|

시장보고서

상품코드

1773384

인테리어용 바이오플라스틱 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Bioplastic for Interior Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

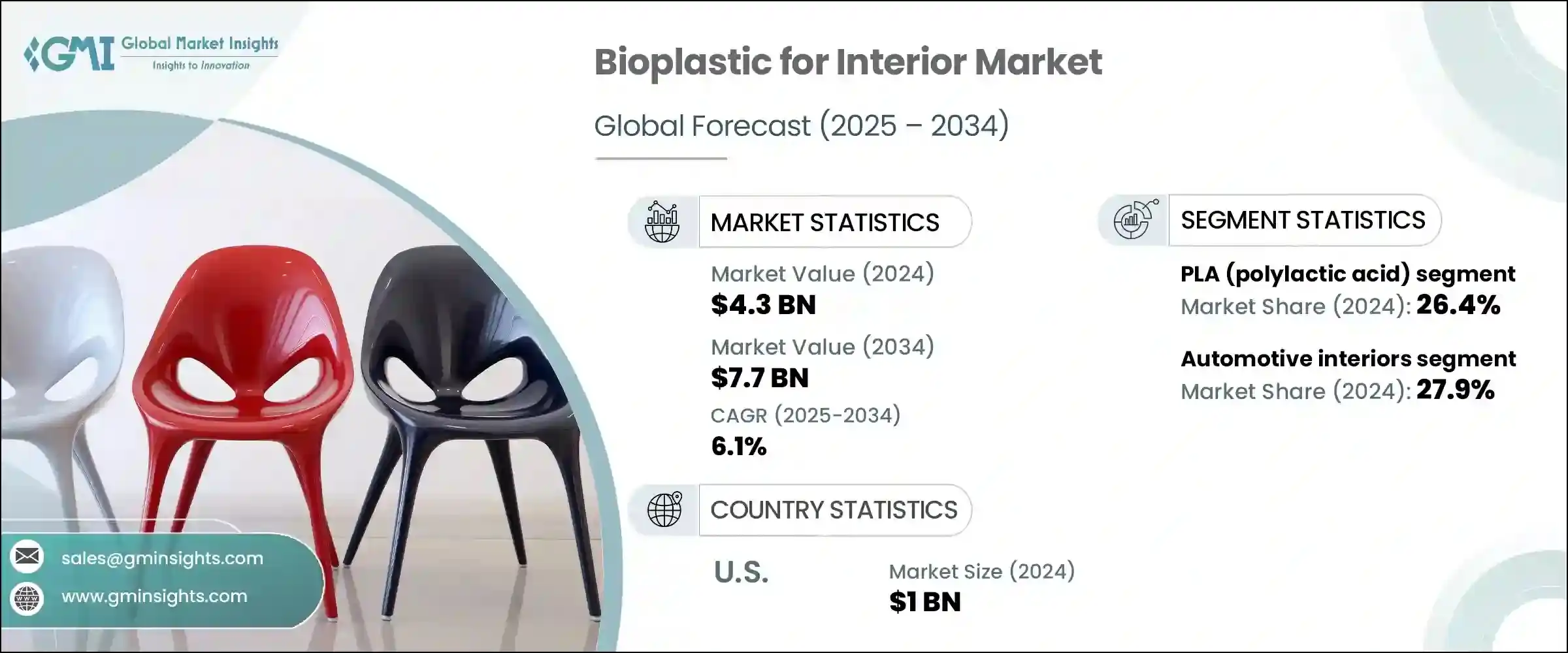

세계의 인테리어용 바이오플라스틱 시장 규모는 2024년에는 43억 달러에 달했고, CAGR 6.1%를 나타내 2034년에는 77억 달러에 이를 것으로 예측되고 있습니다.

소비자나 조직에 있어서의 환경 의식의 고조는 내장재의 전망을 재구축해, 재생 가능하고 저환경 부하의 대체품에의 변화를 촉진하고 있습니다. 이 소재는 환경 목표를 지원할뿐만 아니라 생분해 성과 이산화탄소 배출량을 줄이는 실용적인 이점도 제공하며 지속 가능한 생활과 생산 방법을 요구하는 광범위한 움직임과 일치합니다.

사람들이 보다 환경에 배려한 디자인 요소를 요구하게 됨에 따라, 환경에 배려한 인테리어 수요는 가속하고 있어 이 이행에 있어서의 바이오플라스틱의 역할은 점점 커지고 있습니다. 이 규제의 강화나 플라스틱 오염에 대한 우려의 고조는 제조업체에 지속 가능한 대체품의 채용을 강요하고 있어 인테리어 용도에서의 바이오플라스틱의 성장을 한층 더 밀고 있습니다. 기업도, 환경에 배려한 기호에 대응하는 것의 상업적 가치를 인식하고 있어 지속가능성을 손상시키지 않고 성능을 발휘합니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 43억 달러 |

| 예측 금액 | 77억 달러 |

| CAGR | 6.1% |

2024년 폴리유산(PLA)의 폴리머 유형별 시장 점유율은 전체의 26.4%를 차지했습니다. 이 제품은 시각적 투명성과 강력한 기계적 성능을 통해 특히 투명성과 연마 마무리가 중요시되는 다양한 인테리어 용도로 선호되고 있습니다.

용도별로는 자동차 인테리어가 2024년에 최대의 점유율을 차지해 시장 전체에 27.9% 기여했습니다. 동시에 자동차의 재활용성에 기여하고 있습니다.이 소재는 시트베이스, 대시 보드 구조, 트림 피스, 패널 등 많은 인테리어 부품에 사용되고 있습니다.

최종 사용자별로, 2024년에는 건축 부문이 시장을 선도하고 압도적인 지위를 차지했습니다. 그러나 내장 분야에서 가장 적극적으로 바이오플라스틱을 채용하고 있는 것은 자동차 제조업체입니다. 구조 부품과 미관 부품에 바이오플라스틱을 채용함으로써 차량의 질량을 줄일 뿐만 아니라 라이프사이클 배출량도 줄일 수 있습니다.

가구 제조업체는 바이오플라스틱의 사용량으로 2위에 랭크 인했습니다 모듈러 시스템이나 서스테인블인 인테리어에 바이오 소재를 채용해, 환경 의식이 높은 바이어의 요구에 응하고 있습니다. 인테리어 디자인 스튜디오는 특히 그린 인증 프로그램에 준거한 고급 주택이나 상업시설에서 사용한 프로젝트를 맞춤화하고 있습니다. 또, 소매점이나 쇼룸에서의 사용도 늘고 있어, 서스테인블한 미관이 브랜드의 포지셔닝에 공헌하고 있습니다. 또한, 건축업자나 상업 내장 계약자는 최신의 그린 건축 기준에 적합하는 피복재, 패널, 간 구획 등의 아이템에 바이오플라스틱을 채용하고 있습니다.

2024년 미국의 인테리어용 바이오플라스틱 시장은 10억 달러로 평가되었습니다. 바이오 폴리머의 기술 혁신을 통한 재료 성능 향상은 바이오플라스틱의 대규모 생산 라인에 부드러운 통합을 가능하게 하고 있습니다.

세계적으로 각 회사가 독자적인 소재, 첨단 가공 기술, 지속 가능한 생산 모델에 주력하고 있는 경쟁 환경에 의해 인테리어용 바이오플라스틱 시장이 형성되고 있습니다. 대기업은 비용을 안정시키고 이용가능성을 확보하기 위해 가와카미의 원료 소스를 확보하는 경향을 강화하고 있습니다. 동시에 제품의 내구성을 향상시키고, 녹색 인증을 얻고, 설계 유연성을 제공하는 노력이 각 회사의 차별화에 도움이 됩니다. 이러한 전략을 통해 주요 이해관계자들은 환경을 배려한 인테리어에 대한 규제적 요구와 소비자의 기대를 모두 충족하기 위해 급속히 진화하고 있는 시장에서 한 걸음 더 나아갈 수 있게 되었습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 파괴적 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 시장 기회

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTEL 분석

- 가격 동향

- 지역별

- 폴리머 유형별

- 장래 시장 동향

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 특허 상황

- 무역 통계(HS코드)(참고 : 무역 통계는 주요 국가에서만 제공됨)

- 주요 수입국

- 주요 수출국

- 지속가능성과 환경 측면

- 지속가능한 관행

- 폐기물 감축 전략

- 생산에 있어서의 에너지 효율

- 환경 친화적인 노력

- 탄소발자국의 고려

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계·예측 : 폴리머 유형별(2021-2034년)

- 주요 동향

- PLA(폴리락트산)

- 전분 기반 바이오 플라스틱

- 폴리하이드록시알카노에이트(PHA)

- 셀룰로오스계 바이오플라스틱

- 바이오 PE(바이오폴리에틸렌)

- 바이오 PET(바이오폴리에틸렌 테레프탈레이트)

- 기타

제6장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 동향

- 자동차 인테리어

- 가구 및 홈 인테리어

- 상업 및 사무실 인테리어

- 소매 및 접객업 인테리어

- 기타

제7장 시장 추계·예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 자동차 OEM

- 가구 제조업체

- 인테리어 디자인 회사

- 소매 업체 및 쇼룸

- 계약자 및 건축업자

- 기타

제8장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 기타 라틴아메리카

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

제9장 기업 프로파일

- Arkema SA

- BASF SE

- Biome Bioplastics

- Braskem SA

- Cardia Bioplastics

- Celanese Corporation

- Covestro AG

- DuPont de Nemours, Inc

- Evonik Industries AG

- FKuR Kunststoff GmbH

- Mitsubishi Chemical Group

- NatureWorks LLC

- Novamont

- TotalEnergies Corbion

The Global Bioplastic for Interior Market was valued at USD 4.3 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 7.7 billion by 2034. Growing environmental consciousness among consumers and organizations is reshaping the interior materials landscape, encouraging the shift toward renewable, low-impact alternatives. Traditional plastics are increasingly being replaced by bioplastics, which are derived from natural sources such as sugarcane, corn, and cellulose. These materials not only support environmental goals but also deliver practical advantages like biodegradability and reduced carbon emissions, aligning with the broader push for sustainable living and production practices.

As people seek more eco-conscious design elements, the demand for green interiors is accelerating, reinforcing the role of bioplastics in this transition. The move away from petroleum-based plastics is no longer limited to niche applications; it is gaining traction across furniture, wall treatments, interior decorative elements, and flooring, among other uses. Stricter global waste management regulations and mounting concerns over plastic pollution are pressuring manufacturers to adopt sustainable alternatives, further fueling the growth of bioplastics in interior applications. Businesses are also realizing the commercial value of catering to environmentally driven preferences, leading to widespread adoption of bioplastic materials that offer performance without compromising sustainability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.3 Billion |

| Forecast Value | $7.7 Billion |

| CAGR | 6.1% |

In 2024, polylactic acid (PLA) accounted for 26.4% of the total market share by polymer type. PLA continues to lead the segment due to its favorable environmental profile, renewability, and wide usability. Sourced from plant-based sugars, PLA offers a sustainable substitute for conventional plastic components. Its visual clarity and strong mechanical performance make it a preferred choice for a variety of interior applications, especially where transparency or a polished finish is important. As demand for environmentally responsible solutions grows, PLA stands out as a go-to polymer for manufacturers aiming to blend functionality with ecological benefits.

From an application standpoint, automotive interiors held the largest share in 2024, contributing 27.9% to the overall market. Automakers are actively replacing traditional plastic parts with bioplastics to meet both environmental regulations and consumer expectations. The ability of bioplastics to deliver weight savings plays a significant role in enhancing fuel efficiency while also supporting vehicle recyclability. These materials are used in numerous interior parts, including seat bases, dashboard structures, trim pieces, and panels. Their capacity for precise molding and compatibility with cleaner production techniques make them ideal for automotive applications, where performance and design flexibility are equally important.

On the basis of end users, the building construction segment led the market in 2024, capturing a dominant position. However, automotive OEMs emerged as the most active adopters of bioplastics in the interiors domain. These companies are heavily involved in integrating bio-based materials into vehicle interiors as part of broader environmental strategies. Incorporating bioplastics in structural and aesthetic parts not only reduces vehicle mass but also lowers lifecycle emissions. Many companies are forming long-term collaborations with material suppliers to enhance their bioplastic sourcing capabilities and ensure stable supply chains.

Furniture manufacturers ranked second in terms of bioplastic usage. They are incorporating bio-based materials into modular systems and sustainable home decor, meeting the evolving needs of environmentally conscious buyers. Interior design studios are customizing projects with bioplastics, particularly in high-end residential and commercial settings that adhere to green certification programs. The use of these materials is also rising in retail and showroom installations, where sustainable aesthetics contribute to brand positioning. Additionally, builders and commercial interior contractors are turning to bioplastics for items like cladding, panels, and partitions that comply with modern green building codes.

In 2024, the bioplastic for interior market in the United States was valued at USD 1 billion. Growth in the U.S. is being driven by a combination of consumer awareness and regulatory efforts to reduce environmental impact, especially in the automotive and construction sectors. Leading manufacturers are prioritizing bio-based materials in response to consumer demands for cleaner technologies and sustainable products. Enhanced material performance, driven by innovation in bio-polymers, is allowing smoother integration of bioplastics into large-scale production lines. As a result, U.S.-based producers are not only expanding their capabilities but also setting new benchmarks for sustainable manufacturing.

Globally, the bioplastic for interior market are shaped by a competitive environment where companies are focusing on proprietary materials, advanced processing technologies, and sustainable production models. Leading players are increasingly securing upstream raw material sources to stabilize costs and ensure availability. At the same time, efforts to improve product durability, achieve green certifications, and offer design flexibility are helping companies differentiate themselves. These strategies are enabling key stakeholders to stay ahead in a market that is quickly evolving to meet both regulatory demands and consumer expectations for environmentally friendly interiors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Polymer type

- 2.2.2 Application

- 2.2.3 End use

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By polymer type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Polymer Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 PLA (polylactic acid)

- 5.3 Starch-based bioplastics

- 5.4 Polyhydroxyalkanoates (PHA)

- 5.5 Cellulose-based bioplastics

- 5.6 Bio-PE (bio-polyethylene)

- 5.7 Bio-PET (bio-polyethylene terephthalate)

- 5.8 Others

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Automotive interiors

- 6.3 Furniture & home interiors

- 6.4 Commercial & office interiors

- 6.5 Retail & hospitality interiors

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive OEM

- 7.3 Furniture manufacturers

- 7.4 Interior design firms

- 7.5 Retailers & showrooms

- 7.6 Contractors & Builders

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Arkema S.A.

- 9.2 BASF SE

- 9.3 Biome Bioplastics

- 9.4 Braskem S.A.

- 9.5 Cardia Bioplastics

- 9.6 Celanese Corporation

- 9.7 Covestro AG

- 9.8 DuPont de Nemours, Inc

- 9.9 Evonik Industries AG

- 9.10 FKuR Kunststoff GmbH

- 9.11 Mitsubishi Chemical Group

- 9.12 NatureWorks LLC

- 9.13 Novamont

- 9.14 TotalEnergies Corbion