 전략적 제휴에 주력하고 있습니다. 세련된 강화 유제품과 부가가치가 높은 유제품을 발매하고 있습니다.지속가능성은 중심적인 테마이며, 각 브랜드는 보다 환경 친화적인 에너지원과 재활용 가능한 포장을 채용하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 파괴적 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 시장 기회

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTEL 분석

- 가격 동향

- 지역별

- 제품별

- 향후 시장 동향

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 특허 상황

- 무역 통계(HS코드)(참고 : 무역 통계는 주요 국가에서만 제공됨)

- 주요 수입국

- 주요 수출국

- 지속가능성과 환경 측면

- 지속가능한 관행

- 폐기물 감축 전략

- 생산에 있어서의 에너지 효율

- 환경 친화적인 노력

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계·예측 : 제품 유형별(2021-2034년)

- 주요 동향

- 일반 탈지분유

- 인스턴트 탈지분유

- 고열 탈지분유

- 중열 탈지분유

- 저열 탈지분유

- 유기농 탈지분유

- 강화 탈지분유

- 비타민 강화

- 미네랄 강화

- 단백질 강화

제6장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 동향

- 유아용 조제 분유

- 베이커리 및 제과

- 빵 및 제과류

- 케이크 및 패스트리

- 과자류 제품

- 기타 베이커리 용도

- 유제품

- 재구성 우유

- 요구르트 및 발효 식품

- 치즈 생산

- 아이스크림 및 냉동 디저트

- 가공식품

- 바로 먹을 수 있는 식사

- 수프 및 소스

- 육류 제품

- 기타 가공 식품

- 음료

- 단백질 음료

- 영양음료

- 커피 및 차 미백제

- 기타 음료 용도

- 영양보조식품

- 단백질 보충제

- 스포츠 영양

- 임상 영양

- 동물사료

- 기타

- 화장품 및 퍼스널케어

- 의약품 용도

- 산업 용도

제7장 시장 추계·예측 : 포장 형태별(2021-2034년)

- 주요 동향

- 벌크 포장

- 25kg 봉투

- 50kg 봉투

- 큰 봉투(500-1,000kg)

- 기타 벌크 포장

- 소매 포장

- 소형 파우치(100g-500g)

- 중형 팩(1kg-5kg)

- 캔

- 기타 소매 포장

제8장 시장 추계·예측 : 유통 채널별(2021-2034년)

- 주요 동향

- B2B(기업 간 거래)

- 식품 제조업체

- 유아용 조제 분유 제조업체

- 베이커리 및 제과점

- 푸드서비스 업계

- 기타 B2B 채널

- B2C(기업 대 소비자)

- 슈퍼마켓 및 하이퍼마켓

- 편의점

- 온라인 소매

- 전문점

- 기타 B2C 채널

제9장 시장 추계·예측 : 성질별(2021-2034년)

- 주요 동향

- 기존

- 유기농

제10장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 기타 라틴아메리카

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

제11장 기업 프로파일

- Fonterra Co-operative Group Limited

- Nestle SA

- Danone SA

- Arla Foods amba

- FrieslandCampina

- Lactalis Group

- Dairy Farmers of America(DFA)

- Saputo Inc.

- Glanbia plc

- Sodiaal Union

- Hochdorf Swiss Nutrition Ltd.

- Euroserum

- Dairygold Co-operative Society Limited

- Interfood Holding BV

- Synlait Milk Limited

- Westland Milk Products

- Murray Goulburn Co-operative

- Amul(Gujarat Cooperative Milk Marketing Federation)

- Yili Group

- Mengniu Dairy Company

The Global Skimmed Milk Powder Market was valued at USD 150.3 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 262.2 billion by 2034. The rising awareness around healthier food choices, the push for high-quality dairy proteins, and increasing demand in sectors like infant nutrition, baked goods, and confectionery continue to drive market expansion. Improvements in spray-drying processes have helped enhance product quality and shelf stability, creating strong opportunities for international trade. Although dairy price fluctuations, policy shifts, and trade dynamics have impacted pricing strategies and production planning, the long-term market outlook remains solid.

The competitive landscape is relatively limited, offering plenty of untapped potential for new manufacturers to enter and scale. Emerging markets are steadily adopting protein-rich dietary habits, which further support long-term growth. Market players are also evolving with cleaner processing technologies and environmentally conscious manufacturing to meet global sustainability expectations. Even amid supply challenges and pricing uncertainties, the rising global appetite for dairy-based functional ingredients ensures that skimmed milk powder will continue to play a vital role in the evolution of the dairy sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $150.3 Billion |

| Forecast Value | $262.2 Billion |

| CAGR | 5.8% |

The regular skimmed milk powder segment held a significant 29.5% share in 2024, with a market size of USD 44.4 billion. Its strong position stems from affordability and versatility, which appeal to both industrial and consumer applications. Instant variants are designed for fast solubility and are favored in household use. High-heat and medium-heat varieties serve the industrial food sector well, thanks to their processing tolerance, low-heat versions attract consumers looking for less processed options with more natural qualities.

Bulk packaging segment dominated the market with a 58.8% share and USD 88.4 billion in 2024. This preference is driven by its cost-efficiency, better-handling logistics, and reduced material waste, which align well with the needs of large-scale users. Retail packages continue to focus on consumer convenience, offering features like resealability and branded formats to boost shelf appeal. Across both segments, brands are increasingly adopting eco-conscious packaging designs that align with rising environmental concerns and regulatory pressures.

Europe Skimmed Milk Powder Market held a 34.3% share in 2024. The region's dominance is driven by its well-established dairy industry, strong export infrastructure, and advanced processing capabilities. European producers benefit from robust quality standards, extensive R&D investments, and favorable trade agreements that support consistent global supply. The region also exhibits strong demand across bakery, infant formula, and confectionery applications, further fueling domestic consumption. Moreover, the widespread adoption of sustainable dairy farming practices and technological advancements in spray drying contribute to production efficiency and product consistency.

Key industry leaders include FrieslandCampina, Danone S.A., Arla Foods amba, Nestle S.A., and Fonterra Co-operative Group Limited. Leading companies in the skimmed milk powder industry are focusing on expanding global distribution networks, leveraging region-specific dietary trends, and forming strategic alliances to enhance supply chain efficiency. Investments in state-of-the-art spray drying facilities and automated processing lines allow for better consistency and increased output. Many firms are targeting high-growth regions by launching fortified or value-added dairy variants tailored for specific demographics. Sustainability is a central theme, with brands adopting greener energy sources and recyclable packaging. By aligning with global nutrition standards and maintaining strict quality control, these companies are ensuring long-term trust and brand loyalty across diversified consumer bases.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Liters)

- 5.1 Key trends

- 5.2 Regular skimmed milk powder

- 5.3 Instant skimmed milk powder

- 5.4 High heat skimmed milk powder

- 5.5 Medium heat skimmed milk powder

- 5.6 Low heat skimmed milk powder

- 5.7 Organic skimmed milk powder

- 5.8 Fortified skimmed milk powder

- 5.8.1 Vitamin fortified

- 5.8.2 Mineral fortified

- 5.8.3 Protein enriched

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Liters)

- 6.1 Key trends

- 6.2 Infant formula

- 6.3 Bakery & confectionery

- 6.3.1 Bread & baked goods

- 6.3.2 Cakes & Pastries

- 6.3.3 Confectionery products

- 6.3.4 Other bakery applications

- 6.4 Dairy products

- 6.4.1 Reconstituted milk

- 6.4.2 Yogurt & fermented products

- 6.4.3 Cheese production

- 6.4.4 Ice cream & frozen desserts

- 6.5 Processed foods

- 6.5.1 Ready-to-Eat meals

- 6.5.2 Soups & sauces

- 6.5.3 Meat products

- 6.5.4 Other processed foods

- 6.6 Beverages

- 6.6.1 Protein drinks

- 6.6.2 Nutritional beverages

- 6.6.3 Coffee & tea whiteners

- 6.6.4 Other beverage applications

- 6.7 Nutritional supplements

- 6.7.1 Protein supplements

- 6.7.2 Sports nutrition

- 6.7.3 Clinical nutrition

- 6.8 Animal feed

- 6.9 Others

- 6.9.1 Cosmetics & personal care

- 6.9.2 Pharmaceutical applications

- 6.9.3 Industrial applications

Chapter 7 Market Estimates and Forecast, By Packaging Type, 2021 - 2034 (USD Billion) (Thousand Liters)

- 7.1 Key trends

- 7.2 Bulk packaging

- 7.2.1 25 kg bags

- 7.2.2 50 kg bags

- 7.2.3 Big bags (500-1000 kg)

- 7.2.4 Other bulk packaging

- 7.3 Retail packaging

- 7.3.1 Small pouches (100g-500g)

- 7.3.2 Medium packs (1kg-5kg)

- 7.3.3 Cans & tins

- 7.3.4 Other retail packaging

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Liters)

- 8.1 Key trends

- 8.2 B2B (Business-to-Business)

- 8.2.1 Food manufacturers

- 8.2.2 Infant formula manufacturers

- 8.2.3 Bakeries & confectioneries

- 8.2.4 Foodservice industry

- 8.2.5 Other B2B channels

- 8.3 B2C (Business-to-Consumer)

- 8.3.1 Supermarkets & hypermarkets

- 8.3.2 Convenience stores

- 8.3.3 Online retail

- 8.3.4 Specialty stores

- 8.3.5 Other B2C channels

Chapter 9 Market Estimates and Forecast, By Nature, 2021 - 2034 (USD Billion) (Thousand Liters)

- 9.1 Key trends

- 9.2 Conventional

- 9.3 Organic

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Liters)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.3.7 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Fonterra Co-operative Group Limited

- 11.2 Nestle S.A.

- 11.3 Danone S.A.

- 11.4 Arla Foods amba

- 11.5 FrieslandCampina

- 11.6 Lactalis Group

- 11.7 Dairy Farmers of America (DFA)

- 11.8 Saputo Inc.

- 11.9 Glanbia plc

- 11.10 Sodiaal Union

- 11.11 Hochdorf Swiss Nutrition Ltd.

- 11.12 Euroserum

- 11.13 Dairygold Co-operative Society Limited

- 11.14 Interfood Holding B.V.

- 11.15 Synlait Milk Limited

- 11.16 Westland Milk Products

- 11.17 Murray Goulburn Co-operative

- 11.18 Amul (Gujarat Cooperative Milk Marketing Federation)

- 11.19 Yili Group

- 11.20 Mengniu Dairy Company