|

시장보고서

상품코드

1773375

승용차 캐빈 모니터링 시스템 시장(2025-2034년) : 기회, 성장 촉진요인, 산업 동향 분석, 예측Passenger Vehicle Cabin Monitoring System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

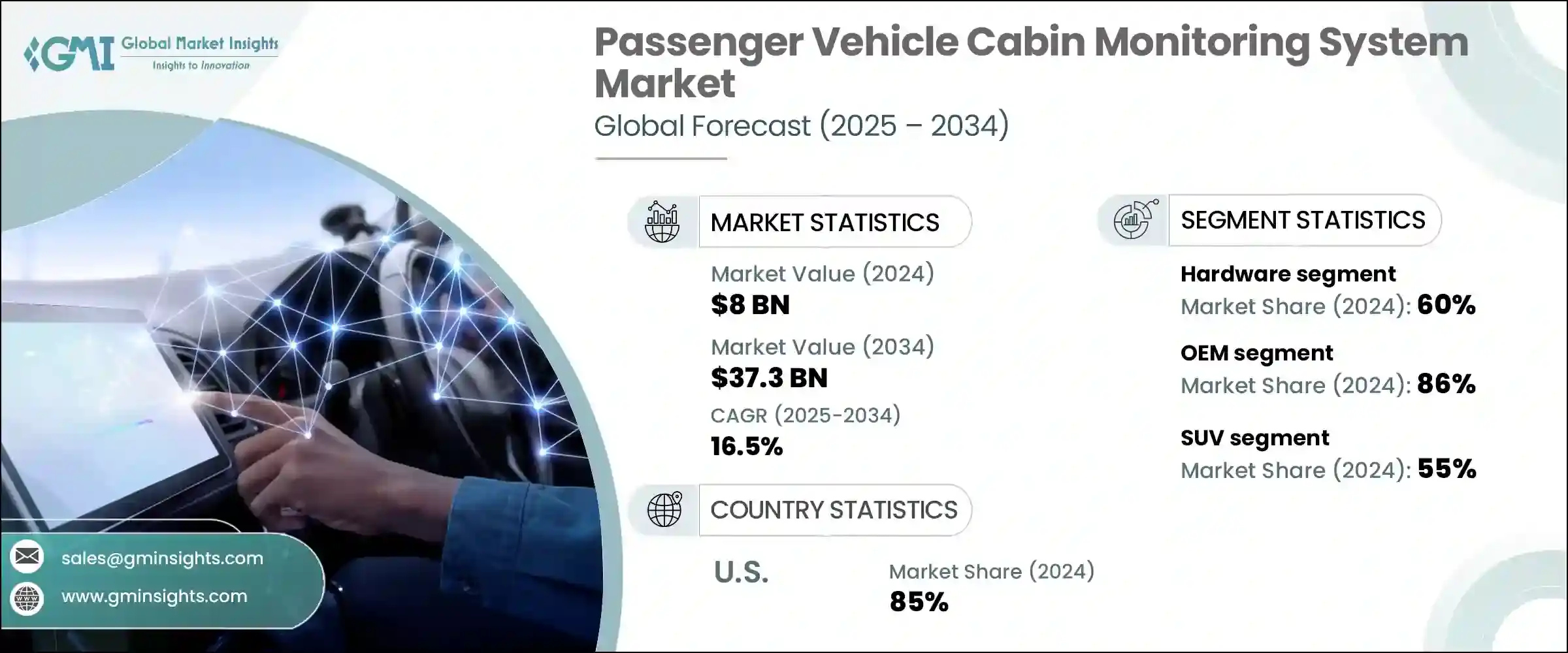

세계의 승용차 캐빈 모니터링 시스템 시장 규모는 2024년에는 80억 달러에 달하였고, CAGR 16.5%로 성장하여 2034년에는 373억 달러에 이를 것으로 예측됩니다.

자동차 제조업체와 소비자 모두 탑승자의 안전성, 쾌적성, 스마트한 차내 기술에 주목하면서 이 성장의 주요한 추진력이 되고 있습니다. 자동화의 자율화가 진행됨에 따라 바이탈 사인 탐지, 탑승자 식별, 드라이버 모니터링을 포함한 캐빈 모니터링 시스템의 통합이 최신의 자동차 설계의 표준이 되고 있습니다.

이 시스템은 센서와 AI를 활용한 알고리즘의 조합에 의존하며 운전자의 의식을 모니터링하고 동승자를 탐지하며 심지어 생체 데이터를 분석하여 졸음 경고, 적응형 에어백 전개, 긴급 개입 등의 기능을 지원합니다. 주요 자동차 시장의 규제 기관이 고급 안전 기능을 의무화하고 구매자가 개인화된 프로액티브 캐빈 경험을 강력히 요구하고 있기 때문에 지능형 캐빈 모니터링 솔루션 시장은 급성장의 추세에 있습니다.

| 시장 범위 | |

|---|---|

| 시작연도 | 2024 |

| 예측연도 | 2025-2034 |

| 시작금액 | 80억 달러 |

| 예측금액 | 373억 달러 |

| CAGR | 16.5% |

이러한 시스템은 컨셉의 단계를 넘어 탑승자의 식별, 운전자의 주의력 평가, 아이의 안전 확보에 필수적인 요소가 되어, 일상적인 자동차에서의 역할을 확고히 하고 있습니다. 첨단 캐빈 모니터링 시스템은 바이탈 사인 탐지, 피로 레벨 모니터, 긴급 상황에 대한 실시간 대응 등 편의성과 차내 안전성을 모두 향상시키기 위해 통합되어 있습니다.

2024년에는 하드웨어 분야가 60%의 점유율을 차지했으며, 2025-2034년의 CAGR은 16%로 예측되고 있습니다. 자동차 제조업체가 차량 내 스마트화에 주력하는 동안 견고하고 응답성이 높은 하드웨어의 필요성은 매우 중요합니다.

OEM 부문은 2024년에 86%의 점유율을 차지하였으며, 자동차 업계가 센서 대응 공장 설치형 안전 솔루션을 추진하고 있는 것이 성장 배경에 있습니다. OEM을 통한 설치는 시스템의 정확성, 신뢰성 및 소비자 신뢰를 높이기 위해 이 시장에서 선호되는 제공 방법입니다.

북미의 승용차 캐빈 모니터링 시스템 시장은 2024년에는 85%의 점유율을 차지했으며 24억 달러를 창출했습니다. 자동차 제조업체는 생체 추적, 탑승자 감지, 피로 모니터링 등의 기능을 신차 모델에 표준 장비하는 것에 적극적입니다.

승용차 캐빈 모니터링 시스템 업계의 유력 기업은 Magna International Inc., Panasonic Corporation, Robert Bosch GmbH, Continental AG, Valeo SA, Denso Corporation, Visteon Corporation 등이 있습니다. 승용차 캐빈 모니터링 시스템 시장에서의 지위를 굳히기 위해 기업은 몇개의 중요한 전략을 채용하고 있습니다. 각사는 파트너십을 통해 신기술 채택을 가속화하고 특정 OEM 요구에 맞는 솔루션을 제공할 수 있도록 지원합니다.

목차

제1장 조사방법

- 시장의 범위와 정의

- 조사 디자인

- 조사 접근

- 데이터 수집방법

- 데이터 마이닝 소스

- 세계

- 지역/국가

- 기본 추정과 계산

- 기준연도 계산

- 시장 예측의 주요 동향

- 1차 조사와 검증

- 1차 정보

- 예측모델

- 조사의 전제와 한계

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 비용구조

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 정부의 지원을 통한 세계적인 전기차 보급 진행

- 경량이며 스마트한 베어링 기술의 진보에 의해 효율과 내구성 향상

- 신흥시장에서의 EV 제조 확대

- 센서 대응 베어링에 의한 예측 유지보수의 통합

- 업계의 잠재적 위험 및 과제

- 높은 초기 비용

- 복잡한 설치 및 유지보수

- 시장 기회

- 세계적인 EV 생산 급증

- OEM과의 연구개발 및 공동개발

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- Porter's Five Forces 분석

- PESTEL 분석

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 특허 분석

- 가격 동향

- 지역별

- 컴포넌트별

- 생산통계

- 생산거점

- 소비거점

- 수출과 수입

- 코스트 내역 분석

- 지속 가능성과 환경 측면

- 지속 가능한 관행

- 폐기물 감축 전략

- 생산에서의 에너지 효율

- 환경친화적인 노력

- 탄소발자국의 고려

제4장 경쟁구도

- 소개

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 주요 시장기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장계획과 자금조달

제5장 시장 추계 및 예측 : 컴포넌트별(2021-2034년)

- 주요 동향

- 하드웨어

- 카메라

- 센서

- 표시유닛

- 제어유닛

- 소프트웨어

- 서비스

제6장 시장 추계 및 예측 : 차량별(2021-2034년)

- 주요 동향

- 해치백

- 세단

- SUV

제7장 시장 추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 성장 촉진요인 - 모니터링 시스템

- 시선 추적

- 얼굴 인식

- 두위 모니터링

- 졸음 감지

- 주의 산만 검출

- 탑승자 모니터링 시스템(OMS)

- 탑승자 존재 감지

- 안전벨트 모니터링

- 유아 탐지

- 승객 행동 분석

- 기타

제8장 시장 추계 및 예측 : 판매채널별(2021-2034년)

- 주요 동향

- OEM

- 애프터마켓

제9장 시장 추계 및 예측 : 기술별(2021-2034년)

- 주요 동향

- 카메라베이스

- 센서베이스

- 기타

제10장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주 및 뉴질랜드

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

제11장 기업 프로파일

- Aptiv

- Autoliv

- Caaresys

- Continental

- Denso

- Faurecia SA

- Gentex

- Harman International Industries, Inc.

- Hyundai Mobis

- Magna International

- Omron

- Panasonic

- Robert Bosch

- Seeing Machines

- Smart Eye AB

- Tobii

- Valeo SA

- Vayyar Imaging

- Visteon

- ZF Friedrichshafen

The Global Passenger Vehicle Cabin Monitoring System Market was valued at USD 8 billion in 2024 and is estimated to grow at a CAGR of 16.5% to reach USD 37.3 billion by 2034. The rising focus on occupant safety, comfort, and smart in-cabin technology by both car manufacturers and consumers is a key driver of this growth. As vehicles become increasingly autonomous, the integration of cabin monitoring systems-including vital sign detection, occupant identification, and driver monitoring-is becoming standard in modern car designs.

These systems rely on a mix of sensors and AI-powered algorithms to monitor driver alertness, detect passengers, and even analyze biometric data, supporting functions such as drowsiness alerts, adaptive airbag deployment, and emergency interventions. With regulatory agencies in major automotive markets mandating advanced safety features and buyers showing strong demand for personalized and proactive cabin experiences, the market for intelligent cabin monitoring solutions is poised for rapid growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8 Billion |

| Forecast Value | $37.3 Billion |

| CAGR | 16.5% |

These systems have moved beyond the concept stage to become essential in identifying occupants, assessing driver attention, and ensuring child safety, solidifying their role in everyday vehicles. What was once viewed as a premium or futuristic feature is now becoming a standard requirement, driven by both regulatory mandates and shifting consumer expectations. Advanced cabin monitoring systems are now integrated to detect vital signs, monitor fatigue levels, and respond to emergencies in real-time, enhancing both convenience and in-vehicle security. They also support intelligent functions like automatic climate adjustment based on occupancy and biometric-based personalization.

In 2024, the hardware segment held a 60% share and is forecasted to grow at a CAGR of 16% during 2025-2034. Hardware remains the cornerstone of cabin monitoring systems in passenger vehicles, consisting of cameras, radar sensors, infrared modules, and embedded electronics. As automakers focus on smarter interiors, the need for robust and responsive hardware is critical. These components provide the real-time data necessary to fuel AI algorithms that track driver vigilance, passenger presence, and biometric indicators, making them indispensable for system performance.

The OEM segment held an 86% share in 2024, driven by the automotive industry's push toward sensor-enabled, factory-installed safety solutions. Vehicle manufacturers increasingly opt to integrate cabin and driver monitoring systems directly during production, ensuring seamless compatibility with other in-car technologies like climate control, ADAS, and infotainment systems. OEM installation enhances system accuracy, reliability, and consumer trust, making it the preferred method of delivery in this market.

North America Passenger Vehicle Cabin Monitoring System Market held an 85% share and generated USD 2.4 billion in 2024. The country leads adoption due to a mature automotive sector, stringent safety standards, and a strong appetite for innovation. Automakers are proactively incorporating features such as biometric tracking, occupant detection, and fatigue monitoring as standard across new vehicle models. This demand, combined with regulatory support, positions the U.S. as a dominant force in this segment.

Prominent companies in the Passenger Vehicle Cabin Monitoring System Industry include Magna International Inc., Panasonic Corporation, Robert Bosch GmbH, Continental AG, Valeo S.A., Denso Corporation, and Visteon Corporation. To strengthen their foothold in the passenger vehicle cabin monitoring system market, companies are adopting several key strategies. Innovation is at the forefront, with significant investment in research and development to advance sensor accuracy, AI capabilities, and system integration with vehicle architectures. Collaborations and strategic partnerships with automakers accelerate the adoption of new technologies and help tailor solutions to specific OEM needs. Companies are also focusing on expanding their global reach through localized production and customer support to serve diverse markets. Enhancing cybersecurity features and improving system reliability are prioritized to build consumer confidence in safety systems.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 Technology

- 2.2.5 Sales channel

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing global adoption of electric vehicles supported by government incentives

- 3.2.1.2 Advancements in lightweight and smart bearing technologies improve efficiency and durability

- 3.2.1.3 Expansion of EV manufacturing in emerging markets

- 3.2.1.4 Integration of predictive maintenance through sensor-enabled bearings

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial costs

- 3.2.2.2 Complex installation and maintenance

- 3.2.3 Market opportunities

- 3.2.3.1 Surging global EV production

- 3.2.3.2 R&D and co-development with OEMs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By component

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Cost breakdown analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Cameras

- 5.2.2 Sensors

- 5.2.3 Display Units

- 5.2.4 Control Units

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Hatchback

- 6.3 Sedan

- 6.4 SUV

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Driver monitoring system

- 7.2.1 Eye-Tracking

- 7.2.2 Facial recognition

- 7.2.3 Head position monitoring

- 7.2.4 Drowsiness detection

- 7.2.5 Distraction detection

- 7.3 Occupant Monitoring System (OMS)

- 7.3.1 Occupant presence detection

- 7.3.2 Seat belt monitoring

- 7.3.3 Child detection

- 7.3.4 Passenger behavior analysis

- 7.4 Others

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEMs

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Camera based

- 9.3 Sensor based

- 9.4 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Aptiv

- 11.2 Autoliv

- 11.3 Caaresys

- 11.4 Continental

- 11.5 Denso

- 11.6 Faurecia S.A.

- 11.7 Gentex

- 11.8 Harman International Industries, Inc.

- 11.9 Hyundai Mobis

- 11.10 Magna International

- 11.11 Omron

- 11.12 Panasonic

- 11.13 Robert Bosch

- 11.14 Seeing Machines

- 11.15 Smart Eye AB

- 11.16 Tobii

- 11.17 Valeo S.A.

- 11.18 Vayyar Imaging

- 11.19 Visteon

- 11.20 ZF Friedrichshafen