|

시장보고서

상품코드

1773362

전통 팔레타이저 시장(2025-2034년) : 기회와 촉진요인, 업계 동향 분석, 예측Conventional Palletizers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

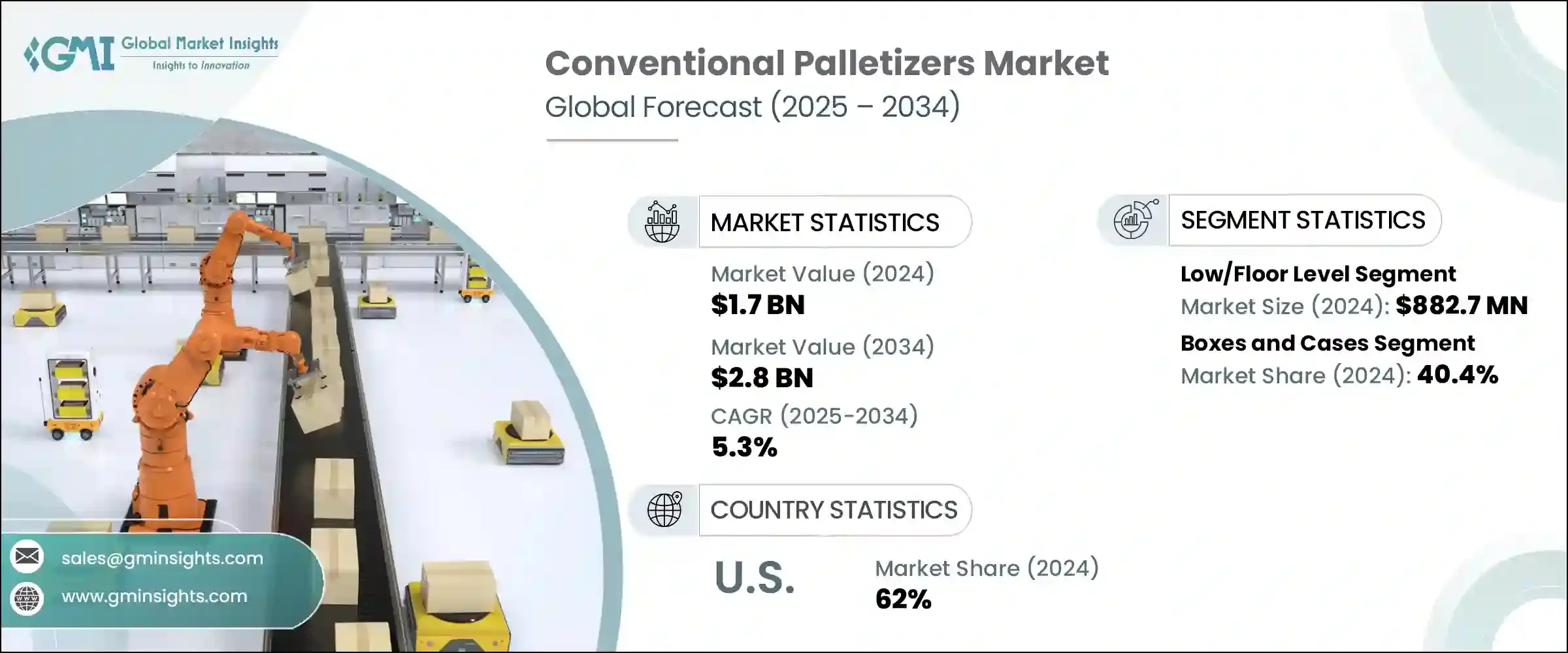

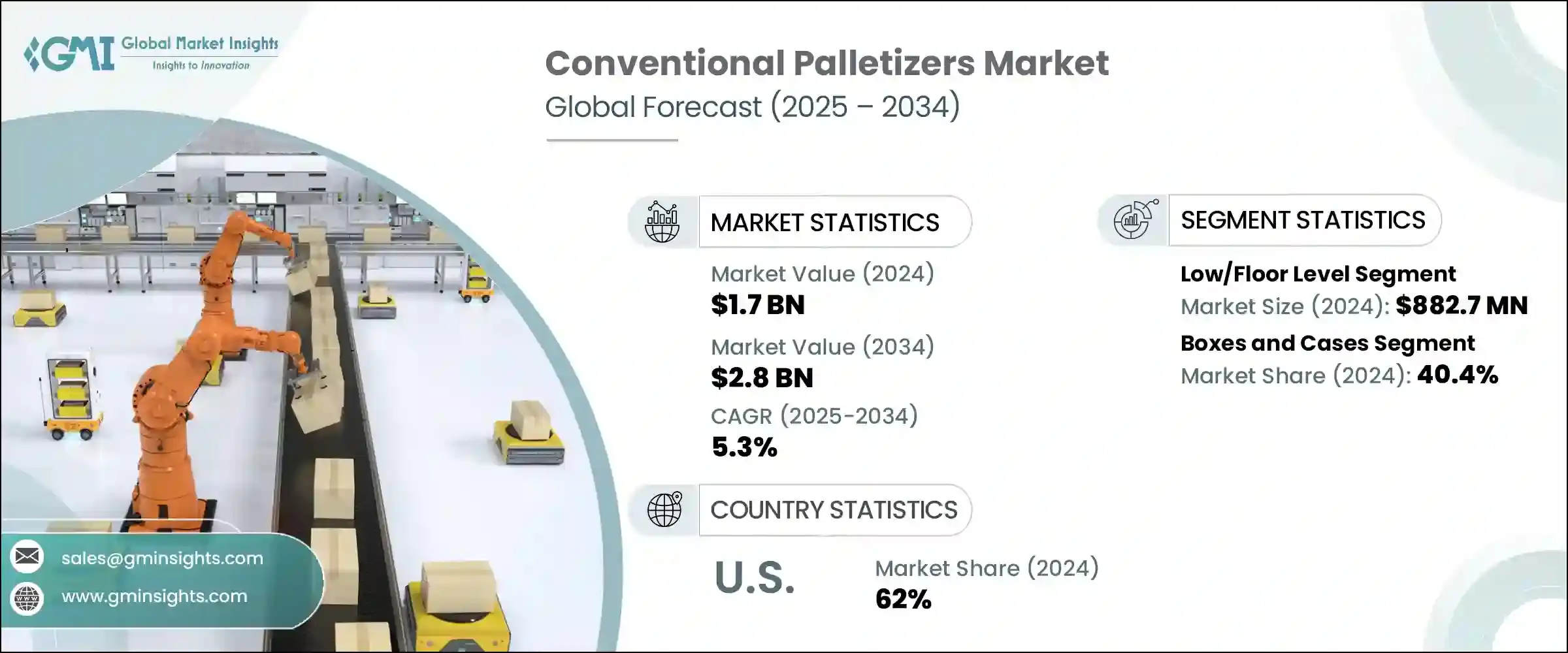

전통 팔레타이저 시장은 2024년에는 17억 달러로 평가되었으며 CAGR 5.3%로 성장하여 2034년에는 28억 달러에 이를 것으로 추정됩니다.

다양한 산업에서의 합리화된 포장과 물류 업무에 대한 수요의 급증이 이 시장의 주요 촉진요인 중 하나입니다. 전통 팔레타이징 시스템은 케이스와 봉투가 유통거점으로 운반되기 전에 일관된 핸들링이 필수적인 경우에 특히 중요합니다.

전통 팔레타이징 시스템은 생산을 중단하지 않고 충전 팔레트와 빈 팔레트의 원활한 마이그레이션을 가능하게 함으로써 포장 라인의 효율을 향상시킵니다. 설치 면적이 작기 때문에 광대한 안전장벽도 불필요하여 공간 최적화가 우선시되는 시설에 최적입니다. 식음료 부문에서는 유제품, 스낵, 통조림을 처리하기 위해 이러한 기계에 크게 의존하고 있습니다. 전통 팔레타이저는 신속한 처리와 배송을 필요로 하는 신선식품에서 빠른 페이스의 생산 수요에 대응하는 출력 속도를 유지함으로써 신뢰를 얻고 있습니다.

| 시장 범위 | |

|---|---|

| 시작연도 | 2024 |

| 예측연도 | 2025-2034 |

| 시작금액 | 17억 달러 |

| 예측금액 | 28억 달러 |

| CAGR | 5.3% |

로우/플로어레벨 팔레타이저 부문은 2024년에 8억 8,270만 달러를 창출했습니다. 위에서부터 쌓아 올리는 고소작업형과 달리 플로어 형태는 적층시의 수직이동이 불필요합니다.

2024년 박스 및 케이스 부문의 점유율은 40.4%였습니다. 퍼스널케어 아이템 등 상자나 케이스는 보호성, 브랜딩 용이성, 적층 효율성으로 인해 업계를 불문하고 여전히 지배적인 포장 형태입니다. 대량 생산을 실시하는 제조업체는 특히 포장량이 많은 경우 균일성과 스피드 및 정밀도를 제공하는 팔레타이징 시스템에 주목합니다.

미국의 2024년 전통 팔레타이저 시장 점유율은 62%였습니다. 인건비 상승과 노동력 부족을 보완할 필요성으로 인해, 이 나라의 제조업체는 전통 팔레타이징 시스템에 대한 투자를 늘리고 있습니다. 이러한 시스템의 도입을 통해 종업원의 이직률을 저하시키면서 안전성과 생산성을 향상시킵니다. 자동화의 추진은 제조업의 성장이나 온라인 소매채널의 확대 등 보다 폭넓은 경제 동향과도 연결되어 있어 이들 모두가 고효율의 엔드오브라인 기기에 대한 수요를 촉진하고 있습니다.

세계의 전통 팔레타이저 시장을 선도하는 주요 기업은 Columbia Machine Inc., 오쿠라 요행, ROBOPAC, MSK Covertech, Premier Tech, KUKA AG, SIPA SpA, Signode Industrial Group LLC, OCME Srl, Brenton Engineering, PAYPER SA, Concetti SpA, BW Flex Taiyang Packaging Technology Co.Ltd. 등이 있습니다. 전통 팔레타이저 시장의 각사는 식품, 의약품, 물류 등 다양한 업계의 요구에 부응하기 위해 제공하는 기기를 다양화함으로써 시장에서의 지위를 강화하고 있습니다. 유연성을 높이고 애프터서비스를 확장하여 유지보수 지원을 제공함으로써 이러한 기업은 고객을 유지하고 시스템 수명을 향상시키고 있습니다.

목차

제1장 조사방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 업계에 미치는 영향요인

- 성장 촉진요인

- 전자상거래와 물류 성장

- 식음료업계에서의 수요 증가

- 다양한 업계의 인건비 증가 및 자동화 도입

- 업계의 잠재적 위험 및 과제

- 초기 투자와 유지비가 높음

- 제품 변형의 유연성이 한정되어 있음

- 기회

- 성장 촉진요인

- 성장 가능성 분석

- 장래 시장 동향

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 가격 동향

- 지역별

- 규제 상황

- 표준 및 컴플라이언스 요건

- 지역 규제 프레임워크

- 인증기준

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁구도

- 소개

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 지역별

- 기업 매트릭스 분석

- 주요 시장기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계 및 예측 : 유형별(2021-2034년)

- 주요 동향

- 하이레벨

- 로우/플로어 레벨

제6장 시장 추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 상자와 케이스

- 가방과 포대

- 트레이와 나무상자

- 기타

제7장 시장 추계 및 예측 : 최종 이용 산업별(2021-2034년)

- 주요 동향

- 식음료

- 의약품

- 소비재

- 전자상거래와 물류

- 기타

제8장 시장 추계 및 예측 : 유통 채널별(2021-2034년)

- 주요 동향

- 직접판매

- 간접판매

제9장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- Baust &Co GmbH

- Brenton Engineering

- BW Flexible Systems

- Columbia Machine Inc

- Concetti SpA

- KUKA AG

- MSK Covertech

- OCME Srl

- Okura Yusoki

- PAYPER SA

- Premier Tech

- ROBOPAC

- Signode Industrial Group LLC

- SIPA SpA

- Wuxi Taiyang Packaging Technology Co Ltd

The Global Conventional Palletizers Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 2.8 billion by 2034. The surge in demand for streamlined packaging and logistics operations across various industries is one of the primary drivers for this market. As e-commerce continues to grow and global supply chains become increasingly complex, the need for automated palletizing systems in manufacturing environments has become more pronounced. These systems are particularly important where consistent handling of cases or bags is essential before they are transported to distribution hubs. While robotic alternatives are commonly favored for varied product assortments in fulfillment centers, conventional palletizers remain highly effective for uniform product stacking at high speeds in industrial settings.

Conventional palletizing systems improve packaging line efficiency by enabling seamless transitions between filled and empty pallets without disrupting production. This capability keeps the workflow steady and minimizes idle time. Compared to alternative solutions, these machines require less floor space thanks to their compact and enclosed stacking mechanisms. The reduced footprint also eliminates the need for expansive safety barriers, making them ideal for facilities where space optimization is a priority. The food and beverage sector, known for its high-volume continuous production, relies heavily on these machines to handle products like dairy, snacks, and canned goods. With perishable goods requiring quick processing and delivery, conventional palletizers are trusted to maintain output speeds that align with fast-paced production demands.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $2.8 Billion |

| CAGR | 5.3% |

The low/floor-level palletizer segment generated USD 882.7 million in 2024. These machines operate on a floor-level conveyor system that aligns and rotates items into rows before pushing them into pallet layers. Unlike their high-level counterparts, which load from above, floor-level units eliminate the need for vertical movement during stacking. This feature reduces load time and increases operational simplicity, making them more efficient and accessible across production floors of varying sizes.

In 2024, the boxes and cases segment held a 40.4% share. These systems are particularly effective at handling uniform containers such as cartons and rectangular packages. Their rigid form makes them suitable for precise stacking, allowing for high-speed operations with minimal error. Whether it's food, electronics, pharmaceuticals, or personal care items, boxes, and cases remain a dominant packaging format across industries due to their protective nature, ease of branding, and stacking efficiency. Manufacturers dealing in mass production turn to palletizing systems that offer speed and accuracy, especially where uniformity and packaging volume are high.

United States Conventional Palletizers Market held a 62% share in 2024. The need to offset rising labor costs and workforce shortages has prompted manufacturers in the country to increase investments in conventional palletizing systems. These systems automate physically intense and repetitive tasks, thereby improving safety and productivity while reducing employee turnover. The push for automation is also tied to broader economic trends, including manufacturing growth and the expansion of online retail channels, which are all fueling demand for high-efficiency end-of-line equipment.

Key companies leading the Global Conventional Palletizers Market include Columbia Machine Inc., Okura Yusoki, ROBOPAC, MSK Covertech, Premier Tech, KUKA AG, SIPA SpA, Signode Industrial Group LLC, OCME Srl, Brenton Engineering, PAYPER SA, Concetti SpA, BW Flexible Systems, Baust & Co. GmbH, and Wuxi Taiyang Packaging Technology Co. Ltd. Companies in the conventional palletizers market are strengthening their market position by diversifying their equipment offerings to cater to various industry requirements, including food, pharmaceuticals, and logistics. They are also integrating smarter technologies such as programmable logic controllers (PLCs), human-machine interfaces (HMIs), and modular designs to enhance operational flexibility. By expanding after-sales services and providing maintenance support, these players are improving customer retention and system longevity. Strategic collaborations with system integrators and packaging automation firms allow manufacturers to offer complete turnkey solutions, increasing value to clients.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.2.4 End Use Industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth of e-commerce and logistics

- 3.2.1.2 Rising demand from the food and beverages industry

- 3.2.1.3 Increased labor costs and adoption of automation in various industries

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Limited flexibility for product variation

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Billion) (Units)

- 5.1 Key trends

- 5.2 High level

- 5.3 Low/floor level

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Units)

- 6.1 Key trends

- 6.2 Boxes and cases

- 6.3 Bags and sacks

- 6.4 Trays and crates

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Billion) (Units)

- 7.1 Key trends

- 7.2 Food and beverages

- 7.3 Pharmaceuticals

- 7.4 Consumer goods

- 7.5 E-commerce and logistics

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Distribution channel, 2021 – 2034 (USD Billion) (Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Baust & Co GmbH

- 10.2 Brenton Engineering

- 10.3 BW Flexible Systems

- 10.4 Columbia Machine Inc

- 10.5 Concetti SpA

- 10.6 KUKA AG

- 10.7 MSK Covertech

- 10.8 OCME Srl

- 10.9 Okura Yusoki

- 10.10 PAYPER SA

- 10.11 Premier Tech

- 10.12 ROBOPAC

- 10.13 Signode Industrial Group LLC

- 10.14 SIPA SpA

- 10.15 Wuxi Taiyang Packaging Technology Co Ltd